Debbie Standring

Consultant

Consultant

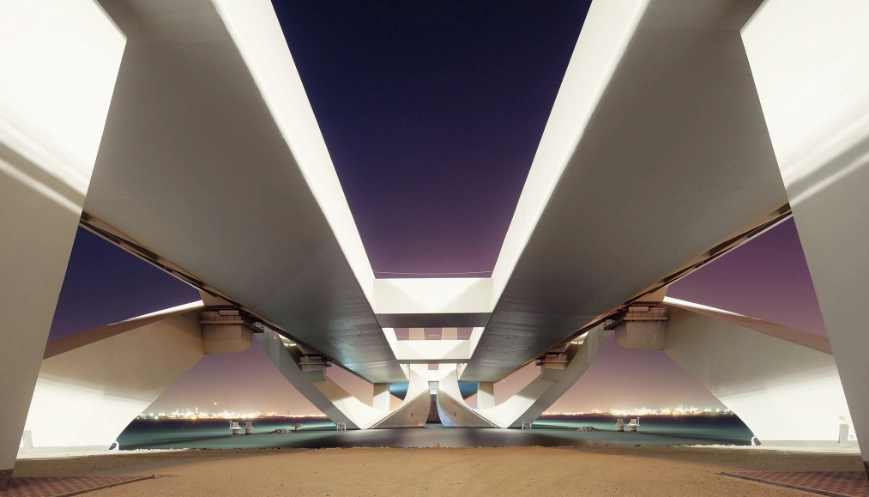

Dubai

Debbie is an Of Counsel in Herbert Smith Freehills Finance division.

Debbie specialises in corporate recovery/insolvency and property finance transactions.

She has particular experience of administrations and company voluntary arrangements, schemes of arrangement and general advice to insolvency practitioners.

Background

Debbie is a member of the Chartered Institute of Management Accountants (CIMA).

Experience & expertise

Selected matters

- Ernst & Young in relation to the administration of the Nortel EMEA business, including the global settlement and the subsequent pan-European CVAs

-

the co-ordinating committee of senior lenders to EnQuest on the market leading 2016 restructuring implemented by way of a scheme of arrangement

-

CPP Plc in connection with its Financial Conduct Authority approved scheme of arrangement to settle potential liability to 7 million customers in relation to the mis-selling of insurance and identity protection products

-

hibu on its complex 2013 financial restructuring implemented by way of a cross-border scheme of arrangement and its £4 billion debt restructuring in 2009

-

Bank of Scotland in relation to various aspects of the Crest Nicholson and McCarthy & Stone restructurings

-

various real estate lenders in relation to ongoing real estate finance insolvencies and restructurings

-

PricewaterhouseCoopers, the joint provisional liquidators of Independent Insurance Company Limited

-

The Futures Representative in the asbestos bankruptcy of the Federal Mogul group of companies

-

Ernst & Young in relation to the administration of the TXU Group of companies

-

Transport for London and London Underground in relation to the PPP administration of Metronet

-

Mezzanine Capital Noteholders in connection with the receivership of Cheyne Finance Plc a SIV incorporated in Ireland

-

Findus Group in connection with the restructuring of its senior and mezzanine debt

-

National Australian Bank and Commonwealth Bank of Australia on the restructuring of Healthcare Locum plc involving the raising of £64.25 million of new equity (facilitating a significant pay down of the existing senior debt) and conversion of £30 million of mezzanine debt into zero coupon loan notes and equity

-

Lloyds Banking Group and Deloitte on all aspects of the insolvency of the Thornfield group