In our penultimate article in our countdown of the most significant risk and compliance issues faced by trust companies, anti-money laundering (AML) is considered the second most significant challenge.

Background

Money laundering and terrorist financing risk has been a key area of focus for regulators across the globe for some years – and this trend is only likely to continue. Exposés such as the ‘Panama Papers’ and ‘Paradise Papers’ have, rightly or wrongly, put offshore wealth in the cross-hairs of regulatory, NGO and law enforcement scrutiny, and the ‘laundromat’ scandals have drawn attention to the need for closer supervision in some jurisdictions and more joined-up cross-border regulatory cooperation.

Trust companies have been at the centre of many recent developments in this space, including the continued push for greater transparency of company and trust beneficial ownership. Under the EU’s Fourth Money Laundering Directive (“4MLD”), for example, regulated entities (which include trust and company service providers (“TCSPs”)) came under an obligation to report beneficial ownership information regarding certain taxable trusts, to be stored on national trust ownership registers accessible by certain public authorities. This obligation was significantly expanded under the Fifth Money Laundering Directive (“5MLD”), which broadened the type of trusts required to report beneficial ownership information, and extended the range of persons who may access it – a development which will be of particular importance in affected common law countries, such as the UK, Cyprus and Ireland. 5MLD also imposes an obligation on regulated entities to report discrepancies between beneficial ownership information they obtain during Know Your Client (KYC) processes and the information stored on the relevant national register.

Many other jurisdictions intend to – or are being encouraged to – adopt additional transparency measures. The UK Crown Dependencies of Jersey, Guernsey and the Isle of Man, for example, have recently announced their intention to provide, within the next couple of years, public access to their corporate ownership registers.

Given this context, it is unsurprising that AML ranked within the top three issues faced by trust companies for over 75 percent of our survey respondents.

The most significant AML compliance challenges for trustees

In order to understand the areas in which trust companies perceive the greatest AML-related challenges to their business, we asked two questions: ‘What are the most significant AML compliance challenges for trustees?’ and ‘How has AML compliance most affected your business over the past 12 months?’.

Our respondents reported that the most significant AML-related challenges they faced were as follows:

What are the most significant AML compliance challenges for trustees?

*respondents were able to choose more than one option

This is relatively unsurprising – despite the fact that obtaining an understanding of the source of funds and source of wealth of clients is a key means of mitigating the risk of money laundering, it is an area in which, in many countries, there continues to be limited practical guidance on the verification measures that should be taken. It is one thing for guidance to assert that a client’s source of wealth should be understood, but another to clarify when and how, in practice, it should be verified.

It is however interesting to note that, in a context where complex ownership structures are to be expected, 24% of firms found it challenging to verify such structures. Perhaps respondents had in mind the difficulty in understanding or verifying the rationale for such structures; this is often a more difficult task in the context of private wealth, where legitimate rationales such as tax planning and privacy can sometimes be difficult to distinguish from the more nefarious reasons why clients might wish to use a vehicle with complex and obscure ownership features.

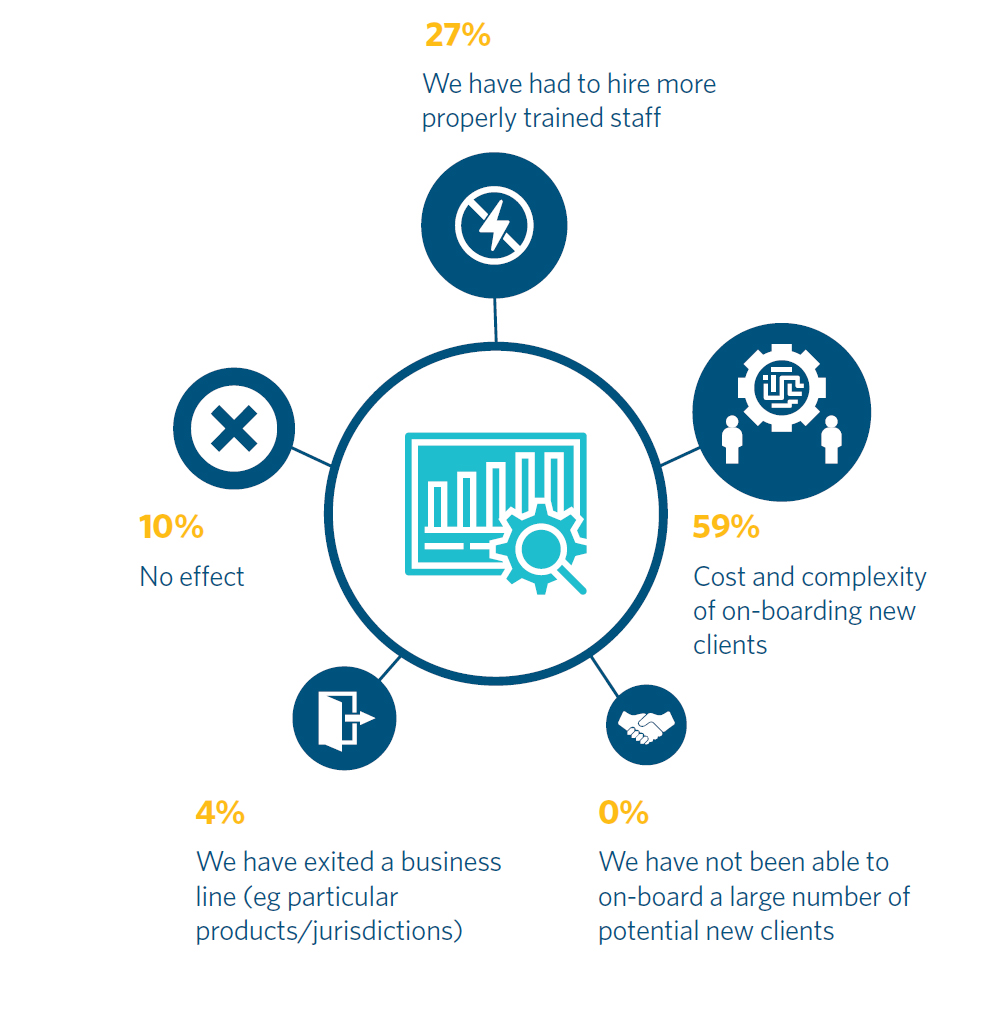

In relation to the area of respondents’ businesses that have been most affected by AML compliance measures:

How has AML compliance most affected your business over the past 12 months?

Measures to address AML risk

The fact that trust companies are facing challenges with respect to AML compliance generally, and that a majority of respondents have been impacted by the cost and complexity of on-boarding new clients, raises the question of what further steps regulators could take that may be helpful for trust companies.

We asked respondents whether more guidance and/or more prescriptive requirements in relation to KYC measures would be helpful for trust companies. In recent years there has been a continued trend towards a risk-based approach to AML compliance; this of course has many benefits, but poses its own challenges in terms of clarity for firms as to their obligations; particularly smaller firms whose compliance resources are more limited, so we asked about this specifically. In response to this question:

Would more guidance and/or more prescriptive requirements on KYC be:

The survey respondents operate across numerous jurisdictions, so these responses may reflect a level of dissatisfaction with the guidance or requirements of particular AML regimes. Nevertheless, the very mixed view is interesting. Perhaps the answer would be additional practical but non-binding guidance – including, for instance, good and best practice examples for firms of varying risk profiles – certainly, it seems that clearer requirements alone are unlikely to provide the solution, but that the current position is also unsatisfactory.

Views on beneficial ownership register obligations

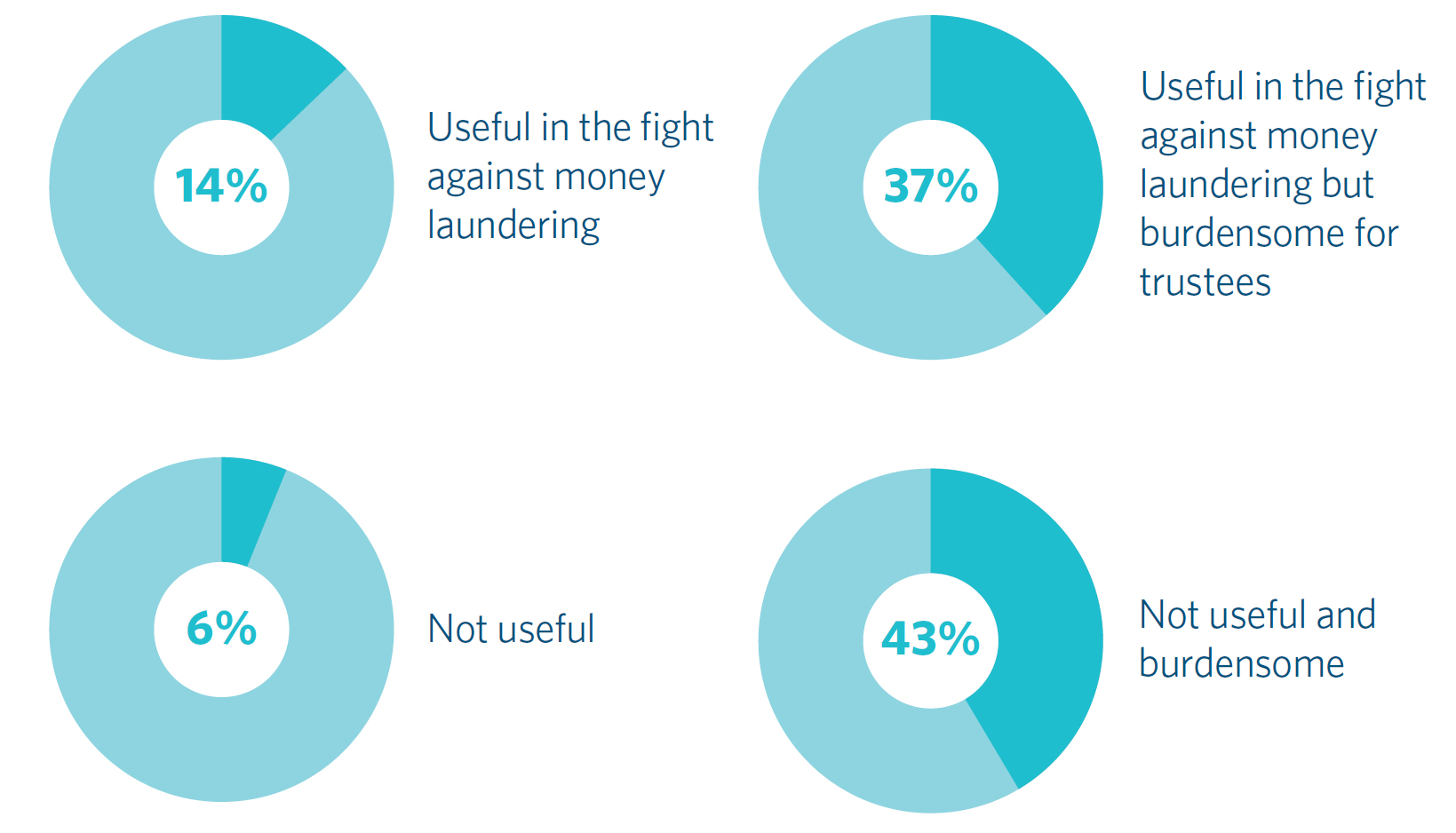

As mentioned above, the EU under 4MLD and 5MLD has imposed additional requirements on trust companies in an attempt to address a perceived area of greater AML risk. We asked respondents for their views about the potential impact of these obligations:

Do you think the introduction/enhancement of requirements on trustees relating to reporting information to beneficial ownership registers (for example, the challenges that will be implemented in the EU under 5MLD) will be:

It is apparent that the industry is fairly evenly divided on the potential utility of these measures in the fight against money laundering, but a large majority agree that they will be burdensome.

Of course, even if these measures have the potential to be useful, much depends on the steps relevant authorities take to investigate any information reported pursuant to these new obligations, and the impact of 5MLD is still largely unknown given that EU member states are at various stages of implementation. It is to be hoped that an evidence base regarding the impact of the new requirements is developed in due course, which other countries could weigh in the balance when considering whether to impose similar measures, given their significant compliance burden.

We also provided an opportunity for respondents to share any further views they may have on the subject-matter of the survey. One respondent expressed the view that many third party firms, when dealing with trust companies based in comparable AML jurisdictions, are unwilling to rely on the customer due diligence (“CDD”) / KYC measures already undertaken.

In the UK, there are several reasons why firms may be reluctant to use the ‘reliance’ provisions under MLR 2017. First, seeking to rely upon the suitability of ‘third country’ AML regimes (i.e. those outside of the EEA, which would be the category assigned to most of the jurisdictions in which our respondents operate) requires a degree of analysis as to the equivalence of AML standards. Given there is no EU ‘white list’ of equivalent regimes, this analysis (which is rarely a straightforward one) typically falls on the relying party. Second, local practices or regulations (for example, confidentiality or data protection laws) might prevent the exchange of CDD information that is required by the provision. Third, as the relying firm remains liable for any failure by the counterparty to comply with the CDD/KYC measures, this is a risk that many firms are only willing to assume after reviewing and assessing the suitability of the counterparty’s AML procedures, which can also be a time-consuming and costly exercise and so it is often only undertaken where there is a clear commercial rationale for doing so.

Listen to our accompanying podcast below

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.