Working drafts of the long awaited standards for sustainability reporting by non-EU ultimate parent companies have just been released ("NESRS"). The current drafts largely follow the standards applicable to EU-incorporated companies, with a few important limitations in scope including a focus on impact materiality only (to the exclusion of financial materiality) and an option to limit the reporting perimeter to EU operations only. The NESRS promised to be lighter than the ESRS applicable to EU-incorporated companies, but do these go far enough?

On 7 November 2024, EFRAG (the European Financial Reporting Advisory Group) – the body responsible for developing the sustainability standards that underpin Corporate Sustainability Reporting Directive ("CSRD") – published its first working draft of the sustainability reporting standards for non-EU parent entities (required under Article 40a of the Accounting Directive) ("NESRS").1 Since then, further drafts were released following EFRAG’s working meeting from 18 November (available here).

As we have previously discussed on ESG Notes, NESRS was originally set to be adopted by the European Commission by 30 June 2024. However, in October last year, the Commission announced a two-year delay for the adoption of NESRS, without delaying the implementation date for non-EU ultimate parent reporting. This has created uncertainty for non-EU companies, who are in scope for non-EU ultimate parent reporting obligations for FY2028, but are already preparing to report for their in-scope EU subsidiaries for FY2024 or 2025.

In this article, we explain what NESRS is and explore how it may differ from the disclosure reporting standard for EU entities (ESRS), which it is based on.

Background

CSRD mandates EU and Non-EU companies with a significant presence in the EU to disclose their sustainability information on an annual basis. CSRD's reporting obligations apply to companies in a phased manner between 2024 and 2029, with companies coming into scope based on their size, turnover, and average number of employees. In overview:

- large companies which were previously regulated by the Non-Financial Reporting Directive ("NFRD") come into scope from FY24 (reporting in FY25);

- all large companies and parent companies of large groups come into scope from FY25 (reporting in FY26);

- small and medium-sized companies come into scope from FY26 (reporting in FY27); and

- non-EU ultimate parent companies of significant EU businesses (see below) come into scope from FY28 (reporting in FY29).

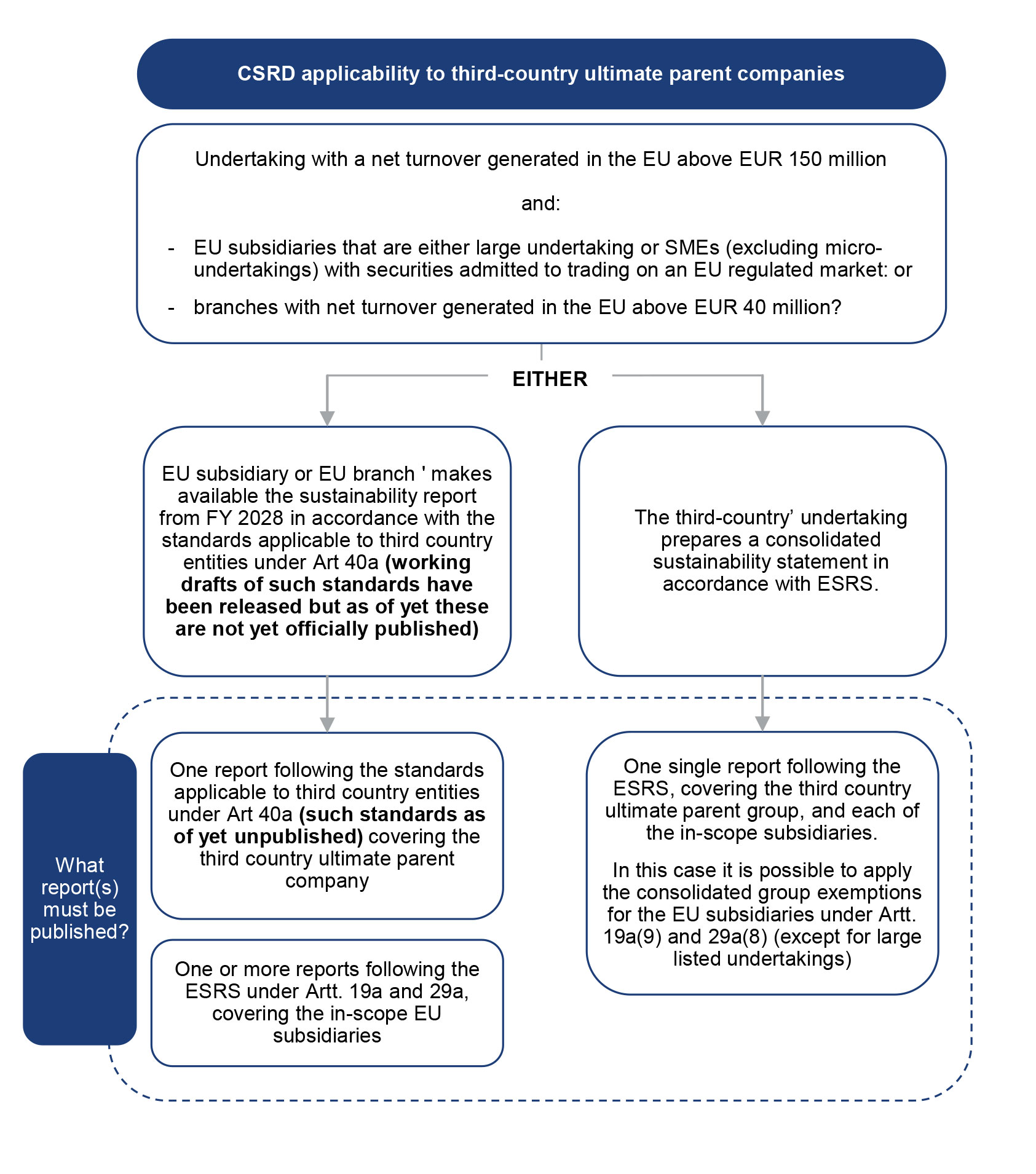

EU companies meet their obligation to report their sustainability information by making disclosures against the detailed requirements set out in European Sustainability Reporting Standard ("ESRS"). In contrast, while it is open to non-EU companies to report under ESRS in respect of the whole group, they are permitted to report under a separate standard for non-EU companies instead (the NESRS), the draft of which had not been available until now.2

|

Deep dive: When will a non-EU parent company be in-scope of CSRD? A non-EU ultimate parent company will qualify as having a significant footprint in the EU where it has:

|

WHEN WIll the NESRS BE USED?

In-scope non-EU ultimate parent companies have the option of either:

- voluntarily reporting at a group level under ESRS; or

- reporting under NESRS.

The NESRS are lighter than the ESRS (see further on areas of discrepancy below, in particular in relation to double materiality). However, in-scope EU-subsidiaries cannot rely on a parent company report prepared under the NESRS and would still be required to prepare their own report under ESRS.

What's the same?

(1) Structure and Content

Mirroring ESRS, NESRS is structured into three parts:3

- NESRS 1 (General Requirements): sets out the concepts and principles which apply when carrying out the reporting process and preparing sustainability statements;

- NESRS 2 (General Disclosures): sets out the minimum disclosures that are required of all in-scope companies; and

- Topical Standards: of the draft NESRS includes the same ten ESG "topical standards" that are included in ESRS, such as climate change, workers in the value chain, and business conduct etc.

(2) Level of Reporting

Consistent with ESRS, the sustainability report required under NESRS must reflect the sustainability information of the group at the level of the non-EU parent, which reflects the reporting boundary used in financial reporting.4

(3) Glossary and Definitions

According to the draft NESRS, there is no separate glossary of definitions for interpreting NESRS. Instead, the ESRS glossary should be consulted.5

What's different?

(1) Double materiality vs impact materiality

In ESRS, EU entities must carry out a 'double materiality assessment'. This means considering both (i) the financial impacts that sustainability-matters have on the business ('financial materiality'), and (ii) the impacts that the entity has on people and the environment, both in respect of its activities and the activities of its value chain, including through its products and services and business relationships ('impact materiality').

In NESRS, non-EU parent companies are only required to consider impact materiality6 and therefore only report on 'impacts' and not 'risks and opportunities' as under ESRS. This means that NESRS will not be aligned with other international sustainability disclosure standards – most importantly ISSB - which only consider financial materiality.

The absence of a double materiality assessment is, among other things, one of the reasons why in-scope EU subsidiaries will not be able to rely on the non-EU ultimate parent's report which is prepared under NESRS in order to meet their own disclosure obligations.

(2) Option to amend the 'perimeter of disclosure'

In the draft NESRS, non-EU parent companies may exclude information about the impacts of sales of goods or provision of services to natural and legal persons outside the EU, except for the climate change topical standard and the general disclosure requirements.7

This means that non-EU ultimate parent companies must report against NESRS 2 and NESRS E1 with respect to the entire global group but may choose to limit the scope of the sustainability report to the impacts resulting from the sales of goods or provision of services in the EU for the rest of the topical standards.

This option will significantly lighten the burden for non-EU parent companies compared to EU companies reporting under ESRS, as operations outside the EU do not need to be reflected in the NESRS report. If non-EU parent companies choose to exercise this option, they must state explicitly that they are doing so in their sustainability report.

|

Deep dive: Some examples of reporting perimeter EFRAG has provided the following examples of situations where a non-EU group may exclude certain non-EU activities from its reporting perimeter.

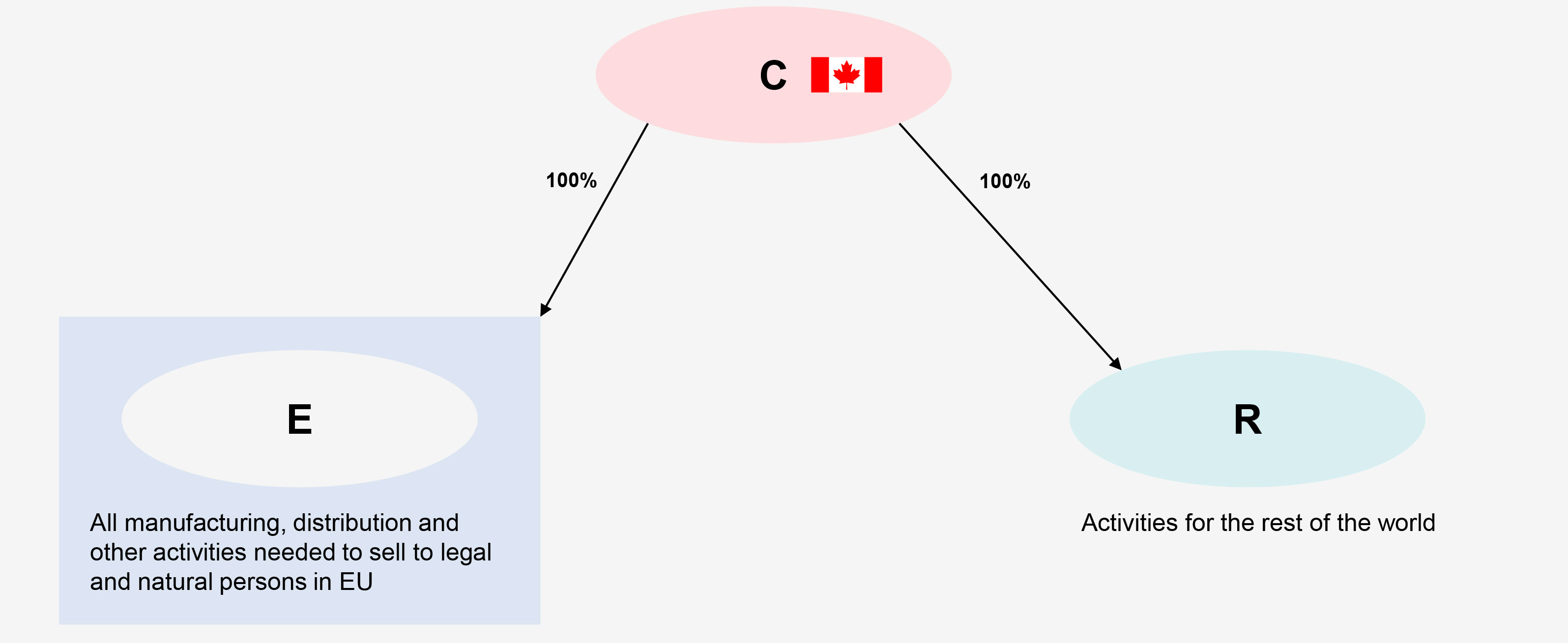

Example 1: A Canadian headquartered group, C, has two intermediate holding companies: one for production and distribution of sales of products to the EU, called E and one for the rest of the world, called R. The NESRS sustainability report only needs to cover E.

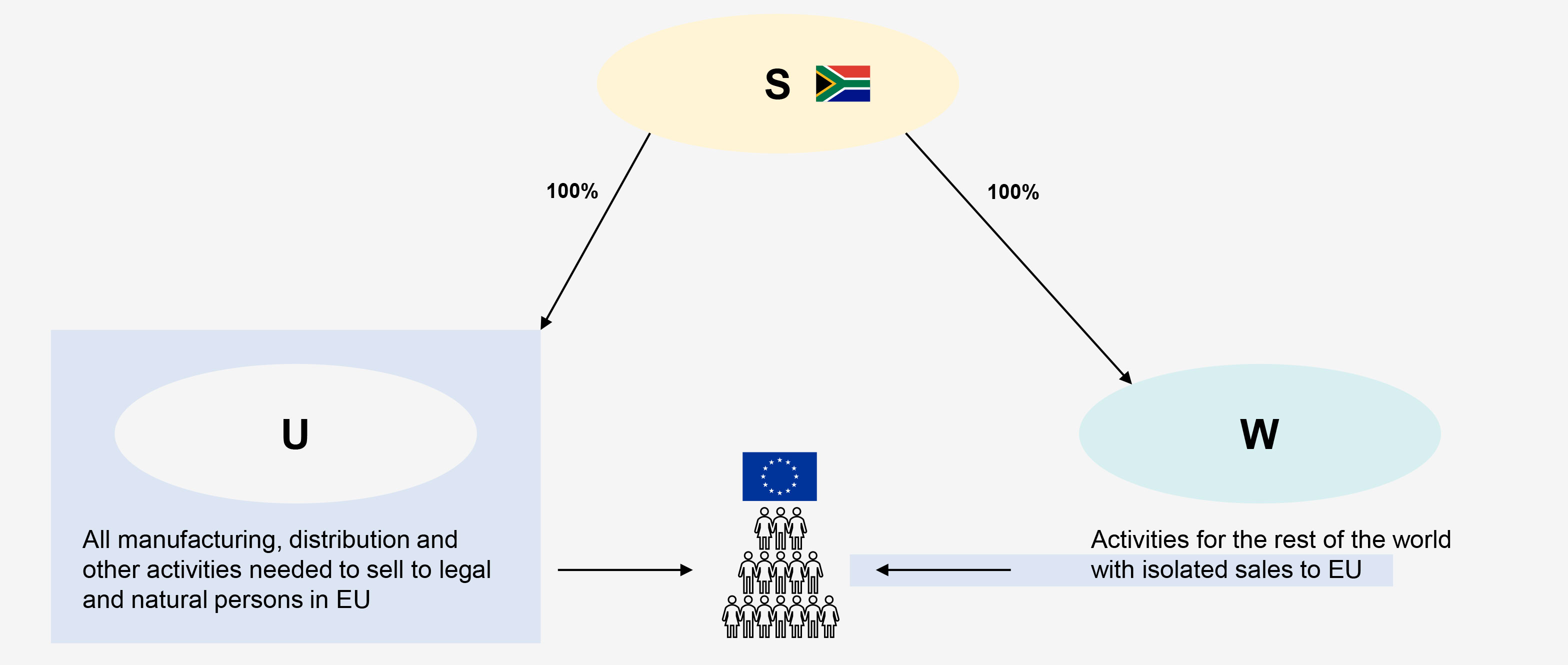

Example 2: A South African headquartered group, S, has manufacturing plant and distribution units in Europe for its sales to EU customers under a European subsidiary – U. There are also some isolated transactions with some EU clients directly from South Africa via an intermediate holding company called W. The NESRS sustainability report should capture subsidiary U as well as impacts related to the isolated transactions from W (on the assumption that the related sustainability matters are material).

|

(3) Treatment of intra-group impacts

NESRS 1 contains a further Application Requirement (AR16A) stating that the elimination of internal transactions in the preparation of consolidated financial statement has no implications for the identification of impacts. In other words, the impacts from internal transactions should still be considered notwithstanding the fact these internal transactions are not taken into account at group level under consolidation of the financial reporting.

This Application Requirement is not present in the ESRS.

(4) EU Taxonomy Regulation Disclosures

Separate disclosures under the EU Taxonomy Requirements are not required for companies reporting under NESRS.

(5) Transitional provisions

ESRS 1 contains various transitional provisions which apply to entities that are reporting in the first three reporting years. These transitional provisions do not exist in the current draft NESRS.8

In EFRAG's working paper which informed the negotiation of the draft NESRS, possible reasons for the absence of transitional provisions are set out. These include that NESRS reporters will have significantly more time to prepare for the requirements compared to ESRS reporters, and that there will be no transitional provisions available for ESRS reporters in 2028, so permitting them for NESRS reporters would be unfair.

What's next?

In summary, NESRS appears to be slightly simpler than ESRS, but not significantly. They largely follow the structure and content of NESRS with a few omissions, notably, the absence of financial materiality and the option to limit scope of reporting to the impacts of sales of goods or provision of services to natural and legal persons within or to the EU (excluding climate change).

At this stage, the draft NESRS is very much a working document, and we expect to see the drafting change over time. EFRAG intends to approve the drafts for issue by mid-to late-December and launch a public consultation in January 2025. EFRAG has until the end of 2025 to present a final draft NESRS to the Commission for consideration for approval. The deadline for adoption of NESRS is June 2026.

EFRAG is currently working towards a timeline of providing drafts of the NESRS to the European Commission by the end of 2025, with the view of launching a public consultation on these in January 2025. Given that Ursula Von der Leyen recently suggested that opportunities should be found to promote alignment between the “often overlapping” requirements under CSRD, CS3D and the EU Green Taxonomy in 2025 to “reduce bureaucracy”, it will be interesting to see how this draft NESRS will evolve through the consultation phases and towards ultimate adoption in 2026.

The authors would like to thank Sophie Pamplin for her contribution.

2. See ¶3A NESRS 1

3. See ¶4B NESRS 1

4. See ¶18A NESRS 1

5. See ¶15A NESRS 1

6. See Sections 3.3 and 3.4 in NESRS 1

7. See ¶¶18A and 18B NESRS 1

8. See page 22 in NESRS 1

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.