Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

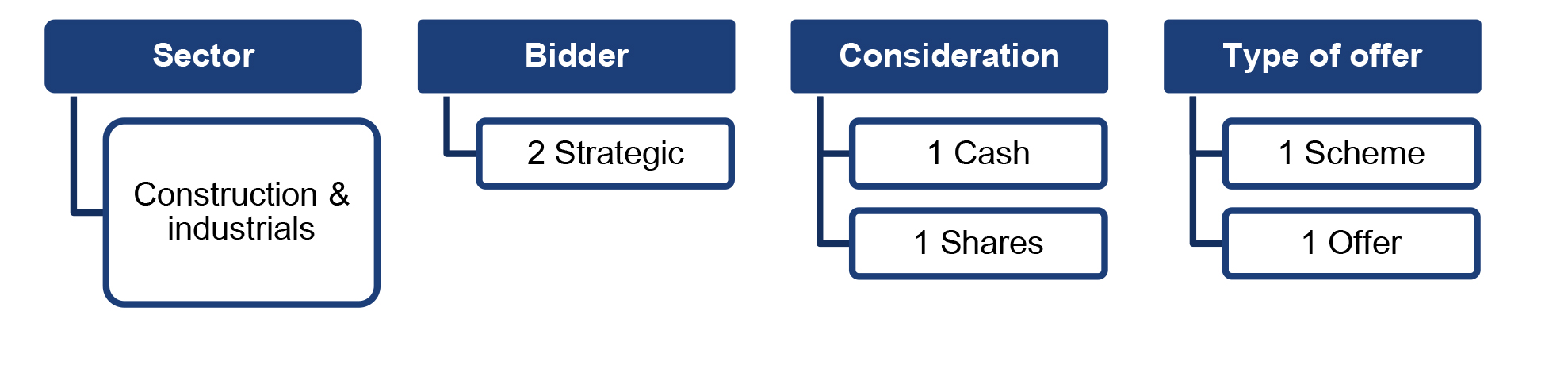

In February 2024, there were two Rule 2.7 announcements made across the UK public M&A market and nine further possible offers announced.

We have published our Global M&A Outlook 2024: Regional perspectives in which our offices around the world recap on M&A activity in 2023, examine legal trends and discuss what we expect to see in 2024.

These regional insights follow our global M&A report for 2024, titled "Global M&A Outlook for 2024: Ready for take-off?", where we explored:

Our sector insights and broader perspectives will follow in March.

In this episode of our public M&A podcast series, we discuss the updated guidance from the Takeover Panel on invoking conditions to an offer and what it means in particular for anti-trust/merger control conditions.

To listen to the full conversation please visit SoundCloud, Spotify or iTunes.

Whilst the number of firms offers announced this February has remained fairly consistent with previous years, the number of possible offers has more than doubled compared to February 2023, with nine possible offers announced. This may indicate that public M&A deal activity will continue to increase throughout 2024 as firm offers are made for these, and other, targets.

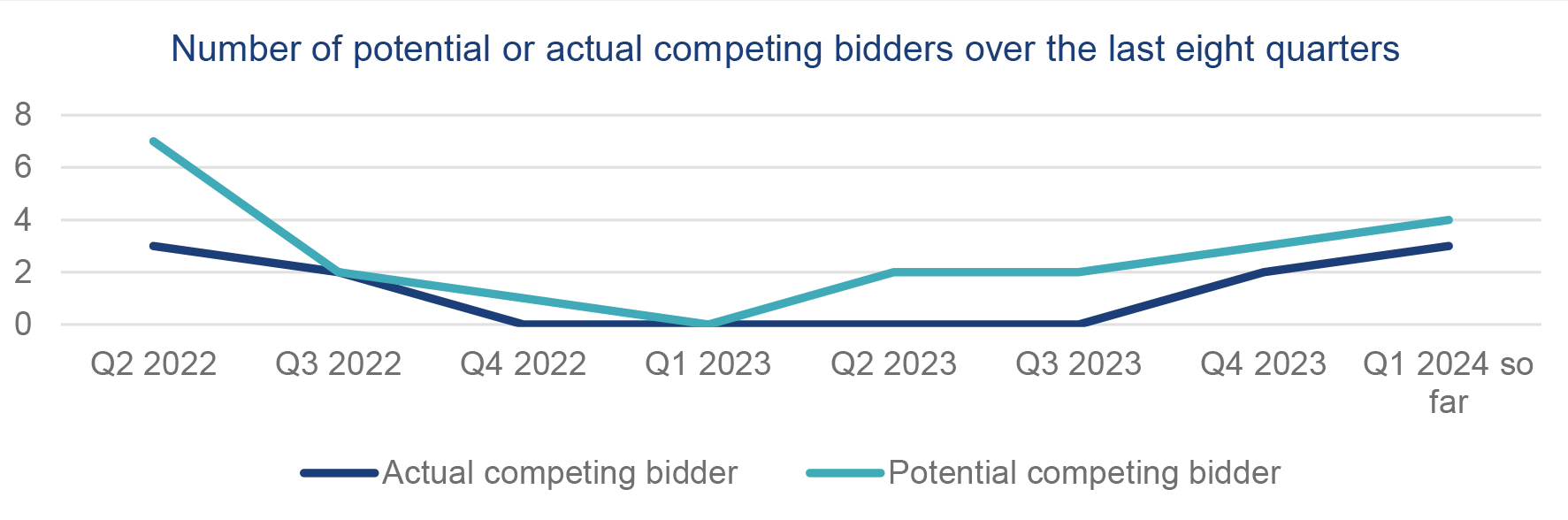

At the end of 2023, we saw BC Partners and Apax make competing offers for Kin and Carta. Already in 2024, we have seen one target receive two firm competing offers, and three other companies receive possible competing offers. This represents the highest number of competitive situations seen since the second quarter of 2022, and is likely a reflection of the current lower valuations seen throughout the market. The firm competing offers are for Wincanton – CMA CGM S.A. announced a £566.9 million offer for the company and then announced a £604.7 million increased final (and at the time) recommended offer; GXO Logistics, Inc. then announced a £762 million offer. The Wincanton directors are now unanimously recommending the GXO offer. The possible competitive situations involve abrdn Property Income Trust Limited, Currys plc and SmartSpace Software plc as the targets. It will be interesting to see if any firm offers are made for these targets and if the number of competitive situations continues to trend upwards in 2024.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs