Background of the loan repayment deferrals

On 20 March 2020, the Australian Banking Association (ABA) announced that banks were allowing the deferral of repayments for small business loans and mortgages for up to six months in order to assist Australians who were suffering financial hardship due to the effects of COVID-19.[1]

APRA reported that, as at 30 June, $274 billion worth of loans were subject to repayment deferrals, which constitutes almost 10% of the total outstanding loans.[2] $195 billion of housing loans were deferred (being 11% of total housing loans) and $55 billion of small business loans were deferred (being 17% of total small business loans).

On 8 July 2020, the ABA announced the second phase, commencing at the end of the six-month deferral period. Where customers are able to restart loan repayments, they will be required to do so. If a customer can demonstrate reduced income or ongoing financial hardship, they may be eligible for an additional deferral of up to four months.[3]

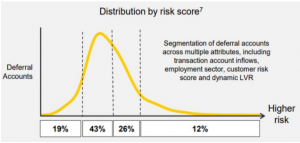

Data from the Commonwealth Bank of Australia (CBA) indicates that a number of loans may still require the additional assistance from lenders because:

- 12% of deferred loans are among those in "higher risk" occupations (such as retail, hospitality and airline staff);

- 84% of loans were for the principal and interest amount (with APRA reporting that around 8% of housing loans have a loan to value ratio of greater than 90%); and

- 14% of deferred home loans involved at least one borrower receiving JobSeeker, and around 30% of deferred business loans were made by borrowers receiving JobKeeper.[4]

Accordingly, it is expected that a notable proportion of deferred loan recipients will continue to be in financial hardship after the expiry of the six month deferral period.

ASIC and APRA’s guidance on loan deferrals

On 13 August 2020, ASIC released guidance reminding retail lenders of its expectations when transitioning out of the current phase of the deferral scheme.[5] This is an expansion on prior guidance released by ASIC on 29 April 2020 and updated on 9 June 2020.[6]

The guidance relates to lenders’ obligations (which include non-bank credit providers) under section 72 of the National Credit Code, whereby a lender must consider varying a consumer’s credit contract if a consumer notifies them that they are or will be unable to meet their credit obligations. In addition, lenders must also do all things necessary to ensure that the credit activities authorised by their licence are engaged in efficiently, honestly and fairly.

When COVID-19 initially began, ASIC’s expectations focused on customers going into hardship, articulating the following expectations:

- Communicate with consumers about the different options that may assist them, depending on their circumstances.

- Be flexible and offer tailored solutions to consumers where a standardised 'one-size-fits-all' approach may not meet a particular consumer need. For example, if a consumer has had their loan repayments deferred, a lender should ensure that how a consumer will catch up on missed repayments is manageable and offer alternatives.

- Ensure all communications with consumers are clear and provide consumers with sufficient information to make an informed decision about the assistance available. This should include details of how different assistance options will affect the consumer’s loan and repayments over the short and long term, including the effect of capitalising interest (where relevant).

- Have ongoing communications with consumers throughout the period of assistance to ensure that any assistance offered remains appropriate and continues to meet their needs.

- Communicate with consumers as their period of assistance comes to an end to understand their financial circumstances at that time, respond as appropriate and ensure each consumer understands what will happen next.

Now that loan deferrals could be reaching an end, expectations 2 and 5 have been further enhanced with ASIC articulating what a process that delivers “appropriate and fair outcomes” includes. While stating that lenders should have in place processes that are easy for consumers to understand and navigate, ASIC has made the following detailed guidance:

| Stage of process | ASIC’s expectations |

| Contacting consumers about the expiry of the deferral period | · Lenders should make reasonable efforts to contact consumers before their loan deferral expires.

· Consumers should have reasonable time to consider their options. · Lenders should provide consumers with information that would assist in their decision making. On this, ASIC considers that more can be done by lenders to provide consumers with personalised information or representative examples about how assistance arrangements may affect their repayments and the cost of their loan over the longer-term. · If a consumer cannot be contacted, lenders should attempt a range of communication channels and should be able to evidence that they have made reasonable attempts to do so. |

| Where a consumer cannot resume full repayments | · Lenders must make reasonable efforts to have a direct interaction (such as a phone call) to allow lenders to gather more personalised information about the consumer’s circumstances to make a decision about the consumer’s loan in a fair and appropriate manner. |

| Deciding to offer further assistance | · If lenders decide that it would be appropriate to offer further assistance, the process should be flexible and the assistance offered should be tailored to genuinely address the consumer’s needs.

· Records should be kept setting out the assistance options provided to each consumer. |

| Deciding not to offer further assistance | · In situations where a consumer’s financial difficulties are so severe that they will not be able to repay their loan over the longer-term, ASIC expects lenders to make all reasonable efforts to work with consumers to keep them in their homes if that is in their best interests. On this, ASIC recognises that there will likely be some circumstances where offering a consumer further temporary assistance may make their situation worse. Such situations will need to be carefully identified by lenders and involve a high level of engagement with those affected consumers.

· Lenders must notify consumers of their right to complain to the Australian Financial Complaints Authority |

| Where loan repayments are missed | · If a consumer’s deferral expires and a subsequent repayment is missed, lenders should make reasonable efforts to contact them and assess the appropriateness of further assistance being offered to them. |

On the same date, APRA announced that it was accepting feedback on a proposal to formalise temporary changes to capital treatment and reporting requirements for deferred loans through legislative instruments. APRA proposes to add an attachment to APS 220 Credit Quality to accommodate this.[7]

Additional ASIC reminders

In the guidance, ASIC provided some reminders for lenders, namely:

- if a consumer is dissatisfied with a lender’s response or actions, lenders must ensure that they comply with the requirements set out in ASIC’s Regulatory Guide 165: Internal and external dispute resolution and the newly released Regulatory Guide 271: Internal dispute resolution, coming into effect in October 2021; and

- responsible lending obligations should not be considered by lenders as a barrier to making appropriate changes to the terms of existing loans in response to hardship situations;

Consequences for lenders - complaints

There are many practical consequences of the above for lenders and this note focusses on one in particular. It is widely anticipated that the above approach will see a significant increase in the number of complaints being raised both with lenders (who may need to increase resources for their complaints handling function in order to meet their complaints handling commitments to consumers) and with complaints referred to AFCA. It can be very time consuming for lenders in addressing complaints referred to AFCA and some market participants are concerned about the approach AFCA will take to these complaints when considered against their ‘fairness’ approach. In addition, some in the market are particularly concerned that AFCA may not take into account directions made by ASIC/APRA to lenders during this time.

[1] Australian Banking Association, ‘Banks announce Small Business Relief Package’, 20 March 2020, https://www.ausbanking.org.au/banks-small-business-relief-package/.

[2] Australian Prudential Regulation Authority, ‘Temporary loan repayment deferrals due to COVID-19, June 2020’, 4 August 2020, https://www.apra.gov.au/temporary-loan-repayment-deferrals-due-to-covid-19-june-2020.

[3] Australian Banking Association, ‘Banks enter phase two on COVID-19 deferred loans’, 8 July 2020, https://www.ausbanking.org.au/banks-enter-phase-two-on-covid-19-deferred-loans/.

[4] The ‘Distribution by risk score’ diagram is helpfully provided by CBA, and the ‘Housing loan risk profiles’ diagram is provided by APRA. See William Jolly, ‘CBA full-year results: Loan deferrals falling, cash deposits rising’, 12 August 2020, https://www.savings.com.au/home-loans/cba-half-year-results-loan-deferrals-falling-cash-deposits-rising.

[5] ASIC, ‘COVID-19 and financial hardship: ASIC’s expectations of retail lenders when loan repayment deferrals end’, 13 August 2020, https://asic.gov.au/regulatory-resources/credit/covid-19-information-for-lenders/covid-19-and-financial-hardship-asic-s-expectations-of-retail-lenders-when-loan-repayment-deferrals-end/. See also ASIC’s media release, 20-184MR.

[6] ASIC, ‘COVID-19 and financial hardship: retail lenders’ obligations and ASIC’s expectations’, 29 April 2020 (updated 9 June 2020), https://asic.gov.au/about-asic/news-centre/news-items/covid-19-and-financial-hardship-retail-lenders-obligations-and-asic-s-expectations/.

[7] APRA, ‘Consultation on treatment of loans impacted by COVID-19’, 13 August 2020, https://www.apra.gov.au/consultation-on-treatment-of-loans-impacted-by-covid-19.

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.