Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

In March 2023, there were four Rule 2.7 announcements made across the UK public M&A market and a further four possible offers announced.

Firm Offers announced this month:

Possible Offers announced this month:

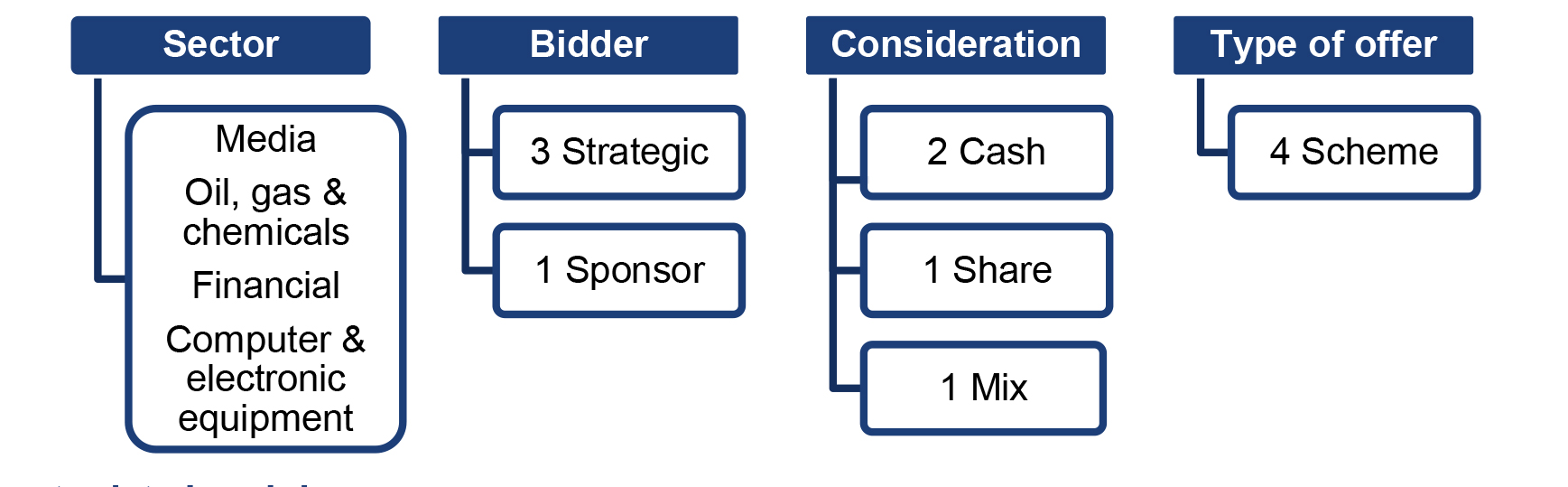

Firm Offers breakdown this month:

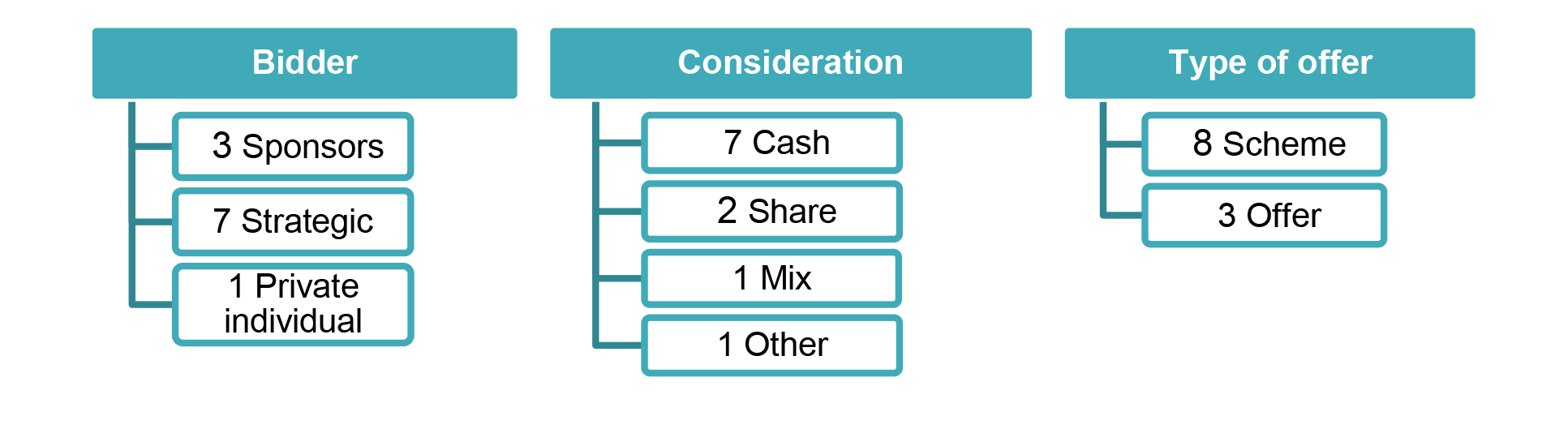

Year to date breakdown:

March 2023 Updates:

Primary Market Bulletin 44

The Financial Conduct Authority (FCA) has published market guidance for issuers on a range of topics in Primary Market Bulletin 44 (PMB 44), including on prospectuses for a scheme of arrangement.

In August 2020, the FCA published for consultation a proposed new technical note on when a prospectus is required where securities are issued pursuant to a scheme of arrangement. In particular the draft note said that if a shareholder is being asked to make a choice between different forms of consideration, for example where a scheme includes a mix and match facility which offers shareholders a choice between shares and cash, in the FCA’s view, a prospectus should be produced (read more on our blog here).

In PMB 44 the FCA says that, having considered the consultation responses, it will not publish the proposed technical note. The FCA notes that respondents to the draft note disagreed with its view and recognises that the question of whether a prospectus is required is a question of law and ultimately is for the courts to decide.

March 2023 Insights:

Public M&A deal activity this March continues to be low in comparison to previous years, with this year marking the lowest number of offers since 2020, with just four firm offers and four possible offers. Deal activity has been slower entering 2023 and this month shows a continuation of that trend. This may be due to the wider issues impacting the markets, such as economic uncertainty, inflationary pressures and the associated higher interest rates.

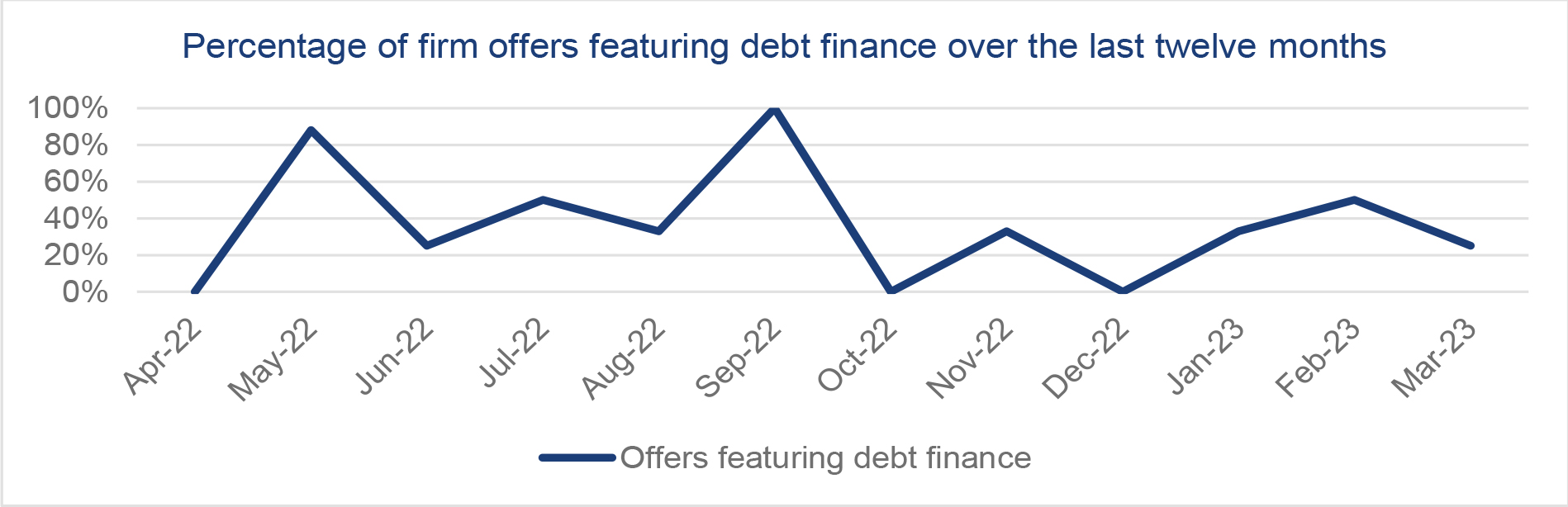

After a period of lower interest rates in 2020 and 2021, rates began to increase rapidly in 2022, going from a Bank Rate of 0.75% in March 2022 to a rate of 4.25% in March 2023. Higher interest rates mean that debt financing has become more expensive and burdensome. As a result, there has been a general decline in the number of firm offers which feature debt financing, an indication of the impact that rising interest rates are having on public M&A transactions. Only one firm offer announced in March 2023 mentioned debt financing, the offer by Providence Equity Partners L.L.C. and Searchlight Capital Partners UK LLP for Hyve Group plc, and even on that transaction the announcement said that the consideration will be funded from equity financing drawn down from the Providence Equity Funds but the bidder may raise debt financing following the announcement. This trend is likely to continue in the coming months as the Bank of England seek to tackle the high levels of inflation.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs