Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

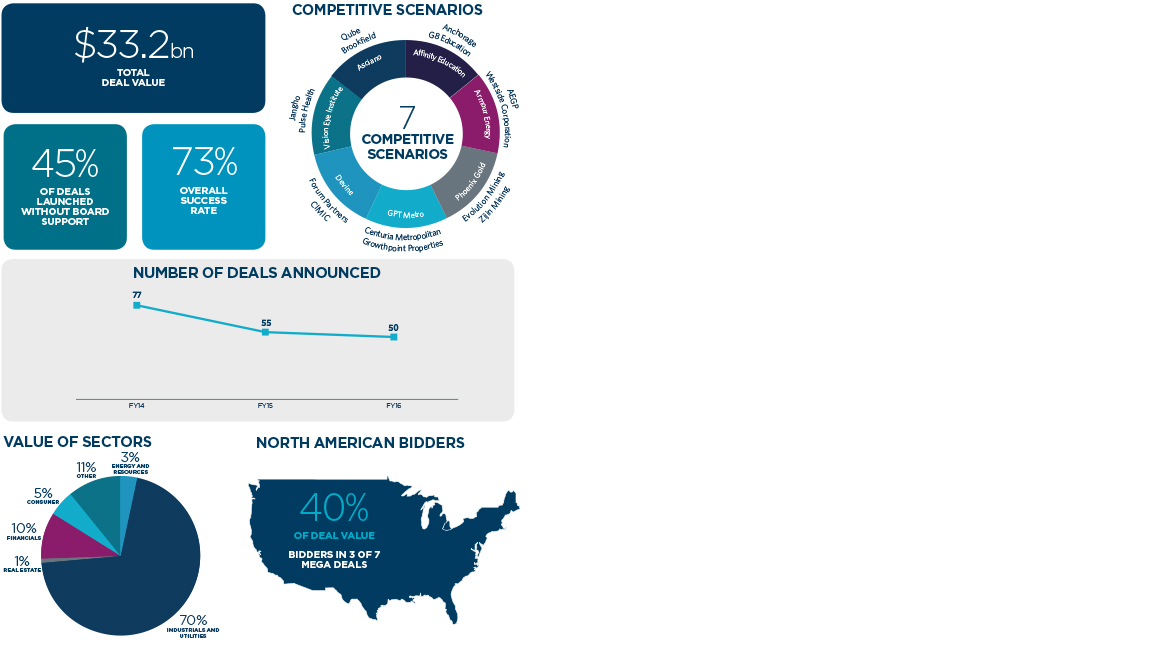

Australian public mergers and acquisitions activity continued to contract in FY16 with the volume of deals slightly down on the previous year.

However, a significant jump in the level of competition for Australian targets, a number of mega deals (valuing the target at more than A$1 billion), continued interest from foreign bidders and strong performance in certain sectors provide cause for a level of optimism for FY17.

Activity continues to retreat

In our last report, we predicted that we would see an increase in M&A activity in Australia in FY16. Low interest rates, low inflation and a soft Australian dollar relative to the US dollar increased Australia’s international competitiveness and provided conditions ripe for M&A, with a number of big ticket transactions being announced at the beginning of FY16. Overall however, FY16 saw a further contraction in public M&A activity, with only 50 deals being announced, down from 55 deals in FY15 and 77 deals in FY14.

Total deal value was slightly higher than in FY15 at $33.2bn, however this was largely due to the competing Brookfield and Qube proposals for Asciano, which alone contributed $18bn.

More competition

FY15 saw a low level of competition post-transaction announcement, with only 2 targets the subject of multiple bidders. FY16 however saw a significant rebound in the level of competition in Australian public M&A, with 7 of the 43 targets attracting multiple bidders. Not only is this a positive sign for public M&A activity in Australia, but it allowed target shareholders to reap the benefit of these competitive scenarios, with shareholders on average receiving a 97% premia from successful bidders.

Big ticket industrials and utilities deals

The industrials and utilities sectors featured strongly in FY16, contributing $23.3bn to overall deal value. Key targets included Asciano (rail & infrastructure), Energy Developments (power generation) and Broadspectrum (industrial services).

In contrast, FY16 proved to be a very challenging year for the energy and resources sectors, characterised by consistently low prices for commodities such as oil, iron ore and coal, slow growth and uncertainty. These challenging circumstances were reflected in the level of deal activity in the energy and resources sectors, with these sectors contributing only $1.1bn to total deal value, the lowest value we have seen since commencing our Report in FY09.

Dominance of North American bidders

FY16 saw a consistently low Australian dollar against the US dollar relative to previous years and the resurgence of the North American economy. Unsurprisingly, North American bidders were more prominent in FY16 than we’ve seen in previous years, with 27% of bidders coming from North America (in contrast to only 15% in FY15, 19% in FY14 and 11% in FY13).

North American bidders were also active in the mega deal space, with 3 of the 7 mega deals involving North American bidders.

The economic climate remains conducive to M&A in Australia, with modest domestic growth rates driving companies to look to M&A for growth opportunities and the relatively weak Australian dollar increasing the attractiveness of Australian targets for foreign bidders. Equity markets remain volatile and share prices in many cases remain low, which may encourage opportunistic activity.

In the early part of FY17 Australian public M&A activity has continued at a similar rate to that in FY16 (though without the large number of mega deals which featured in early FY16). We believe that there is positive overall sentiment in the Australian market for M&A moving forward (see also our Beyond Borders: The Future of Deal Making report published in April 2016) and we therefore remain optimistic regarding activity levels for the remainder of FY17.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs