The Australian competition watchdog's proposals suggest a more muscular approach to regulating digital service providers

While certain proposals are ostensibly targeted at specific digital platforms, the Australian Competition and Consumer Commission's (ACCC’s) recommendations (if adopted) will have broad ramifications for businesses that handle data or have an online presence.

KEY TAKEAWAYS

The ACCC’s Interim Report on Regulatory Reform proposes reforms to increase regulation of digital service providers.

Our key takeaways are:

- Broad, new power to make service-specific codes of conduct applying to “designated” digital businesses. The ACCC emphasises flexibility in recommending a new regime based on mandatory codes of conduct. The regulator will likely have broadly expressed powers (constrained by "broad principles") to develop and enforce codes. That would provide significant discretion as to the services affected and new code obligations, which will only be determined later, after the regime is in place. The nature of the ACCC’s concerns indicates that code obligations will directly affect how designated digital businesses interact with their data, their competitors and their users.

The designation criteria, by which a regulator or Minister decides which businesses are regulated, would be intended to capture digital businesses with a “critical position in the Australian economy” and “the ability and incentive to harm competition”.But those criteria are not yet clear, and could be broad - for example, based on global revenue, market shares (with the ACCC referring to overseas thresholds as low as 10-15%), or the fact that a business is an intermediary (eg a marketplace) or supplies multiple digital services (ie an ecosystem). - New “unfair trading practices” prohibition, directly affecting how many online businesses interact with users. The new prohibition would apply to all sectors and be intended to go well beyond existing consumer protections. Digital businesses would need to consider how online user interfaces, choice architecture and service and privacy terms influence consumer behaviour and decision-making.

- Further, specific consumer protections for users of digital platform services. The ACCC proposes a suite of obligations for digital platform service providers that face risks of scams, harmful apps and fake reviews and consumer dispute resolution processes. The ACCC’s initial views indicate a preference to implement the measures through legislated prohibitions, which could be supported by ACCC guidelines or a code.

- Enforcement. The ACCC considers that the proposed measures should be backed by the recently increased competition and consumer law penalties regime: see our briefing here. The ACCC suggests that stronger “behavioural and structural remedies” may be necessary to deter large digital platforms – referring to (but not specifically proposing) "big stick” asset divestiture orders in energy markets and anti-competitive conduct notices.

- Merger reform deferred. The ACCC has not recommended any digital sector-specific merger reforms, instead reserving this for consideration in a broader economy-wide review of the current merger regime.

OVERVIEW OF RECOMMENDATIONS

|

Recommendation |

Who would it apply to? |

|---|---|

|

General prohibition on ‘unfair trading practices’ |

All businesses that deal with consumers or small businesses |

|

Mandatory processes to prevent and remove scams, harmful apps and fake reviews Mandatory internal dispute resolution standards Independent external ombuds scheme to make final determinations of consumer complaints and disputes |

Businesses supplying certain “digital platform” services At minimum, likely to include search, social media, online private messaging, app stores, online retail marketplaces and digital advertising services Other services may be captured through a legislated definition, or by later determination |

|

Mandatory codes of conduct that address a range of anti-competitive conduct |

Separate codes of conduct, each applying to a specific digital service (for example general search, app stores) Codes only apply to “designated” digital platforms, as determined by a regulator or Minister, subject to criteria |

CONTEXT AND NEXT STEPS

The Interim Report marks the mid-point of the ACCC’s Digital Platform Services Inquiry. It follows public consultation on the issues and proposed approaches to reform identified in the ACCC’s Discussion Paper on Updating Competition and Consumer Law for Digital Platform Services.

While previous interim reports have focused on specific services, this Interim Report sets out the ACCC’s view on the regulatory reforms it has proposed to Government in respect of digital platform services more broadly.

The Government is now considering the ACCC’s recommendations and has stated that it will consult publicly with stakeholders. Additionally, the Government notes that it is already strengthening consumer protections and has committed to establishing a new National Anti-Scam Centre.

