Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

ASIC’s guidance for the fairness test in scrip acquisitions can often lead to a “not fair, but reasonable” opinion from an independent expert in circumstances where the transaction would have been “fair and reasonable” had it been assessed as a merger. This was an issue in the Newmont-Newcrest merger that we advised Newcrest on.

The conclusion has not proven to be an impediment to securing shareholder support in past transactions. However, a “not fair, but reasonable” headline is confusing for shareholders and is likely to understate the financial benefit of the transaction for target shareholders, which is being recommended by directors. We ask if experts need to be given more flexibility in these situations.

ASIC’s guidance in Regulatory Guide 111 (Content of expert reports) (RG 111) for the fairness test in scrip acquisitions can often lead to a “not fair, but reasonable” opinion from an independent expert in circumstances where the transaction would have been “fair and reasonable” had it been assessed as a merger. This was an issue in the Newmont-Newcrest merger that we advised Newcrest on.

The conclusion has not proven to be an impediment to securing shareholder support in past transactions for a transaction. However, a “not fair, but reasonable” headline is confusing for shareholders and is likely to understate the financial benefit of the transaction for target shareholders, which is being recommended by directors.

The appointment of an expert in a public company transaction is customary, though not always mandatory. 1 The expert is appointed to opine on the merits of the scheme or takeover. The primary purpose of the independent expert’s report is to assist target shareholders with their decision on how to vote on a scheme or whether to accept a takeover offer.

Under the Corporations Act, the expert in its report must opine on whether the takeover is ‘fair and reasonable’ or whether the scheme is in the ‘best interests of shareholders’. Although the opinion wording for schemes and takeovers differs, the expert is ultimately asked the same two questions: (1) is the scheme or takeover fair; and (2) is the scheme or takeover reasonable?

The questions of fairness and reasonableness are independent of one another. That is, a scheme or a takeover can be not fair, but reasonable. However, if a scheme or a takeover is fair, then it is reasonable. A scheme that is not fair, but reasonable can still be in the best interests of shareholders.

Fairness

The assessment of fairness in a control transaction requires a comparison between the value of the target (on a 100% control basis) and the value of the consideration being offered. Typically, unless the transaction is viewed as a ‘merger’, the value of the consideration in a scrip bid is taken to be the recent market price of the shares being offered (on the basis that the market is fully informed). For the proposal to be ‘fair’, the value of the consideration must be equal to or greater than the value of the target shares. This will include a control premium (usually around 30% or more).

The problem is that, as the bidder’s shares are valued on a trading basis, the offer must be generous to meet the 100% value of the target, including a premium.

RG 111 is rigid in this respect, though it does allow an expert to adopt the same approach for valuing the target’s shares and the bidder’s shares if the transaction is a ‘merger of equals’. In that case, control premium is not required for the fairness test (even though a premium may still be commercially warranted given the context). Usually that requires the bidder to be issuing new shares equivalent to at least 40% of the diluted share capital under the transaction and for control of the enlarged company to be shared post-transaction (though other factors are considered).

Reasonableness

Scrip mergers often have factors that contribute to the assessment of reasonableness. For example, a scrip merger may still be reasonable notwithstanding a control premium not being offered because of expected synergies, the creation of a larger and more diversified merged company or from undertaking an analysis of the target’s contribution to the merged company.

Therefore, a transaction which is not ‘fair’, can still be ‘reasonable’.

The related inherent challenge is share price volatility between signing of the deal, the expert’s report publication and control passing. The comparison in a control transaction is the market value of bidder scrip against a fixed estimated value for the target, a point in time assessment.

This fails to recognise that most long term investors’ interests are not determined based on the share price at a point in time or even the short period between signing and implementation. The approach to fairness adopted by experts needs to be able to take into account:

There are a number of reasons that support the view that a less rigid approach to assessing fairness in this context is warranted so that an expert could choose to assess a scrip takeover transaction on a similar basis to a merger of equals, that is, a relative contribution measure.

In both transaction types:

The counter argument to these points is that, in a scrip acquisition of a smaller company, the target shareholders are foregoing the opportunity for a future control transaction for which they should be compensated. However, this is more nuanced, for example (1) the same could be true in a merger of equals; and (2) in both transaction types, the combined group may be a more appealing target.

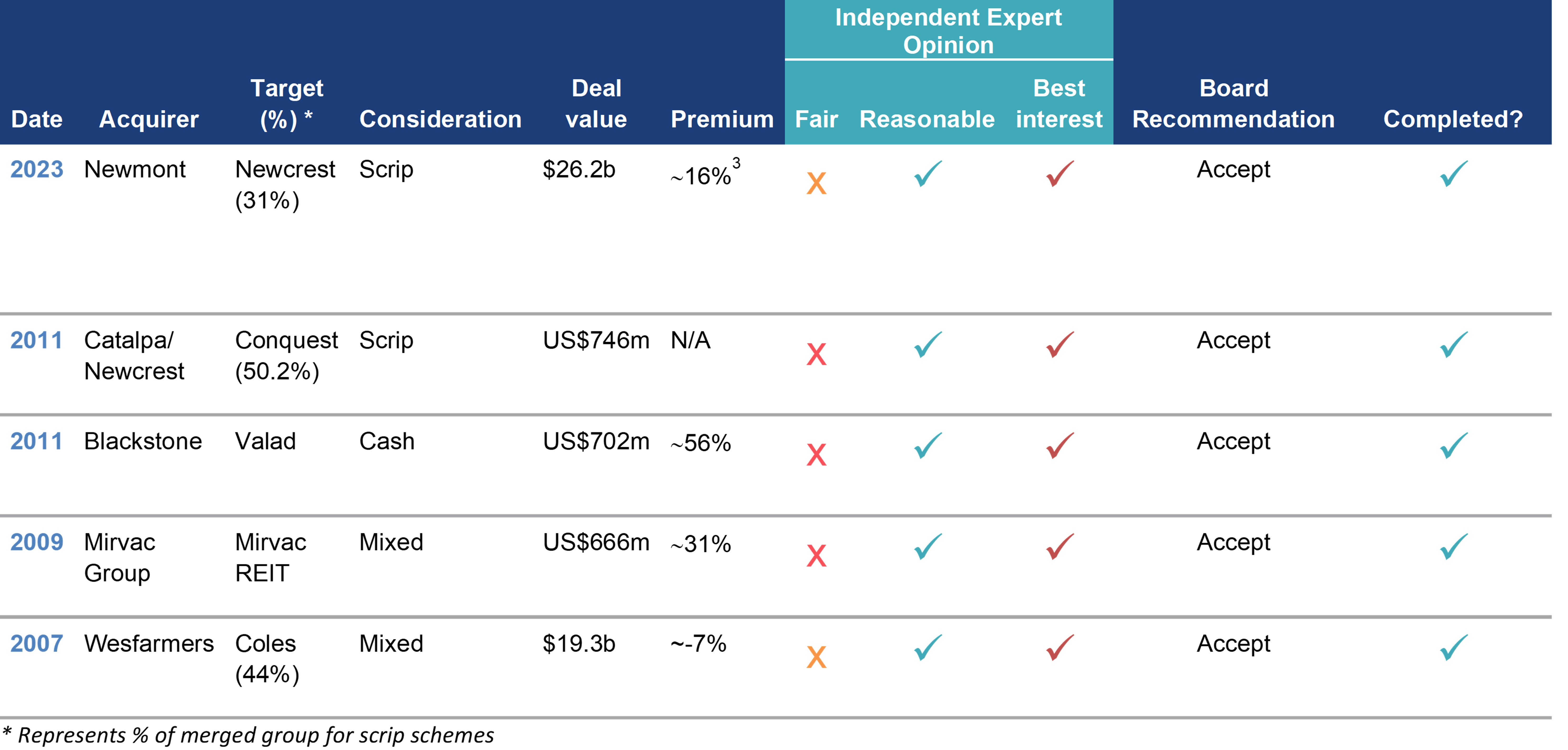

The table below sets out examples of scrip transactions where the expert found the transaction was “not fair, but reasonable.” We consider the recent Newmont-Newcrest and Wesfarmers-Coles scrip mergers in more detail below.

Newmont-Newcrest

In Newmont’s $26 billion acquisition of Newcrest, Newcrest shareholders would end up owning approximately 31% of the merged entity (Newmont shareholders, approximately 69%).

At the time of announcing the agreed deal in May 2023, the Newmont scrip consideration offered under the scheme represented a premium of approximately 30%. A premium that, according to the expert, would have satisfied the test for fairness. However, the Newmont share price had dropped in line with the gold price after signing. At the time of preparing the independent expert’s report, the premium was 16.1%.

The expert’s fairness analysis was undertaken on a ‘control transaction’ basis. The value of the consideration was insufficient to meet the underlying value of Newcrest for the transaction to be ‘fair’ in terms of ASIC’s regulatory guidelines. However, the expert stated that shareholders could also view the transaction as a ‘merger’, and assess the target shareholders’ shareholding relative to the equity contribution of each company (that is, relative historic market values). The expert considered that to be a more meaningful “premium” assessment because it is not a reflection of estimates of absolute values at one point in time.

Newcrest shareholders ultimately approved the scheme by an overwhelming majority.

Wesfarmers Coles

In Wesfarmers’ acquisition of Coles, Coles shareholders would account for 44% of the merged entity (Wesfarmers shareholders, approximately 56%).

As in the Newmont-Newcrest transaction, the expert undertook its fairness analysis on a ‘control transaction’ basis. The expert found that the assessed value of Wesfarmers’ proposal was at a discount to the assessed value of Coles, and did not deliver a full premium for control.

The expert acknowledged that while shareholders need not accept an offer that is not “fair”, the expert’s valuation of Coles is subject to uncertainty and a wide range of valuation conclusions. In addition, the Wesfarmers share price had fluctuated significantly since the announcement of the Wesfarmers proposal, the expert noting that “in these circumstances judgements about the value of the consideration are inevitably imprecise.”

The expert stated that a wide range of valuation conclusions could credibly be reached. It also noted that Wesfarmers’ proposal was the outcome of an extensive worldwide sales process and was the only firm offer for Coles - on one view, this offer therefore represented the full underlying value of the business.

The expert’s ultimate finding that the transaction was in the best interests of Coles shareholders (despite it being unfair) was further supported by the following:

Where a ‘not fair but reasonable’ opinion is provided, it can cause confusion for shareholders and lead them to believe the deal is not in their financial interests, even though it may be. Giving the word ‘fair’ a specific meaning in this context which differs from its meaning in everyday English usage is not particularly helpful to shareholders.

In the scrip acquisition context, we consider that ASIC’s rigid position regarding its fairness assessment should be softened, to give experts more scope to exercise their discretion in assessing the financial benefits accruing to target shareholders and what is being given up in the transaction.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs