This article is a part of our Remediation Round-Up series which explores potential issues for financial services licensees when conducting remediation and ways to optimise the design of remediation programs.

Introduction

Financial advice has been a very significant area for financial services remediation in Australia in recent years. ‘Financial advice remediation’ is a broad term which covers a wide range of potential issues. In this chapter we cover issues with inappropriate advice, which is an ongoing source of remediation issues for financial advice. Inappropriate advice covers situations such as when:

- the advice didn’t match the client’s instructions;

- the advice wasn’t within the client’s risk profile; or

- the person who provided the advice wasn’t qualified to provide it.

In this chapter we set out how financial advice remediation for inappropriate advice works in practice, and discuss a number of issues with remediation programs we have encountered which are unique to this area, and how to resolve these issues.

Of course, remediation exercises for lack of provision of advice have also been very pertinent and have raised thorny issues in the context of scenarios where it is not clear whether financial advice was provided due to lack of relevant “evidence of service”. This is a classic example of where a licensee may have provided compensation beyond its strict legal obligation, often at the behest of ASIC.

How to remediate inappropriate financial advice

When approaching a financial advice remediation, RG 256 states that the basis for any remediation is the loss or detriment suffered by the customer. This is the end goal to keep in mind, but when developing a financial advice remediation, the initial detriment at least will always be receiving inappropriate advice.

The next step is to identify the consequential effect or loss to the client as a consequence of receiving inappropriate advice. This may appear obvious but is an important distinction, as a number of resulting client impacts may not come about as consequence from receiving inappropriate advice.

| Case study – investment losses not a consequence of the inappropriate advice

If the only defect with the advice was a minor disclosure issue with the advice document, this can hardly be said to have caused the investment loss. For example, if a statement of advice omits the provider’s AFSL number. |

To quantify the appropriate loss or detriment suffered, the typical approach in an advice remediation is to construct the counterfactual. By this we mean ‘what would the client’s circumstances have been if the advice provided had been appropriate’. Comparing the client’s way to identify counterfactual is a useful way to identify the loss or detriment suffered by the customer as a result of the inappropriate advice.

| Case study – establishing a counterfactual scenario to identify loss

A client received inappropriate advice which recommended they invest in a high growth, high risk portfolio, and this was outside of their risk tolerance. The counterfactual will identify what would have been a typical portfolio within their risk tolerance. If a typical portfolio would have been a balanced growth, medium risk portfolio, the detriment suffered by the client is the difference in investment earnings between the two portfolios. In this example the client may not have suffered any financial loss and may have increased investment earnings. The detriment however is that their present day asset allocation is inappropriate for their risk profile. |

Practical considerations

Remediating inappropriate financial advice holistically can be challenging. Many advice licensees have dedicated significant resources to resolving customer loss and detriment.

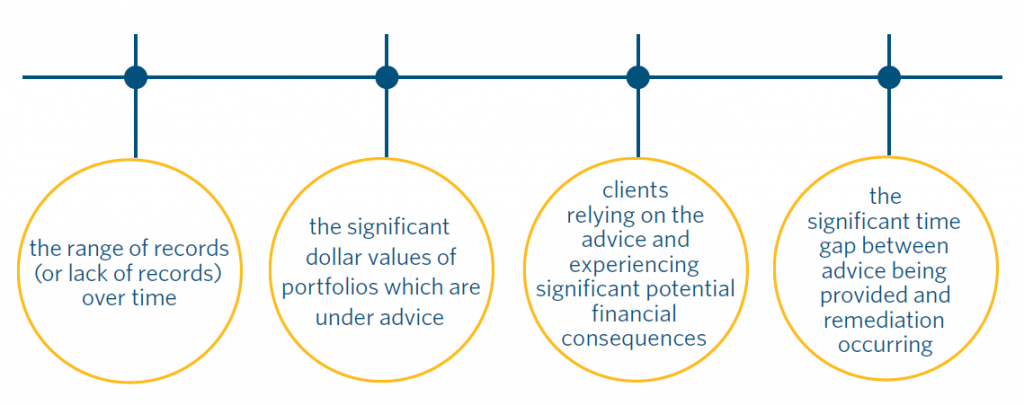

Some of the reasons why financial advice remediation can be so challenging include:

Some of these key factors, and other issues which play into remediating financial advice, are worked through in more detail below.

Remediating general advice

The majority of financial advice remediation, and ASIC’s own guidance, focuses on personal advice. But general advice can also require remediation and has its own considerations.

Personal advice typically requires remediation as it must necessarily refer to the client’s objectives, financial situation and needs the advice (and may in practice get these wrong). General advice is non-specific, aimed at a wider audience, making it more difficult to make errors.

General advice can require remediation when there are factual inconsistencies or inaccuracies in the advice (for example, general advice about a product where the wrong product features are described). General advice can also be problematic where the persons providing it are not qualified to do so. For example, call centre employees might inadvertently provide personal advice, without appropriate training.

Remediation for general advice typically warrants a general response. This can be in the form of mass letters and mail outs, informing customers of the issue, and inviting them to engage with the provider if they have further questions. Constructing a counterfactual is challenging for general advice as the provider will necessarily not know the circumstances of the person receiving the general advice.

ASIC cautions against the use of ‘opt-in’ remediation in RG 256, however, RG 256 only applies to personal advice. In certain general advice scenarios where inappropriate advice was provided and it is not clear how any client may have suffered loss, there are arguments as to why opt-in remediation may be appropriate.

Delays and documentation

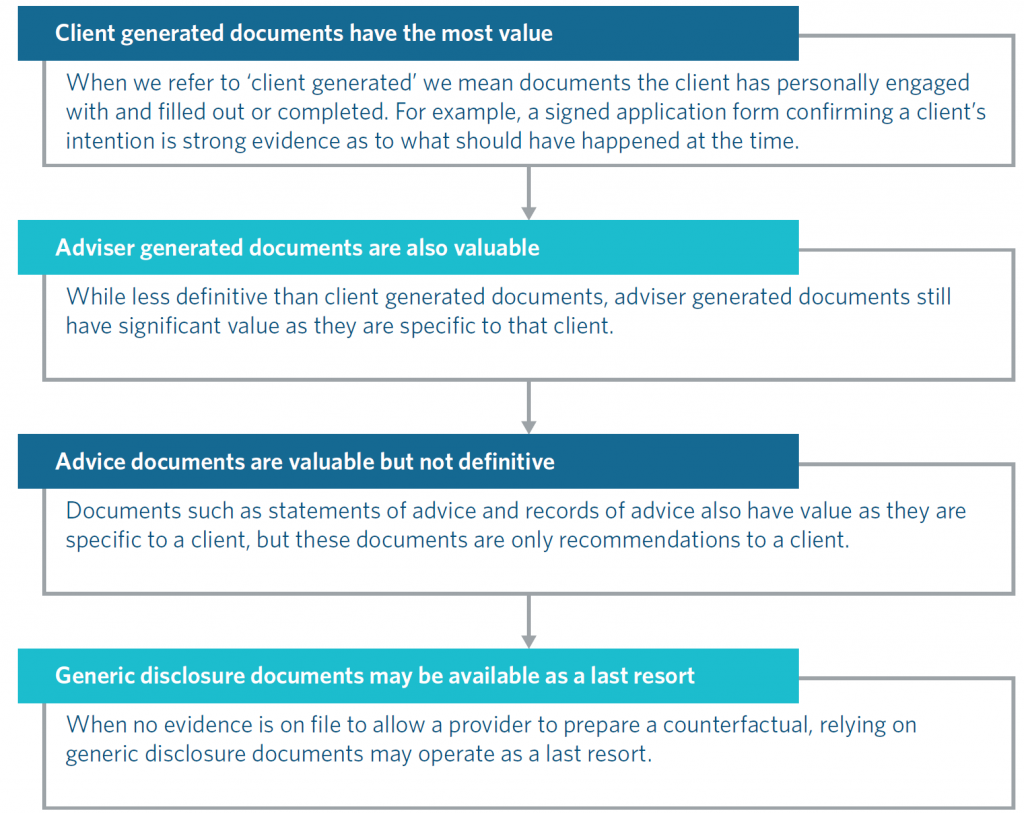

Constructing a counterfactual becomes increasingly difficult over time. The licensee will need to rely on the available documentary evidence determined what the appropriate advice would have been as all memories of the time have faded. A range of documentary evidence is normally available, as shown below:

Disclosure issues

The Corporations Act places strict disclosure requirements on advice. In some situations, it might not beclear that a client has suffered any loss, but there may still be a technical breach of the Corporations Act (e.g. breach of an obligation to disclose certain fees in dollar amounts instead of percentages).

Where disclosure issues are present, the key issue is whether the client is still able to understand and agree to implement the advice, but for the technical disclosure breach.

Remedies

This chapter has covered when remediation is required, and what kinds of issues may require remediation. Putting it in to practice however comes down to the essential question of what a provider needs to do to fix a client’s loss or detriment.

As mentioned, advice remediation is often technical and fact specific, with significant time gaps, and a range of potential remedies. The two main types of remedies are set out below.

This is the most obvious remedy and it can generate the most visibility and media attention. Compensation is often required when a customer has suffered financial loss, but quantifying that loss can often be challenging. It is difficult to place a monetary value on the loss suffered where the client received inadequate disclosure of the advice fees they were being charged, and lost the opportunity to be aware of the fees charged, to potentially switch to a cheaper provider, but issues like this can arise in practice. Whether interest should be paid is obviously a key question.

This can take a number of different forms. It could involve providing the client with updated advice, so that a provider can be confident that the updated advice is not defective. If a client received inappropriate advice at the time, but has become comfortable relying on that advice over time, the client may choose to retain the original advice received, and rectification could simply involve a confirmation they want to retain the (originally) inappropriate advice.

Issues to consider

- Do you have enough information about a client to construct a counterfactual?

- What documents will you rely on to create a counterfactual? If the documents in a client’s file contradict each other, which document has priority?

- Most ASIC guidance and material is focussed on personal advice remediation. Is your remediation program separate to personal advice, which means that RG256 may not apply or may partially apply?

- What is the appropriate remedy? Monetary compensation might not be enough. Does the client also need to receive updated advice as well?

Key takeaways

|

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.