The previous interim report for March 2022 focussed on online retail marketplaces (see our summary here) and a further interim report (on social media services) is due in March 2023. The final report for the five year Digital Platforms Inquiry is due to be submitted to Government in early 2025.

COMPETITION CODES OF CONDUCT TO REGULATE ‘DESIGNATED’ DIGITAL PLATFORM SERVICES

The ACCC recommends that a relevant regulator is given broad powers to develop, administer and enforce mandatory codes of conduct in relation to specific digital platform services, to address certain forms of anti-competitive conduct, perceived barriers to entry and treatment of business users. In the recommended regime, the regulator and/or a Minister would:

- determine which services would be regulated via a code of conduct, and in what priority;

- draft, implement and update the codes of conduct; and

- determine (by designation decision) which businesses the codes of conduct will apply to, by reference to criteria.

While the ACCC recommends that each of these processes involve public and industry consultation, the regulator would likely have substantial discretion in determining which services should be regulated and the additional obligations. In addition, non-compliance with the codes of conduct may attract the maximum competition and consumer law penalties – which have been increased to $50 million or 30% of Australian turnover during the period of contravention.

The ACCC’s report suggests that the priority services are search, ad tech, app stores and mobile OS services. However, the power would be broadly expressed, to allow codes to be developed for other services (such as social networking, video-sharing platforms, virtual assistants and cloud computing services) and digital services developed in future.

The obligations under the proposed new codes would only apply to businesses that are “designated”. Whilst the ACCC expresses a preference for more certain “quantitative” criteria, it recognises that more contestable qualitative criteria may be necessary.

The potential criteria identified by the ACCC are summarised in the table below. Some criteria draw on the Digital Markets Act in the EU, which recently entered into force and will enable the European Commission to designate a company as a “gatekeeper” (to whom the rules apply) if it meets quantitative or qualitative criteria (see our briefing here).

|

Designation criteria |

Potential metric or standard |

|---|---|

|

Financial strength (Quantitative) |

|

|

Reach (Quantitative) |

|

|

Characteristics (Qualitative) |

|

The report does not discuss how the ACCC proposes designation decisions (or any decisions under a code) would be reviewed or challenged.

How will these codes work?

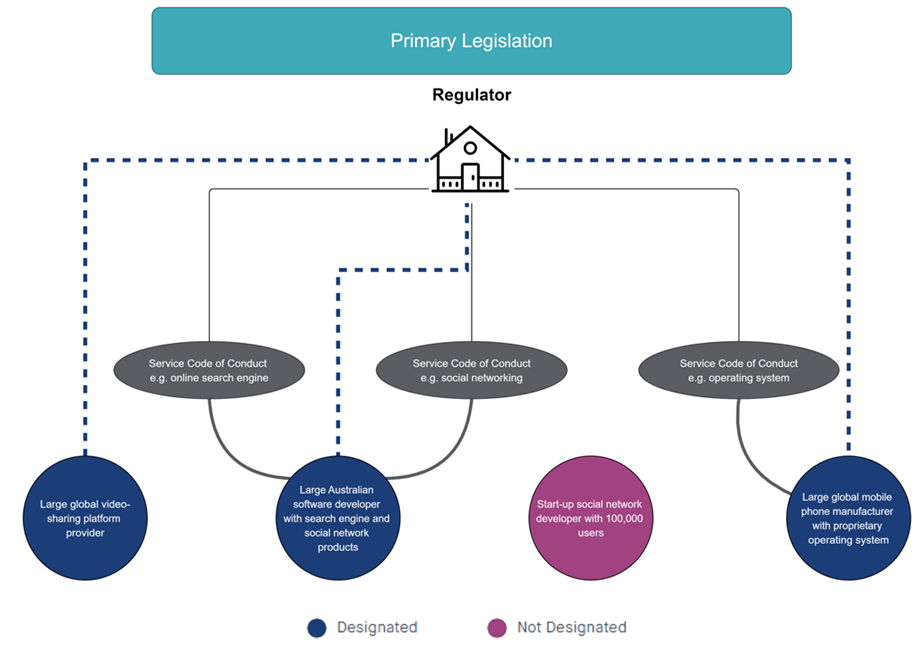

There are several layers in the proposed regime. Businesses will only be subject to new obligations where there is a code which regulates the specific service they provide and where they have been designated by the regulator (or the Minister) in respect of that service. An illustration of how the regime could operate is set out in the diagram below, with the grey lines depicting codes and blue lines depicting designation determinations.

What kinds of conduct will these codes target?

Examples of the diverse types of conduct the ACCC seeks to address are summarised below. Those concerns and possible obligations indicate that a broad and flexible power would likely be required to regulate such complex business practises and processes in a rapidly developing industry. The possible obligations also indicate the potential risks to privacy, data security, product efficiency and functionality and innovation that could result from poorly designed or enforced obligations. However, the ACCC suggests that code obligations should be tempered to permit legitimate conduct.

|

Competition concern |

Example obligations and restrictions (exceptions may apply to permit legitimate conduct) |

|---|---|

|

Self-preferencing and tying |

|

|

Barriers to customer switching |

|

|

Interoperability |

|

|

Lack of access to data |

|

|

Lack of transparency |

|

|

NEW PROHIBITION ON UNFAIR TRADING PRACTICES

The ACCC proposes that a new prohibition against unfair trading practices be incorporated in the existing Australian Consumer Law. If adopted, this will apply to all businesses and not just digital platforms, and will be subject to recently increased penalties: see our briefing here.

The prohibition is intended to capture a broad range of conduct, such as:

- restrictions on consumer choice in data handling and privacy – for example, “all or nothing” consents, an issue that is also under consideration in the current Privacy Act review being conducted by the Attorney-General's Department;

- practices designed to dissuade user actions – for example long contracts; free trials that roll into paid subscriptions and are difficult to cancel; multiple pop-up warnings when users seek to use third-party apps; and

- design and processes of user interfaces that ‘confuse’, ‘manipulate’ or ‘impede’ consumer decision-making – such as using ‘illogical’ colours for click options; ‘false hierarchies’ where one option stands out through size, placement or colour; or changing click sequences.

The ACCC has not yet made a recommendation on how to frame the unfair trading practices prohibition. However, given the complexity of the conduct identified, the ACCC has suggested that it may issue guidelines to support compliance.

The Commonwealth is developing a regulatory impact statement regarding the prohibition, which is expected to be open for public consultation in due course.

ADDITIONAL CONSUMER PROTECTIONS FOR USERS OF DIGITAL PLATFORM SERVICES

To increase consumer protection for users of digital platform services, the ACCC proposes the measures outlined below. At a minimum, the proposed obligations would likely apply to businesses providing search, social media, online private messaging, app store, online retail marketplace and digital advertising services (as relevant). However, the ACCC emphasises the flexibility to include other services in the future, potentially by Ministerial determination.

- Mandatory processes should be introduced to prevent and remove scams, harmful apps and fake reviews, including:

- a notice-and-action mechanism allowing users to report a scam or harmful app, and requiring the platform to respond, share information with relevant agencies, and offer redress, as appropriate;

- verification of certain users (eg advertisers, app developers, merchants), to minimise scams and harmful apps;

- public reporting on mitigation efforts; and

- requiring digital platforms to take pro-active steps to protect consumers from scams or harmful apps.

- Setting minimum standards for internal dispute resolution processes, supported by an independent dispute resolution (‘ombuds’) scheme, including:

- minimum standards of accessibility, timeliness, accountability, the ability to speak to a human representative, and transparency of processes and outcomes; and

- the ability to escalate disputes to an independent ombuds scheme with powers to investigate, order compensation and make binding resolutions on complaints.

Failure to comply with a decision by the independent ombudsman could be subject

to penalties.

Whilst the ACCC indicates a preference to introduce these consumer protections through primary legislation, it recognises that code(s) of conduct may be required.

Key contacts

Linda Evans

Regional Head of Practice – Competition, Regulation and Trade, Australia, Sydney

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

Stay in the know

We’ll send you the latest insights and briefings tailored to your needs