Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

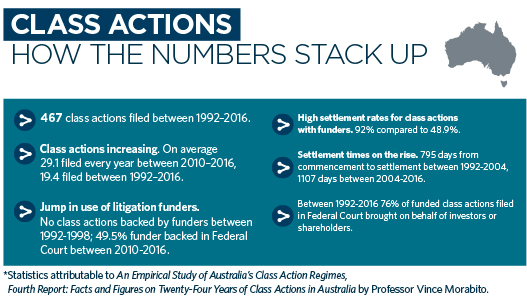

New report revealing trend towards shareholder claims.

As the class action mechanism in Australia approaches its 25th anniversary, a recent study presents some interesting findings about the Australian class actions environment. On 29 July 2016 Professor Vince Morabito from the Monash Business School released An Empirical Study of Australia’s Class Action Regimes Fourth Report: Facts and Figures on Twenty-Four Years of Class Actions in Australia.

The Report, the fourth in the series, finds that:

Professor Morabito’s report provides further evidence that class actions and litigation funders are a well-established part of Australia’s litigation landscape.

The first class action regime in Australia, Part IVA of the Federal Court Act was introduced by the Commonwealth Parliament with effect from 5 March 1992. This was followed by Pt 4A of the Supreme Court Act 1986 (Vic) with effect from 1 January 2000 and by Pt 10 of the Civil Procedure Act 2005 (NSW) with effect from 4 March 2011.

Professor Morabito’s report shows that in the first 24 years of the regimes, 19.4 class actions were filed on average every 12 months.5 In the last six years this figure increased to an average of 29.1 class actions being filed every 12 months.6

The Report’s findings suggest that the rise in the number of class actions being filed may be due to competing class actions being commenced in relation to the same or similar subject matter.7

Click here to enlarge.

The increasing role and influence of commercial litigation funders, observed by practitioners and corporate defendants over many years is also borne out in Professor Morabito’s research.

In the first six years of the class actions regime in Australia not one proceeding was supported by a litigation funder. In the second six years, only 1.6% of class actions involved commercial litigation funders. This environment has now shifted with 49.5% of class actions commenced in the last six years in the Federal Court being funded by commercial litigation funders.8

Class actions involving litigation funders also had a higher settlement rate (92%) compared to unfunded actions at 48.9%.9

As we continue to observe, securities and investor actions continue to be the preferred type of class action for litigation funders, with 76% of funded Federal Court proceedings filed during the review period of the Report being brought on behalf of investors or shareholders.10 The rise in funding activity may in part explain the shift from the predominance of product liability cases in the early days of the Federal Court regime to the modern day prevalence of investor and securities class actions.

The Report identifies that on average, class actions that concluded in a settlement are taking a longer time to get there. The Report shows that in the first 12 years of the regime, the average time taken to reach a settlement was 795 days. In the second 12 years it took on average, 1107 days for the parties to reach a settlement.11

Professor Morabito’s report provides further evidence that class actions and commercial litigation funders have become a well-established part of Australia’s litigation landscape.

Professor Morabito’s full report and findings are available here.

This article was written by Damian Grave, Partner and Leah Watterson, Senior Associate, Melbourne.

For information regarding possible class action implications for your business, contact Damian Grave.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs