Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

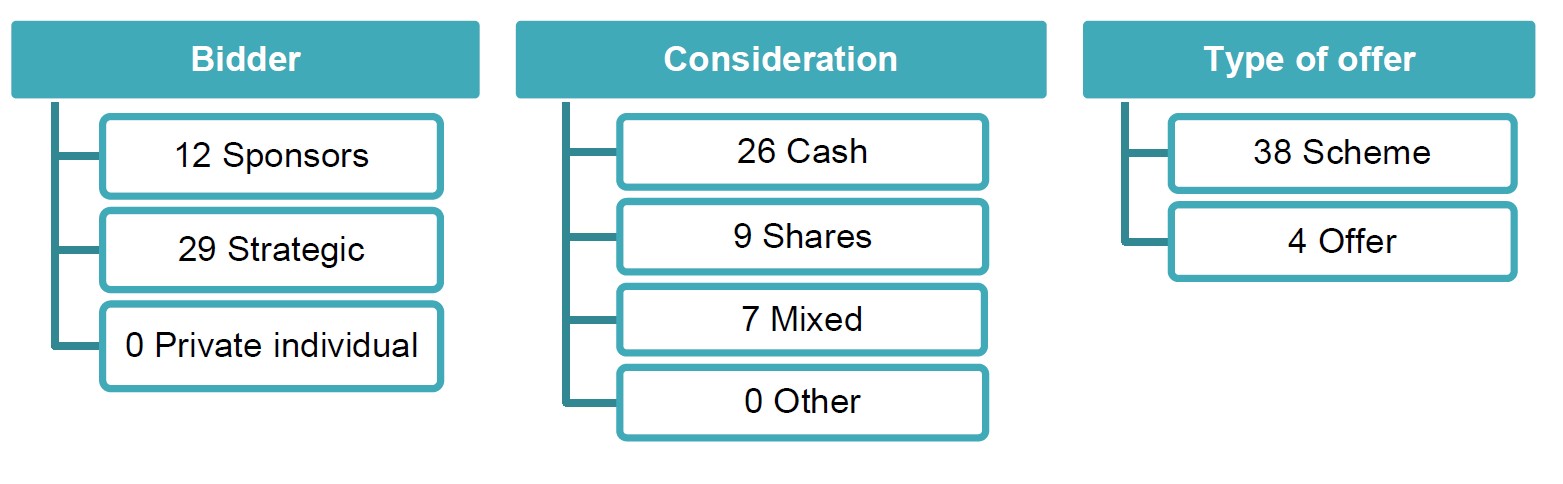

In September 2024, there were four Rule 2.7 announcements made across the UK public M&A market and five further possible offers announced.

September 2024 Insights:

September has seen activity that is fairly consistent with the same period across the previous five years. There has been a slight dip in the number of possible offers, down from eight to five, but 2024 still remains higher than the years preceding 2023. In terms of industry sector, September was a very active month for real estate, with three firms offers and one possible offer. This follows the trend of deal volumes in the sector increasing in the first half of 2024, which may be down to the UK real estate market now recovering faster than the rest of Europe. After a two-year slump in the sector, the UK real estate market may be ready to bounce back.

Comparing the consideration types for the year in September 2023 against September 2024, we've seen a rise in share and mixed consideration in 2024. Cash remains king however, bidders are seemingly more open to other forms of consideration. For example, September 2024 saw AngloGold Ashanti's plc offer for Centamin plc and NewRiver REIT plc's offer Capital & Regional plc using a cash and share consideration, whilst share consideration was used in the offer for Tritax EuroBox plc by SERGO plc. It will be interesting to see if this trend continues as 2024 comes to a close.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs