This article is a part of our Remediation Round-Up series which explores potential issues for financial services licensees when conducting remediation and ways to optimise the design of remediation programs.

Key points

- ASIC is expected to obtain a joint mandate with APRA to regulate the operation of superannuation funds. Once this mandate is introduced, we expect ASIC to take an active interest in ensuring that superannuation members are remediated appropriately for any losses related to the operation of superannuation funds.

- Issues with fund administration, investment management, insurance in superannuation, and financial advice in relation to superannuation can all give rise to expectations on trustees to remediate members. Trustees can also be liable to remediate members due to a failure by an outsourced service provider that leads to member detriment.

- The design of a remediation program for superannuation fund members will often give rise to a myriad of complex legal issues, due to the interplay of the SIS Act, Corporations Act, trust law and contract.

Potential triggers for remediation

Trustees should consider whether a remediation is necessary if there is:

- a contravention of contract law, trust law, the SIS Act, Corporations Act (or ASIC Act) that may have an adverse effect on members or their benefits; or

- an error in administering any aspect of the fund, including fund assets.

The table below sets out some examples of situations that can give rise to an expectation on a trustee to remediate members.

| Category | Examples of conduct that can create a risk that customers may need to be remediated |

| Sale and distribution of superannuation products |

|

| Member administration |

|

| Investment management |

|

| Financial advice on superannuation |

|

| Insurance in superannuation |

|

| Other triggers |

|

Importantly, not all losses will amount to a breach of a trustee’s duties and a corresponding need a need to remediate affected members to rectify a contravention of that covenant. Justice Jagot, in a recent case, observed that:

“a trustee’s duty does not amount to a duty to avoid all loss and that an ordinary prudent person (and for that matter prudent superannuation trustee) can commit errors of judgement without being liable”.[1]

There are also situations where AFCA or ASIC may expect members to be compensated even where no fiduciary or statutory breach has occurred. For example, AFCA can, subject to some limitations, make a determination to vary a trustee’s decision if AFCA is satisfied that a decision or conduct by an entity such as the trustee was unfair or unreasonable.

For each issue, the need to remediate members, and the appropriate amount of compensation for each affected member, should be considered on a case-by-case basis.

Among other sources, the legal basis for remediation by a superannuation trustee can often be traced to:

- section 55 of the SIS Act, which enables members to make a claim for compensation if they have suffered loss or damage as a result of the trustee breaching a statutory covenant;

- a member’s entitlement to equitable compensation for a breach of an equitable obligation by the trustee, which could extend to an obligation to disgorge profits from the breach; and

- contraventions of the Corporations Act or ASIC Act.

Where a superannuation member suffers loss as a result of conduct by a person who is not the trustee, such as an external investment manager, a member may still have a claim to the extent that trustees remain ultimately accountable to members for their interest in the fund.

Despite this, relatively complex questions can still arise around which entities can be held to account for compensation to members, including:

- Trustee directors

- Employer-sponsors

- Insurers

- Outsourced service providers

- Product distributors

- Members

The future state of superannuation trustee regulation

In 2019, the Royal Commission recommended that ASIC should be given a mandate to regulate the operation of superannuation funds as a conduct and disclosure regulator, with a focus on the relationship between RSE licensee and individual consumers.

In response, on 12 November 2020 the Government tabled the Financial Sector Reform (Hayne Royal Commission Response) Bill 2020, which proposes to enact the following changes:

| NOW | AFTER |

| Under the SIS Act, ASIC is responsible mainly for administering provisions relating to disclosure and the record keeping. | ASIC will also administer, in conjunction with APRA, penalty provisions and provisions that broadly relate to member protections in the SIS Act |

| Superannuation trustees are regulated by ASIC under the Corporations Act, but only in relation to ‘dealing’ in superannuation interests or providing financial product advice. | ASIC will also regulate the operation of registrable superannuation funds as a ‘financial service’ under Chapter 7 of the Corporations Act. |

This change and the Royal Commission reforms more broadly will significantly impact the regulation of superannuation trustees and regulator expectations around appropriate remediation for members.

In addition to the existing best interests duty, trustees will be required to operate funds in accordance with the general Australian financial services licensee obligations in section 912A of the Corporations Act, including the obligation to act ‘efficiently, honestly and fairly’, and will be expected remediate members consistently with ASIC’s interpretation of those obligations. This will extend the ambit of these obligations beyond the dealing in the superannuation interest to the more administrative aspects of operating the superannuation interest.

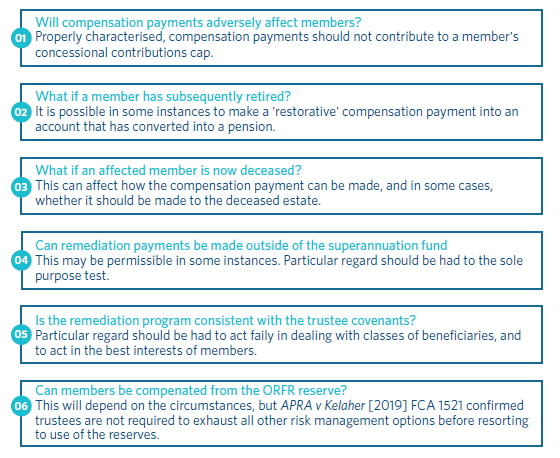

Common issues on remediation design

Remediation programs for superannuation frequently raise a number of complex legal questions. Our answers to a few common questions are set out below:

On 10 April 2019, APRA and ASIC issued an open letter to RSE licensees on fees that have been deducted from member accounts. APRA and ASIC have stated that where fees have been deducted inappropriately:

"the trustee should look to recover fees paid to financial advisers and make whole members’ accounts within the superannuation system using agreed remediation methodologies."

Although the question of whether remediation payments can be made outside the superannuation system is (with respect) more complex this, the letter is emblematic of APRA and ASIC’s broader position that trustees must actively make good detriments to members that are caused by a breach of trustee duties.

From our experience, APRA and ASIC’s position in this regard is not limited to remediation for fees charged to member accounts, and extends to any other issue that may give rise to a need to remediate members. It is likely to be regarded as insufficient from a regulator’s perspective for trustees to take a passive approach by not pursuing or providing compensation for members where a breach has occurred.

Issues to consider

|

[1] APRA v Kelaher [2019] FCA 1521, at [39].

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.