Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

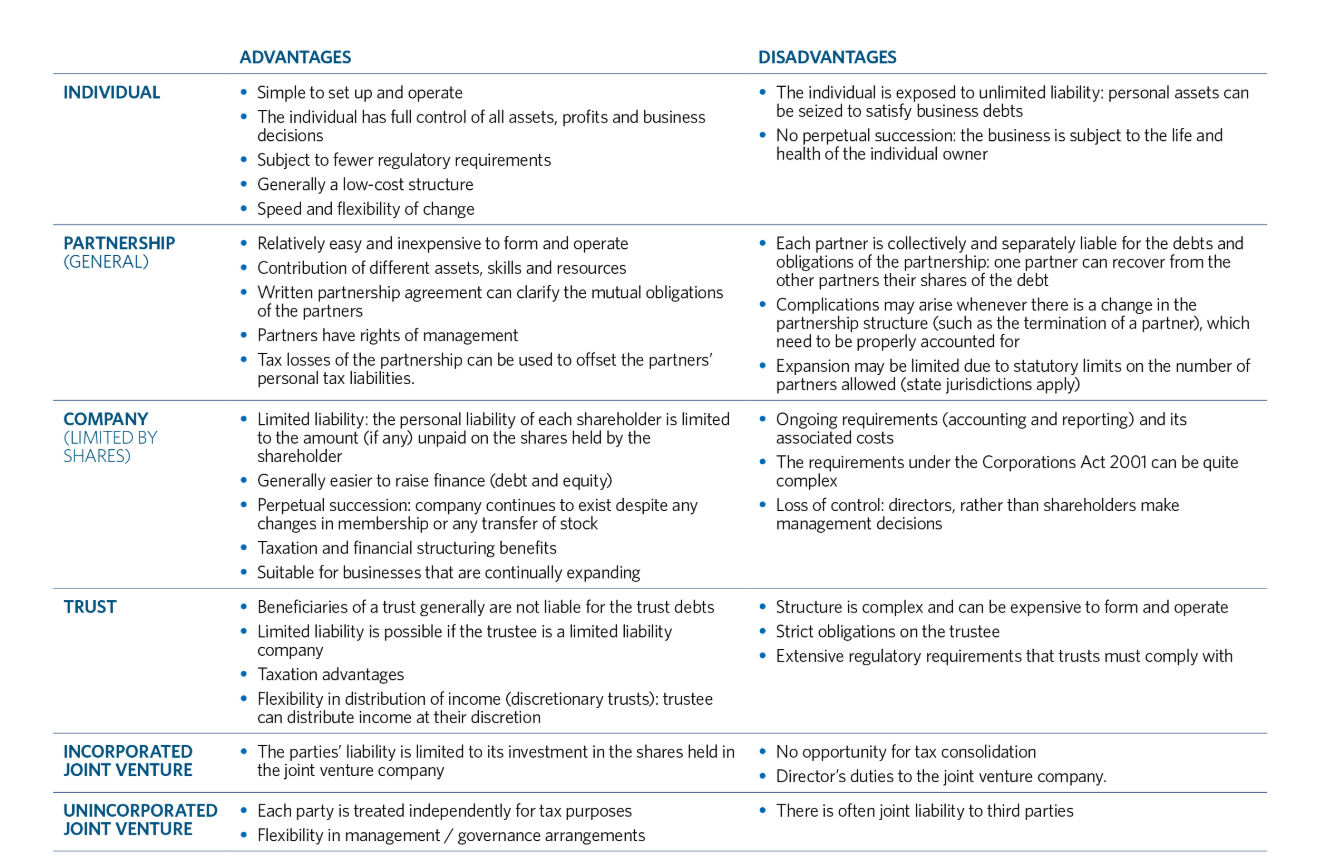

Foreigners may carry on business in Australia as an individual, a partnership, a company, a joint venture, a trust or an Australian branch office of a foreign company. The structure that is most suitable will largely depend on the nature of your business and its objectives. Each of the different business structures are described below.

This is the simplest form of business structure and is most common for small business ventures. If the business is not being conducted under the name of the individual (that is, first name and surname, or initials and surname), then the individual must register the relevant business name with the appropriate state or territory authority (a list can be found on the Australian Government’s website, www.business.gov.au). An individual is not subject to the same regulation as a company. However, an individual is exposed to unlimited personal liability and may not be eligible for taxation or financial structuring benefits.

A business may be carried on as a partnership. A partnership is an arrangement between two or more people or companies to carry on a business in common with a view to profit. Unless the partnership is a professional partnership, it must not exceed 20 partners. A partnership may be created by an agreement between the partners and will be governed by contract law, state or territory legislation and the common law.

A partnership is not a separate legal entity distinct from the partners themselves. Each partner is collectively and separately liable for the debts and obligations of the partnership. If one partner is required to pay the debt of the whole partnership, that partner can recover from the other partners their shares of the debt. Partners also share the profits of the partnership.

In some states, limited liability partnerships can be created. These usually comprise one (or more) general partner(s) who has unlimited liability and one (or more) limited partner(s) whose liability is limited to the capital they have agreed to contribute to the partnership, provided the limited partner does not participate in the management of the business. In Australia, corporate limited partnerships are generally taxed as companies.

A company may be used to conduct business in Australia. The registration, management and control of companies is governed by the Corporations Act 2001 (Cth) (Corporations Act), which is administered by the Australian Securities and Investments Commission (ASIC). For more information about ASIC, see the Corporate regulators chapter of this publication.

The Corporations Act recognises the following classes of companies:

Companies may be registered in Australia as either a proprietary (private) or a public company. A proprietary company is generally simpler and less expensive to administer than a public company because it is subject to fewer of the administrative requirements imposed by the Corporations Act. Only companies limited by shares or unlimited liability companies may be proprietary companies.

A proprietary company cannot have more than 50 non-employee shareholders and must have at least one member at all times. It must have at least one Australian resident director and it may also, but is not required to, have an Australian resident company secretary. A proprietary company must not invite the public to subscribe for its shares or debentures, or to deposit money with the company. It must include the term 'Proprietary Limited' or 'Pty Ltd' in the company name if it is a limited liability company (or 'Proprietary' or 'Pty' only if it is an unlimited liability company). A proprietary company will generally only be required to appoint an auditor if it is a large proprietary company.

A public company must have at least three directors (two of whom must be Australian residents) and at least one Australian resident company secretary. A public company must include the term 'Limited' or 'Ltd' in the company name (unless it is an unlimited liability company or a company limited by guarantee provided it meets certain requirements—for example, the company pursues charitable purposes only and does not make distributions to its members or pay fees to its directors). A public company may raise funds from the public and be listed on the Australian Securities Exchange (ASX), or may be unlisted. A public company must have an auditor.

Step 1

Step 2

Step 3

Step 4

Step 5

If a company which is established outside Australia starts carrying on business in Australia or engages in certain other activities in Australia, it must register as a foreign company. A registered foreign company must have a registered office in Australia and a local agent.

Registration requires proof of incorporation of the company in the foreign country, particulars of the company directors (including home addresses), a certified copy of the constitution of the company, details and documents in relation to charges on the company’s property and the address of the company’s registered office in its place of incorporation. All foreign companies must have a local agent who is responsible for any obligations the company must meet. Herbert Smith Freehills can assist foreign companies in locating third-party service providers that can provide a registered office in Australia and/or act as the local agent for a branch office of a foreign company.

Once the company and company name are registered, a separate business name may be registered with ASIC. A company number, known as an Australian Registered Business Number (ARBN) will be issued. The company name and number must be displayed at all times.

A registered foreign company must lodge a copy of its balance sheet, cash flow statement and profit and loss account for its last financial year, at least once every calendar year and at intervals of not more than 15 months. If the company is not required by the law of the place of its incorporation to prepare these financial statements, they must be prepared and lodged in such form and contain such particulars as those required for a public company under the Corporations Act. ASIC may require these statements to be audited.

Exemption from annual financial reporting requirements may be available if the registered foreign company is not 'large' or part of a 'large' group (defined by revenue, assets and number of employees), or the company is not 'large' and is covered in consolidated financial statements of a controlling company which are lodged with ASIC. If the exemption applies, the registered foreign company must instead file an annual return with information including share capital, paid up capital, details of directors and local agents and a declaration of exemption from the financial reporting requirement.

Companies must maintain a number of registers, including registers of shareholders, option holders and directors, on the company’s property (company property means either the company’s registered office, the company’s principal place of business or a place in Australia where the work of maintaining the register is done). Listed companies must also comply with the continuous disclosure requirements of the ASX.

All companies must keep financial records of their activities. Each financial year, public companies, large proprietary companies and some small proprietary companies must also prepare:

These reports are collectively known as an 'annual report'. Annual reports must be sent to all of the shareholders of the company. The required contents of an annual report are set out in the Corporations Act. The requirements for listed companies are more stringent than for other types of companies. Some companies are also required to prepare half-yearly reports. The contents of a half-yearly report are substantially similar to those of an annual report, except that they relate to a half of the financial year. Additional reporting requirements set out in the ASX Listing Rules for entities carrying on mining and exploration activities may also be applicable and may require the preparation of quarterly reports.

The accounting requirements for a proprietary company depend on whether it is classified as 'small' or 'large' in a given year. A company is 'small' only if it satisfies at least two of the following tests; otherwise it is registered as large:

Small proprietary companies are required to keep financial records that explain their transactions and financial position and that would enable true and fair financial statements to be prepared and audited. However, subject to certain shareholder or ASIC directions, they do not have to prepare annual financial reports or directors’ reports.

Large proprietary and public companies must prepare annual financial reports and a directors’ report, have the financial report audited, and send both reports to all the shareholders. A company’s financial report must comply with the accounting standards set by the Australian Accounting Standards Board (AASB), be lodged with ASIC and give a true and fair view of:

Subsidiaries of foreign companies which are small are required to have their accounts audited unless they meet detailed exemption criteria, including certain net asset requirements and after tax profit.

Auditing and the appointment of auditors is strictly regulated by the Corporations Act. Auditors are subject to significant duties of independence, diligence and skill.

ASIC must be notified of changes to the company within prescribed times, including changes to the company’s shareholders, issued capital, ultimate holding company, location of a register, directors, company secretary, registered office, principal place of business and any registrable charges or mortgages given by the company. A proprietary company does not have to give notice of a change to its constitution unless it changes the status of the company from a proprietary to a public company. A public company must always notify ASIC of changes to its constitution.

A business may be carried on by individuals or companies as a joint venture. A joint venture typically involves two or more parties that come together to undertake a specific project. There are predominantly two forms a joint venture may take: an incorporated joint venture or an unincorporated joint venture. Each form entails distinct considerations, particularly in terms of the flexibility of the arrangement, taxation requirements and party liability.

An incorporated joint venture arises when the parties use a corporate entity to undertake the joint venture activity. Generally, a special purpose joint venture company is created, with each party being a shareholder in the company. Because of this, the terms of an incorporated joint venture are set out in a Shareholders’ Agreement. The parties must also comply with the rules contained in the Corporations Act.

Directors of an incorporated joint venture company owe the same duties as the directors of any other corporate entity. These duties include the duty to act in good faith in the best interest of the joint venture company.

For the purposes of tax, a joint venture company is unable to offset profits and losses against income and losses outside of the incorporated joint venture. Instead, tax losses are retained in the company until future years when assessable income is derived by the company. For more information about tax, see the Taxation, stamp duty and customs duty chapter of this publication.

Under an unincorporated joint venture (UJV), the parties agree to a contract usually called the 'Joint Venture Agreement' which sets out the rights and obligations of each party. In a UJV each party owns a percentage interest in each asset of the joint venture, is responsible for its share of expenses and receives its share of the product generated from the venture. The parties will usually appoint a manager to operate the UJV and a marketing and sales agent to sell the product on behalf of each joint venturer.

As there is only a contractual relationship between the parties, each party is treated independently for tax purposes. Parties are therefore able to adopt their own preferred tax structure. Each party is also able to finance its share of the UJV separately, although for project financing all parties to the UJV often act together.

The joint venturer’s liability under a UJV is several (separate) as between the parties but often there is joint liability to third parties.

UJVs are generally the preferred legal structure for natural resources projects in Australia.

A trust structure can be used to carry on business in Australia. The trustee owns and manages the property and business of the trust wholly for the benefit of the beneficiaries (which may be individuals, trusts or companies). The beneficiaries usually have no specific interest in any particular asset of the business and no right to directly control the use or disposal of any particular asset; this is managed by the trustee. However, the beneficiaries are entitled to share in the proceeds of the trust property as a whole in equal shares (in a unit trust) or such proportions of the trust property as determined by the trustee (in a discretionary trust).

Generally, the trust itself will not be taxed on the income earned by the trust that is distributed to the beneficiaries. The beneficiaries will be assessed on their share of the trust income if they are “presently entitled” to a share of the income (that is they could be assessed even if they have not actually received income). If beneficiaries are not presently entitled to the income, the trust will be liable for the tax on the income. A trust cannot distribute a “loss” to the beneficiaries. That loss is retained in the trust and may be offset against the trust’s future income.'

Last updated 01/01/2023

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs