Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

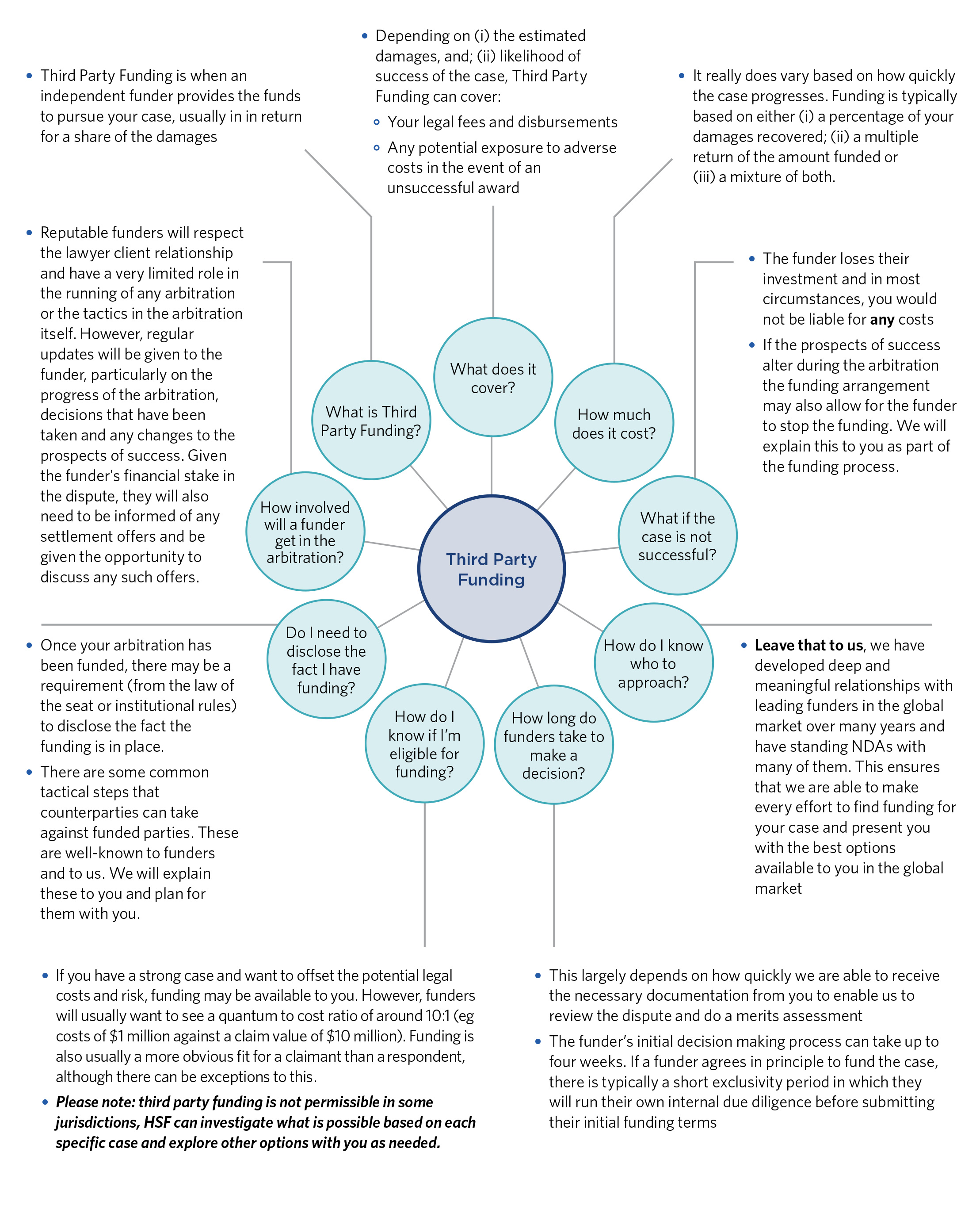

With the number of ways to pay for legal services growing, we assess how third-party funding and alternative fee arrangements can help businesses

Our clients are used to paying lawyers on an hourly rate. While this is often the right option, there are many other practical alternatives. Over the past decade the legal landscape has shifted in many jurisdictions allowing for more innovative ways of providing legal services, particularly in arbitration. Historically, many of these options have been viewed as ways of allowing insolvent companies access to legal advice to bring a legitimate claim against a counterparty. But in practice, third-party funding and alternative fee arrangements (AFAs) can help a broad range of clients manage the costs associated with disputes. This includes solvent businesses who can use these novel structures to deploy their cash flow elsewhere and share risk and reward with their lawyers or a third party.

|

The legal market has seen increased liberalisation of third-party funding over the last 20 years. However, there are signs this may be challenged. On 3 October 2022, the European Parliament published a proposed directive to regulate commercial third-party funding within the EU. The directive would oblige Member States to regulate and authorise third-party funders. It would also empower courts to make adverse costs orders against funders and cap their recovery at 40% of the total award or judgment. The European Commission will need to decide whether to move ahead with the initiative. Nonetheless, the draft does show concerns within Europe about the lack of consistent regulation of the funding market and the need for appropriate safeguards. The current draft appears intended to apply to arbitrations where the proceedings are seated in the EU, regardless of where the litigation funder is based. However, as is often the way with legislation designed to address both litigation and arbitration, the proposed directive does not explicitly address how funders will be made liable for adverse costs awards in an arbitration context – funders are not party to the arbitration and not subject to the tribunal’s jurisdiction. The proposals such as the 40% cap on recovery may also be controversial in the funding community within international commercial arbitration where the users of third-party funding are becoming increasingly sophisticated. Mathias Wittinghofer, Partner, Frankfurt and Emily Fox, Of Counsel, Paris |

Funding may not be a viable option for you or may not be something you want to explore for your case. If so, other options may be available.

These include:

The options are numerous, and we are open to discussing these arrangements with you.

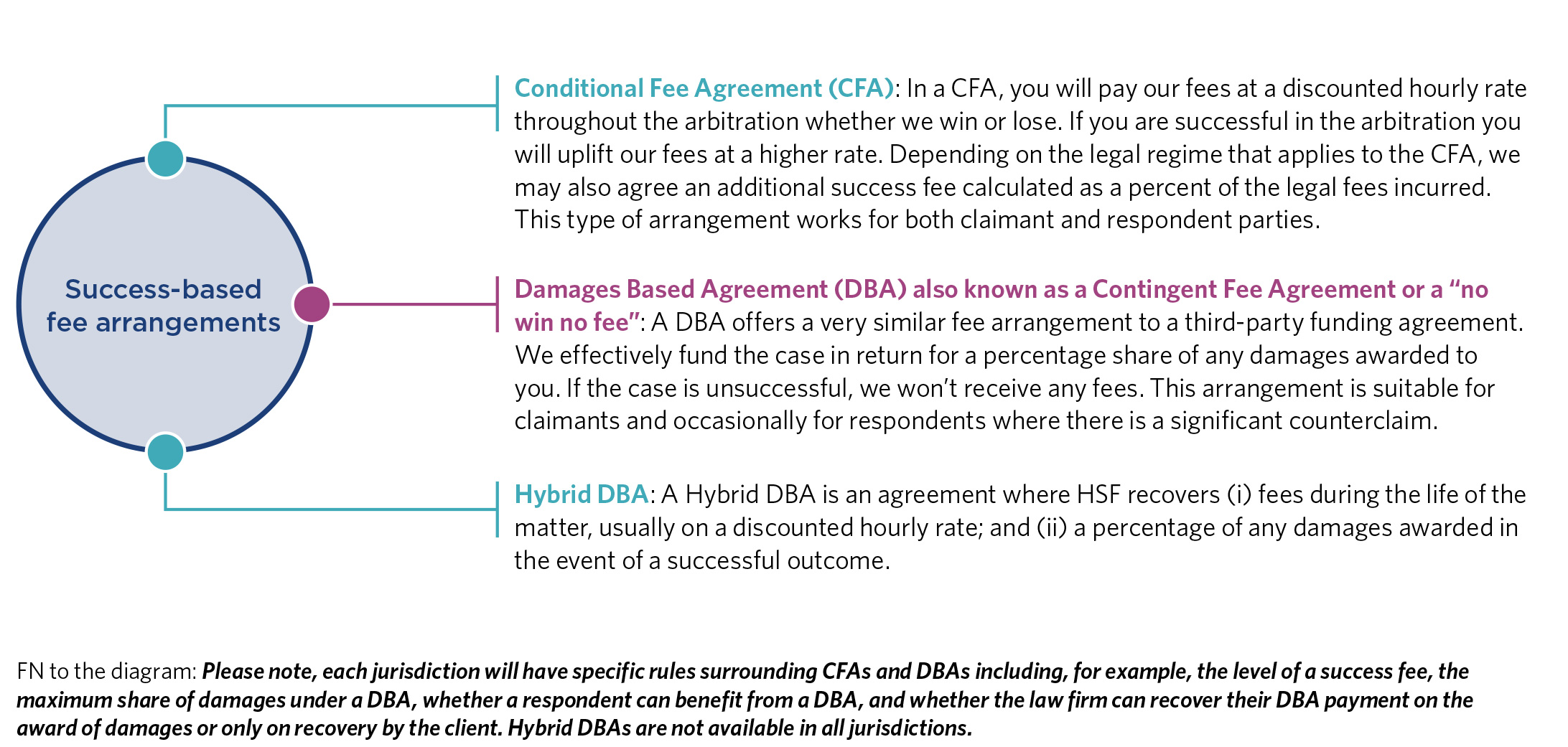

The most common understanding of an alternative fee arrangement is based on performance, such as a successful outcome in the arbitration. These involve the firm taking a share of the risk with you. The three most common success-based arrangements are:

The availability of these three fee arrangements will depend on our assessment of the dispute and your attitude to risk and reward. However, these are not necessarily all-or-nothing arrangements. These are versatile structures that can be adapted to suit your needs. It may be possible to agree that a traditional fee structure will apply to one part of a case and an AFA will apply to another. The fee agreement may incorporate both fee structures from the outset or provide that one type of fee structure will be converted to the other if specified trigger events occur.

|

Case Study We were working on arbitrations where we considered the client's case to be strong but the projected cost-to-damages ratio made the case less attractive to third-party funders. I worked with our pricing and analytics team to find way for us to act for the client in a way that didn't leave HSF financially exposed. We worked with a specialist insurance broker to design a policy for the firm that sat alongside a damages-based agreement. The policy enabled us to act for the client on a full no-win-no-fee basis but ensured that we would recoup some of our fees in the unlikely event that we lost the case. This innovative policy is now being used more widely across the legal market. Amal Bouchenaki, Partner, New York |

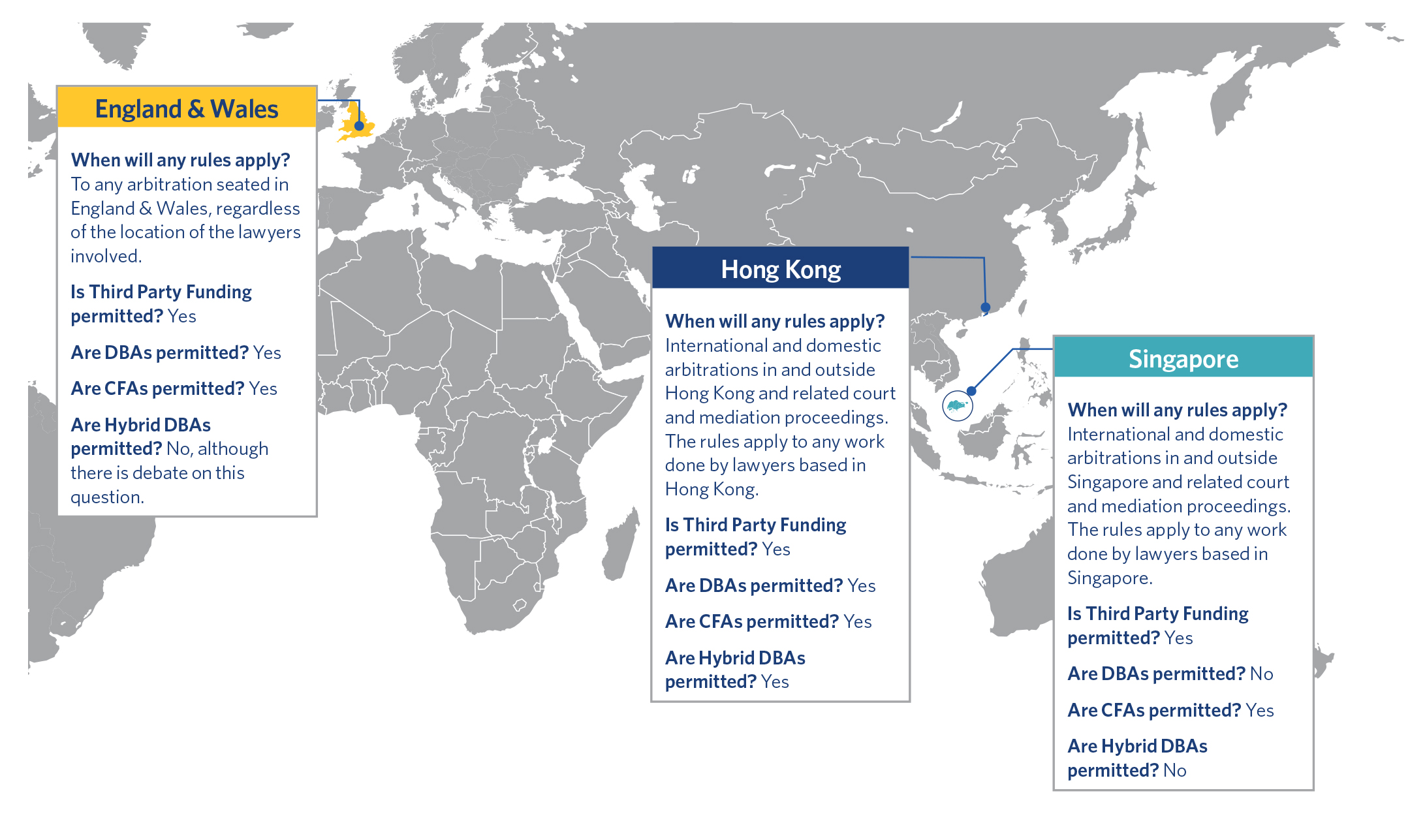

Can you use AFAs and third-party funding for any arbitration?

The short answer is no. There is no single international framework for third-party funding or AFAs and every country has their own rules. But there have been exciting developments in the availability of third-party funding and AFAs in the last few years, particularly in the key arbitration venues of Singapore and Hong Kong. However, even here there are some significant differences in the rules that have been adopted and what is permissible. If we compare Singapore, Hong Kong and England & Wales, it is clear there are plenty of trip hazards for the unwary:

|

Singapore: third-party funding and contingency fees are now permissible "In January 2022, Singapore passed a bill to permit CFAs. This bill came into effect on 4 May 2022, with the passing of the Legal Profession (Conditional Fee Agreement) Regulations. These amendments build on Singapore’s 2021 reforms, which allowed third-party funding in arbitrations and related court and mediation proceedings, as well as SICC proceedings. CFAs are now allowed in relation to:

This includes work done for the purposes of, and before, the contemplated proceedings, such as preliminary advice, negotiations or the settlement of disputes. CFAs are permitted even if those proceedings are not eventually commenced, or if the dispute is settled. DBAs remain prohibited. The uplift fee cannot be a percentage or proportion of the damages awarded. This is an important step for Singapore, enabling HSF's Singapore-based arbitration team to offer success-based fee arrangements to our clients." |

Hong Kong: New legislation makes DBAs, CFAs and Hybrid DBAs available "On 16 December 2022, lawyers in Hong Kong became able to offer success-based fee arrangements for work in Hong Kong on arbitrations and related proceedings. Hong Kong’s new regime permits a broad range of fee options, including:

Hong Kong-based lawyers can agree to a success-based arrangement for arbitrations seated in Hong Kong or anywhere else in the world, as well as related court and mediation proceedings. This means that Hong Kong now boasts one of the world’s broadest legal success fee regimes for arbitration, giving parties the flexibility to cover legal costs while mitigating risk, aiding cash flow, and enhancing budget control." |

|

| Tom Furlong, Partner, SIngapore | Kath Sanger, Partner, Hong Kong |

| "Alternative fee arrangements offer real flexibility to clients. However, in international arbitration, it is very easy to get the rules wrong in different jurisdictions. We saw this last year when a boutique law firm was ordered to repay $1.6 million to a former client after its conditional fee agreement for an investment treaty arbitration was found to be unenforceable. Our pricing, litigation funding and insurance team keeps on top of changes in our key markets to ensure we can offer you market-leading fee arrangements whenever they become permissible. We have also been at the forefront of the DBA and CFA insurance market, working with insurers to cover our risk of taking on a success fee, reducing the risk for the firm and therefore the cost for you." |

| John O'Donoghue, Head of Legal Operations for UK, US & EMEA and Litigation Funding and Insurance Team Head |

|

Would working with HSF on an AFA look different to working with us on an hourly rate? "We always want to ensure we are working with you on a fee arrangement that meets your needs. If you approach HSF to act on your dispute we will: Ask you questions about the matter to get the best possible understanding of its complexity and the potential outcomes. Use our market-leading Genesis Arbitration tool to predict the time needed to undertake the work based on over 1000 historic arbitration matters from across our global network. Consider the widest range of permissible fee arrangements available to us, factoring in your needs and priorities, the risks undertaken by both parties, the lawyers working on your matter, the seat of arbitration and the place of enforcement. Consider any jurisdiction-specific requirements on how your fee arrangement is structured. For example, caps on the success fee, cooling-off periods, termination provisions, etc. We can then propose appropriate fee arrangements to you and reach an agreement with you on how to proceed. Once we start working together, you will notice little difference between how we operate on an hourly rate and an AFA arrangement. You will continue to receive the high-quality legal advice you would expect from HSF as we work to bring about the best possible outcome for you. HSF will keep track of the hours we spend working on your matter, even where we are working on a full DBA. This enables us to monitor our own performance, assess how accurate our price-predictions were, and also seek recovery of legal costs from the counterparty on success. We may also include a member of our legal project management team on the matter to help carry out that monitoring process. What might be different? HSF may insure the risks of taking on an AFA and we may (with your agreement) need to share some information with the insurer. The insurance policy will not affect the day-to-day running of the case and you will not be a party to it." |

| Mike McCLure, Partner, Seoul |

HSF is a market leader in disputes pricing. Our pricing and analytics team works with our lawyers and clients to achieve optimal pricing and commercial arrangements that work for everyone. Our litigation funding and risk transfer insurance practice for dispute resolution is a unique offering in the global market.

To find out more about the alternative fee arrangements we can offer around our network or about third-party funding, contact your usual Herbert Smith Freehills contact or to any of the authors.

Partner, Head of China and Japan, Dispute Resolution, Co-Head of Private Capital, Asia, Hong Kong

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs