Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

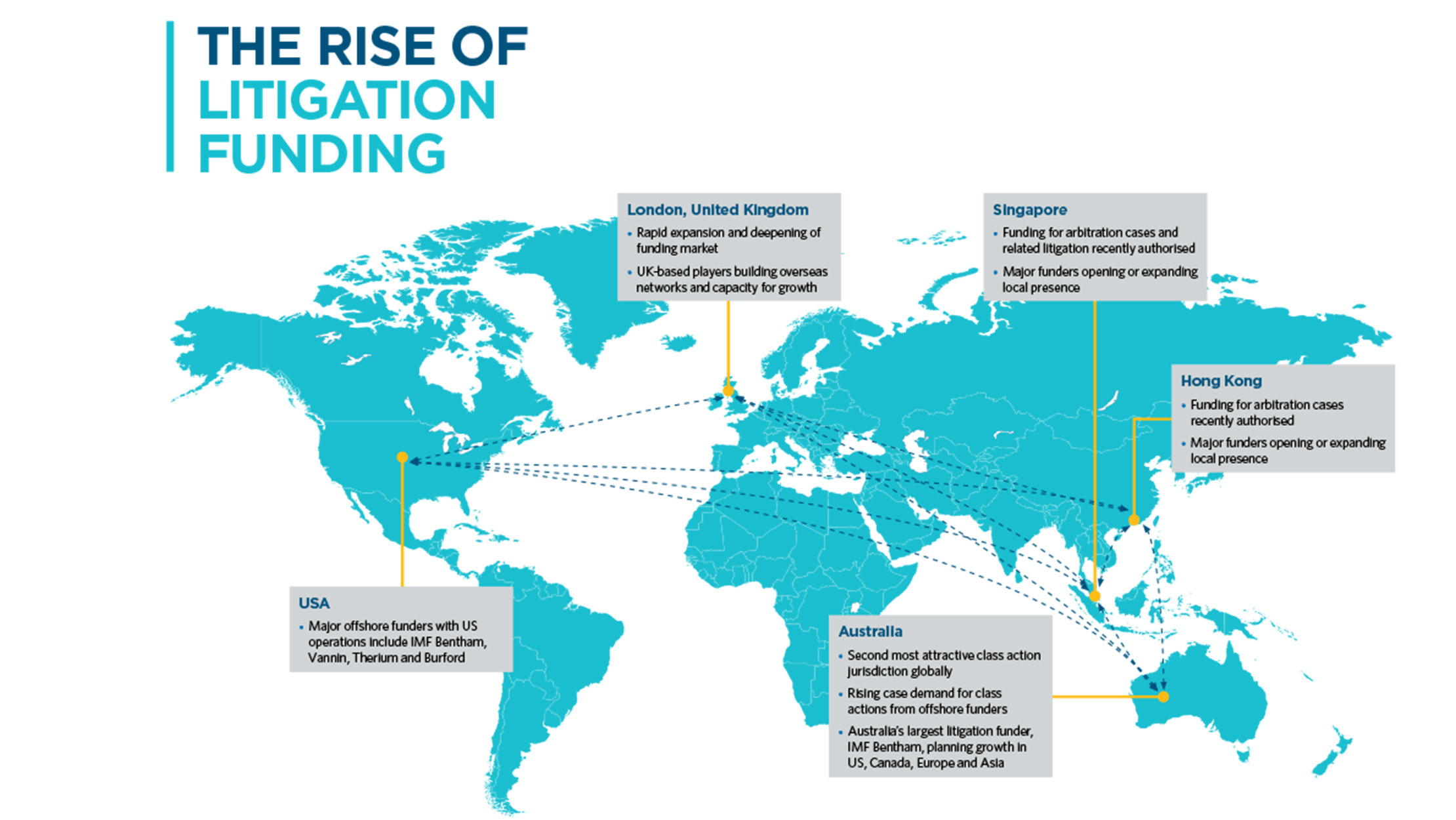

With external funding of disputes expanding fast, we chart its development across the key global markets.

Australia has long been on the frontline of legal and commercial developments in this regard. Here, Damian Grave and Helen Mould provide a snapshot of the current global funding landscape and identify some key trends that are likely to see funders continue to increase their involvement in international litigation and arbitration.

The litigation funding market in the UK has grown rapidly and deeply in recent years, as courts have increasingly accepted funding arrangements as promoting access to justice, and following the endorsement given by Lord Justice Jackson in his 2009 review of civil litigation costs.

Early last year, it was reported that funders’ investments in UK litigation had risen more than 25% in 2016, from £575 million to £723 million.

Most major funders active in the UK have significant involvement in also funding offshore claims, as well as funding international arbitration cases, including investor state dispute settlement claims.

Several recent or current large group actions in the English courts have been financed, at least in part, by funders (for example, the shareholder claims against RBS, Lloyds and Tesco, litigation regarding automotive emissions testing and claims against Mastercard in relation to fees).

A key reason for the substantial growth of the litigation funding industry in Australia in the last decade has been its development in parallel with the Australian class action regime.

In a pivotal 2006 decision, the Australian High Court ruled that commercial funding arrangements were not contrary to public policy. Subsequently, acceptance by Australian courts of “closed class” proceedings (where class membership is restricted to signed-up claimants), and more recently, the approval of the “common fund” doctrine (permitting funders to recover a commission across the “open class”) have enhanced funders’ returns.

Empirical research confirms that class actions have been commenced in Australia with much greater frequency in recent years. Data published in 2016 indicated that approximately 40% of the total number of actions filed since commencement of the regime in 1992 had been commenced in the 6 years to 2016. In the period 2010-2016, 49.5% of Australian class actions were funded by commercial litigation funders, up from 23.4% in the 6 years prior.

An increasing number of Australian class actions are backed by off-shore funders, and Australian based funders are increasingly pursuing opportunities in overseas markets.

In June 2017, the Hong Kong Legislative Council enacted legislation expressly approving use of third party funding in arbitration. The legislation implemented recommendations of the Hong Kong Law Reform Commission. The Commission’s report concluded that the reforms were necessary to enhance Hong Kong's competitive position as an international arbitration centre and to avoid the loss of arbitrations to other seats where funding was permitted.

A similar rationale was advanced for Singapore’s introduction, also in 2017, of legislation permitting third party funding for international arbitration cases and related court and mediation proceedings, including those for, or in connection with, the enforcement of arbitral awards.

The internationalisation of commercial litigation funding is apparent from the footprint of some of the major players in the area.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs