Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

The Herbert Smith Freehills 2016 Australian Public M&A Report was released on 10 November 2016. The Report examines the 50 public takeovers and schemes involving ASX-listed targets that were announced in FY16.

Now in its eighth year, the Report gives readers a detailed insight into how market conditions have evolved in recent years and provides an indication of where M&A activity may be heading in years to come.

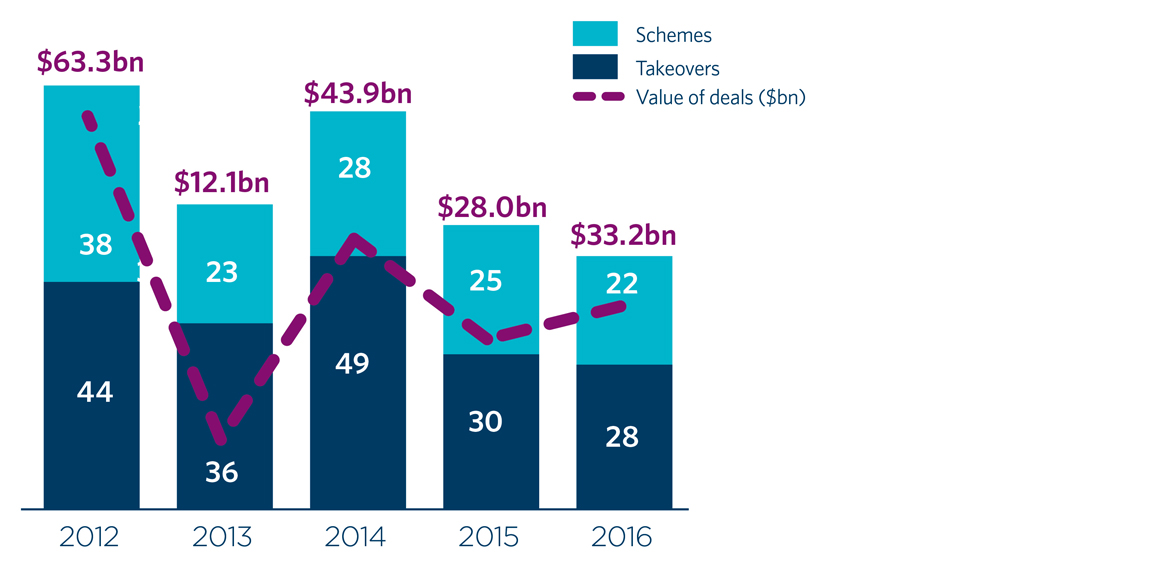

There were 50 deals announced in FY16, down from 55 deals announced in FY15. This contraction of public M&A activity is consistent with a significant reduction in deal volume experienced over the last 4 years. However, despite the lower numbers of deals, at $33.2 billion total deal value was higher than FY15 (largely due to the competing Brookfield and Qube proposals for Asciano, which alone contributed approximately $18 billion).

The Report’s key findings include the following:

Some of the Report’s findings relating to competition in FY16 and hostile deals are explored in more detail below:

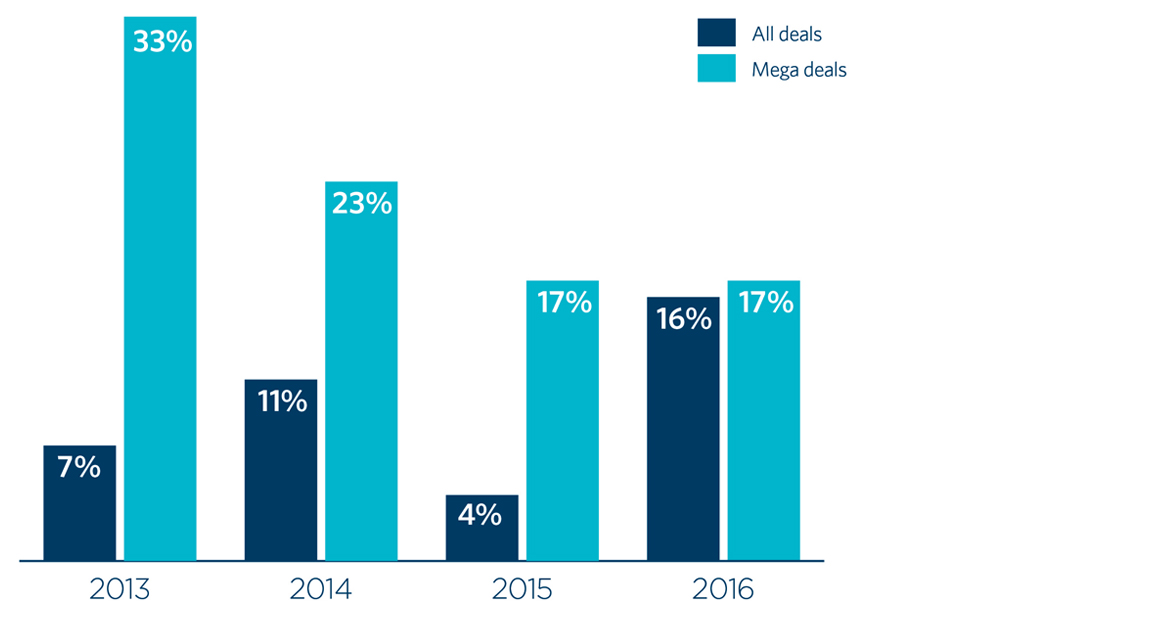

FY16 was a competitive year by historic standards, with 16% of targets attracting multiple bidders. Despite the high levels of competition, success rates remained high, with 73% of completed deals being successful (compared to 73% in FY15, 60% in FY14 and 64% in FY13).

Targets attracting multiple bidders in FY16 included:

Competitive deals predominantly involved targets valued at between $100m to $500m (62%). Only one target in the mega deal space (Asciano) attracted multiple bidders.

Target shareholders in competitive scenarios often received significant premia from successful bidders, this year averaging 97%.

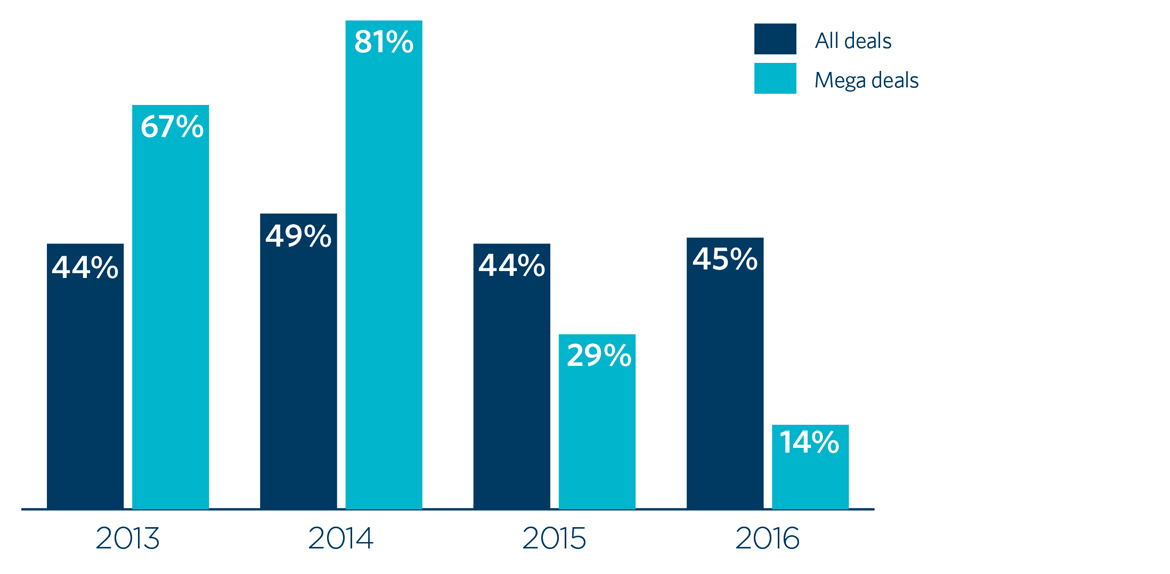

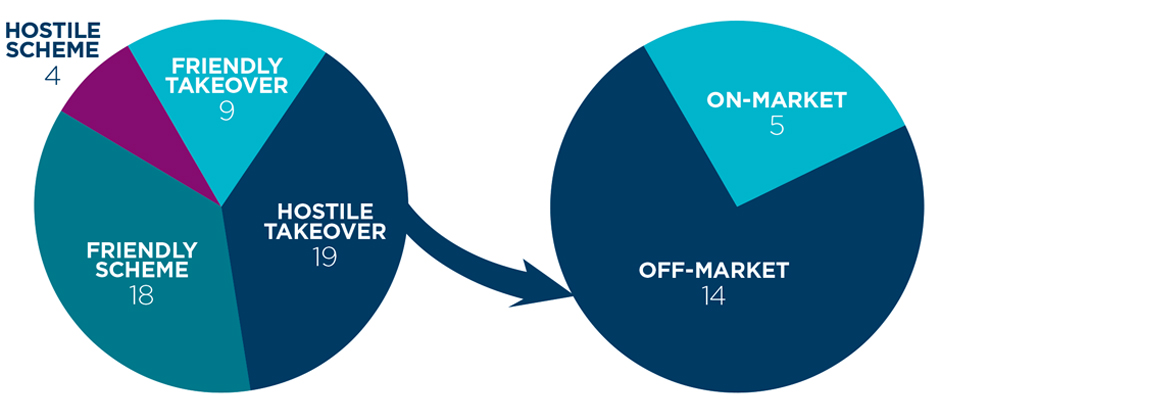

The proportion of deals launched without support from the target board in FY16 (and therefore categorised as hostile) was consistent with previous years.

However, the trend for mega deals to be announced on a friendly basis continued in FY16, with only 1 of the 7 mega deals being announced without target board support. This was Equifax’s initial proposal to acquire Veda by scheme of arrangement (presented as a non-binding expression of interest). Veda’s board later recommended an improved proposal from Equifax.

Cash only consideration was the most prominent form of consideration offered in hostile deals, with 70% of bidders offering cash only (as opposed to 56% of bidders offering cash only in friendly deals).

Of the hostile bids in FY16, for 65% the first substantive response (ie. other than a take no action type of response) was to recommend the shareholders reject the offer.

For those target boards that recommended that shareholders reject the offer, defence tactics varied and included:

61% of hostile bids were ultimately successful, with the target board eventually recommending acceptance in all of those bids. No hostile bids were successful where the target directors retained their reject recommendation for the full duration of the bid.

In the 8 cases where target boards used their recommendation to secure an increase in consideration for target shareholders, the increases ranged from 9.5% to as high as 92.3% (averaging 24.7%) on the initial consideration. In more than half of those cases (5/8), the target board had commissioned an independent expert report.

In 3 hostile bids a rival bidder emerged following a recommendation that shareholders reject the initial offer. The rival bidder was ultimately successful in each of those cases, with shareholders receiving an average increase on the value of the initial proposal of 54.9%.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs