Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

Yesterday, the Securities and Futures Commission (the SFC) published its Guidance Note on Cooperation with the SFC (the Guidance).

The Guidance contains an updated section on disciplinary proceedings and a new section on proceedings in the civil courts and the Market Misconduct Tribunal (MMT). It does not apply to criminal proceedings, which is subject to the unfettered discretion of the Department of Justice. The Guidance replaces the previous version issued in March 2006.

This will be of keen interest to the increasing number of firms and individuals who are subject to regulatory scrutiny. The Guidance covers several key topics which are considered below:

Clarification on the kind of action that will be viewed as cooperation;

The factors that the SFC will use to assess cooperation;

The measures the SFC will use to encourage cooperation in disciplinary proceedings, including discounts to sanctions; and

The SFC's current practice of resolving proceedings in the civil courts or the MMT with cooperative parties.

The SFC has also issued FAQs to help the industry and the public understand the Guidance.

Clarifying what constitutes cooperation

The Guidance clarifies what action will amount to "cooperation" in the eyes of the SFC and the factors it will take into account when assessing cooperation. Mere compliance with statutory or regulatory requirements will not be enough since this is already expected of firms and individuals. Cooperation means going above and beyond these requirements.

The Guidance sets out a number of "forms of cooperation" which relate to reporting, providing evidence and information to the SFC, accepting liability, taking rectification measures, waiving legal professional privilege, commissioning third-party reviews and giving directors’ undertakings to address the SFC’s regulatory concerns. Further details on each of these areas are summarised in the table at the bottom of this bulletin.

Assessing cooperation

While the Guidance stresses that each case will dependent on its facts, the SFC will generally take into account the following factors when assessing cooperation:

Uncooperative conduct which has the intent or effect of impeding investigations or enforcement proceedings may also be taken into account by the SFC. This might include for example failing to promptly and fully report a material breach or failing to disclose, or withholding relevant information.

Measures to encourage cooperation in disciplinary proceedings

In general, the SFC will be more willing to enter into an agreement to resolve disciplinary proceedings at an early stage pursuant to section 201 of the Securities and Futures Ordinance (SFO) if cooperation has been demonstrated.

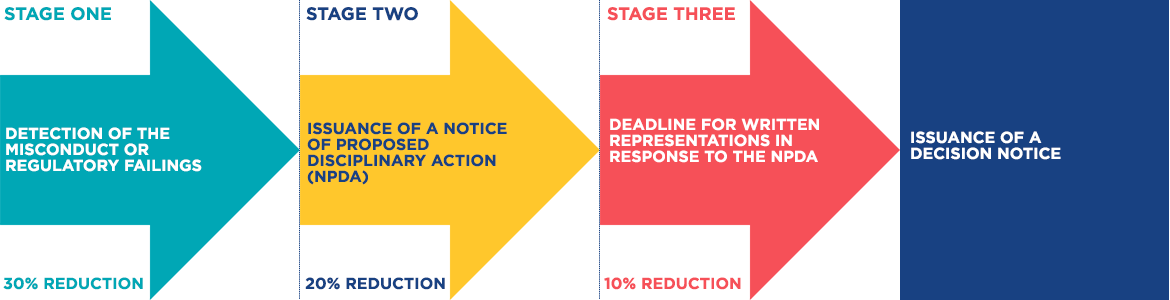

Furthermore, to encourage early cooperation and resolution of cases, the SFC has divided its disciplinary process into three stages. Where a person cooperates with the SFC and a section 201 agreement is reached, the SFC may reduce the sanction imposed. The scale of the reduction will depend on the stage of the proceedings:

The discounts available largely follow those applied by the Financial Conduct Authority in the UK regulatory regime. Further reductions may be possible in cases where there has been exceptional and substantial cooperation. However, as a general principle, the SFC would not be willing to resolve disciplinary matters in private or on a “no admission of liability” basis.

Civil court and MMT proceedings

Where the SFC issues proceedings in the civil court or in the MMT, the Guidance sets out further ways a party might seek to cooperate with the SFC. This includes agreeing to use the Carecraft procedure (section 214 SFO) or agreeing to use statements of agreed facts and proposed/consent orders (section 213 SFO and MMT proceedings).

The SFC may recognise cooperation through:

FAQs

The SFC has also issued FAQs to help the industry and the public to understand the Guidance. In particular, the second FAQ sets out the SFC's rationale and approach with respect to grouping together multiple failings within a company or corporate group, and resolving these in a single resolution. Generally, the SFC will be more likely to use this approach to target systemic issues and weaknesses where the failings have not caused losses to clients or the investing public.

Conclusion

The Guidance sets out in clearer terms what a firm or individual would need to do in order to gain the benefits of cooperation from the SFC. Of course, cooperating in this way may not necessarily be to your advantage in every situation. The Guidance is nonetheless welcome in that it will allow firms and individuals to form clearer strategies in dealings with their regulator.

| Forms of Cooperation | |

| Reporting |

|

| Providing evidence and information to the SFC |

|

| Acceptance of liability |

|

| Taking rectification measures |

|

| Legal professional privilege |

|

| Third-party reviews |

|

| Directors’ undertakings to address the SFC’s regulatory concerns |

|

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs