Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

Herbert Smith Freehills has cemented its position as the Australian market’s leading legal advisor for renewable energy projects, retaining its No. 1 league tables ranking for the fifth year running.

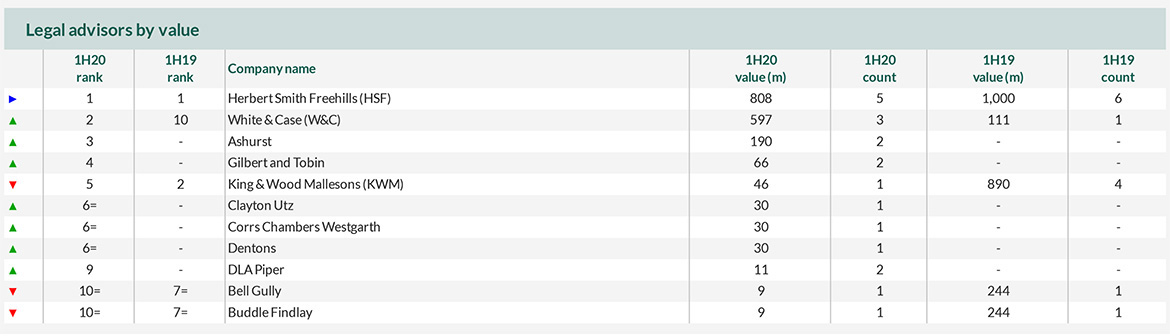

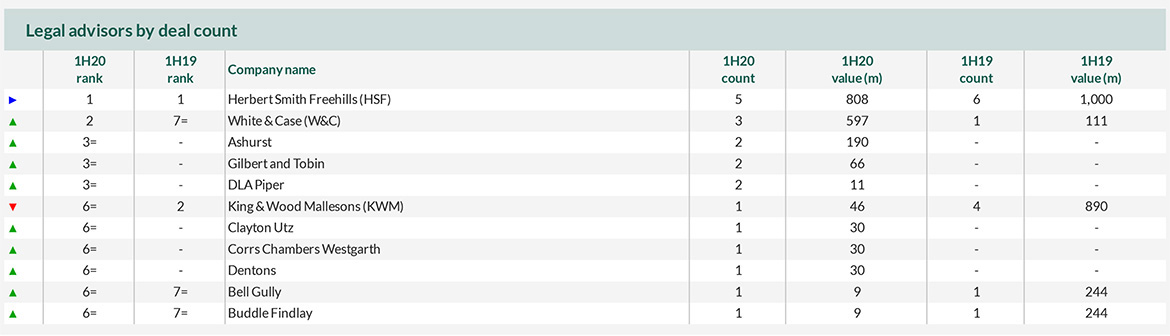

The firm has retained its No. 1 position in the recently released Inframation and Sparkspread Australia and New Zealand renewable energy league tables for the first half of 2020 for both deal value and deal count.

So far in 2020, Herbert Smith Freehills has advised on five projects with a combined value of AUD $808 million. The largest matters for the period were the refinancing of the Hornsdale Wind Farm, the refinancing of the Daydream and Hayman Solar Farms and the greenfields project financing of the Winton Solar Farm, all on which Herbert Smith Freehills advised.

Herbert Smith Freehills project finance partner Gerard Pike said the rankings reflected the firm’s depth and experience in renewable energy in the Australian market.

“It has been a challenging time in the Australian large scale renewables market due to Covid-19, transmission congestion and grid connection issues, but despite the challenges our renewable energy clients and their financiers have managed to achieve financial close on some well-structured deals,” Mr Pike said.

“It is pleasing to see that despite the challenging environment there have been more renewable energy projects financed in the Australian market in the last year than in any other sector, which is testament to the resilience of the industry and the ongoing improvements and reduction in cost of wind, solar and battery technologies.”

Herbert Smith Freehills has acted on some of the most significant project finance deals in the energy and renewables space in recent times, including advising:

the bank syndicate on UPC/AC Renewables’ 720MW(AC) New England Solar Project

the bank syndicate on the $650m consolidated platform refinancing of Stages 1, 2 and 3 of the Hornsdale Wind Farm

ABN AMRO and ING on the project financing of Fotowatio Renewable Ventures’ (FRV’s) 85mw (AC) Winton Solar Farm

the financiers on the $616m project financing for the 270 MW Snowtown 2 Wind Farm

Impact Investment Group on the financing for its Solar Asset Fund projects

Investec Bank on the project financing of the Molong Solar Farm

The above information was sourced from Inframation news. The full rankings can be found here.

We’ll send you the latest insights and briefings tailored to your needs