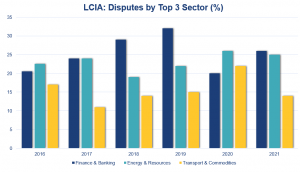

The LCIA has released its Annual Casework Report for 2021, showing that disputes in the Banking and Finance sector represented the LCIA's biggest industry sector in 2021, overtaking Energy and Resources disputes. The 2021 Report shows that 26% of disputes registered with the LCIA in 2021 relate to the sector. The LCIA saw a corresponding increase in loan agreements and other loan facilities agreements in LCIA arbitrations, up from 16% in 2020 to 21% in 2021. Although the headline statistic for the sector were bolstered by a group of 27 related cases (making up 32% of all the banking and finance cases at the LCIA in 2021) as discussed further below, the LCIA's figures are in line with a softening of the attitude of finance clients towards arbitration.

This Part 1 of our series on Arbitration in the Banking and Finance Sector looks at what may have prompted this rise and offers some observations on current dispute resolution trends. Part 2 will look at the myths and realities of arbitration, picking up on some of the key points that clients in the Sector need to be aware of. Part 3 will consider the increasing use of investment treaty arbitration by banks to protect their investments. A full analysis of the LCIA's Annual Casework Report will follow.

General rise in arbitration of disputes in banking and finance sector

This year's statistic shows a continuation in the growing trend for arbitration in the banking and finance sector since 2016.

Paula Hodges QC, President of the LCIA Court and Global Head of International Arbitration at HSF comments: "The increases in recent years suggest changing attitudes from banks and financial institutions towards resolving their disputes by arbitration. Certainly in private practice we are seeing more interest from clients in this sector in exploring what arbitration has to offer. Whilst there are many factors at play, arbitration may be suitable in a broad range of different finance transactions, not only where there are concerns about enforceability of court judgments or the need for a neutral forum, but also in cases where the procedural flexibility of arbitration or the private resolution of disputes may work to the parties' advantage. Clients are also increasingly recognising that arbitration offers a chance to choose a decision-maker from a very high-quality pool".

The LCIA is not alone in this trend. An increase in the sector can also be seen in some other institutions – for example, banking and finance services disputes represent 16.2% of the cases registered in 2021 with the HKIAC (up from 13.5% in 2020).

Interlinked factors driving growth in use of arbitration in the banking and finance sector

A number of interlinked factors appear to be driving growth of the use of international arbitration in the banking and finance sector:

- Increasing involvement of parties from a multitude of jurisdictions, including emerging market jurisdictions, in complex finance transactions – parties need a neutral venue to resolve their disputes, as well as to ensure an enforceable outcome. There is no reciprocal enforcement regime for court judgments with the global reach of the New York Convention 1958, to which 170 countries are party.

- Efforts from the institutions – institutions have highlighted the key features of arbitration that may work for disputes arising out of complex financial products, such as choosing specialist decision-makers, and fixing the perceived flaws, such as the absence of an equivalent to summary judgment proceedings. In particular, institutions now provide for the early dismissal of unmeritorious claims or defences. The LCIA Rules 2020 expressly confirmed the power of the Tribunal to make an early determination and expedite proceedings. The Annual Casework Report confirms that in 2021, there were 15 applications for early determination, seven of which were granted, two were rejected, one was superseded by the parties’ settlement of the case, and five were yet to be determined at the end of 2021. Other institutions, such as the ICC, have also made clear that their rules empower the tribunal to make similar early determinations. Further, institutions such as ISDA – who published an Arbitration Guide in 2013, revised in 2018, for use with an ISDA Master Agreement – and PRIME Finance, a specialist foundation focused on providing access to expertise and arbitral rules for resolution of complex financial markets disputes – have helped to raise the profile of arbitration as a method of dispute resolution.

- Decreasing fear factor – traditional myths about arbitration are being dispelled, and there is increased interest in how the features of arbitration can offer some advantages in certain banking and complex financial transactions - our experience of finance clients' evaluation of their dispute resolution options is described in more detail below. Procedural flexibility, privacy, the ability to choose an arbitrator with practical sector experience, and more limited production of documents can all be valuable in the right circumstances.

HSF's observations on most recent trends – no wholesale market changes but a rise in the "arbitration-curious"

In our experience, a jurisdiction clause – often in favour of the English or New York courts – remains the preferred choice in many banking and financial markets transactions. In the English courts, parties have been able to rely upon a solid body of law (both general contract law principles and, particularly since the 2008 financial crisis, on the interpretation of complex financial products). The law is applied by the English courts in an exact and predictable manner.

However, some banks and financial institutions, particularly in the loan and derivatives markets, have also cautiously regarded arbitration as a suitable option in certain situations. For example, arbitration represents a neutral choice for those transactions where a counter-party resists the favoured choice of court; it helps to manage enforcement risk where emerging market jurisdictions are involved or in cases of sovereign lending (including when dealing sovereign wealth funds) where the counterparty may benefit from immunity from jurisdiction.

Quite sensibly, Brexit and the changes around the enforcement regime for English court judgments in the EU have not seen an automatic pivot towards arbitration. However, both due to Brexit, and in any case periodically, banking and finance clients have been revisiting their internal policies on choice of dispute resolution clause. In particular, our clients have reflected on the use of unilateral jurisdiction clauses (which are broadly understood to fall outside the reciprocal enforcement regime of the Hague Convention on Choice of Court Agreements – for more information on this, please see our Guide here). They have also considered the scope of those dispute resolution policies so far as they point towards arbitration. In particular, they have sought advice on how arbitration might work for the kind of disputes that they encounter and how they could make the most of the features of the arbitration process.

In Part 2 of this series we will focus on some of the key considerations for banking clients when reflecting on arbitration within their suite of dispute resolution choices. We will consider the myths and the realities of arbitration in the context of disputes in the Banking and Finance Sector and highlight situations in which arbitration may offer strategic advantages.

For more information, please contact Paula Hodges QC, Global Head - International Arbitration, Hannah Ambrose, Senior Associate, or your usual Herbert Smith Freehills contact.

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.