We asked trust companies questions about the most significant risk and compliance issues they face. The respondents identified tax compliance issues as the fourth most significant challenge.

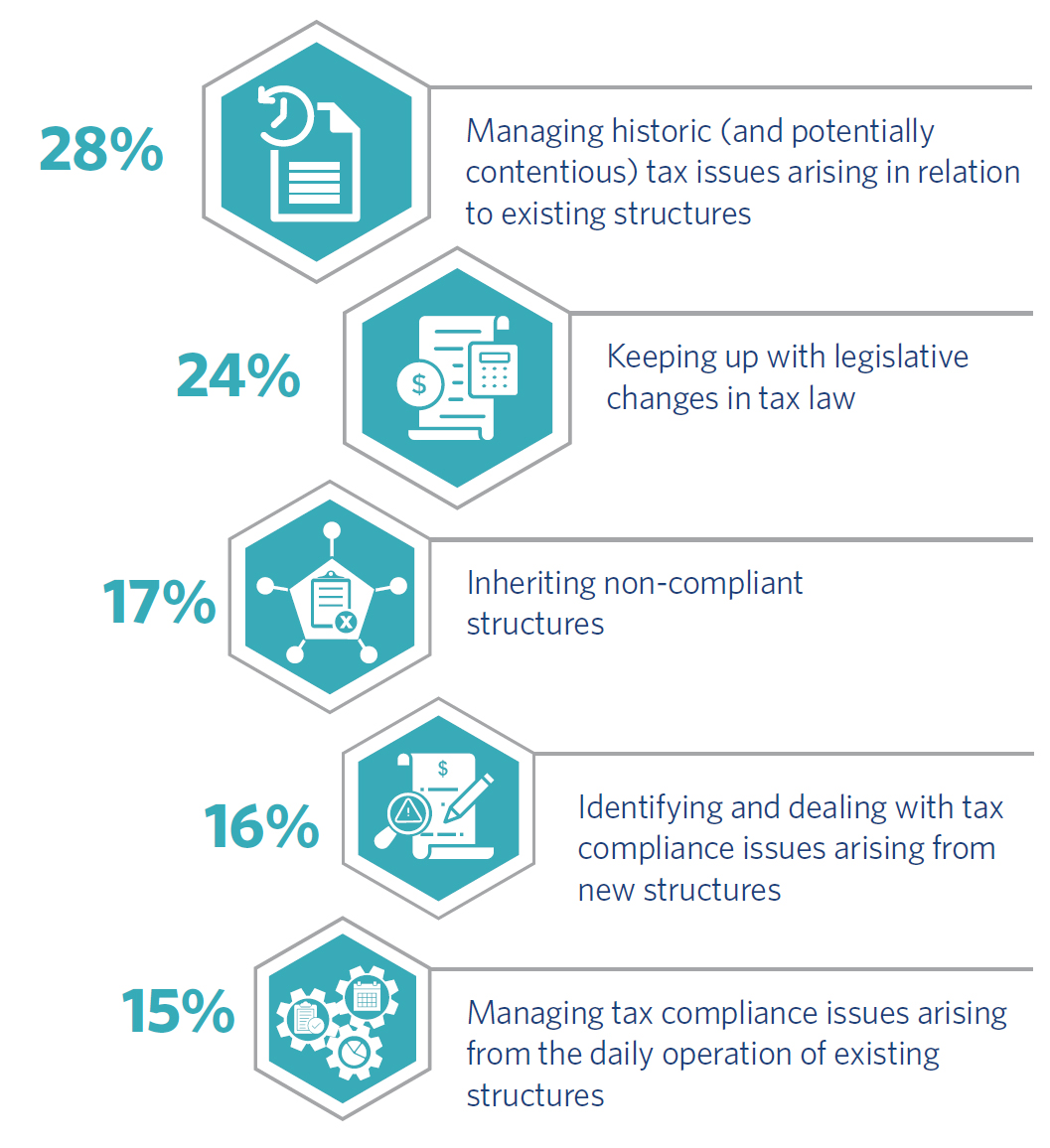

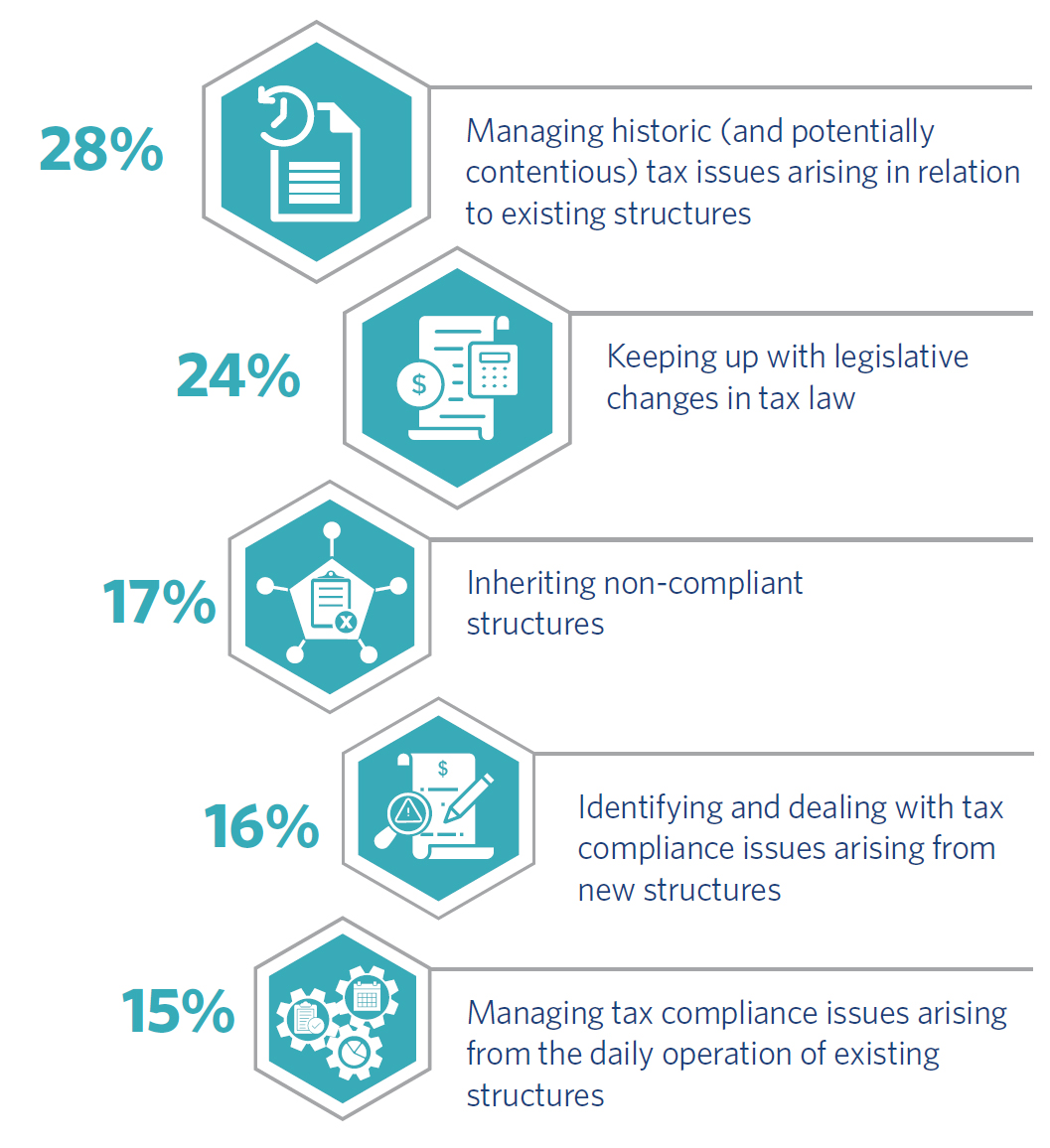

The survey mapped which specific tax compliance issues trust companies struggled with the most. A fairly even share of the vote for most pressing issue (15-17%) was taken by each of (1) managing tax compliance issues arising from the daily operation of existing structures; (2) identifying and dealing with tax compliance issues arising from new structures, or (3) inheriting non-compliant structures as the most pressing issue. However, the front-runners emerged as keeping up with legislative changes in tax law (24%) and the management of historic (and potentially contentious) tax issues arising in relation to existing structures (28%).

What do you find most challenging about tax compliance?

This is perhaps to be expected given current trends in tax compliance and transparency, resulting in the surfacing of historic tax issues. Transparency is, of course, here to stay, and this year (2020) sees the introduction of the following regimes:

- Reporting of cross border arrangements (pursuant to sixth EU directive on administrative cooperation, “DAC 6”). As most readers will be aware, DAC 6 requires intermediaries (that is, anyone who designs, markets, manages, organises or makes available for implementation) to report cross-border arrangements which bear certain hallmarks.

- Augmentation of trust registration requirements (pursuant to the fifth EU money laundering directive, “5MLD”). Among other things, 5MLD requires registration of all UK express trusts and non-UK express trusts which acquire UK real estate or enter into a business relationship with a regulated person in the UK (including registration of controlling interests in non-EEA entities).

Based on experience, particularly that which emerged from the “requirement to correct” process in the UK (“RTC”), many of the historic tax issues arising for trust companies were caused by (i) reluctance on the part of clients to provide full disclosure of relevant facts and analysis (particularly in relation to domicile status) and (ii) difficulty in keeping up to speed with tax rule changes (which, in our survey, registered as the second biggest challenge for trust companies). In relation to the RTC, we are now seeing HMRC starting to assess and enforce the significant penalties promised in that legislation of up to 300%.

- As regards the marshalling of facts, certainly post-implementation of CRS and the RTC, we have seen trust companies revisiting their terms and conditions and new business intake processes in an effort to reconsider (i) what information is required; (ii) how that information is verified; and (iii) how tax risks are allocated between the parties.

- As regards legislative change, in order to assist the reader with issue spotting and horizon scanning from a UK perspective, we set out below some of the most relevant recent and future developments relating to UK trust taxation (and a link to our briefing on the recent Budget can be found [insert hyperlink to briefing]).

It is also now known that HMRC are considering approximately 30 cases in relation to the (relatively) new strict liability corporate criminal offence of failing to prevent the facilitation of tax evasion (the “CCO”). In summary, that offence is committed where an associated person of a corporate/partnership (whether or not UK resident) facilitates another person to evade tax (whether foreign or UK), and the relevant corporate/partnership cannot demonstrate that it had in place “reasonable prevention procedures”.

Given this increase in enforcement activity, it is more important than ever that businesses ensure they have conducted an appropriate risk assessment; implemented appropriate policies and procedures to address any risks identified; and ensured staff and associates (particularly those within populations identified as being high risk) have received adequate training. HMRC’s actions make clear that they are taking seriously the new regime, and are serious about targeting advisors and service providers as well as non-compliant taxpayers themselves.

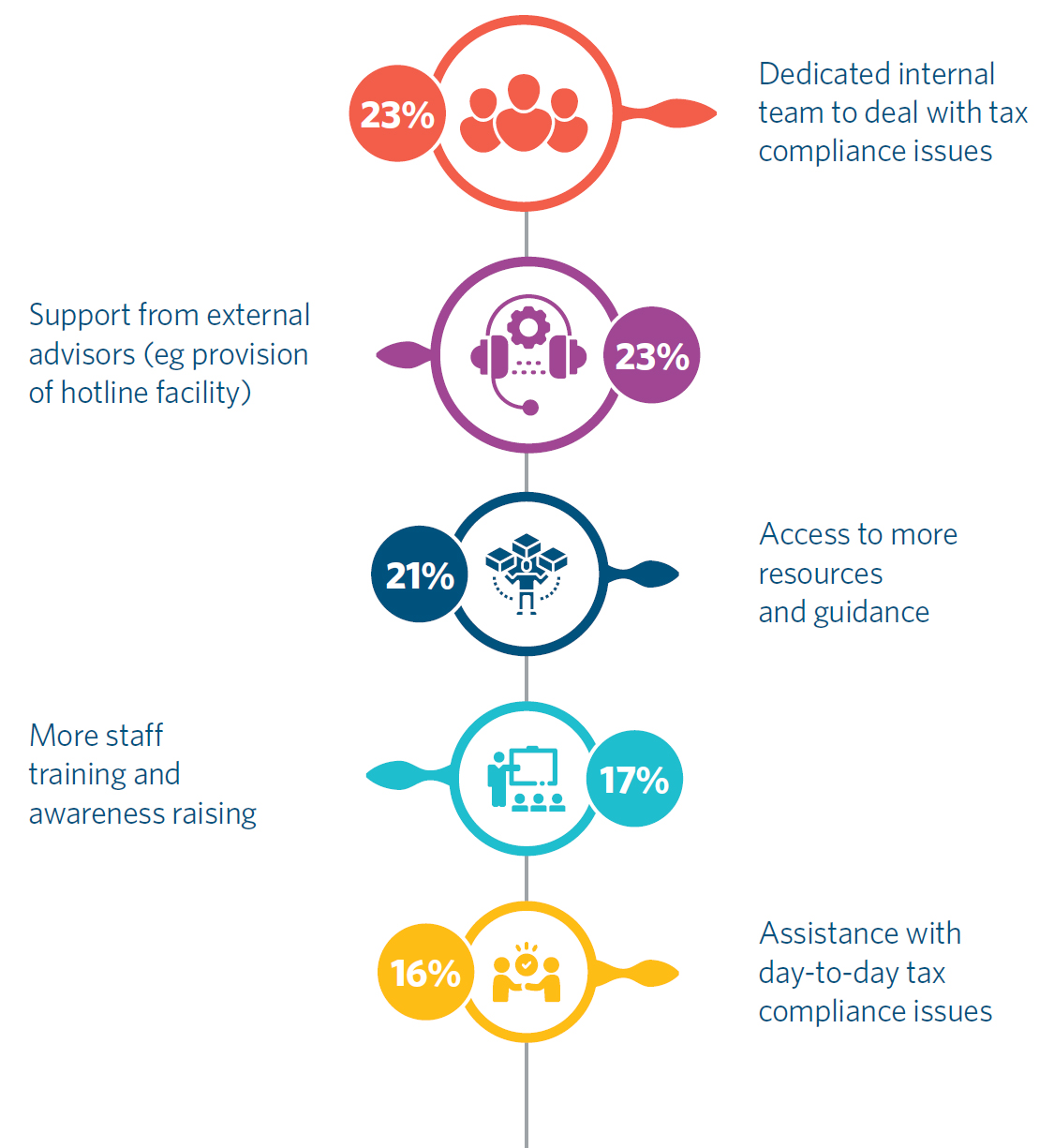

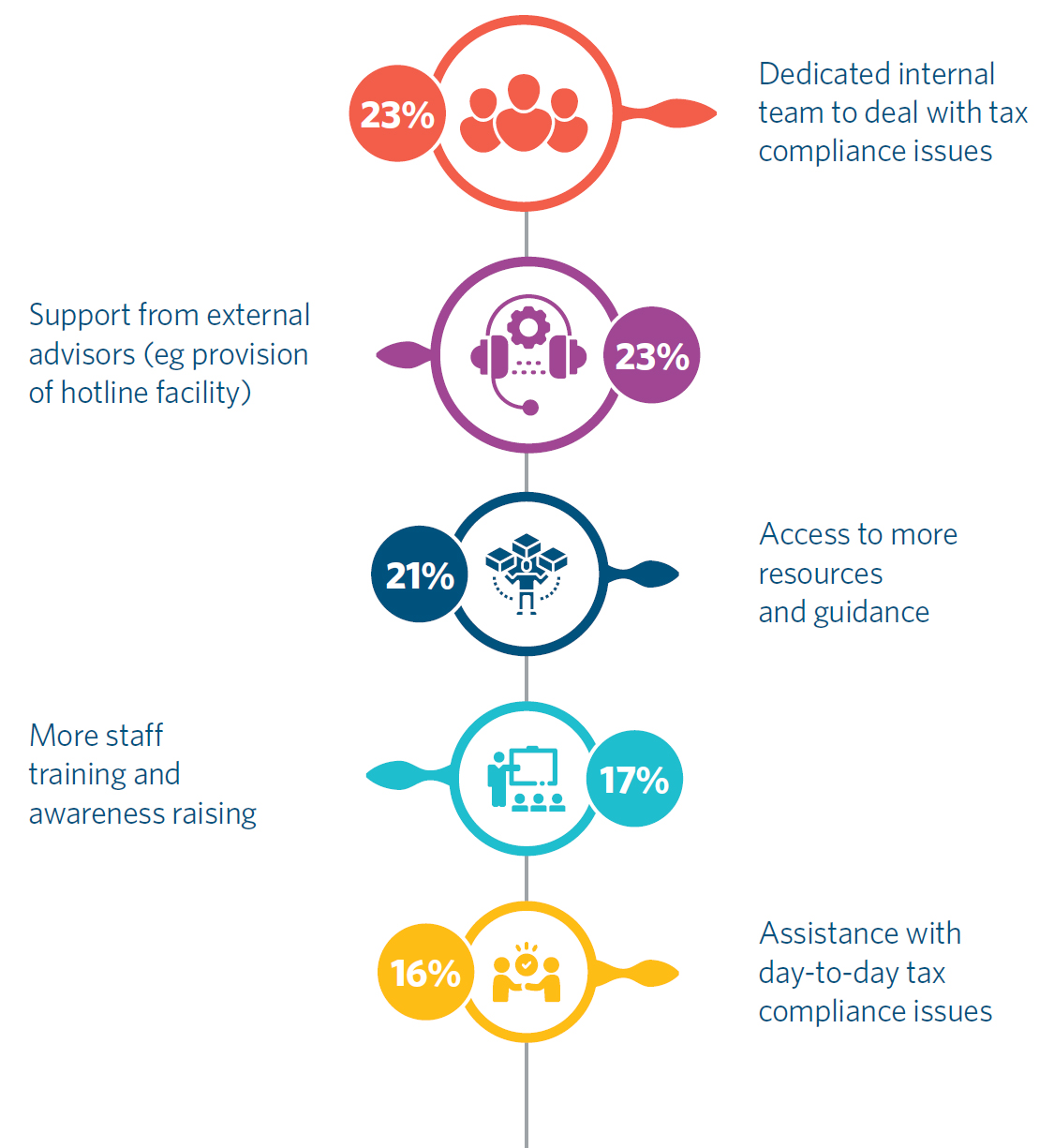

What would be most helpful in handling the tax compliance issues in your organisation?

Recent changes

- Remittance basis. Since tax year 2017/18, the remittance basis of taxation has been unavailable to (i) any individual after they have been UK resident for 15 out of 20 years; and (ii) any individual who was born in the UK with a domicile of origin within the UK. (See our blog here for the latest on the UK’s statutory residence test in light of Covid-19.) In each case, such an individual is now “deemed domiciled” within the UK for income and capital gains tax purposes (the deemed domicile rules for inheritance tax purposes have also been changed, and are subtly different). As such, they will be taxed on an arising basis on benefits received from UK trusts (as well as on personal income and gains), and any trusts established by them will be within the scope of UK inheritance tax.

- Trust protection and tainting. In parallel with the deemed domicile changes, rules were implemented to ensure that non-UK trusts (established prior to the settlor acquiring deemed domicile status) can still be used as tax efficient roll up vehicles within the UK provided that (broadly) (i) the wealth remains in the trust, and (ii) no property is added to the trust by the settlor.

- Anti-recycling rules etc. From tax year 2018/19, rules prevent the avoidance of tax by routing trust payments to UK resident beneficiaries via non-UK residents. These rules will not generally apply where the payment to the UK resident is made more than 3 years after the original distribution. At the same time, rules were enacted to (i) tax settlors where certain trust payments are received by close family members and (ii) to prevent income and gains being “washed-out” by distributions to non-UK resident beneficiaries (prior to distributions to UK resident beneficiaries).

- IHT relating to UK real estate. From April 2017, interests held by non-UK trusts in certain companies and partnerships have been within the scope of UK inheritance tax if and to the extent the value of those interests derives from UK residential property (or, in certain cases, the proceeds of disposal of the same). Complex rules also apply to create charges where monies are used to finance or the secure the purchase of such property.

- CGT relating to UK real estate. From April 2019, complex rules apply to ensure that non-UK residents are chargeable to capital gains tax on the disposal of both directly held and indirectly held interests in UK real estate (in the latter case, only where the holding is substantial, and the relevant entity is property rich).

Future changes

- Trust taxation. The UK Government launched a wide ranging consultation on the reform of trust taxation. Although the consultation period closed almost a year ago, the Government’s response is still awaited, so the likely scope of any reforms remains unclear. A Government response to a review it commissioned of the UK’s inheritance tax regime is also awaited (the review, conducted by the UK’s Office of Tax Simplification, concluded that wide ranging simplification was advisable).

- Compliance. Prior to re-election in December 2019, the UK Conservative Party published a manifesto pledging (among other things) new increased sanctions for tax avoidance and evasion law; a “beefed-up anti-tax evasion unit in HMRC”; and consolidation of the UK’s existing anti-avoidance and evasion measures and powers. The development and deployed of these pledges is still a work in progress.

Listen to our accompanying podcast below

To review the other articles in this series, please click on the link below

Herbert Smith Freehills Trust Companies Survey: Navigating Troubled Waters