Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

ASIC has recently released a report (Report 423: ASIC regulation of corporate finance: July to December 2014) which sets out its recent regulatory activities and developments, and the concerns it has had, in corporate transactions including takeover bids, schemes of arrangement and shareholder approvals under item 7 of s611 of the Corporations Act 2001 (Cth) (Corporations Act). The report reveals a number of interesting developments. Some of those developments are outlined below.

Shareholders are able to approve increases in voting power above the 20% threshold under item 7 of s611 of the Corporations Act. There is no requirement to provide a draft copy of a relevant explanatory memorandum to ASIC for its review before its despatch to shareholders; although ASIC does encourage companies to do this voluntarily. In its report, ASIC has observed a 'substantial increase' in companies doing this voluntarily.

ASIC has noted that it is encountering a number of 'novel transaction structures' which technically fall within the exceptions to the 20% rule, but give rise to concerns as to whether they meet the underlying policy objectives of Chapter 6 of the Corporations Act. In this regard, ASIC indicates in the report that it will continue to closely monitor:

ASIC has again raised concerns with the quality of independent experts’ reports, in particular, regarding the quality of reports and the experience of experts. ASIC has noted that its concerns have most commonly arisen in reports prepared at lower price points and that its concerns have resulted in transaction delays and additional costs associated with engaging new experts.

ASIC says it has observed a new feature in some control transactions involving substantial shareholders being given veto rights over matters which would normally be within the domain of the board (for example, veto rights over significant strategic and operational decisions). ASIC has expressed concerns that such rights can, among other things:

ASIC says it will closely scrutinise deals where veto rights are included in an agreement between a company and a substantial shareholder in a way that is contrary to the policy objectives of Chapter 6. ASIC has also flagged that obtaining shareholder approval for such rights may not necessarily allay its concerns.

ASIC has reminded market participants that it is prepared to refer matters to its enforcement team when it considers further action is necessary. ASIC cited the following three examples:

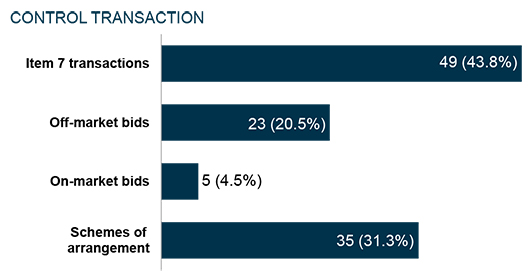

ASIC provided some interesting historical statistics on the use of takeovers and schemes over the period from the 2006 financial year to 31 December 2014. Those statistics are graphically demonstrated below.

Source: ASIC Report 423: ASIC regulation of corporate finance: July to December 2014, p40.

Note: in relation to the 2014-15 scheme booklets, ASIC’s figures show 66 scheme booklets were lodged during this period. However, ASIC said this figure was distorted by 4 restructure schemes with multiple entities. ASIC indicated that, after removing the effect of the distorting transactions, in the first half of 2014-15 there were 18 scheme booklets lodged with ASIC.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs