Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

The impact of the COVID-19 pandemic has been felt across the globe. States have had to make some difficult decisions in response to the spread of the virus while trying to mitigate both economic and societal damage in the short and longer term. This has led to the introduction of a whole range of measures designed to protect public health, including mandatory social isolation, the suspension of contractual rights, the requisitioning or nationalisation of private property, the closure of borders, and export and travel restrictions.

In such extraordinary times, a degree of interference by states with private rights is almost inevitable. But, even in times of crisis, there may be legal ramifications from this sort of wide-ranging action. In this article we consider the balance that states must strike between their response to this pandemic and their obligations to foreign investors under investment treaties. We also offer some thoughts to both states and investors in assessing the measures that have been introduced against the standards of protections these treaties offer.

The international law obligations of states may be relevant in this crisis in a myriad of ways. But in this article, we focus on the international obligations assumed by states under investment treaties, which are particularly pertinent to both our state and investor clients.

An investment treaty is an agreement between states which contains reciprocal undertakings for the promotion and protection of private investments made by the nationals of one state in the territory of the other state. The treaty may be “bilateral” (between two states) or “multilateral” (between a number of states). Some treaties are specifically focused on investment alone but investment protections may be found in treaties with broader scope, such as free trade agreements or sectoral agreements. These investment protections are usually agreed by states to provide confidence to foreign investors that their investment will not be negatively affected by certain types of irregular action by the state hosting the investment (known as the host state). Significantly, whilst these are state-to-state agreements, they usually contain provisions allowing a private investor from one state to enforce the protection their investment is afforded against the host state. That enforcement is usually through international arbitration.

For a foreign investor to be able to rely on investment protections there needs to be an applicable treaty between the host state taking the measures affecting the investment, and that foreign investor’s “home” state (commonly, in the case of a company, the state of its incorporation).

That foreign investor also needs to have an “investment”. Each treaty will usually contain its own definition of “investment” and it is important that an investor is able to show that their activity falls within this definition. In many treaties, the definition of “investment” is quite broad. Many treaties use the phrase “every kind of asset” followed by a non-exhaustive list of types of assets that fall within the definition. In some treaties an “indirect” investment in a host state through a subsidiary may also qualify.

Investment treaties are entered into by many different states. While there are many common features, precisely what the treaties include may depend on a number of factors, such as the state’s negotiating power, experience and expertise, its economic situation, and whether it is a largely capital exporting or capital importing country. Also relevant is the date when the treaty was entered into – older treaties tend to include standard protections without further definition, while modern treaties can be more sophisticated, for example including carve-outs for certain state behaviours, CSR and environmental issues and in some cases investor obligations.

While there may be many similarities in the types of protections included in treaties, subtle differences in language can have a significant impact. There can also be differences in key terms like qualifying “investor” or qualifying

“investment” which will mean that the scope of protection offered by individual treaties will differ.

It is therefore really important to look carefully at the specific provisions of any treaty.

Even in extraordinary times such as these, states must continue to comply with their obligations under investment treaties. Legitimate questions may exist regarding whether the extent of the measures imposed in certain jurisdictions is justified, or whether the measures are proportionate to the serious economic damage which they may inflict. Depending on the circumstances, state action taken in response to the COVID-19 pandemic or indeed, in response to the longer term economic fall-out as a result of the pandemic, could potentially breach the protections outlined above that are offered by these treaties. Investors may then be able to take direct action against that state through international arbitration and claim for the losses caused by the breach of those protections.

However, assuming there is an applicable treaty, the question of whether there has been a breach will depend heavily on the nature of the state action, the circumstances in which it was taken, and the wording and interpretation of the treaty. Each investor’s potential claim against a state will therefore need to be considered on its own merits. It is also important to note that some treaties carve out, or permit state behaviour which interferes with the foreign investment in certain circumstances (for example, where the measures the state introduces are intended to protect public health or preserve national security or public order). There are also a number of defences that may be available under customary international law, based on necessity, distress or force majeure.

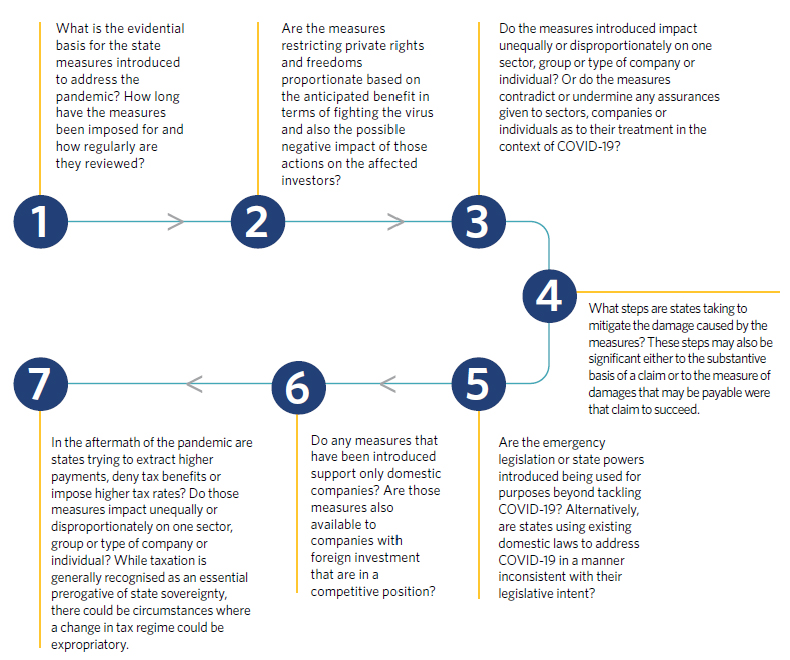

What does this mean for investors looking to investment treaties for protections or for state representatives (in either the legislature, executive or judiciary), who are weighing their various obligations? There are some important questions to ask when assessing whether a state’s response to COVID-19 is consistent with its treaty obligations. These might include:

Whether or not state actions in response to COVID-19 result in a breach of treaty protections, and whether an actionable claim arises as a consequence, will be heavily fact- and treaty-specific.

Where measures introduced by particular states raise concerns, investors are well-advised to look at the investment structure underpinning their investment in that host state and carry out a treaty audit to identify potentially relevant treaties. Investors may also want to consider obtaining external legal advice to identify and assess any potential claim, and to help ensure that any discussions with a host state get off on the right foot.

States may likewise wish to keep a careful eye on their matrix of investment treaties and be aware of the treaty rights that foreign investors may have. Seeking external legal advice through this developing situation on how to balance their treaty obligations against broader public duties and obligations in light of the pandemic may be invaluable in the successful defence of future claims.

States should retain comprehensive contemporaneous records of the basis for decision-making and the state of knowledge at the time. They should also be careful to ensure that communications with individual investors, as well as industry and sector groups, are clearly documented.

Likewise, investors will want to keep contemporaneous records of the impact on the investment(s) affected by state action. Any communications with states, particularly those seeking or receiving assurances as to treatment, should be carefully recorded and those records preserved.

Partner, Global Co-Head of International Arbitration and of Public International Law, London

Partner, Co-Head of the Latin America Group, Co-Head of the Public International Law Group, US Head of International Arbitration, London

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs