Between November 2019 and January 2020, we conducted a survey of trust companies. We asked trust companies of different sizes, from a variety of onshore and offshore jurisdictions, with different ownership structures, questions about the most significant risk and compliance issues they face. The survey comprised 18 questions, with a randomised order of possible answers wherever this was feasible to increase the integrity of the responses.

The one thing we did not ask people was the risks posed by major public health incidents. Coronavirus disease (COVID-19) is now the biggest threat to countless businesses around the world. I am typing this from home because my firm’s London office is closed (like many others around the world). I am looking out onto the street and seeing people taking detours onto the road to maintain the requisite 2m distance from oncoming pedestrians. My children are learning via Google Classroom because their school is closed and they are only allowed out of the house once a day. Health service workers are heroically looking after the large numbers of people affected. I am acutely conscious that the effects on me and my family are incredibly modest compared to many around the world. It feels like the archetypal Black Swan i.e. those life changing outliers which seemingly almost no-one saw coming. In his book, Nassim Nicholas Taleb warned us of the hubris of predictions. Some may note that the UK’s National Risk Register 2017 (the last one I could find) warned of the possibility of a pandemic with wide ranging health and economic impacts, but the extent of the lockdowns around the world seems to have been unanticipated.

Does this all render our survey and its results irrelevant? Null and void? I don’t think so. The ramifications of this will be felt for some time and may well change some of the ways that we work, but even now – seemingly quite early in this crisis – various businesses across the globe (by no means all of course) are putting in place their business continuity plans and finding ways of carrying on.

I have contacted a number of people at trust companies over the last few days and weeks and the consistent message has been that things are busy. They may not be able to travel the world, but their business life is adapting and going on. The themes of the survey remain as relevant as ever, as one commented: “Regulatory change has not stopped”. Given the predicted length of the impact of the virus, some things have to continue to the extent they can – all aspects of life and business cannot simply go on hold.

So without in any way wishing to downplay the significance of current events and their devastating impact on so many, here is the introduction to our survey.

The respondents

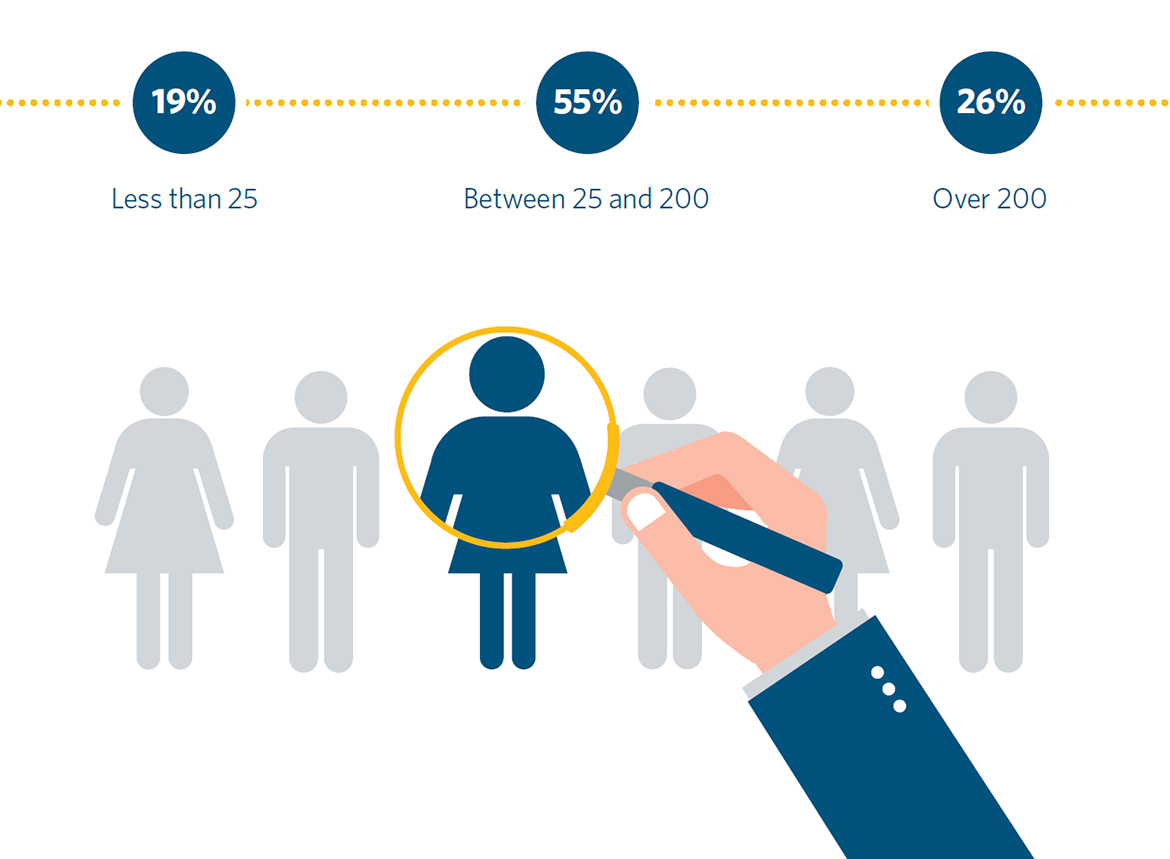

Around a quarter of the total number of responses we received were from smaller trust businesses (i.e. fewer than 25 employees), and a similar proportion from large entities (i.e. over 200 employees). The majority of respondents were medium-sized trust companies, with 25-200 employees.

HOW MANY EMPLOYEES DO YOU HAVE IN YOUR FIDUCIARY BUSINESS?

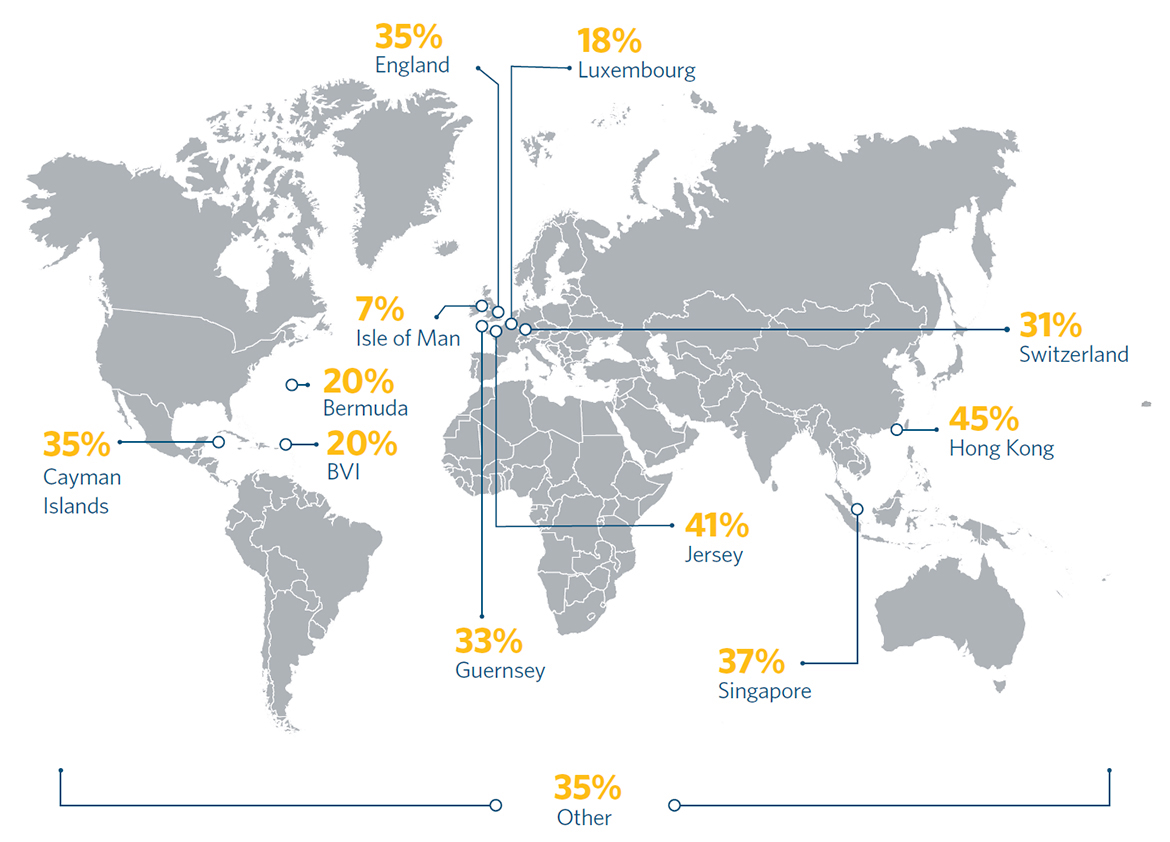

In terms of jurisdictional spread, the respondent entities operate in all major International Financial Centres, such as Bermuda, British Virgin Islands, the Cayman Islands, Guernsey, Isle of Man, and Jersey, as well as some of the major onshore trust jurisdictions, including England and Wales, Hong Kong, Singapore, Switzerland, and Luxembourg.

WHICH JURISDICTION(S) DO YOU OPERATE IN?*

*respondents were able to choose more than one jurisdiction

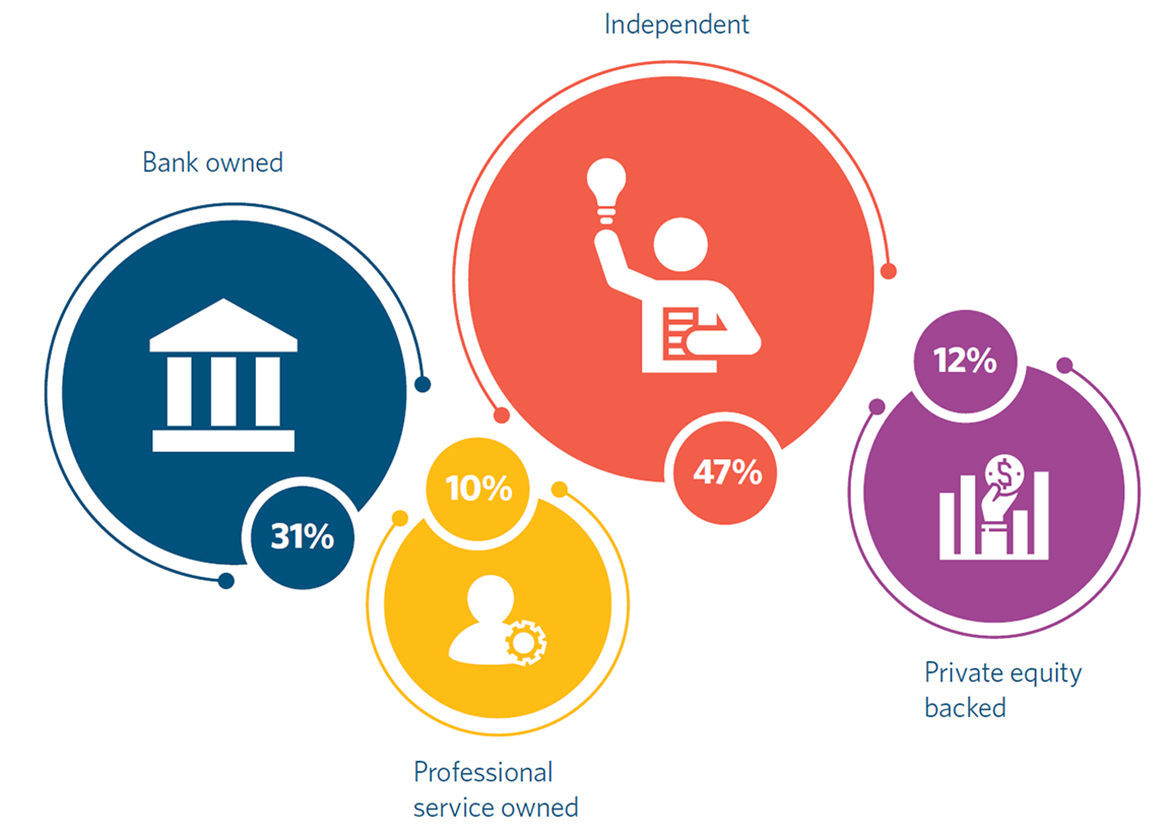

The survey also covered a wide range of trust company ownership structures. Around 10% of the respondent businesses are owned by professional services firms and around the same proportion are private equity backed. Around 30% are bank owned, and just under 50% are independent.

WHAT IS YOUR OWNERSHIP STRUCTURE?

Specific topics covered

Over the coming weeks, we will be releasing the results of our survey and counting down from seven to one the top risks trust companies face. In broad terms, our forthcoming publications will cover the following topics (listed in alphabetical order, so as not to give anything away), and will identify how significant a risk each of these is perceived to be by trust professionals:

- Anti-Money Laundering (AML): We will discuss and analyse the most significant AML compliance challenges for trustees; how AML compliance issues have affected trust company businesses in the last year; how helpful (or otherwise) the trustees find the new guidance and more prescriptive Know your Customer (KYC) requirements.

- Beneficiary disputes: Our survey reveals the most common sources of beneficiary disputes (i.e. disputes brought by beneficiaries against trustees) that trust companies encounter. We will also consider the measures trustees might be able to take to minimise any adverse consequences from such disputes.

- Cybersecurity: Our analysis will cover what the main cybersecurity risks faced by trustees are; the types of cyberattacks trust companies tend to suffer in practice; and what trust companies are currently doing, and what they could be doing to tackle the cybersecurity risks they face.

- Data protection: We have investigated what trust companies find the most challenging about privacy compliance, and will provide practical guidance on managing the most difficult aspects.

- Regulatory compliance: We have mapped the most significant regulatory challenges faced by trust companies, as well as trust companies’ views on whether regulatory intervention in their business is inevitable.

- Reputational risks: We will discuss the reputational risks for trust company clients arising out of being associated with “offshore” structures and jurisdictions.

- Tax compliance: Our publications will cover what trust companies identified as the most burdensome tax compliance issues and the most helpful solutions for handling tax compliance within trust company businesses.

Over the next few of weeks you will receive market leading and thought provoking content which will be equally helpful for (a) trust companies trying to navigate the increasingly complex and regulated risk and compliance landscape, and (b) others operating in the private wealth and trusts industries, with insights into the major issues trust companies are facing.

We are excited to embark on this journey, and look forward to sharing our insights along the way.

Read more in this series

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.