This article is a part of our Remediation Round-Up series which explores potential issues for financial services licensees when conducting remediation and ways to optimise the design of remediation programs.

Issues to consider

- Clarity and transparency is key when communicating with clients.

- Licensees should tailor communication strategies to the client's technical and financial literacy.

- Settlement deeds should balance risk management and the client's rights.

Introduction

Effective communication is key to ensuring that clients can understand the remediation and how it will affect them. It is also integral to ensuring that a remediation program can be implemented effectively, with minimal questions and complaints.

This Chapter covers:

- how client communications should be designed and implemented; and

- how and when licensees can obtain comfort that the misconduct which is the subject of remediation will not lead to any further disputes or claims through the use of settlement

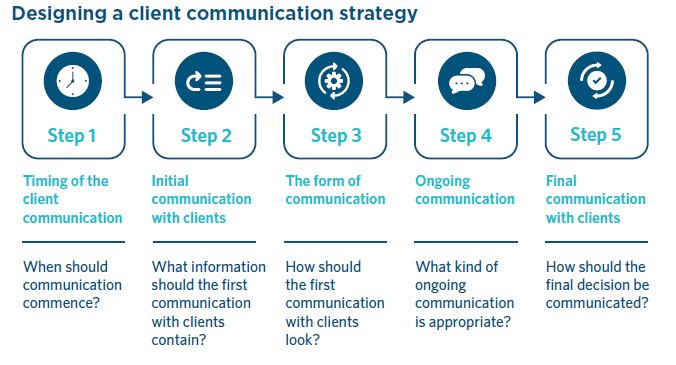

Step 1: Timing of client communication

The timing of client communication will vary depending on the nature of the remediation, its scale and anticipated timeframe.

In particular, the appropriate timing of client communications will differ depending on the nature of the licensee’s client base, the progress of the review and remediation program, the expected timelines for the review and remediation, what is expected of clients at each stage, and the type of misconduct or other compliance failure.

For example, it would be important to ensure that clients are informed as soon as possible if the client is able to mitigate potential losses if they are aware of the misconduct (e.g. in the event of a data breach). Similarly in cases where an “opt-in” remediation approach is adopted, early and regular communication will be important.

A licensee may communicate with clients at the following times (among others):

- at the beginning of a remediation program, to inform the client that they are included in the scope of the review and remediation; or

- after the review has been completed, to inform the client of the financial decision and how the client will be remediated, if applicable.

It will be important that the communication strategy is well planned, and compliant with the licensee’s obligation to notify clients of significant events under section 1017B of the Corporations Act.

Step 2: Initial communication with clients

Where the licensee communicates with clients before a decision is made on whether remediation is appropriate, ASIC recommends that such correspondence is made in writing and contains the following:

Step 3: The form of communication

Outlined below are six fundamental principles that licensees should have regard to when considering the form of communication to be utilised for a remediation program.

- Consider the “first impression” of the correspondence. Clients may not read correspondence that looks dense or complex. Conversely, clients may also not read correspondence that is covered in corporate branding which resembles marketing material. It is important to strike the right balance to ensure that clients understand that the correspondence relates to an important matter which requires their attention without losing their interest.

- Use the appropriate method for communicating. Licensees should consider the client’s circumstances including their technical literacy and age when nominating the appropriate method for communication to ensure that the client has access to the nominated communication channel. In doing so any preferences previously expressed by clients should strongly influence any decision that is made.

- Use the appropriate tone for communicating. Licensees should consider the client’s financial literacy and language skills and where required, ensure that correspondence does not use overly complex jargon. Interpreters and staff who are trained cross-culturally or trained to cater for clients with particular needs (e.g. poor English skills or low financial literacy) may assist. Where appropriate, diagrams and tables should be utilised to illustrate any complex issues.

- Avoid lengthy letters. Instead of lengthy letters that may become difficult to digest, any ancillary information can be moved into supplementary material to accompany the letter, such as a brochure. This will ensure that the letter conveys the key points for the client while still providing all other information.

- Highlight the actions the client is required to take and the key messages. The likelihood of the client taking the required actions will increase where the licensee prominently highlights, at the top of any communication, what the client is required to do. This will also help the remediation program run efficiently and smoothly.

- Where possible, remove uncertainty about the process. If possible, explain what is expected to happen in the future such as how long each remediation step may take and when the client can expect to hear back from the licensee.

Step 4: Ongoing communication

The level of ongoing communication with clients throughout the process will depend on the nature of the remediation program, the progress of the review and remediation against the timeframe initially communicated to clients, the client’s preferences, and the licensee’s existing communication strategies. Licensees should give careful consideration to the best time to contact clients, as sending correspondence too frequently can be costly and also cumbersome for the client. In addition, correspondence should not be sent around certain periods, such as the December/January holiday period.

Clients should at least have an opportunity to obtain updates on the progress of their review. ASIC suggests that this could be done, for example, by:

- providing a direct telephone number or email that the client may contact to obtain this information (e.g. a hotline);

- providing access to a secure electronic facility that includes information on the progress of the review of the client’s file (e.g. an online portal); or

- communicating in a way that is agreed with the client.[1]

Step 5: Final communication with clients

When communicating a decision to a client, licensees should clearly set out in writing:

- what the decision is;

- the reasons for the decision;

- what factors have been taken into account in forming the decision;

- if remediation is offered, its components, how it was calculated and how it will be paid; and if not offered, the reasons why;

- the client’s rights if they are unhappy with the decision (e.g. lodging a dispute with EDR scheme or calling the hotline);

- contact details if the client wishes to discuss the decision further.[2]

The form of communication as considered in Step 3 above should be considered when designing the final communication to clients.

Requesting a response from clients

Sometimes it may be necessary to request a response from clients. For example, the licensee may require the client to provide additional information or communicate their acceptance of an offer of remediation.

At such times, licensees may request that clients respond within a specified timeframe. In doing so, the timeframe should be prominently disclosed, reasonable and flexible, taking into account that clients will require time to consider the letter and collect any information. ASIC recommends that licensees give clients at least 30 days to respond to any requests.[3] Whatever timeframe is provided, clients should not be excluded from the review and remediation or be denied remediation on the basis of not responding within a specified timeframe.[4]

Where a client does not respond, reasonable efforts should be made to contact the client. This may include:

- searching records for alternative contact details; or

- searching publicly available information.

Licensees should also consider what assistance could be provided to clients to generate responses. For example, licensees could provide:

- a checklist of simple tasks that a client is required to complete in order to accept an offer of remediation;

- a slip form that the client can sign and return, along with a return envelope; and

- a hotline that the client can call to ask any questions before providing their response.

Care needs to be exercised if the remediation program is structured to remediate clients only if they opt-in to the program. Regulators may regard this approach as inappropriate, not customer centric and in some cases, may even view an opt-in approach as a breach of certain statutory obligations.

Acceptance of an offer of remediation

Settlement deeds are an important part of the process, particularly from a risk management perspective. However, deeds should only be relevant to the conduct being remediated and should not require the client to waive any other rights they may otherwise have. Further, settlement deeds should not restrict a client’s ability to speak to:

- Commonwealth, state or territory agencies (e.g. ASIC, OAIC);

- AFCA;

- an industry body associated with the licensee; or

- the client’s legal representatives.

Well-drafted settlement deeds are a great tool to settle the liability of the licensee arising out of the original misconduct. Previous AFCA decisions demonstrate that it will not intervene in a complaint with a pre-existing settlement agreement, as long as the licensee complied with its obligations under the settlement agreement.[5]

Licensees can also consider offering assistance to clients who wish to seek their own professional advice about the licensee’s offer of settlement. Such assistance could come in various forms, such as offering:

- to reimburse the client (e.g. up to a limit of $5,000) for professional advice sought by the client (e.g. advice sought from a lawyer, accountant or financial adviser); or

- the service of a group of professionals independent of the licensee’s business to provide advice to the client, free of charge.

ASIC has stated that an offer of assistance is appropriate where, given the nature of the remediation offer (e.g. its relative size compared to the client’s overall wealth or the complexity of the underlying issues) the client might reasonably want to test the offer but may not have the resources to do so.[6]

[1] RG 256.184.

[2] RG 256.184.

[3] RG 256.188.

[4] RG 256.190.

[5] See, for example, AFCA Determination case number 669093.

[6] RG 256.198.

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.