Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

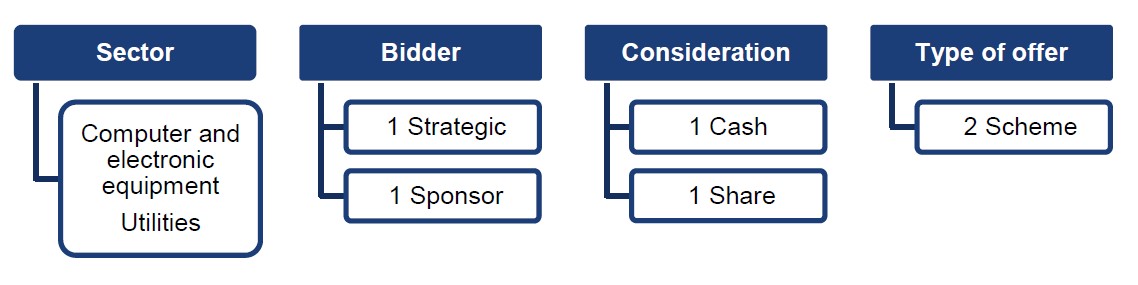

In February 2025, there were two Rule 2.7 announcements made across the UK public M&A market and four further possible offers announced.

Changes to the companies to which the Takeover Code applies and UK Public M&A podcast EP 30

The rules that narrow the scope of companies to which the Takeover Code applies are now in force.

The changes to the Code, which came into force on 3 February 2025, were set out in RS 2024/1, published in November 2024.

Under the new rules:

We discuss the rule changes in more detail in this episode of our public M&A podcast series and the Takeover Panel’s website has a page detailing the companies to which the Code applies.

In the episode, we discuss:

To listen to the full conversation please visit SoundCloud, Spotify or Apple.

All episodes in our UK public M&A podcast series are available on our public M&A podcast page.

M&A – our regional insights for 2025

In our global M&A report for 2025, ‘Gaining Altitude’, we forecast deal activity increasing throughout the year, but with the hard work which characterised so many deals in 2024 likely to continue.

We also explored:

We have now published regional perspectives from our teams around the world in which we look at regional trends in M&A and the outlook for 2025.

M&A – webinar on the psychology of M&A success

We are hosting a webinar, in collaboration with psychology experts Positive Group, on The Heart of the Deal: The Psychology of M&A Success.

In it, we will explore how psychological insights – particularly the role of perception, emotion, and trust – can challenge decision-making and improve deal outcomes.

The session will provide practical insights to help approach negotiations and decision-making with a new perspective.

You can register for the webinar, which will be on 12th March 2025 at 12.30pm, here.

February 2025 Insights:

Whilst the number of firms offers announced in February has remained fairly consistent with previous years, the number of possible offers has dropped back to levels seen in the years prior to February 2024, with four possible offers announced. This probably reflects the uncertainty in the market at the moment, due to heightened geopolitical tensions surrounding the war in Ukraine and Russia.

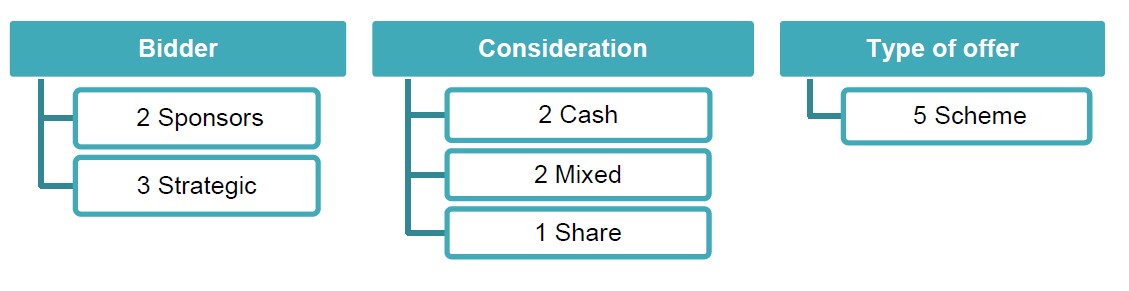

All five firm offers this year have been by way of scheme, continuing the trend seen in 2024 of schemes being the preferred choice for bidders.

Though it is early in the year, there seems to have been a shift in the consideration being used in 2025, compared to 2024. So far in 2025, we have seen an increase in mixed consideration, with 40% of firm offers using this form of consideration, compared to 22% across the whole of 2024. There has also been an increased use of share consideration, highlighted by Checkit plc's share offer for Crimson Tide plc in February. Cash reigned supreme in 2024 with nearly 70% of firm offers using cash consideration, so it will be interesting to see if the early trend of the increased use of mixed and share consideration continues in 2025.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs