Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

Australia’s new Foreign Investment Portal (the New FIRB Portal) is expected to begin its first phase of operations this month.

This marks the beginning of a transition towards a centralised in-system approach to foreign investment proposals and compliance, which seeks to deliver a ‘stronger, more streamlined and more transparent’ foreign investment system.

In the coming months, the New FIRB Portal will entirely replace the current FIRB Application Portal and will become the primary method for submitting and managing FIRB applications, compliance reporting and communications with FIRB.

For now, the first phase is the ‘compliance launch’, due to commence on 24 February 2025.

From 24 February 2025, it is expected that all investors and agents will be able to:

Functionality during the compliance go-live period will not include submission of FIRB applications.

To access the New FIRB Portal and submit a new compliance report, a new button titled ‘Manage compliance’ next to the existing ‘Submit a proposal’ button on the foreign investment home page will become available.

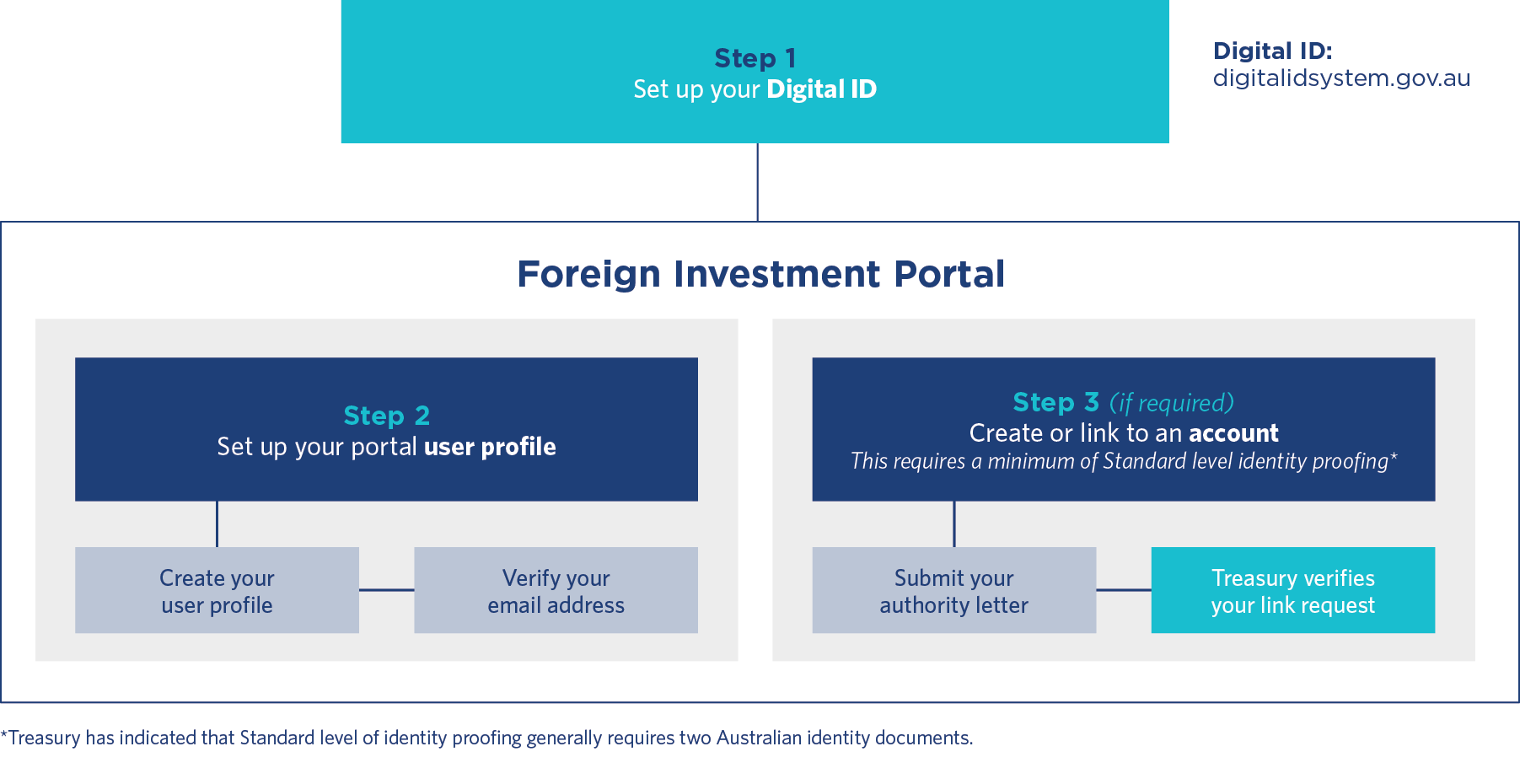

First time users who want to utilise the New FIRB Portal will need to verify their identity using a Digital ID set up with the Australian government. They can then create a new user profile, which needs to be email verified.

Individual users will have the option to link their user profile to an organisation’s account (e.g. a solicitor linking to their law firm’s account) by submitting an authority to act in a form approved by Treasury. We anticipate that the form of this authority will be released on the compliance go-live date. Linked users will have enhanced functionality to make, amend or withdraw submissions, pay fees, and apply for waivers.

Where FIRB approvals have been issued subject to conditions which impose reporting requirements, foreign investors are currently required to provide those reports by way of email to Treasury. To date, any further queries from Treasury and associated communications have similarly occurred via email.

From 24 February 2025, all compliance reports (including for pre-existing exemption certificates and no objection notifications) will need to be submitted through the New FIRB Portal. Portal users will also be able to initiate communications with Treasury and easily access communications history.

The expectation (and hope) is that the compliance forms will become more user-friendly and prompt the accurate collection of information, and allow for centralised communication with Treasury to improve response times and administrative efforts.

During the compliance go-live phase until the full go-live, foreign investment proposals will continue to be submitted through the existing FIRB Application Portal. Any correspondence relating to the outcome or conditions imposed on FIRB approvals will continue to be emailed to applicants, in accordance with the usual practice.

Full functionality of the New FIRB Portal is anticipated to go live by the end of April 2025. At this stage, foreign investment proposals will need to be notified via the portal by completing structured submission forms that prompt responses (as opposed to the current practice of submitting a detailed cover letter alongside an online form).

Similarly, our current understanding is that from the full go-live all communications between applicants and Treasury in relation to notified proposals will occur entirely through the New FIRB Portal. Email correspondence will be reserved for general FIRB queries only.

We understand Treasury will be publishing further details and public guidance on the New FIRB Portal over the coming months. For more information on the New FIRB Portal, you can also refer to our previous article.

We will continue to monitor for any updates, as well as the practical implications of these changes. If you have any queries regarding the New FIRB Portal, please contact Melissa Swain-Tonkin, Partner, Stephen Dobbs, Partner or your usual Herbert Smith Freehills contact.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs