Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

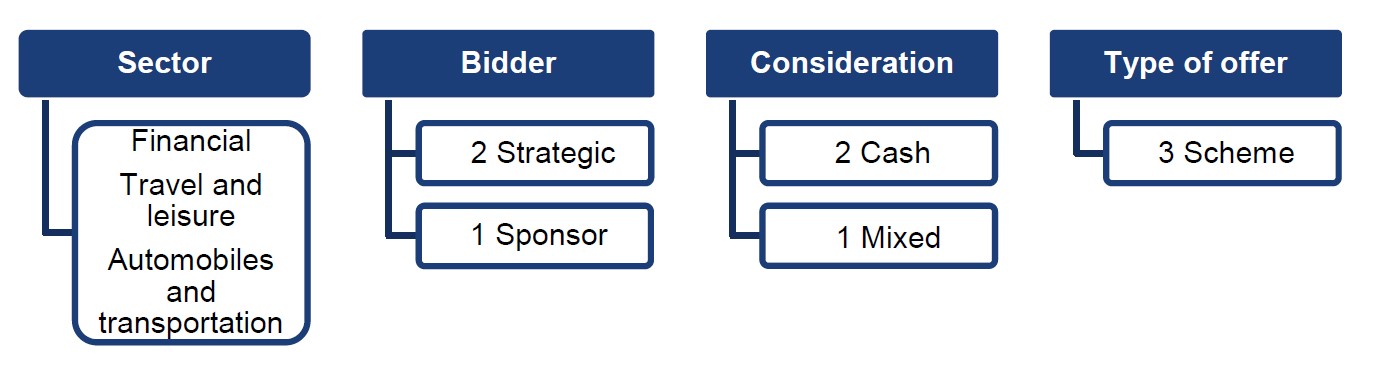

In October 2024, there were four Rule 2.7 announcements made across the UK public M&A market and five further possible offers announced.

Public M&A – changes to the companies to which the Takeover Code applies

The Takeover Panel has published a response statement (RS 2024/1) confirming that the scope of companies to which the Takeover Code applies will be narrowed to focus on UK companies which are, or have in the last two years been, quoted in the UK.

The changes, which are broadly in line with the Panel’s proposals in its consultation paper PCP 2024/1, take effect on 3 February 2025. The principal change to the amendments proposed in the consultation paper is that the length of each of the run-off period and the transition period will be two years, rather than the three years originally proposed.

Companies that will be subject to the Takeover Code under the new rules

Under the new rules, the Code will apply to a company if it has its registered office in the UK, the Channel Islands or the Isle of Man and either:

The Code will therefore no longer apply to: companies which were UK-quoted more than two years prior to the relevant date; companies whose securities are, or were previously, traded solely on an overseas market; companies whose securities are, or were previously, traded using a “matched bargain facility”; any other unlisted public company; or a private company which has filed a prospectus at any time during the 10 years prior to the relevant date.

Other points to note

We discussed the proposals as set out in the Takeover Panel’s consultation in this episode of our public M&A podcast series.

Disclosure of inside information – FCA Primary Market Bulletin

The FCA has published a Primary Market Bulletin (PMB 52) on inside information. One of the topics it covers is whether the receipt of an approach about a possible takeover offer is inside information.

The FCA says it has seen cases where companies have been advised that inside information crystallised only when a final offer was accepted by the company’s directors, because the likelihood of the transaction taking place before that point was not deemed certain.

It says that whether the receipt of an offer is inside information should be assessed on a case by case basis. Relevant factors to take into account could include the identity of the bidder, the nature and quantum of the offer and the likelihood that the offer will be recommended by the board of the listed or traded target company.

The clear reminder is that an approach can be inside information before it has been formally considered and recommended by the board.

The FCA also discusses:

The FCA sets out actions that issuers can consider to make sure they correctly identify and disclose inside information, including establishing a disclosure committee, training relevant employees to enable them to recognise inside information and documenting the reasons for determining that information was, or was not, inside information.

Inside information under UK MAR

Article 7.1(a) of UK MAR defines inside information as:

Information will be ‘precise’ if it indicates a set of circumstances which exist or which may reasonably be expected to come into existence. There must be a more than fanciful chance of the future event or circumstances coming into existence or occurring, but that the threshold is lower than the event or circumstances being ‘more likely than not’.

M&A – UK Guide

We have authored the UK chapter of the International Corporate/M&A Practice Area Guide published by Global Law Experts.

We discuss matters such as:

You can read the chapter here.

November 2024 Insights:

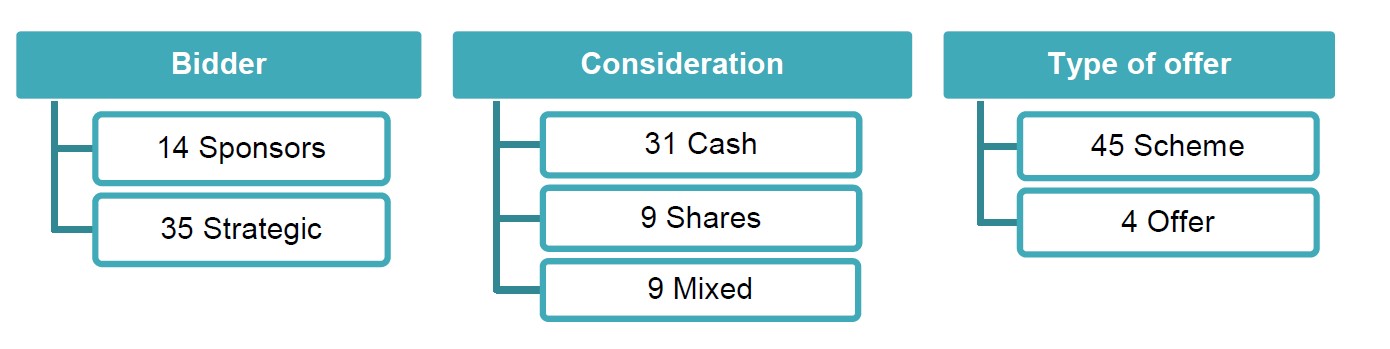

November has continued a strong year for public M&A with SIX Exchange Group's offer for Aquis Exchange plc, Fortress Investment Group's offer for Loungers plc and TI Fluid Systems Plc receiving an offer from ABC Technologies. Deal value has also risen, with the average deal value being over three times that in 2023, standing just shy of £1 billion. In terms of total deal value, 2024 dwarfs 2023 with almost £48 billion compared to £19.4 billion for the whole of 2023. Investors continue to see value in UK listed companies, and this has driven a competitive and lucrative market, particularly for larger companies.

2024 has seen a decline in offers compared with 2023, with schemes reigning supreme this year.

Schemes have made up 92% of firm offers this year, compared to 75% in 2023.

The last contractual offer in 2024 was Global Yatırım Holding A.Ş offer for Global Ports Holding plc back in July.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs