Technology, media, and telecommunications (“TMT”) as an overarching sector has experienced sustained growth and turmoil for a number of years characterised by cross-border collaboration, expansion, consolidation and, of course, innovation. The sector (and in particular the telecommunications sector) remains a focus for direct investment and capital demands for the underlying infrastructure such as full fibre networks, 5G networks, data centres, mobile towers and subsea cables – driven by the ever-increasing demand for data both at a consumer and enterprise level - remain high. Against this background, we continue to see investor-state disputes arise and develop into arbitrations. This article aims to consider any new trends in this area, and to offer some thoughts on the potential implications for investors and states.

For readers who are interested, our last survey on investor-state arbitrations in the TMT sector in 2018 may be found here. The number of active TMT cases has increased further from our last report, where we concluded that investor-state arbitration in this sector was "on the rise". We identified 68 active cases in our last report – there are 71 active cases between May 2019 and May 2020.

While the incidence of disputes and claims continues to be high, so too does the percentage of settlements. This is perhaps reflective of the global need to build out the infrastructure support innovation and the delivery of content, supporting consumers interacting digitally on the move, machines communicating with machines and SMEs, enterprises and governments moving to the cloud, which tends to provide incentives for both sides to solve disputes as they arise and threaten investment and development, rather than treat them as reasons to abandon projects and write-off growth opportunities.

Introduction

The broad purpose and character of investor-state arbitrations will be familiar to many readers. Those who require a primer or reminder of the essential characteristics may listen to our podcast series here. Investor-state arbitrations exist to enable foreign investors aggrieved by the conduct of a ‘host’ state to bring claims directly against the host state on defined grounds based on standards of treatment promised by that host state to investors from a particular state or group of states which are typically contained in an International Investment Agreement (“IIA”). Such IIAs are intended to offer a safe environment to encourage foreign investment between two states, or within a connected group of states. Typical protections will include a promises of non-discrimination, fair and equitable treatment (“FET”), and a commitment to compensate for any expropriation conducted by the host state (e.g. on nationalisation). Where an investor considers that these promised protection have been, or will be, breached, the investor may bring claims directly against the host state pursuant to the dispute resolution mechanism provided for in the IIA (which will often be international arbitration). In this regard, IIAs enjoy a number of advantages over relying on claims made between or through states, or in the national courts of the host state, including (1) providing a direct cause of action for investors against the host state; (2) allowing for claims to be heard by a neutral tribunal; (3) promising a higher prospect of enforcement and higher level of finality; and (4) offering greater procedural flexibility.

Statistical Trends

Our main sources of case information come from the International Centre for Settlement of Investment Disputes (“ICSID”) database and The United Nations Conference on Trade and Development (“UNCTAD”) Investment Dispute Settlement Navigator, accessible here and here, respectively. Where detailed case information is not available or is limited due to parties’ choice of non-disclosure, we have gathered information from case reporters or news bulletins, which we cite below.

We recorded 71 active investor-state arbitrations in the TMT sector between May 2018 and May 2020, up from 68 cases in May 2018. According to ICSID, the information and communication sector made up 6% of the total ICSID caseload in 2019.[1] The sector also constituted 6% of the new cases registered in 2019 (compared to 8% in 2017).[2]

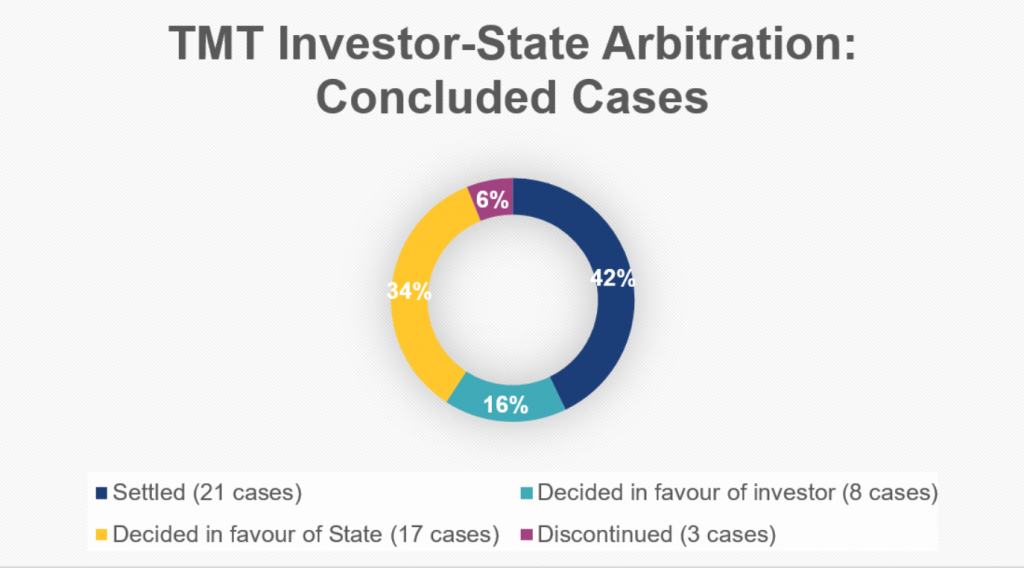

We then recorded the most up-to-date status of the cases – settled, decided in favour of the investor, decided in favour of the state or discontinued. After compounding the data, we found that between May 2018 and May 2020, 42% of the concluded cases in the TMT sector were settled before a final award, see Figure 1.[3] This is a high rate of settlement and supports the general understanding that the initiation of proceedings may give investors more leverage, and states a greater impetus, to negotiate a satisfactory settlement. There are bound to be other unreported disputes that were settled at an early stage prior to commencing arbitration.

Figure 1

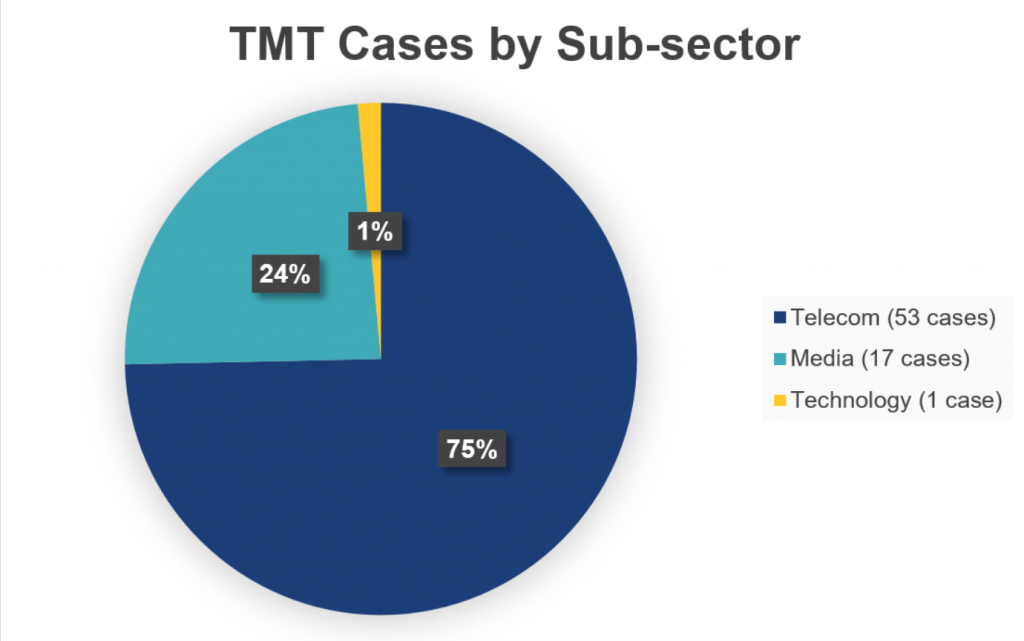

Looking into the distribution of cases amongst the telecommunications, media and technology sub-sectors, we observe that a great majority of cases have arisen from the telecommunications industry, which amount to 75% of the total caseload of both concluded and pending cases for the TMT sector, see Figure 2 below.

Figure 2

The large amount of investment treaty arbitrations in telecommunications perhaps reflect both active cross-border investment and the ‘host’ governments’ often active involvement and regulation. Of course, it may also reflect the more mature and embedded nature of much of the investment in the telecoms sector.

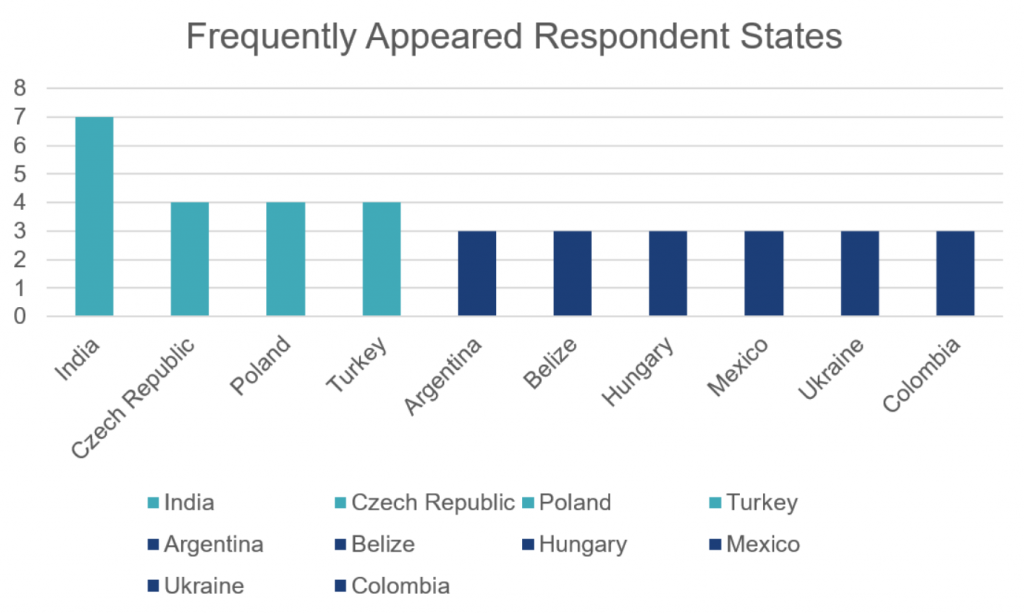

Figure 3

The top four states that appear as respondents within our survey are: India (seven cases),[4] Turkey (four cases),[5] Poland (four cases),[6] and the Czech Republic (four cases).[7]

The Technology behind the Disputes

As observed above, 75% of the TMT investment arbitration cases captured by our survey are within the telecommunications sub-sector. Mobile telecommunications services and networks have attracted global investors venturing into different countries in the past years, and indeed decades. Within our survey period alone (which covers roughly two years), we have identified on-going or newly concluded disputes concerning 2G mobile technology spectrum resources in India,[8] 2G mobile technology licenses in India,[9] 4G mobile technology network development in Poland,[10] mobile operation services in Nepal,[11] and wireless spectrum licenses in Canada,[12] to name a few.

The marked concentration of investor-state disputes in the mobile telecommunications industry is perhaps not surprising. The industry is capital-intensive, in both tangible and intangible forms. It requires a substantial amount of risky, high up-front sunk cost investment over a long period of time before investments reap returns. The mobile communications industry is often heavily regulated by the host government (in particular in developing economies), and the state or the state-owned enterprises often play a pivotal role. These characteristics of the industry and high sensitivity to state action or inaction create fertile ground for disputes to arise.

Cross-border investment played – and continues to play - a key role in the global deployment of 4G mobile technology networks and preceding generations of mobile technology. As the world races to the development and deployment of ubiquitous 5G mobile technology networks, cross-border investment will continue to play a key role. Of course, international investment opportunities are not limited to the underlying 5G network infrastructure. For instance, the increased peak speeds, lower latency and more efficient traffic handling characteristics of 5G mobile technology will enable massive IoT – the ability to connect millions of things to the Internet - which in turn will stimulate international investment in services and solutions in adjacent sectors such as transport and energy.

The foreseeable high volume of cross-border investment in mobile telecommunications means that both investors and states may benefit from our observations of some recurring themes that led to investor-state disputes in the TMT sector which we set out below based on the cases we surveyed.

Dealing with Changing Regulations

The TMT sector, especially the telecommunications industry, is highly regulated. When host governments introduce or change regulations this may significantly affect the profitability of investments especially if these decisions are unexpected and therefore had not been factored into investors’ original business plans. We identified multiple cases submitted as a result of the host government’s change of regulations and policies.

Global Telecom Holding S.A.E. v. Canada[13]

The Egyptian claimant (“GTH”) entered into a joint venture with other Canadian investors to obtain wireless spectrum licenses which were auctioned in Canada in 2008. The joint venture operated mobile telecommunications services in parts of Canada. GTH’s investment in the joint venture included an option to acquire a controlling stake in the joint venture. However, GTH was not allowed to take over the joint venture pursuant to a national security review under the Investment Canada Act.

At the time of investment, Canada had in place a transfer restriction that prohibited GTH from selling its interest in the joint venture to other incumbent operators in Canada within five years of its investment (“Transfer Framework”). GTH intended to sell its interest following the end of five years. However, this was not allowed due to a regulatory change in Canada’s Transfer Framework. GTH eventually exited the market in late 2014 by selling its shares to one of the original partners in the joint venture, allegedly suffering a loss of US$927 million.

GTH alleged that Canada breached several of its obligations under the Canada-Egypt Foreign Investment Promotion and Protection Agreement (“FIPA”) including the obligation to accord fair and equitable treatment, full protection and security, national treatment and to refrain from imposing restrictions on the transfer of investments and returns.

The Tribunal ultimately held by a majority that neither the Canadian government’s national security review, nor the change to the Transfer Framework breached its obligations under the Canada-Egypt FIPA, including in the provision of fair and equitable treatment. One key factor highlighted in the Tribunal’s reasoning was that the passage of the five-year “locked-in” period was a necessary but not sufficient condition to sell the stakes to other Incumbent operators. GTH should not have had any reasonable expectation that the sale of its interest would be automatically approved by the Canadian regulators after the expiry of five years.

Deutsche Telekom AG v. The Republic of India[14]

Following two rounds of equity investment in 2008 and 2009, Deutsche Telekom held a 20% interest in a company called Devas Multimedia Private Limited (“Devas”), via its wholly-owned Singaporean subsidiary Deutsche Telekom Asia Pte Ltd (“DT Asia”). The Indian state-owned entity Antrix and Devas had in place a 2005 agreement to lease the S-band electromagnetic spectrum capacity provided by two orbiting Indian satellites (“Devas Agreement”).

In February 2011, the Indian Cabinet Committee on Security (“CCS”) approved the annulment of the Devas Agreement (“CCS decision”). When Deutsche Telecom brought arbitration alleging India’s breach of the FET obligation under the Germany-India BIT, India justified its decision by invoking the “essential security interests” carve out of the Germany-India BIT. The investor also made alternative claims direct and indirect expropriation, and breach of full protection and security. After analysing in detail the events that led to the CCS’ decision, the tribunal found that “a mix of reasons or objectives led to the annulment of the Devas Agreement”. These include military-related concerns (which did seem to fall under the essential security rubric), as well as other rationales, including the perception that Devas did not pay enough for its contractual rights and the desire to use satellite space for other “societal needs, such as train-tracking, disaster management, tele-education, tele-health and rural communication”.

Given this mix of rationales, the Tribunal turned to examine “whether the CCS decision was necessary to protect those interests, in the sense that it was principally targeted to safeguard ‘to the extent necessary’ the defence and other strategic needs that fall within the purview of “essential security interests”. The Tribunal found that India had “failed to establish that the CCS decision was necessary to protect” its essential security interests.

On that basis, the Tribunal found CCS’ cancellation of the Devas Agreement arbitrary and lacking transparency, and in breach of the FET obligation under the Germany-India BIT.

India sought to challenge the Award in the Swiss Federal Tribunal, being the court of supervision of the arbitration. In December 2018, the First Civil Law Court of the Federal Tribunal rejected India’s application for the annulment of the Award.

Telcell Wireless, LLC and International Telcell Cellular, LLC v Georgia[15]

A subsidiary of the two claimant companies (“Magticom”) was embroiled in a dispute with Georgia’s telecommunications regulator, the National Communications Commission (“GNCC”). Magticom announced in 2018 that it would be increasing prices for mobile data tariffs, but it delayed its plans after the GNCC protested against the price increases. In early 2019, Magticom and another local competitor reportedly made another announcement about increasing their tariffs. However, in February 2019, the GNCC again suspended the price hike before it could come into effect.

The facts of this case are still scarce due to limited disclosure by the parties. This appears to be a dispute caused by the host government’s price control and regulations on mobile communications services. The claim is brought under the Georgia – U.S. BIT, and the tribunal has also been recently formed.

Continuation of Concessions/Contracts

In a highly regulated sector, the concession right or the licence is of course key to the value of an investment. Several cases in our survey revealed the potential for mismatch in the expectations of the renewal of such rights.

Neustar, Inc v Republic of Colombia[16]

Between 2009 and February 2020, Neustar operated the .CO internet domain under a 10 year concession agreement with the Colombian government, which, according to the company, was renewable for another 10-year term. The dispute arose when Colombia’s Ministry of Technology, Information and Communication refused to renew the concession agreement.

Neustrar initiated arbitration proceedings in March 2020 with ICSID based on the Colombia-US Trade Promotion Agreement. The case is currently at an early stage, and further details are yet to emerge.

Joshua Dean Nelson. Jorge Luis Blanco and Tele Fácil v. United Mexican States[17]

Nelson, Blanco and a Mexican national (“Miguel Sacasa”) founded Tele Fácil in 2009 in a bid to enter the Mexican market to provide telephone, internet and cable television services. The company was awarded a concession by the Mexican government in 2013.

The dispute concerns a series of measures taken by Mexico’s state telecoms regulator, the Federal Institute of Telecommunications (“IFT”). Tele Fácil needed to connect indirectly via a third party with the dominant telecommunications service provider (“TelMex”), however Tele Fácil and TelMex had differences relating to some of their commercial terms. In 2014 , the IFT ruled unanimously in Tele Fácil’s favour ordering both sides to sign an agreement to interconnect indirectly via a third party within 10 business days for a term of three years. TelMex, however, challenged IFT’s ruling and sent back a draft agreement to the claimants which reduced the duration of the contract from three years to 21 days. The claimants referred the matter back to the IFT for the implementation of its rulings.

The IFT then undid its prior ruling in April 2015, deciding instead that all previously agreed terms between Tele Fácil and TelMex, including the price to be paid, were no longer valid.

The case was brought to ICSID in 2016 based on NAFTA, on the grounds of unlawful expropriation and breach of FET obligations.

The claimants allege that the IFT originally recognised their legitimate investment rights, but then “dramatically, unjustifiably and illegally” reversed its own rulings. They argue that the IFT’s reversal of its original decision amounts to an expropriation of its investment, as one of Tele Fácil’s principal assets, the agreed terms for interconnection, was “deprived of all value” and its related rights “extinguished”.

The Claimants lost the case on both grounds.[18] One fatal flaw in their case was that the draft agreement on the rates between Tele Fácil and Telmex was never signed. Tele Fácil therefore had no “rights under the Interconnection Agreement”, hence no investment to be expropriated of. The Tribunal also found no evidence suggesting that IFT’s second ruling was arbitrary, discriminatory, grossly unfair or lacking due process. Consequently, the FET claim also failed.

Public Joint Stock Company Mobile TeleSystems v. Turkmenistan (II)[19].

MTS, which is part of the Russian conglomerate Sistema headed by Vladimir Yevtushenkov, invested in the telecommunications services in Turkmenistan. Its licence was valid until July 2018.

MTS attempted to negotiate with Turkmenistan’s regulatory authorities and the state-owned companies to extend permission to use frequencies and other resources necessary to operate in the country. Turkmenistan’s position is that while MTS’ licence for communications services was valid until July 2018, the company’s contract with TurkmenTelekom expired and the state entity had no obligation to extend it.

MTS was forced to suspend its operations in Turkmenistan. It alleges that the actions of state-owned entity TurkmenTelekom resulted in the disconnection of its local subsidiary’s international and long-distance zonal communication services and internet access, and harmed its investment. It has brought an arbitration under the Russia-Turkmenistan BIT which is ongoing.

Fines and taxes

Our survey also identified a number of disputes related to fines, taxes or other levies imposed by the ‘host’ state within the survey period, some with substantial amounts of money at stake.

Telefónica, S.A. v. Republic of Colombia[20]

In 2017, a domestic arbitral tribunal at the Bogota Chamber of Commerce issued an award against the local subsidiaries of Telefónica and a Mexican company (“América Móvil”), for failing to comply with contractual obligations to revert ownership of certain telecoms infrastructure to the state in 2013. Telefónica was reportedly fined US$1.02 billion.

Although Telefónica paid the fine, it first put Colombia on notice of a dispute under the Colombia-Spain BIT for the fine. In March 2016. Negotiations between the parties were attempted but eventually broke down. In February 2018, Telefónica submitted the disputes to ICSID, claiming Colombia’s indirect expropriation in the form of the fine, and breach of FET obligations. The proceeding is reported to be at the document production stage as at mid-2020.

Axiata Investments (UK) Limited and Ncell Private Limited v. Federal Democratic Republic of Nepal[21]

Axiata acquired an indirect 80% interest in Ncell – Nepal’s largest mobile network operator – via the subscription of 100% shares in Reynolds Holding Limited. The dispute relates to the imposition of a capital gains tax on Axiata’s acquisition of Reynolds Holding Limited from TeliaSonera in 2016, levied on Axiata’s subsidiary Ncell. The Nepalese government demanded over US$348 million, but this was resisted by the claimants.

Axiata and Ncell commenced proceedings against Nepal at ICSID in May 2019, based on the UK-Nepal BIT. The proceeding is on-going.

Conclusion

The two year survey period (May 2018- May 2020) in our study provides an illuminating snapshot of the sorts of issues are leading to investor-state arbitrations in the TMT sector.

Changes to regulations, licence renewals, and regulatory fines and levies are aspects of the TMT environment that most companies will encounter in their operations. However, it is the capacity for such matters fundamentally to undercut the profitability of a cross-border investment, coupled with the investment protections promised by host states seeking to attract such investment, that lead to such matters becoming the focus on investment treaty claims.

Investors, and regulators, need to be alive to the possibility of such disputes leading to investment treaty claims. Even before then, investors also need to be aware of the existence of the network of investment treaties, and the requirements to fall within the scope of the protection of such treaties, so that such recourse will be available to them should the worst happen.

In a world when remote connection, developing technologies, and home media consumption have become more important than ever, the focus and investment on the TMT sector will be greater than ever.

For more information, please contact Nicholas Peacock, Partner, Aaron White, Partner, Peter Chen, Associate, or your usual Herbert Smith Freehills contact.

[show_profile name="Peter" surname="Chen" jobtitle="Associate" phone="+44 20 7466 3868]

[1] The ICSID Caseload Statistics, Issue 2019-2, https://icsid.worldbank.org/en/Documents/ICSID_Web_Stats_2019-2_(English).pdf, p. 12.

[2] The ICSID Caseload Statistics, Issue 2019-2, https://icsid.worldbank.org/en/Documents/ICSID_Web_Stats_2019-2_(English).pdf, p. 12, p. 25.

[3] Telefónica S.A v. Mexico, ICSID Case No. ARB(AF)/12/4; Orange SA v. Jordan, ICSID Case No. ARB/15/10; Dunkeld v. Belize (II), PCA Case No. 2010-21; Dunkeld v. Belize (I), PCA Case No. 2010-13; Orascom Telelcom Holding S.A.E v. Algeria, PCA Case No. 2012-20; Millicom International Operations v. Senegal, ICSID Case No. ARB/08/20; Mobile TeleSystems v. Turkmenistan, ICSID Case No. ARB(AF)/11/4; Vivendi v. Poland, UNCITRAL; MTN v. Yemen, ICSID Case No. ARB/09/7; E.T.I. v Bolivia (II), UNCITRAL; E.T.I. v Bolivia (I), ICSID Case No. ARB/07/28; Telefónica v. Argentina, ICSID Case No. ARB/03/20; France Telecom v. Argentina, ICSID Case No. ARB/04/18; Motorola v. Turkey, ICSID Case No. ARB/04/21; IBM v. Ecuador, ICSID Case No. ARB/02/10; Lemire v. Ukraine (I), ICSID Case No. ARB(AF)/98/1; Ameritech v. Poland, UNCITRAL; France Telecom v. Poland, UNCITRAL; Telekom Malaysia v. Ghana, PCA Case No. 2003-03; France Telecom S.A. v. Argentine Republic, ICSID Case No. ARB/04/18; PT Ventures, SGPS, S.A. v. Republic of Cabo Verde, ICSID Case No. ARB/15/12.

[4] Astro and South Asian Entertainment v. India, UNCITRAL; Deutsche Telekom v. India, UNCITRAL; Khaitan Holdings Mauritius Limited v. India, UNCITRAL; Maxim Naumchenko, Andrey Poluektov and Tenoch Holdings v. India, PCA Case No. 2013-23; Vodafone v India (I), PCA Case No. 2016-35; Vodafone v India (II), UNCITRAL; Devas v. India, PCA Case No. 2013-09.

[5] Motorola Credit Corporation, Inc. v. Republic of Turkey, ICSID Case No. ARB/04/21; Saba Fakes v. Republic of Turkey, ICSID Case No. ARB/07/20; Cascade Investments NV v. Republic of Turkey, ICSID Case No. ARB/18/4; Ipek Investment Limited v. Republic of Turkey, ICSID Case No. ARB/18/18.

[6] Juvel and Bithell v. Poland, ICC; Ameritech v. Poland, UNCITRAL; France Telecom v. Poland, UNCITRAL; Vivendi v. Poland, UNCITRAL.

[7] Nagel v. Czech Republic, SCC Case No. 049/2002; CME v. Czech Republic, UNCITRAL; Lauder v. Czech Republic, UNCITRAL; European Media Ventures v. Czech Republic, UNCITRAL.

[8] Khaitan Holdings Mauritius Limited v. India, PCA Case No. 2018-50.

[9] Astro All Asia Networks and South Asia Entertainment Holdings Limited v. India (UNCITRAL Arbitration).

[10] Juvel Ltd and Bithell Holdings Ltd. v. Poland, ICC Case No. 19459/MHM.

[11] Axiata Investments (UK) Limited and Ncell Private Limited v. Federal Democratic Republic of Nepal, ICSID Case No. ARB/19/15.

[12] Global Telecom Holding S.A.E. v. Canada, ICSID Case No. ARB/16/16.

[13] ICSID Case No. ARB/16/16 - Tribunal rendered award on 27 March 2020.

[14] PCA Case No. 2014-10, award published in September 2018. On 11 December 2018, India failure to set aside the award in the Swiss Court.

[15] ICSID Case No. ARB/20/5 - request for arbitration on 12 February 2020.

[16] ICSID Case No. ARB/20/7 - ICSID registered the request for arbitration on 9 March 2020.

[17] ICSID Case No. UNCT/17/1.

[18] ICSID Case No. UNCT/17/1 – Award.

[19] ICSID Case No. ARB(AF)/18/4 - Tribunal formed on 18 December 2018.

[20] ICSID Case No. ARB/18/3.

[21] ICSID Case No. ARB/19/15.

Disclaimer

Herbert Smith Freehills LLP has a Formal Law Alliance (FLA) with Singapore law firm Prolegis LLC, which provides clients with access to Singapore law advice from Prolegis. The FLA in the name of Herbert Smith Freehills Prolegis allows the two firms to deliver a complementary and seamless legal service.