Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

In March 2017 Australia will mark the 25th anniversary of the commencement of its first class action regime, which was introduced in the Federal Court of Australia in 1992.

In that time, we have seen a steady increase in not only the number of class actions being filed in Australia, but also the number of plaintiff law firms and third party litigation funders entering the Australian market to take advantage of Australia’s relatively ‘pro-plaintiff’ legal environment.

Moreover, until very recently class actions could only be commenced in either the Federal Court, or the Supreme Courts of New South Wales and Victoria. However, the recent introduction of a class action regime in Queensland, as well as calls for a similar regime to be introduced in Western Australia, highlights the continuing growth of class action litigation in Australia.

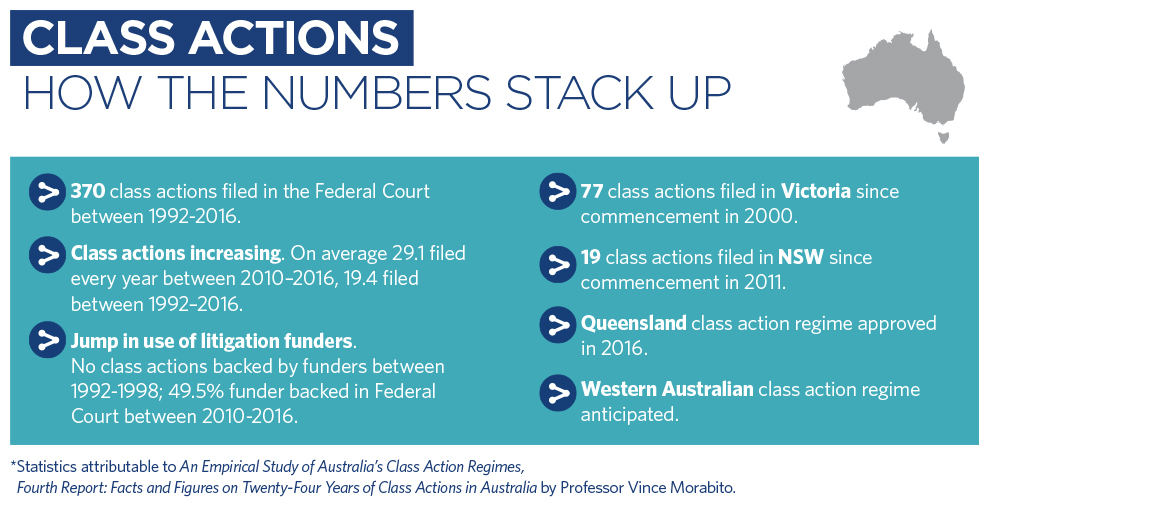

Since the introduction of Australia’s first class action regime in the Federal Court in March 1992, close to 400 class actions have been filed in that jurisdiction. Similarly, in Victoria, which adopted its class action regime in 2000, approximately 80 class actions have been filed, and in New South Wales, which introduced its class action regime in 2011, around 20 class actions have been filed.1

Notably, there has been a steady growth in the number of class actions filed in the federal and state-based class action jurisdictions over the last 6 years in particular. For example, between 1992 and 2016 approximately 19 class actions were filed on average each year throughout Australia. However, in the period 2010-2016, this number increases substantially to an average of 29 class actions per year.2

Although the reasons for the increase in class action litigation in Australia since 2010 are many, one of the primary factors has been the growth in the involvement and participation of third party litigation funders in class action litigation. For example, in the period 1992-1998, not a single class action in the Federal Court was backed by a litigation funder. However, in the period 2010-2016, approximately 50% of all Federal Court class actions were funded by a third party litigation funder, including many funders from overseas.3 We expect that the recent decision in Money Max Int Pty Ltd (Trustee) v QBE Insurance Group Limited will further encourage third party funding in the Australian class action market.4

Given the growth in class action litigation in Victoria, New South Wales and the Federal Court, particularly since 2010, it is not surprising that other Australian states have either implemented class action regimes or are actively seeking to do so.

In November 2016, and after years of being on its legislative agenda, the Queensland Parliament finally passed legislation that will allow class actions to be commenced in Queensland for the first time. The Queensland class action regime largely adopts the class action regimes in Victoria, New South Wales and the Federal Court and will likely deal with claims similar to those currently being brought under the existing class action regimes, as well as actions particular to Queensland.

Similarly, we expect to see Western Australia follow Queensland’s example and introduce a class action regime at some point. In October 2015, the WA Law Reform Commission recommended that Western Australia introduce laws similar to those in Victoria and New South Wales to allow for large class actions to be brought in Western Australia. The idea of introducing a class action mechanism has bipartisan political support, with WA Attorney-General, Michael Mischin, saying that the government agreed ‘in principle’ with the Commission’s proposal for legislative change to allow for a state-based class action regime. There has been no update on the likely timeline for that change, and it remains to be seen whether the proposed WA regime will adopt a similar form to other state and federal based regimes.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs