Overview

We are now just over one month in to the UK Government's new policy, revising its support for the overseas fossil fuels sector.

As flagged in the initial request for consultation responses, as of 31 March 2021, the UK Government has determined, with some limited exceptions, that it will no longer provide new direct financial or promotional support for the fossil fuel energy sector. The "fossil fuel" sector includes fossil-fuel fired power plants, and the extraction, production, transportation, refining and marketing of crude oil, natural gas or thermal coal.

It is worth noting that support for unabated gas fired power generation will still be available, with certain strict conditions, such as ensuring that the support provided will not delay the transition to renewable sources, and that the relevant country has a credible net zero pathway in line with Paris commitments.

The support affected by this policy includes new Official Development Assistance (ODA), international investment, financial and trade promotion activity and notably, UK Export Finance support.

In terms of wider Government support, whilst the Government will no longer conduct proactive lobbying and/or facilitation of engagement with foreign governments if that support promotes the production or use of fossil fuels, it will continue to support oil and gas companies in relation to disputes with foreign governments regarding certain competition rules and trade agreements/disputes, and will assist in resolving barriers to promote export of low-carbon technologies.

It is also worth noting that this policy will inform any voting position that the UK may have on boards of Multilateral Development Banks, and influence investment policies of other development financial institutions where Government funding is used.

This policy applies to all direct and indirect support where it is possible to specify where the funds will be used.

In relation to financially intermediated transactions (eg indirect equity investments / corporate loans) where it may not be possible to determine where funds will be used, the Government will require evidence that the recipients are working towards aligning portfolios with the Paris Agreement.

There is a one-year exemption for SMEs, to allow SMEs to adjust to the change in policy. UKEF has also developed a new 'Transition Export Development Guarantee' with a view to allowing oil and gas companies with transitional plans to benefit from working capital support.

It is worth noting that there is very little detail at this time as to the process for applying for exemptions.

The policy may be found here.

Policy Implementation – the Limited Exemptions

A key question which was raised in the consultation with industry was the scope and definition of the exemptions from this policy. The policy guidance lists the following exemptions through which the Government will continue to provide support:

(a) Support for unabated gas fired power generation, subject to: such support not delaying transition to renewables, the relevant country having a pathway to net zero in line with the Paris Agreement and a credible NDC; managing stranded asset risk; and compliance with best practice standards including to minimise methane leakage. The policy indicates that a gas power project would be supported where the project supports decommissioning of coal and runs alongside renewable projects which do not meet demand immediately. Excluded from this is support for gas production, distribution and generation into the international market.

Directly related infrastructure is only supported to the extent that a project meets this exemption. Otherwise, there is no support for fossil fuel related transportation, transmission, storage and distribution infrastructure (including ports and roads used primarily for fossil fuels);

(b) Support for stand-alone diesel or gas generators if certain conditions are met (for example where renewable-powered generators are not feasible). An example given is diesel generators in emergency response settings;

(c) Support for Liquid Petroleum Gas (LPG) for cooking and heating;

(d) Support for CCS or CCUS projects in the gas power sector only where projects will significantly reduce emissions. This excludes CCUS with enhanced oil or gas recovery, coal bed methane or equivalent technology;

(e) Technical or regulatory assistance to support energy or emissions efficiency, health, safety, social and environmental standards;

(f) Capital support (ie capex/maintenance investment) for technology exports which improve energy or emissions efficiency or health, safety, social and environmental standards for existing assets (except where this extends the asset's operating life). The policy notes that this list is not exhaustive and the "relevant department will make a judgement on a case-by-case basis in line with the intention of the policy", however does not further explain on the process for applying for an exemption;

(g) Technical or regulatory assistance to countries on energy market reform to help accelerate their low carbon transition. However, there is a presumption against unabated fossil fuel projects unless there is no cost-effective low carbon alternative; and

(h) Support for the decommissioning of existing fossil fuel energy assets or their conversion into use for non-fossil fuel energy infrastructure. This excludes supporting the conversion of an existing fossil fuel asset into another fossil fuel asset.

Areas out of scope of this policy for which UK government international support is unaffected

This includes, but is not limited to:

(a) Electricity or heat transmission and distribution networks, regardless of the fuel used for generation;

(b) Industries that need high temperatures that can only be achieved through burning fossil fuels (e.g. cement, ceramics, steel, glass, paper);

(c) Industries that use hydrocarbons as feedstock but that do not produce fuels (e.g. steel, detergents, paint and petrochemicals);

(d) Support for economic activities outside of heavy industries (eg may include farms that use fossil fuels as an energy source);

(e) Use of CCUS to decarbonise industrial processing (non-fossil fuel energy sector uses);

(f) CCUS: CO2 transport and storage projects which would provide abatement for emission sources;

(g) Transport sector, including rail, ship, vehicle and aircraft manufacturing, fleets and supporting infrastructure;

(h) Support to fossil fuel sectors to enable a secure transition of workers and fossil fuel dependent communities;

(i) Health and safety training;

(j) Methane capture and detection;

(k) Support for blending of ethanol/biofuels in petroleum products;

(l) Support for defence / security sector applications;

(m) Non-oil and gas specific products and services; and

(n) Direct use of hydrocarbons as climate friendly alternatives to hydrofluorocarbons that are being phased down under the Kigali Amendment to the Montreal Protocol.

Application of the Policy to Indirect support

In relation to non-ODA working capital schemes or other fungible financing support, where it is impossible to know where the funds will be used and where they are designed to support UK exporters:

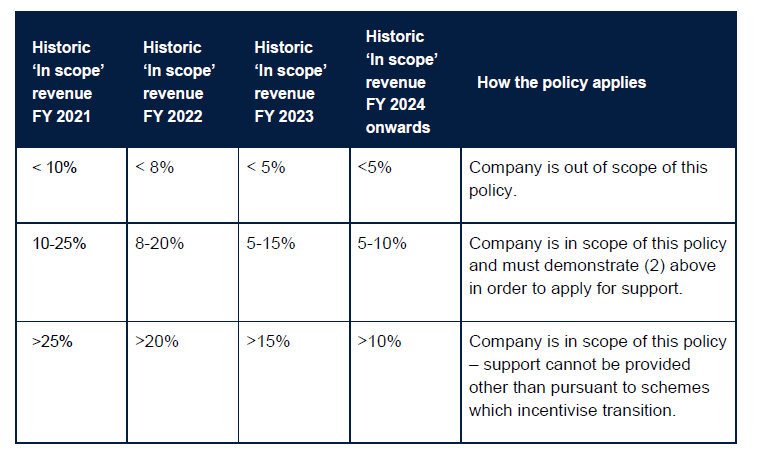

(a) a Revenue Threshold Test will apply (ie the proportion of total international fossil fuel revenue to total revenue being within the limits of the table extracted below); and

(b) the applicant must demonstrate: (i) a commitment to increase revenue in out-of-scope sectors; (ii) it is "actively transitioning away from fossil fuels"; and (iii) it has a clear commitment to align future activities with the Paris Agreement (and the Loan documents or agreements will contain the requirement to monitor progress against such commitments).

The Revenue Threshold Test decreases to 2024 as follows (and as set out on p12 of the policy):

Otherwise, it may be possible to apply for a working capital support scheme which specifically incentivises energy transition activities, if the company can demonstrate a credible climate Transition Plan (which will be subject to full assessment). The loan documentation will test ongoing compliance with the Transition Plan and trigger an increase in the interest rate margin for failure to meet key milestones/elements.

Contacts

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.