This article is a part of our Remediation Round-Up series which explores potential issues for financial services licensees when conducting remediation and ways to optimise the design of remediation programs.

Issues to consider

- Does the remediation team have immediate access to advisors who can provide input on each stage of the remediation process, if an urgent problem or question arises?

- Which aspects of a remediation program could pose the greatest risks to the business, which may benefit from independent assurance?

- Which aspects of a remediation program are most likely to give rise to conflicts of interest if handled by internal staff?

Commentary

Historically, ASIC has favoured the use of independent experts to provide input on remediation by financial services licensees. RG 256 states:

In some situations, it may be appropriate for a firm or person external to your business and any related entities, who has expertise in overseeing review and remediation, to be engaged to provide assurance about the governance, design and operation of your review and remediation.

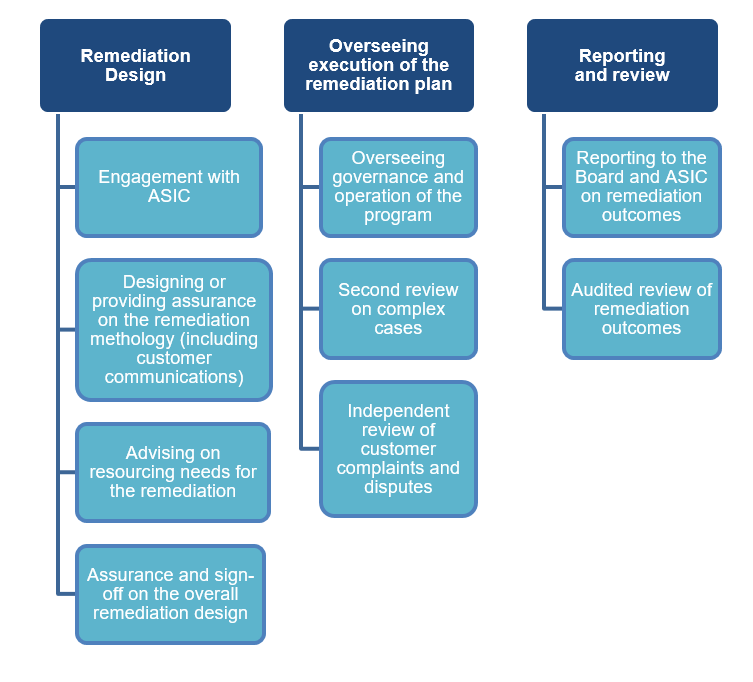

An independent expert can be used for only limited purposes, or to assist with nearly any aspect of a remediation program, including:

ASIC has stated that it is more likely to consider the engagement of an independent expert to be appropriate where a remediation is complex, likely to involve public reporting, or in situations where the licensee may have more limited experience or independent staff to assist with the remediation.

However, an independent expert can provide input on complicated issues that frequently arise throughout a remediation process, such as:

- Remediation design – whether the compensation amount will be sufficient to meet potential future claims, and is likely to meet regulator expectations;

- Customer communication – whether the communication presents an accurate view of the licensee’s legal position; and

- Post-remediation conduct – whether changes to business practices will be sufficient to meet regulatory obligations.

An independent legal expert can be particularly valuable to provide an independent sign-off on:

- controls to address the issues that gave rise to the remediation;

- the proposed formula for identifying customers within the scope of the remediation;

- the proposed formula for calculating the quantum of compensation to each relevant customer;

- the content of customer communications;

- a regulatory engagement strategy; or

- dealing with intra-group, related party transactions in order to demonstrate adequate dealing with conflicts or potential conflicts of interests.

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.