On 21 February 2025, the Office of the United States Trade Representative (USTR) announced a proposed Section 301 action targeting China’s maritime, logistics and shipbuilding sectors to address China’s dominant market position in these sectors (the Proposed Action)1.

Potential impact

The Proposed Action, if implemented, will greatly increase costs for any shipping operator owning Chinese-built vessels trading with the US.

It could also increase costs throughout the supply chain for shippers (importers and exporters), producers, traders and consumers involved in US trade using Chinese-built vessels.

While the Proposed Action is expected to have a major effect on Chinese shipping operators, many other non-Chinese operators also have Chinese-built vessels as a significant part of their fleets.

Chinese-built container ships make up some 29% of existing global shipping capacity, and 70% of the prospective orders for container ships.2

Non-Chinese operators are already considering rescheduling existing liner business and using non-Chinese-built vessels for their US services.

As a result, booking demand for non-Chinese-built vessels could increase, shippers may find it more difficult to book suitable vessels in the short term, and longer waiting times for vessels may increase storage costs.

Recommendations

We recommend that shippers and traders review their trading contracts, especially clauses on the allocation of port fees, sanction, force majeure and termination.

If the contract includes specific details of the vessels used, the parties should consider whether they need to negotiate a change of vessel to deal with the imposition of service fees if the Proposed Action passes into law.

Shipping operators are advised to consider rescheduling the fleet calling on US ports or making transshipment arrangements. Shipping operators may also wish to review their ongoing shipbuilding contracts (such as clauses on material adverse effect and change in law) and consider ways to mitigate future risks.

Investors in the shipping and logistics industry should consider reviewing investment plans and projects involving import from and export to the US if the Proposed Action is implemented.

USTR is currently inviting public comments on proposed Section 301 actions. A public hearing will be held on 24 March 2025. Please see Key Dates in the section below for the deadlines for submitting written comments and requesting an appearance at the hearing.

For specific legal advice, please contact your usual Herbert Smith Freehills contact or our shipping specialists below.

Background

Section 301 of the Trade Act of 1974 authorises the US Trade Representative (USTR) to investigate and act against foreign countries that USTR finds to have unreasonable or discriminatory practices that burden or restrict US commerce.

On 12 March 2024, five US labour unions filed a petition requesting an investigation into China’s acts, policies and practices in the maritime, logistics and shipbuilding sectors. USTR accepted the petition and initiated the investigation against China.

On 16 January 2025, USTR published the Section 301 investigation report, which found that China’s targeting of the maritime, logistics and shipbuilding sectors for dominance was unreasonable and that it burdens or restricts US commerce, opening the way for a response against China.

The Proposed Action

The Proposed Action includes several measures designed to counteract China’s dominance in maritime sectors and to increase the use of US-built vessels to carry US goods.

The Proposed Action includes that appropriate and feasible action may include one or more of the measures, so it is still unclear which, if any, of these measures will be adopted officially after the public consultation process.

Fees on services

(a) Service fee on Chinese maritime transport operators

Up to US$1,000,000 per vessel call to a US port; or

Up to US$1,000 per net ton of the vessel’s capacity, per vessel call to a US port

(b) Service fee on maritime transport operators with fleets comprised of Chinese-built vessels

Up to $1,500,000 per vessel call for a Chinese-built vessel to a US port; or

Up to the following amounts per vessel call for a Chinese-built vessel to a US port based on the percentage of Chinese-built vessels in the operator’s fleet as follows:

|

Percentage of Chinese-built vessels in fleet |

Fee per vessel entrance to a US port |

|

≥50% |

US$1,000,000 |

|

25%-50% |

US$750,000 |

|

0%-25% |

US$500,00; or |

An additional fee of up to US$1,000,000 per vessel call for a Chinese-built vessel to a US port if the number of Chinese-built vessels in the operator’s fleet is equal to or greater than 25%.

(c) Service fee on maritime transport operators with prospective orders for Chinese vessels

|

Percentage of vessel orders from Chinese shipyards |

Fee per vessel entrance to a US port |

|

≥50% |

US$1,000,000 |

|

25%-50% |

US$750,000 |

|

0%-25% |

US$500,00; or |

Up to US$1,000,000 per vessel call to a US port if at least 25% of the total number of vessels ordered by, or expected to be delivered to, the operator will be from Chinese shipyards over the next 24 months.

The Proposed Action also proposes that additional fees up to US$1,000,000 may be refunded per vessel call to a US port of a US-built vessel used in international maritime transport. However, the Proposed Action does not elaborate further on the procedure, schedule or amount of these refunds.

Restrictions on services

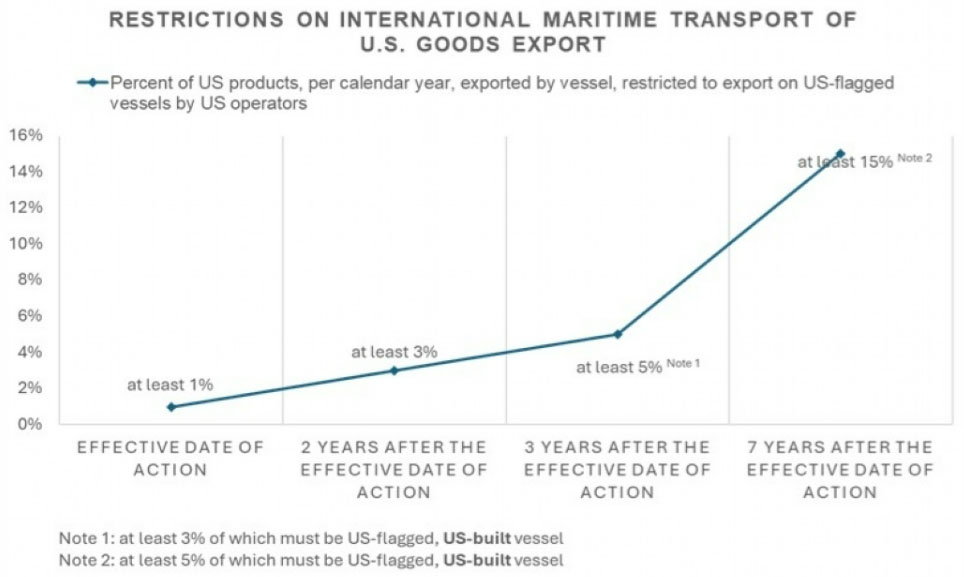

The Proposed Action proposes the following restrictions on the overall percentage of US goods that should be exported by US-flagged (and US-built) vessels: an increase from 1% that will apply immediately, up to to 15% over the next seven years.

Further, the Proposed Action proposes that US goods that are to be exported on US-flagged, US-built vessels, but may be approved for export on a non-US-built vessel provided the operator demonstrates that at least 20% of US products per calendar year that the operator will transport by vessel will be transported on US-flagged, US-built ships.

The precise details of how this is to be calculated and implemented remain to be seen.

Other actions

The Proposed Action mentions other possible measures, such as banning terminals at US ports and US ports from using China’s National Transportation and Logistics Public Information Platform (LOGINK) software and restricting LOGINK access to US shipping data.

Key dates

Stakeholders can make written submissions or participate in the hearing scheduled for 24 March 2025 in order to present their views on the Proposed Action. The key dates are:

- 21 February 2025: the public comment period opens. You can access the USTR portal and submit comments here;

- 10 March 2025: deadline to submit requests to appear at the hearing and a summary of testimony; and

- 24 March 2025: date of hearing, and deadline to submit written comments.

1 For details of the USTR news release, please visit: https://ustr.gov/about-us/policy-offices/press-office/press-releases/2025/february/ustr-seeks-public-comment-proposed-actions-section-301-investigation-chinas-targeting-maritime

2 Statistics from Linerlytica, quoted in https://www.wsj.com/articles/trump-administration-readies-order-to-bolster-u-s-shipbuilders-punish-china-d6a2749b

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.