Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

Our 11th annual review of Australia's deal scene sizes up the key themes in marquee acquisitions

This edition examines the 63 control transactions involving Australian targets listed on the ASX that were conducted by way of takeover or scheme of arrangement in the 2019 financial year.

The Report provides detailed insight into:

An overview of some of the key findings of this year’s Report is set out below.

Australian public M&A activity continued to grow in FY19.

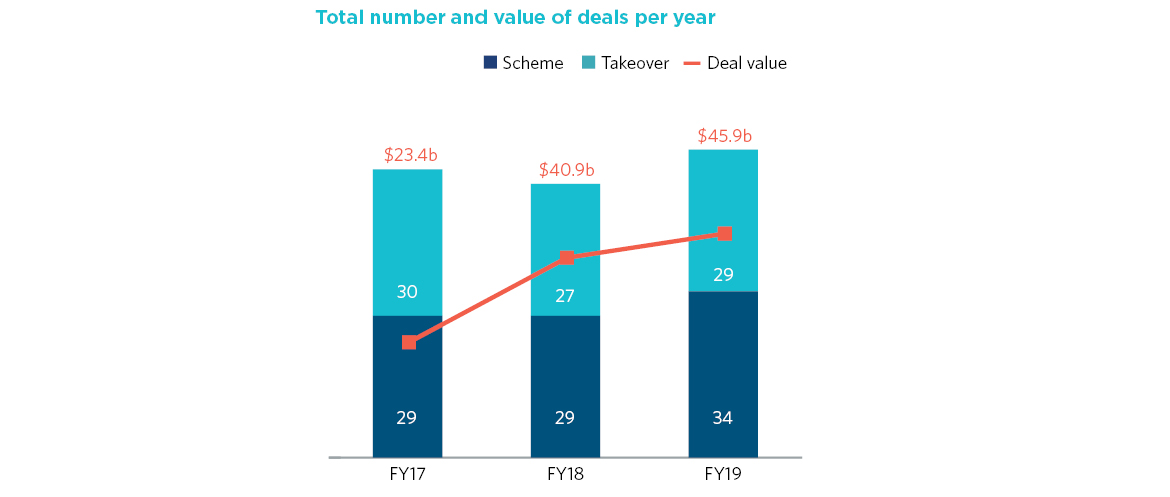

There were 63 deals announced in FY19, compared to 56 deals in FY18 and 59 deals in FY17, with total deal value increasing to $45.9bn (up from $40.9bn in FY18 and almost double the $23.4bn seen in FY17).

Success rates were also high in FY19, with 72% of deals that had completed at the time of writing the Report seeing the bidder acquire 100% of the target.

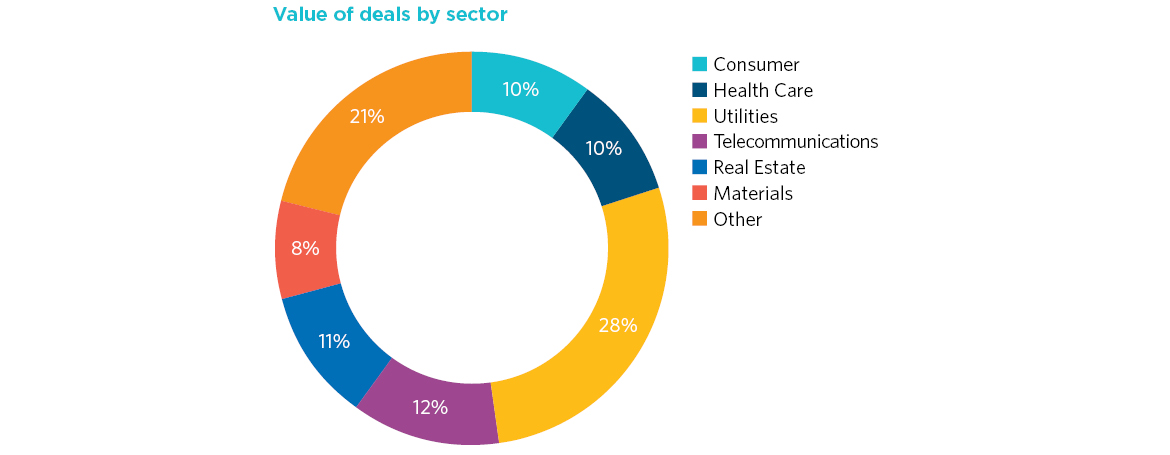

FY19 saw high value targets spread across several sectors, including Telecommunications (TPG Telecom), Real Estate (Investa Office Fund), Health Care (Healthscope) and Consumer (Navitas).

The Energy and Resources sector accounted for 30% of public M&A activity in FY19 by number of deals. Both the Consumer and Diversified Financial sectors also featured strongly, each representing 16% by number of deals.

The Utilities sector (representing 28% of total deal value in FY19) was buoyed by CK Group’s ultimately unsuccessful $12.98bn bid for APA Group.

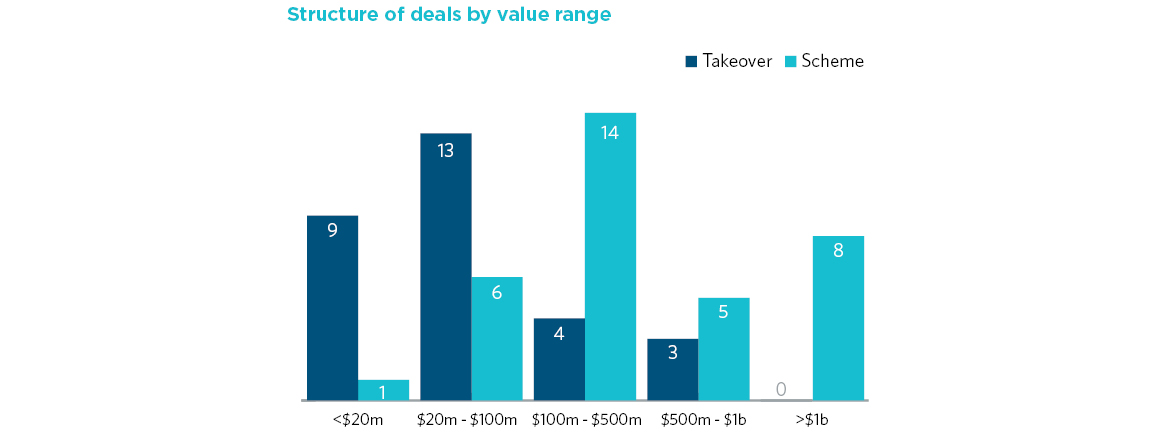

In FY18, we reported that schemes had become the preferred transaction structure over takeover bids for the first time since the inception of our Report. This trend continued in FY19, with 54% of deals being structured as schemes (and 100% of deals valued >$1bn).

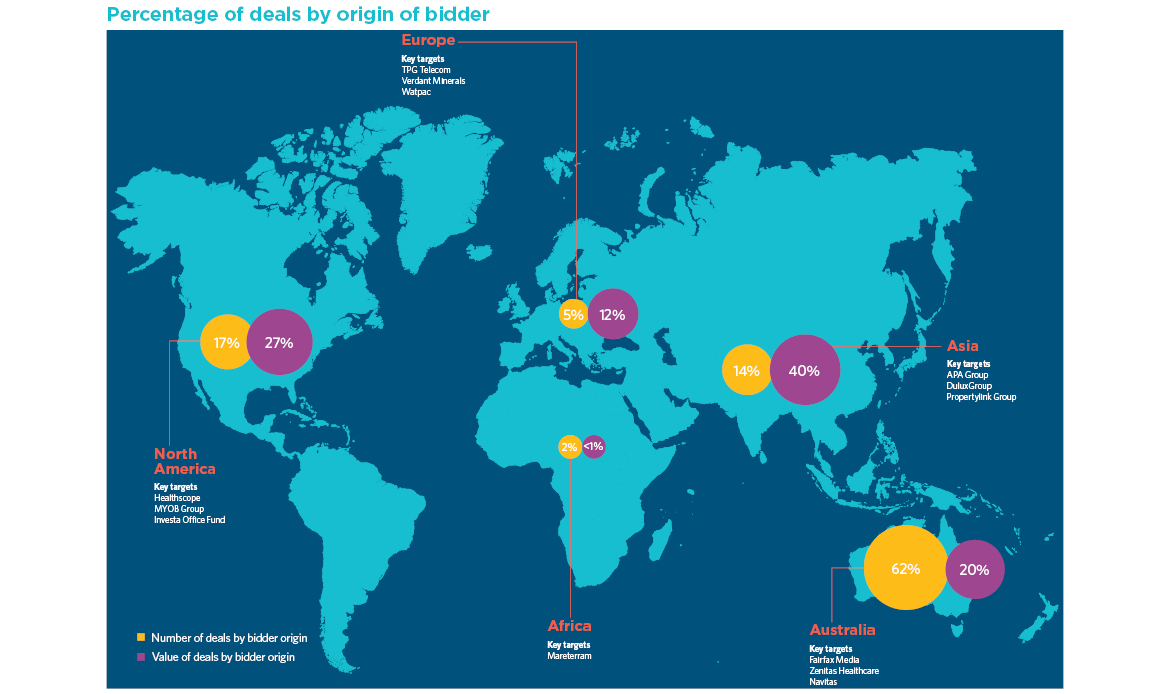

FY19 saw a slight reduction in foreign bidder activity compared to FY18, both by number (38% in FY19, 52% in FY18) and by value (80% in FY19, 90% in FY18).

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs