Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

ASIC’s focus on truth in takeovers, already high, is increasing, as evidenced by its latest corporate finance report.

The latest ASIC corporate finance report for the six months to June 2018 gives some insights into ASIC’s attitude to recent issues concerning the truth in takeovers policy.

ASIC says that over the six month period it has intervened on “numerous” statements made by market participants.

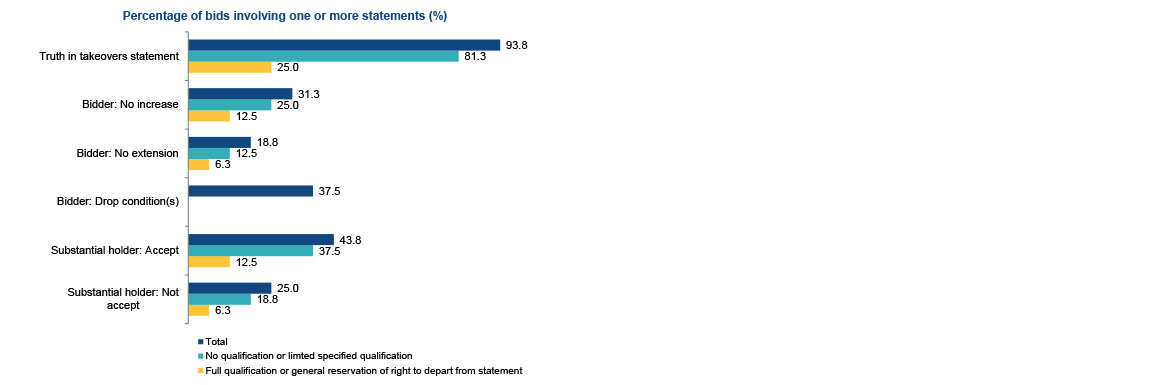

ASIC says that truth in takeover statements have become “commonplace” with statements by bidders and target shareholders the most frequent. This is demonstrated in the following table that ASIC included in its report.

This table shows that the vast majority of takeover bids include one or more truth in takeover statements and that, in almost three out of four takeovers, statements are made by substantial shareholders that they will or will not accept the bid.

Given that truth in takeover statements have the potential to influence the market significantly, ASIC’s report offers the following tips for making truth in takeover statements:

ASIC’s report gives two examples where ASIC sought clarifications.

In the first, a newspaper article cited comments made by a CEO of an acquirer under a proposed scheme of arrangement. The article quoted the CEO as saying the acquirer “will not move the offer price” without any qualification. After a query from ASIC, the acquirer issued a clarification that it reserved its right to increase the offer.

In the second example, a bidder announced shareholder intention statements for over 20% of the target’s shares. While checking whether the bidder had exceeded the takeover threshold, ASIC discovered that the bidder’s announcement failed to disclose that the shareholders reserved their rights to depart from the statements. ASIC required immediate clarification.

During the six month period, ASIC also applied to the Takeovers Panel for a declaration of unacceptable circumstances concerning Finders Resources Limited, where a major shareholder and two of the target’s directors departed from earlier statements that they did not intend to accept the bid by Eastern Field Developments Limited.

This matter has been the subject of other articles published by HSF1 and the decision is currently subject to judicial review. But, it shows the willingness of ASIC to hold to account the makers of statements.

ASIC has flagged that it will be reviewing the policy set out in RG 25. The policy was published in 2002 and ASIC states that the review will consider how RG 25 could be updated to provide greater certainty to the market about the application and enforceability of the truth in takeovers policy.

We will await the policy review with interest.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs