Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

In December 2023, there were seven Rule 2.7 announcements made across the UK public M&A market and three further possible offers announced.

Global M&A Outlook 2024: Ready for take-off?

Our 2023 M&A report, 'Headwinds, Tailwinds, and Fog' highlighted potential challenges we saw in the M&A market this time last year. In the end, the greater clarity needed on economic forecasts, the peaking of interest rates and the easing of lending conditions did not emerge in time to save the year.

Now, as we look ahead to 2024, there is cautious optimism that we may see a resurgence in M&A. In our latest report, we look at why the upcoming year could be a busy one across global M&A and explore how geopolitics are shaping the transactional landscape, how deals will be sold, what is driving and influencing public M&A, the need to plan for regulatory issues, and key drivers for M&A activity such as private equity, energy transition and ESG.

Read our digital report here.

Changes to the Takeover Code took effect on Monday 11 December 2023. The changes mainly focus on Rule 21.1 on frustrating action, but there are some other miscellaneous changes.

Rule 21.1 restricts the board of a target company from taking any action which may result in an offer or bona fide possible offer being frustrated, unless the company obtains shareholder approval or the consent of the Panel.

The changes are intended to provide increased flexibility for targets and greater clarity as to the actions that are and are not restricted. The key points to note are:

The Notes on the Rule and a new Practice Statement No. 34 discuss the restrictions in more detail, such as when a contract is material and the Takeover Panel’s approach to incentivisation arrangements.

There are also amendments to Rules 21.3 (equality of information to competing offerors) and Rule 21.4 (information to independent directors in buy-outs) to ensure that an offeror or bona fide potential offeror is not denied access to the target company’s information on a technicality and to reduce the administrative burden on the parties to an offer where information is requested.

For further information on the changes, see our post here.

On 20 December 2023, the Financial Conduct Authority (FCA) published in draft most of the new UK Listing Rules, to implement a radical restructuring of the UK listing regime (CP 23/31). While the genesis of the rule changes is the desire to attract more companies to list in London, they will of course have a significant impact on existing listed companies.

The FCA is implementing a new single segment, the new “equity shares (commercial companies)” category, to replace the current premium and standard segments, with just one set of continuing obligations for normal commercial companies. Most significantly in the context of M&A will be the anticipated removal of the requirement for listed companies to obtain shareholder approval for significant transactions. The aim is to make listed companies more agile in M&A processes.

The final rules are expected to be published at the start of the second half of the year, with the rule changes coming into force two weeks later.

December 2023 Insights:

While the number of possible offers announced in December 2023 remained fairly consistent with previous years, the number of Rule 2.7 announcements almost doubled, with the announcement of seven firm offers and three possible offers. This level of deal activity is consistent with what we saw throughout Q4 2023 and, overall, represents an uptick in public M&A deal activity as compared with the rest of 2023.

Generally, public M&A activity was fairly subdued throughout 2023, following a decline in activity at the end of 2022 when the market was impacted by political and eonomic instability, including rising interest rates, inflation, war and energy security issues. Conditions have now become more stable and consequently M&A activity is on the rise once more. Q4 2023 saw the highest number of firm offers announced in the last two years, with 23 Rule 2.7 announcements – 38% of the firm offers announced in 2023.

2023 saw fewer high value bids, with only 7% of firm offers being vaued at over £1 billion, compared to 27% in 2022 and 36% in 2021. The majority of bids (67%) were valued at £250 million or less. However, a number of notable £1 billion plus deals did take place including Teddy Sagi's offer for Kape Technologies plc (£1.25 billion), EQT Fund Management Sarl and Abu Dhabi Investment Authority's offer for Dechra Pharmaceuticals plc (£4.5 billion), Brookfield Business Partners LP and Brookfield Asset Management Ltd's offer for Network International Holdings plc (£2.2 billion) and Kohlberg Kravis Roberts & Co. L.P. offer for Smart Metering Systems plc ( £1.3 billion).

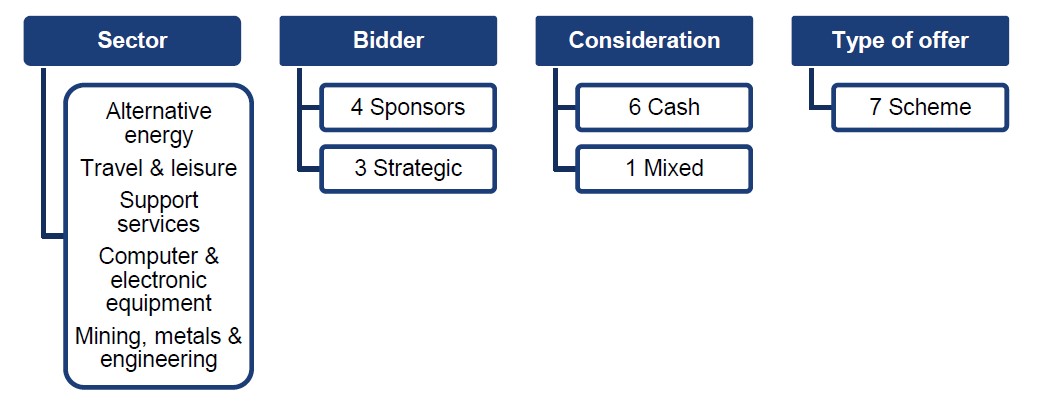

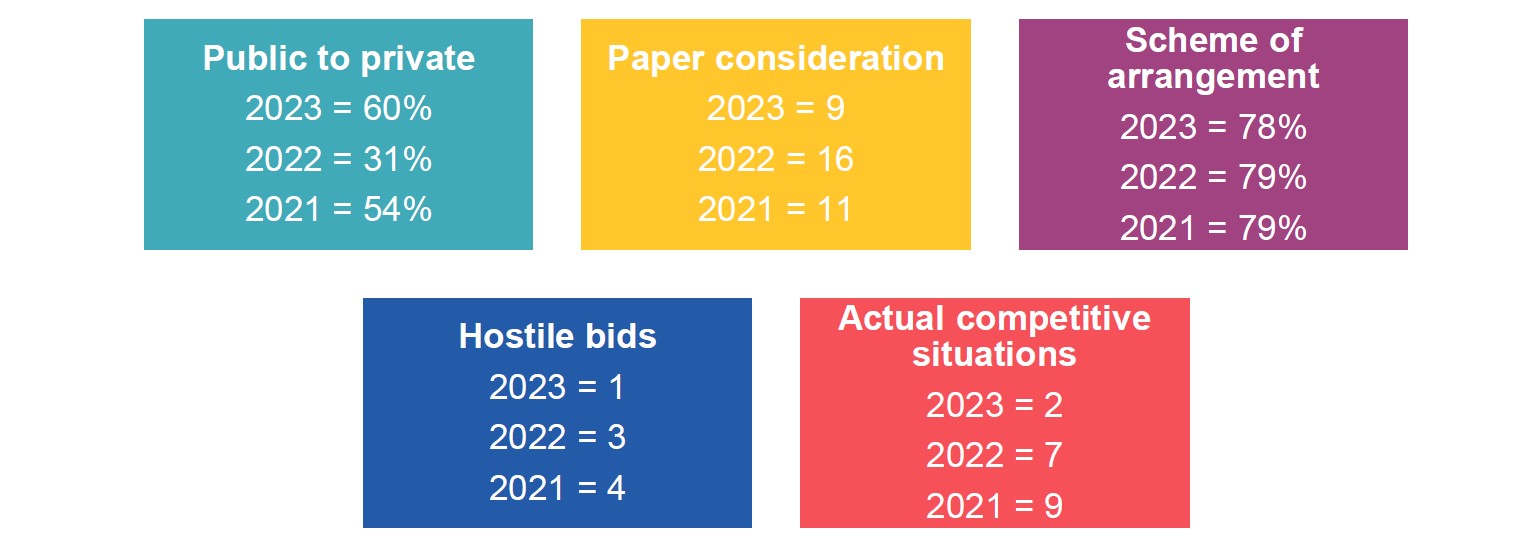

After a significant decline in public to private (P2P) transactions in 2022, the number of P2P bids in 2023 almost doubled, with 60% of firm offers being structured as P2Ps. This suggests that buyers, particularly private equity bidders who made up 42% of bidders in 2023, have become more comfortable pursuing targets in the current macro economic environment. Additionally, the number of deals involving paper consideration decreased, with nine firm offers involving paper consideration compared to 16 in 2022 and 11 in 2021. The number of actual competitive situations was lower than the previous two years, with only one target receiving competing firm offers – Apax Partners LLP and BC Partners LLP both made firm offers for Kin and Carta plc. We did, however, see targets receive approaches about possible offers from more than one party several times in 2023. Given the current lower valuations, we may see more competitive situations in 2024.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs