Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

Following a busy year, the consolidation of two leading Dubai arbitration centres has radically changed the UAE disputes landscape

The past year has been eventful in the United Arab Emirates (UAE), with the country commemorating 50 years since its formation and hosting over 24 million visitors at the delayed Expo2020. This year saw the largest legislative overhaul in the country's history, in addition to the adoption of a new working week to align with other key financial and legal centres. The arbitration community was not left out, with the consolidation of the two leading Dubai arbitration centres and the publication of much-anticipated new DIAC Rules. We cover these and other major developments below.

What happened to the DIFC-LCIA?

In September 2021, Decree No. 34 of 2021 concerning the Dubai International Arbitration Centre (DIAC) was issued, taking many in the UAE arbitration community by surprise. The decree dissolved the Dubai International Financial Centre Arbitration Institute (DAI), the entity that operated the DIFC-LCIA Arbitration Centre and the Emirates Maritime Arbitration Centre in a joint venture with the London Court of International Arbitration (LCIA). This resulted in a transfer of the assets, rights and obligations of the DAI to DIAC.

All the arbitration centres and other relevant authorities were granted six months from the entry into force of the decree to comply with its terms.

What does this mean?

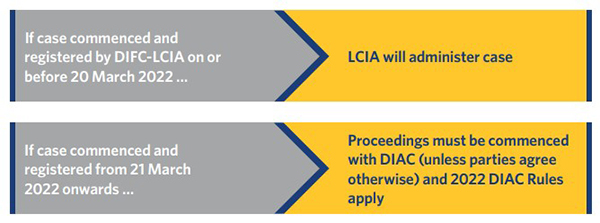

In March 2022, the DIAC and the LCIA agreed the LCIA will administer all cases commenced and registered by the DIFC-LCIA under a case number on or before 20 March 2022. In order for administration to be transferred to the LCIA, parties had to file a Request for Arbitration and pay the registration fee, and the DIFC-LCIA would need to have registered the case and assigned a case number before the deadline.

The decree states that DIFC-LCIA arbitration agreements entered into before the effective date are still deemed valid. However, as of 21 March 2022, where a party wishes to commence new proceedings under a DIFC-LCIA agreement, such proceedings must (unless the parties agree otherwise) be commenced with DIAC, and DIAC will administer them under the new DIAC Rules.

What do I need to know about the new DIAC Rules?

The decree presented an opportunity for DIAC, now Dubai's sole arbitral institution, to issue new rules enacting changes envisaged by draft rules issued in 2017. DIAC has also announced the appointment of an Arbitration Court, which replaces the Executive Committee of DIAC and will supervise the management of all cases administered by DIAC.

The updated DIAC Arbitration Rules 2022, which entered into force on 21 March 2022, are a total overhaul of DIAC proceedings. The changes represent a long-awaited departure from the DIAC Rules that have been in force since 2007 and align more closely with international standards of other leading institutions such as the ICC and LCIA. They also address a number of hot topics in arbitration, notably in relation to third-party funding, virtual hearings and expedited and emergency proceedings. The 2022 Rules are an important step in securing Dubai’s reputation as the leading hub for commercial arbitration in the region, following a period of uncertainty since the abolition of the DIFC-LCIA Arbitration Centre. Our blogpost summarising the rules can be read here.

The DIFC court continues to demonstrate its willingness to support DIFC-seated arbitrations and to enforce awards.

Importantly, the DIFC courts have, for the first time, issued an anti-suit injunction in favour of a party to pending DIFC-LCIA arbitration proceedings. The injunction was issued to prevent the defendant from taking further steps in the Dubai courts but also required the discontinuance of existing onshore proceedings.

The decision (summarised in our blogpost here) sends a robust message that parties with contracts that provide for arbitration with a DIFC seat must respect this choice of forum. It is hoped this decision will curtail a disruptive tactic common in Dubai whereby a party commences litigation in the local courts contrary to an agreed dispute resolution clause providing for a different forum.

The onshore UAE courts continue to frame arbitration as an “exceptional arrangement” and a form of waiver of the right to access courts. As a result, failure to comply with procedural formalities may have significant consequences both during proceedings and at the enforcement stage. In summary:

The sweeping changes over the last year represent a significant overhaul of the UAE's arbitration landscape. Following a period of uncertainty since the abolition of the DIFC-LCIA Arbitration Centre, the disputes community has witnessed a number of positive steps aimed at securing Dubai’s reputation as the region's leading hub for commercial arbitration. Combined with other major legislative changes in recent years, including the implementation of a new federal arbitration law in 2018, the UAE offers an increasingly modern and sophisticated legal framework both onshore and within its financial free-zones.

“The key take-away is for parties to ensure particular care is paid to drafting arbitration clauses – particularly for multi-party and multi-contract projects common in construction and financial services contexts – given that a party's intention to arbitrate must be explicit and unequivocal.”

NICK OURY

“Parties should also keep in mind the consequences of not complying with procedural matters, which may appear at first glance to be minor idiosyncrasies of the region, can be severe.”

STUART PATERSON

| At a glance |

|

Managing Partner, Middle East and Head of Middle East Dispute Resolution, Dubai

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs