With three UK based InsurTech companies earning “unicorn” status in 2021, the UK InsurTech market has the potential to be one of the most dynamic in the world.

However, investment and impactful innovations in the insurance sector have so far been primarily focussed on small business and personal lines, as well as improving the efficiency of back-office processes. Meaningful innovation affecting lines of sophisticated, commercial insurance has been less evident.

This briefing gives a snapshot of the UK InsurTech market to date, and considers whether there might be reasons for those in the complex end of the market to invest now, rather than waiting to see how the market develops.

Insurance value chain and InsurTech

InsurTech is the use of emerging hardware, software and user interfaces to address inefficiencies or create opportunities in the insurance value chain. For example, the new UK “unicorn”, Tractable, uses AI to rapidly assess photos and videos of car damage; this speeds up a process that previously took several days involving human appraisers.

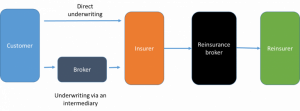

The traditional insurance value chain is as follows:

Areas of InsurTech Innovation

Investment in InsurTech is hitting record levels; Willis Towers Watson’s data shows investment in global InsurTech at an all-time high of US$7.1bn in 2020, with investments in the first quarter of 2021 indicating further growth.

In the UK, the companies attracting the highest valuations have often been for personal insurance lines e.g. Zego (gig economy insurer), Bought By Many (pet insurance), or digitising “back office” aspects of the existing insurance value chain e.g. Tractable (AI to help insurers assess damage to photos/videos of motor vehicles).

Despite steadily increasing levels of investment in InsurTech generally, many participants in the traditional insurance value chain for more sophisticated commercial insurance lines are adopting a “wait and see” strategy. There are various reasons for this, with some of the view that what is on offer will not increase the value of their business sufficiently to warrant the investment. Others believe that they can build something themselves that will be almost as good and not as expensive.

Some within the sector are, however, sceptical that this remains the right strategy. Participants in this group are looking to take advantage as “early movers” to establish a position in, or occupy more of, new technology-enabled value chains. This group believe that slow movers are at risk of seeing their traditional services challenged by nimbler competitors.

An InsurTech business that works with a combination of insurers, brokers and policyholders could impact the market significantly if it finds traction. This is best illustrated by a real-life example.

Case study

Insurwave seeks to digitise as much of the insurance value chain as it can. It currently operates mainly in marine insurance (i.e. a high value, complex insurance market), and is looking to expand to other parts of the insurance sector.

Insurwave is a software platform which creates a digital ecosystem for the participants in the insurance value chain (policyholders/ brokers/ (re)insurers) to transact with one another.

Insurwave’s business case is that, in the short to medium term, it automates and digitises the sharing of information using blockchain, so there is mutual agreement and understanding of the important information between participants in the value chain (thereby cutting down administrative time / cost for updating information). For example, the geographical location of the ship at any given time could impact the cost of premiums depending on whether the ship is in “safe” or “dangerous” international waters.

Three simple examples of how Insurwave’s business model might evolve help to illustrate how an early mover might gain advantage when it comes to InsurTech:

- Policyholders as primary clients: policyholders are offered a service that allows them to better capture individual risks and manage the administration of their insurance programmes more efficiently. Over time, policyholders become less reliant on brokers to assist with the insurance programme, and can work directly with panel insurers. In addition, insurance providers could be interchanged with reduced friction if policyholders have better, more standardised risk information. Bespoke risk programmes could then become a more commoditised product that more insurers could write.

- Brokers as primary clients: brokers work with Insurwave to offer policyholders a better service than competitors. By offering this improved service, and by working with policyholders to improve their insurance programme, the brokers become difficult to displace.

- Insurers as primary clients: insurers offer policyholders improved rates if they work with the insurer to make the process more efficient and to allow the insurer access to more bespoke data about the specific risks to which policyholders are exposed. The insurers gain a competitive advantage over their competitors, and potentially displace the policyholders’ brokers in respect of some parts of the value chain. Policyholder reliance on a suite of services provided by an insurer (in conjunction with Insurwave) could make it challenging to change insurer, in the same way some technology companies offer an ecosystem of products/ services to their customers which makes it attractive not to change.

While these examples are obviously simplified, they do serve to show that the future winners and losers may be dictated by who acts now to influence the way the market develops. They also show that the threat to a business may not come from InsurTech companies directly, and could come from unexpected sources (such as policyholders taking innovation into their own hands and forcing change upon other market participants).

Conclusion

There are signs that InsurTech may have moved to a new stage in the “hype cycle”, with expectations of what can be achieved being more realistic and propositions more focussed. Some will feel the “wait and see” approach adopted in the past has served them well. Whether that will remain the case should be tested rigorously as the InsurTech market develops and the products offered become more sophisticated and refined.

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.