Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

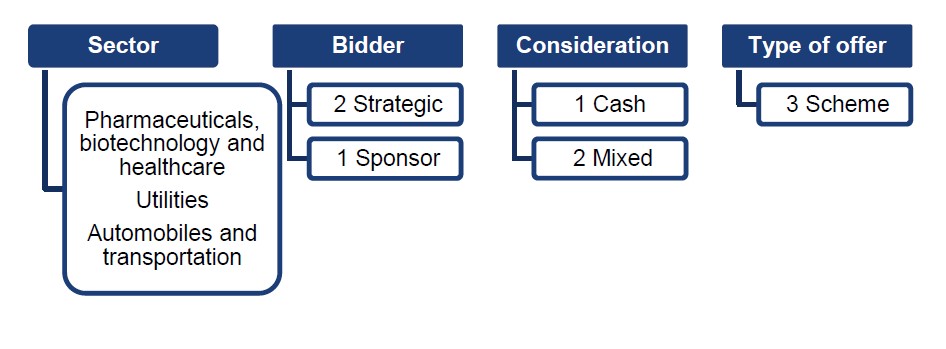

In January 2025, there were three Rule 2.7 announcements made across the UK public M&A market and six further possible offers announced.

UK Public M&A podcast Ep 29: Takeover Panel obtains court order to enforce ruling

In this episode of our public M&A podcast series, we talk about the latest development in the MWB ruling. As we discussed in Episode 26 of our podcast series, the Takeover Panel last year issued an order to members of management in MWB Group to pay compensation to MWB shareholders of up to £33 million (as well as issuing 10 cold-shoulder rulings).

The Takeover Panel has now obtained a court order enforcing its order to pay compensation.

In the episode, we:

To listen to the full conversation please visit SoundCloud, Spotify or Apple.

All episodes in our UK public M&A podcast series are available on our public M&A podcast page.

M&A – our 2025 global M&A report

We have published our latest annual global M&A report titled 'Global M&A Outlook for 2025: Gaining Altitude'.

Looking back at 2024, we asked if the mergers and acquisitions market was ready for take-off. The answer? Not quite. Challenges like inflation, geopolitical tensions, and rising costs persisted, with recovery driven largely by big-ticket deals rather than widespread activity.

Our report reflects on the efforts required to launch deals in 2024, and the anticipation of a surge of activity in 2025.

In particular, we look at:

To provide more depth to our insights, we will be releasing regional perspectives from our offices around the world in February, followed by sector-specific insights in March.

January 2025 Insights:

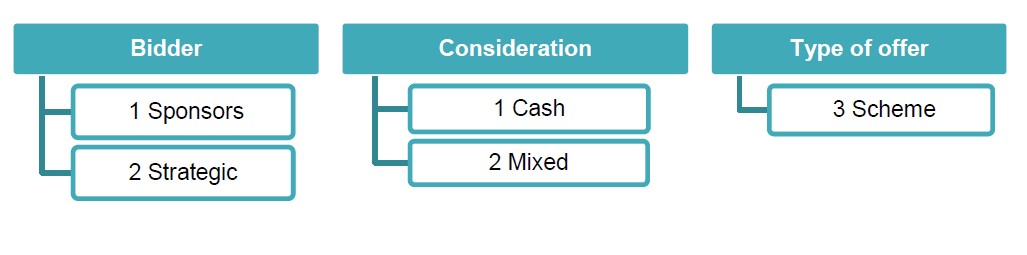

January saw a decrease in the number of firm offers compared to the previous year, with three firm offers, but saw an uptick in possible offers announced with twice as many as 2024. The trend in 2024 of schemes being the preferred type of offer has continued into January, with all three firm offers being by way of scheme. High value deals are already being done in 2025, with the offer by American Axle & Manufacturing Holdings, Inc. for Dowlais Group plc being valued at £1.16 billion, continuing the trend of high value bids seen in 2024. Additionally, two of the firm offers made in January involved mixed consideration, perhaps forecasting a move away from cash consideration, which dominated 2024.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs