Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

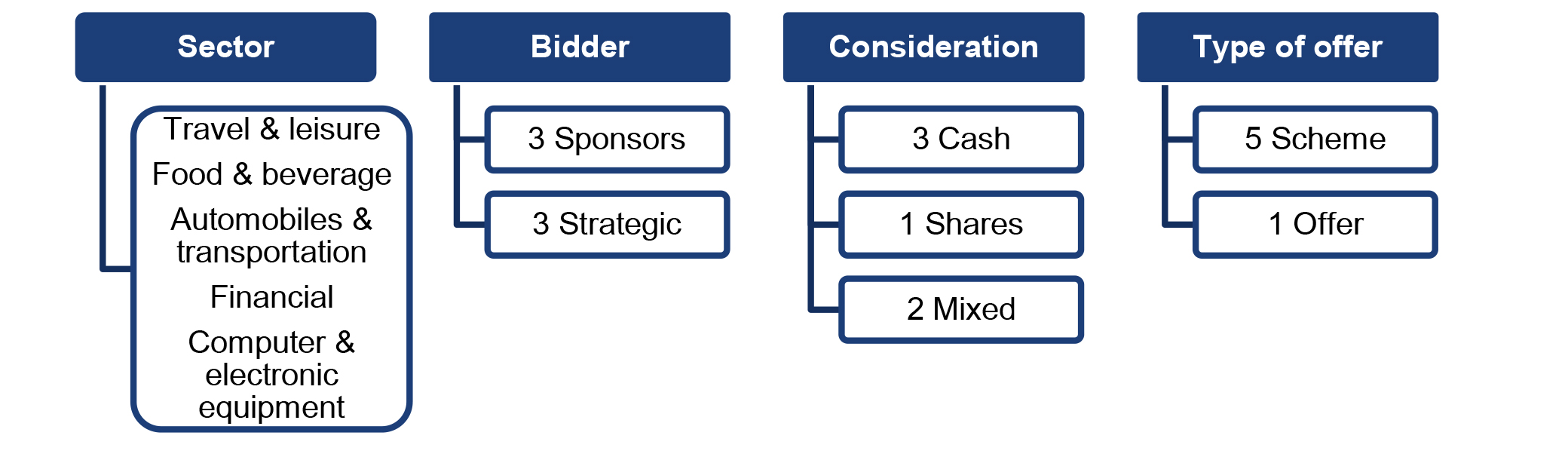

In January 2023, there were three Rule 2.7 announcements made across the UK public M&A market and a further two possible offers announced.

Review of investment screening regime in National Security & Investment Act

The government has published a Call for Evidence on the scope and implementation of the UK’s National Security and Investment (NSI) regime, which governs screening of transactions on national security grounds for both foreign and UK investors.

The National Security and Investment Act 2021 introduced a new framework for the review of transactions and investments on national security grounds in the UK with effect from 4 January 2022. Since entering into force, the UK has seen significantly more filings than many other foreign direct investment (FDI) regimes and concerns have been raised by investors and advisors that the regime places disproportionate burdens on companies and investors and operates without sufficient transparency.

The government is inviting comments on the operation of the regime to date, with the stated aim of making it “as pro-business and pro-investment as possible”.

The Call for Evidence makes clear that the government is not currently considering any changes to primary legislation, such as changing the shareholding thresholds for mandatory notification. However, it asks for views on various proposals, including:

The deadline for responses to the Call for Evidence is 15 January 2024. The government has indicated that it may subsequently undertake more detailed consultation on specific measures or proposed legislative changes, depending on the responses received.

For further information on the Call for Evidence, see our Competition Notes blog post.

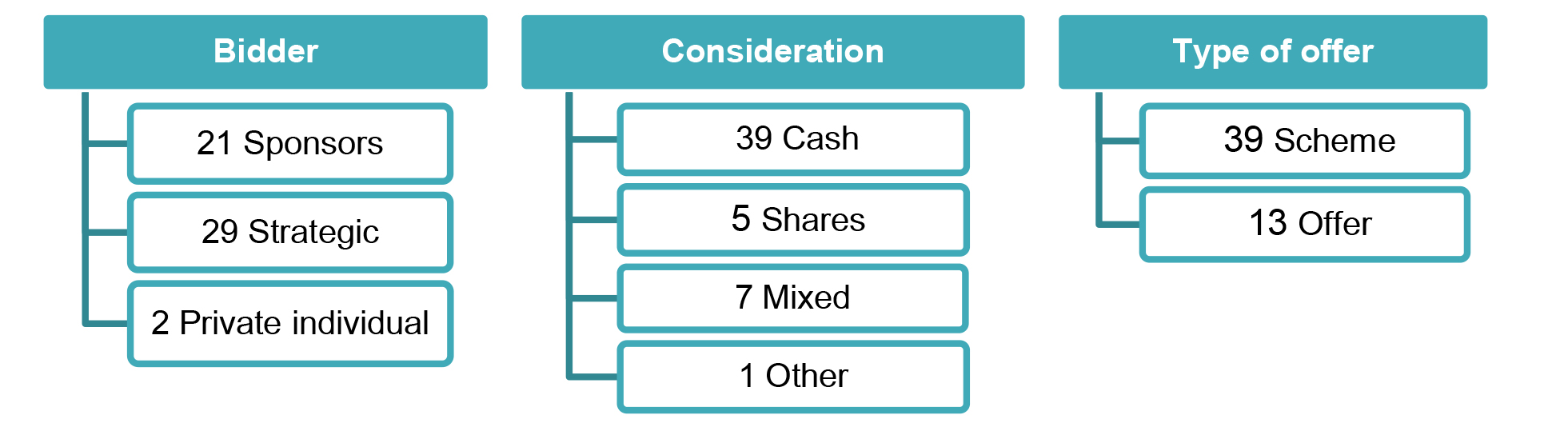

Public M&A deal activity this November has more than doubled compared to the same period in 2022, with six firm offers and seven possible offers announced. This follows a busy October during which 10 firm offers were announced. The number of firm offers in November is not quite as high as this, but it does demonstrate that public M&A deal activity has picked up once more a year after its decline. Deal making was hindered by rising interest rates, high inflation and geopolitical uncertainty, but bidders have now adapted to these conditions and are continuing to take advantage of the emerging opportunities and the low valuations seen in the market.

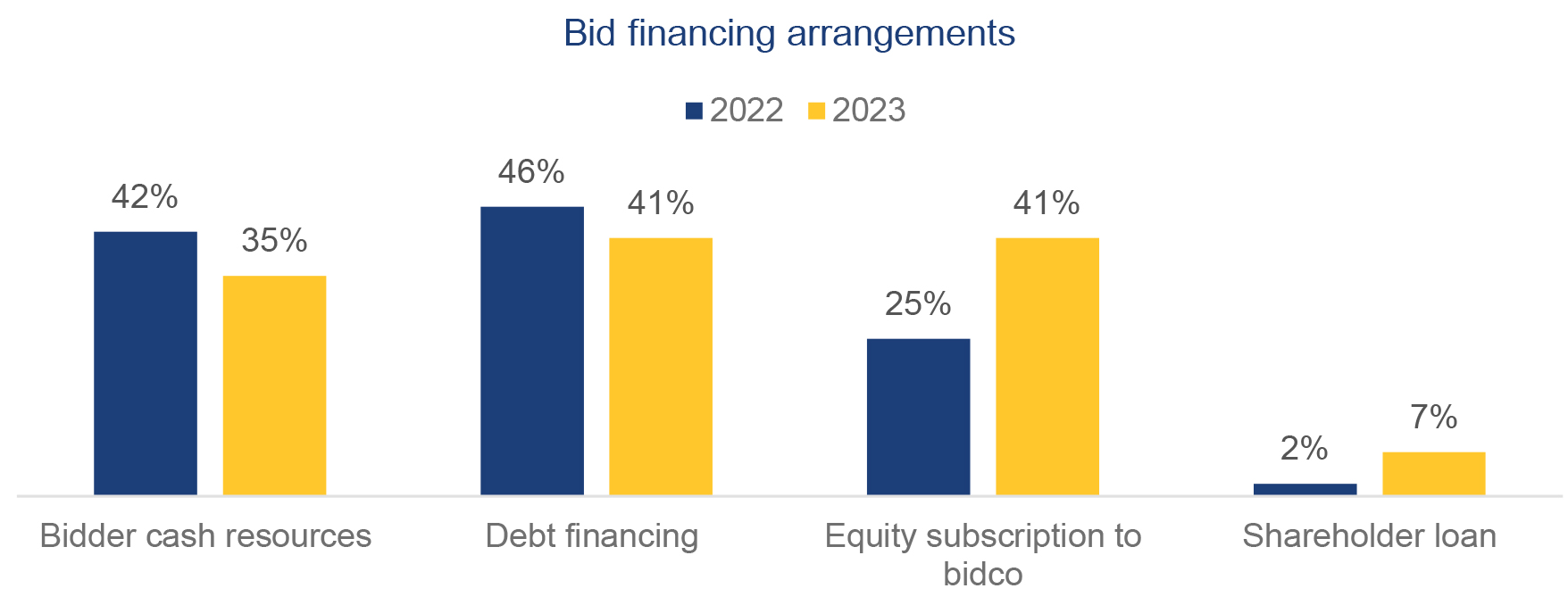

As a result of the high interest rates and inflationary pressures seen throughout 2023, the financing arrangements used by bidders have changed compared to 2022. Given this macroeconomic environment, it is unsurprising that the number of bids which featured an element of debt financing have decreased. Conversely, the number of bids which involved an equity subscription to the bidco have almost doubled compared to 2023, and shareholder loans have been included on three times as many offers. If interest rates begin to fall as forecast, it will be interesting to see if the popularity of debt financing increases again

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs