Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

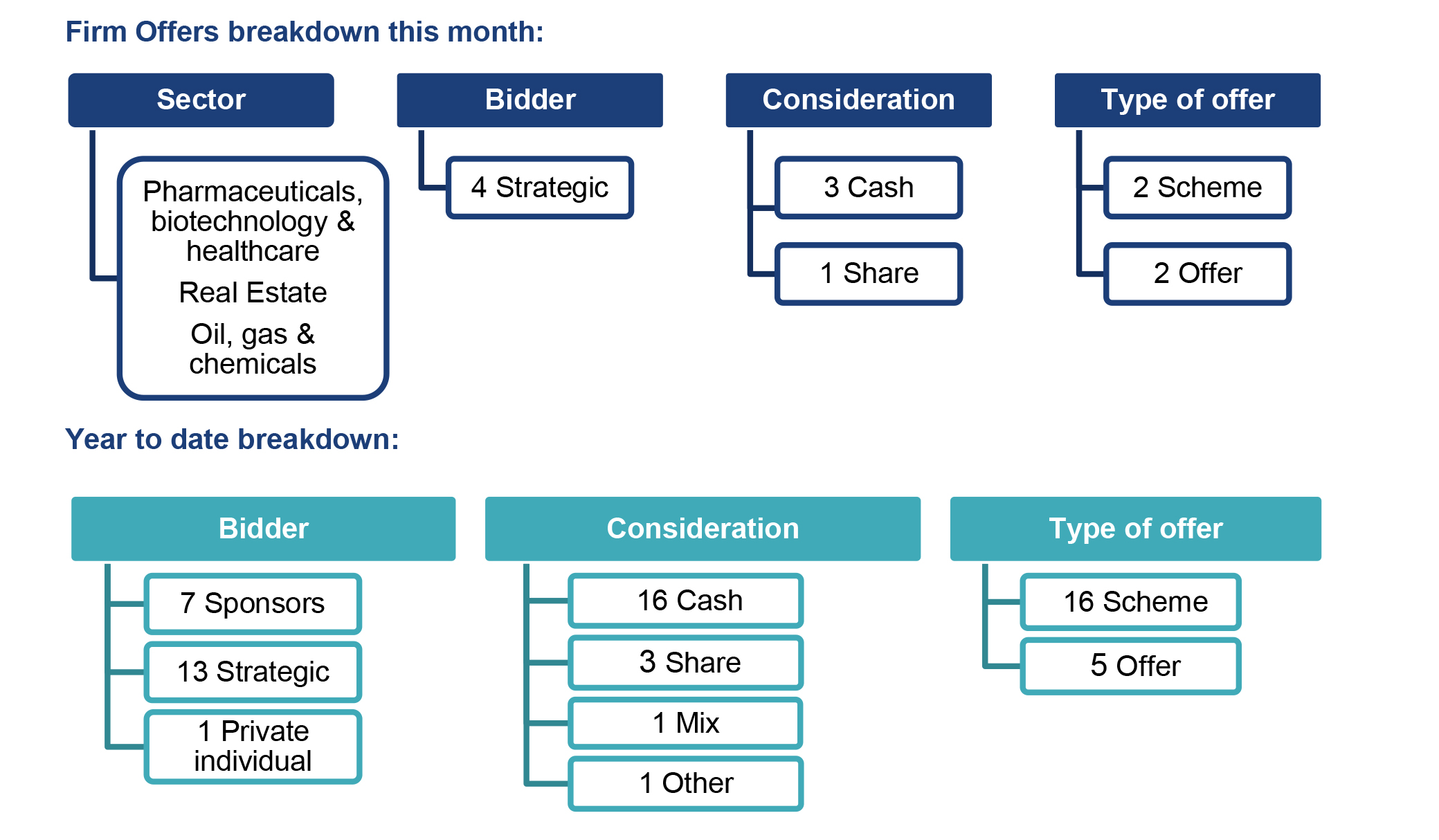

In May 2023, there were four Rule 2.7 announcements made across the UK public M&A market and a further two possible offers announced.

Firm Offers announced this month:

Possible Offers announced this month:

Takeover Panel consultation on frustrating action

The Takeover Panel has published a consultation paper on possible amendments to Rule 21 on frustrating action (PCP 2023/1).

Rule 21.1 of the Takeover Code restricts the board of an offeree company from taking any action which may result in an offer or bona fide possible offer being frustrated, unless the target obtains shareholder approval, or the Panel gives its consent, for the action.

Overall, the Panel says it thinks Rule 21.1 operates satisfactorily and so it does not propose fundamental amendments to the Rule. However, it is proposing to:

A company will still need to consult the Panel about any proposed action that may be restricted by the Rule.

The Panel is also proposing a number of amendments to Rules 21.3 and 21.4 to reduce the administrative burden on the parties to an offer where a request for information is made under Rule 21.3 (equality of information to competing offerors) and to enhance the target’s ability to protect its commercially sensitive information.

The consultation closes on 21 July 2023 and final amendments to the Code are expected to be published in Autumn 2023 (to come into effect approximately one month after publication).

Takeover Code changes now in force

Changes to the Takeover Code came into force on 22 May 2023. The changes relate to:

For further information on the changes, see our blog post here.

The Takeover Panel has also made minor consequential amendments to some of its Practice Statements to reflect the rule changes.

In the latest episode of our public M&A podcast series, we discuss recent changes to the Takeover Code as well as current themes and trends in public M&A transactions in the UK. You can listen to the podcast here.

May 2023 Insights:Public M&A deal activity this May has more than halved compared to the same period last year, with four firm offers and two possible offers announced. However, deal activity is at a similar level as has been seen throughout 2023 so far, with the exception of April when there was a surge in the number of both firm and possible offers. May 2023 has also had the lowest number of possible offers since January 2023, with just two possible offers. Overall, deal activity in May continues the trend seen throughout 2023 of a lower volume of deals, as economic uncertainty continues. |

|

|

Average deal value has been much lower throughout 2023 so far, as compared with the same period in 2021 and 2022, with an average deal value of £224 million, compared to £683 million in 2022 and £1.14 billion in 2021. This may be because larger value deals require more leverage and rising interest rates are continuing to reduce the availability and viability of debt finance. However, high values deals are still being done indicating that there is still an appetite for high value public M&A, for example, Teddy Sagi's £1.27 billion offer for Kape Technologies plc which completed at the end of April 2023. |

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs