Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

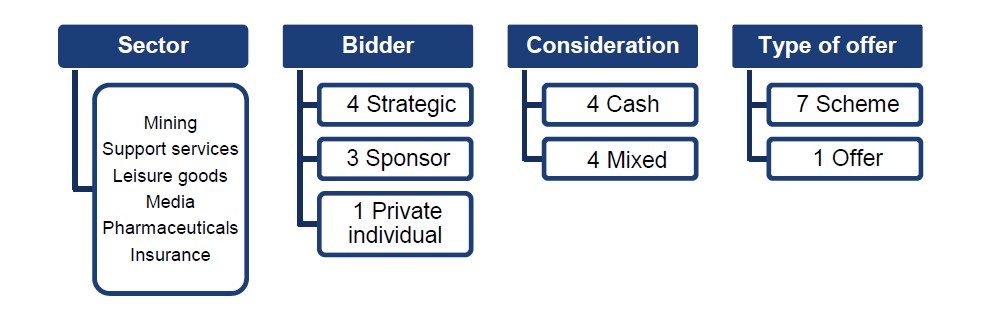

In December 2024, there were eight Rule 2.7 announcements made across the UK public M&A market and four further possible offers announced.

Changes to the UK merger control regime

Regulations that brought into force changes to the UK merger control regime from 1 January 2025 were published in December 2024.

The Digital Markets, Competition and Consumers Act 2024 (Commencement No.1 and Savings and Transitional Provisions) Regulations 2024 will bring into certain provisions of the Digital Markets, Competition and Consumers Act 2024 (DMCC Act) including the thresholds at which the UK merger control regime is engaged.

When the UK merger control regime will be relevant

Competition and Markets Authority (CMA) has jurisdiction over “relevant merger situations” in the UK. Before 1 January 2025, a transaction gave rise to a relevant merger situation where two or more enterprises cease to be distinct and:

Under the changes made by the DMCC Act, from 1 January 2025:

These provisions apply to any transaction that was not completed (or where the CMA had not launched a formal investigation) before 1 January 2025.

Other changes to the UK merger control regime

Other changes to the regime that came into force on 1 January 2025 include:

Other areas covered by the DMCC Act

The scope and implications of the DMCC Act are wide-ranging. In addition to merger control, other key reforms introduced by the DMCC Act include implementing the UK’s new digital markets regime, which will see technology firms with strategic market status having their conduct regulated by the CMA and subject to a new mandatory merger reporting requirement, and strengthening the CMA’s role in the enforcement of consumer protection legislation.

For more information on the DMCC Act, see our Competition, Regulation and Trade ebulletin.

UK Public M&A podcast Ep 28: Takeover approaches and the Market Abuse Regulation

In this episode of our public M&A podcast series, we discuss Primary Market Bulletin 52 where the FCA reminds companies that they need to consider the UK Market Abuse Regulation, as well as the Takeover Code, if they receive an approach about a possible takeover offer.

In the podcast, we discuss:

To listen to the full conversation please visit SoundCloud, Spotify or Apple.

All episodes in our UK public M&A podcast series are available on our public M&A podcast page.

December 2024 Insights:

December was a strong month for public M&A activity and saw higher levels of activity than the previous four years. Eight firm offers were announced including Aviva plc's £3.7 billion offer for Direct Line Insurance Group plc, along with a further four possible offers, rounding off a good year for public M&A. Dealmakers will hope the momentum built in December will continue in 2025 with a further increase in public M&A activity.

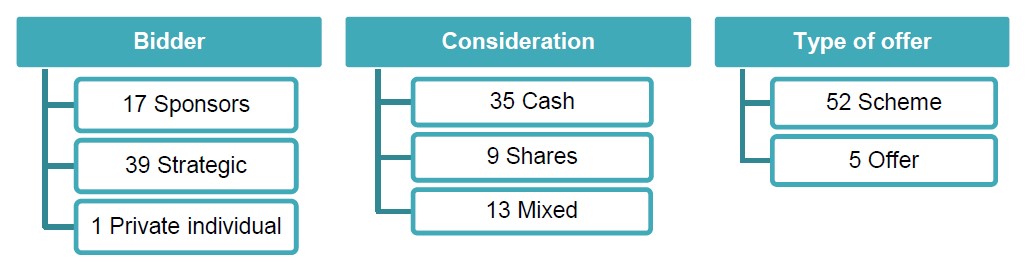

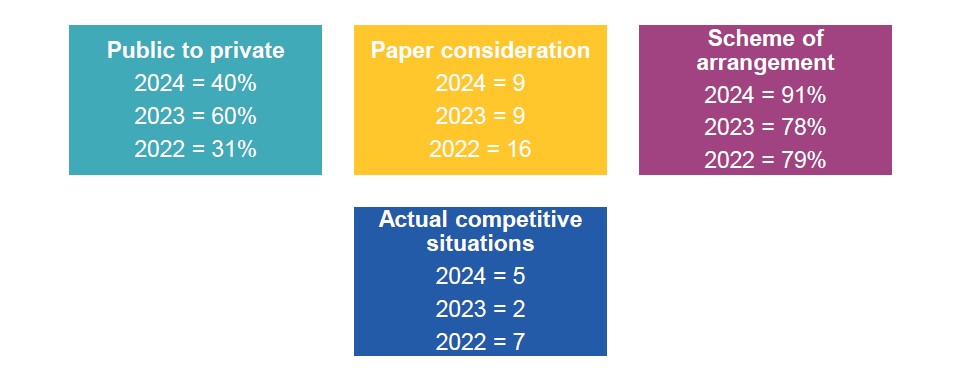

2024 was a better year for high value bids with 30% of firm offers being valued over £1 billion, compared to 7% in 2023 and 27% in 2022. There were several notable £1 billion plus deals taking place including International Paper Company offer for DS Smith Plc (£5.8 billion), CVC Group, Nordic Capital and Abu Dhabi Investment Authority offer for Hargreaves Lansdown plc (£5.44 billion), Aviva plc offer for Direct Line Insurance Group plc (£3.7 billion), and Carlsberg A/S offer for Britvic plc (£3.3 billion). Additionally, there were fewer bids valued at £250 million or less with 26 offers compared to 40 in 2023. The average deal value rose substantially in 2024, with the average value being £977 million, which dwarfs the 2023 average of £362 million.

Public M&A activity remained fairly consistent throughout 2024, peaking in Q2 with 18 firm offers being announced. Overall, 2024 saw 57 firm offers which is slightly lower than in 2023 which saw 60 firm offers. However, this is still a positive return amidst political and economic instability with conflicts in Ukraine and the Middle East, US elections and a new UK government. Conditions are looking more favourable going into 2025 with a strong month for activity in December.

The number of deals involving paper consideration remained the same as 2023, with nine firm offers involving paper consideration, still lower than the 16 seen in 2022. The number of actual competitive situations increased on numbers seen in 2023, with five competing bids, compared to two in 2023, but still lagged behind 2022 which saw seven competitive situations. Targets of competing bids included Wincanton plc, Spirent Communications plc, Hipgnosis Songs Fund Limited, Trinity Exploration & Production plc and Tritax EuroBox plc. The increase in competitive situations may be due to the lower valuations of companies in 2024 and could continue in 2025.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs