The Pensions Ombudsman recently published both its Corporate Plan 2020-2023 and Annual Report for 2019/2020, which reveal that the number of enquiries the Ombudsman received has significantly increased in the last year. In addition, the Ombudsman expects the number of complaints to “undoubtedly” increase over the next 12 months as a result of Covid-19.

To help trustees and administrators prepare for what’s ahead, we have summarised the key trends identified in the Ombudsman’s Corporate Plan and Annual Report, as well as the type of complaints the Ombudsman expects to receive going forward and how trustees and administrators can prepare for and mitigate against these.

Key trends from the last year

1. Increase in enquiries

Looking back on the last 12 months, the Ombudsman received over 11,552 phone enquiries, which is a dramatic 41% increase on the previous year. Written enquiries also increased by 24%, with the Ombudsman receiving 8,977 in total. Whilst it is difficult to say why there has been such a striking increase, these figures suggest that the general public are more aware than ever before of the Ombudsman’s service and how they can use it.

Although the Ombudsman forecasts a less significant rate of increase in demand in the next 12 months, it does expect demand to continue to grow. Members of the public will soon be able to refer their enquiries through a new online customer portal, which may make it easier for people to raise complaints with the Ombudsman.

2. What about new investigations?

Whilst there was a 22% reduction in adjudication cases over the last 12 months, early resolution investigations increased by 15%. The Ombudsman emphasised that the decrease in adjudication cases was not due to its caseload reducing, but because it had been better able to identify more complaints early in the process that were suitable for early resolution. This is a clear reflection of the Ombudsman’s desire to resolve complaints at an earlier stage without the need for a formal determination.

3. Most common reasons for new complaints

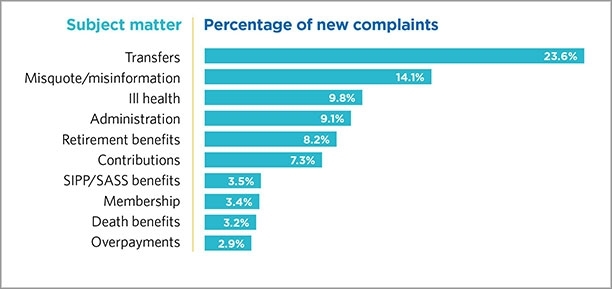

The top 10 reasons for new complaints remain largely unchanged from 2018/2019. Complaints relating to transfers, misquote/misinformation and ill health are still the three most common.

Unsurprisingly, transfers continue to be the most common cause of complaints. During the last year, they represented a significantly larger percentage of complaints at 23.6%, compared to 7.1% in 2018/2019. We expect this trend to continue with transfer values predicted to remain high and fraudsters becoming increasingly sophisticated in how they seek to take advantage of this (see below).

Here is the full top 10:

Looking ahead

During 2020/21 the Ombudsman predicts and is preparing for a significant increase in complaints in four key areas due to the effects of Covid-19.

1. Scams

Recent data has shown the resilience of transfer values over the last month, with XPS Transfer Watch finding that DB transfer values increased to a record high during June. The high value of transfer values, coupled with the impact the Covid-19 pandemic has had (and may have going forward) on the finances of many members, means there is an ever growing risk of members seeking to transfer their benefits in an attempt to access cash quickly.

The Regulator’s guidance for DC schemes emphasises the importance of trustees conducting thorough due diligence on any proposed transfer as they are the first line of defence in protecting savers from being lured in to scams.

Action:

Trustees and administrators should continue to make members aware of the heightened risks of pension and investment scams, and ensure that they are alert to potential scams and suspicious activity, such as pressures to transfer into high-performing investments.

Where schemes are paying transfer values, it is important that they discuss with their administrator and legal advisers:

- what steps should be taken to alert members to the heightened risk of scams, and

- whether any changes should be made to the due diligence process to ensure it is suitably robust.

Trustees of DB schemes should have by now taken steps to update their processes to ensure that the new warning letter is sent to all members who request a transfer.

2. Delays in providing information, processing requests and carrying out transfers

The Ombudsman is anticipating complaints caused by delays in providing information and carrying out transfers due to disruption caused by Covid-19. There may also be an increase in other maladministration complaints, as scheme administrators struggle to process benefits efficiently and maintain normal service levels in the current environment.

If administrators are struggling to process transfer requests, the Regulator’s latest guidance indicates that trustees should keep any decision to suspend transfers under review and that a suspension should only be imposed where it is strictly necessary. The Regulator also reminds trustees that they can apply for an extension of time (of up to three months) if they are unable to process a transfer for reasons outside of their control. However, any applications should be made in good time and not just before the statutory deadline for making a transfer payment is due to expire.

Action:

Trustees and administrators need to ensure benefits continue to be paid correctly. They should therefore consider whether any changes have or need to be made to the way payments are made, and where appropriate, limit any non-critical demands to focus on member queries and reduce the burden on services.

Trustees may also want to consider the need for more regular reporting and updates from administrators (for example, on the processing of core financial transactions, transfer requests and other member activity and member queries) to monitor the impact of current events and consider how to manage an increase in volume of queries, should this arise in the future.

It’s also important to review the lessons that can be learnt from the lockdown experience to date and ensure that suitable arrangements and contingency plans are in place should lockdown measures be reintroduced.

3. Ill health benefit claims

The Ombudsman expects to see a rise in ill health complaints and complaints relating to access to and payment of pension benefits as a result of Covid-19.

Action:

Trustees should bear in mind that members suffering from ill health are often preoccupied by their health and should therefore process any requests in a timely, efficient manner.

Trustees may also want to consider whether any requirements they impose on members who are applying for ill health early retirement are strictly necessary and where a requirement would impose an undue financial burden on an applicant, trustees should consider alternative arrangements.

4. Claims relating to the Coronavirus Job Retention Scheme

The Ombudsman predicts an increase in claims regarding the payment of contributions, salary sacrifice and death cover under the Coronavirus Job Retention Scheme (CJRS).

Recent changes to the CJRS mean that keeping track of and calculating pension contributions and other benefits payable in respect of partially furloughed employees will become more complex. This in turn could lead to incorrect benefit and/or contribution payments and calculations. Furthermore, as the economic impact of Covid-19 and the measures introduced to combat it continue to be felt, many employers are inevitably looking for ways to reduce costs and preserve cash. The Ombudsman believes there is a risk some employers may fail or simply choose not to pay pension contributions in order to cut costs.

Action:

Trustees and administrators of defined contribution schemes should closely monitor the payment of employer and member contributions made whilst sponsoring employers are using the CJRS and take immediate steps to recover any due and unpaid contributions. If employers are using the CJRS, they should consider seeking legal advice regarding whether this impacts their pension contribution payments.

For more detailed information on the CJRS and how it impacts pensions, see our briefing.

Finally…

Given the expected increase in complaints, trustees should make sure they are keeping full records of their decisions and the reasons for these when they impact members, in case they need to justify those decisions to the member or the Ombudsman in future.

In addition, effective member communication is vital during this time, particularly if there are any delays, changes or disruptions to member services. Schemes should inform members of:

- the types of services impacted, and reasons for any change;

- the steps taken to restore normal services and the timescales involved;

- any temporary changes to service levels for processing member requests and what the new timescales are for processing member requests; and

- any delays to annual publications or member communications and what the new timescales are for publishing these documents.

Trustees should also continue to ensure their scheme has an adequate internal disputes resolution procedure in place to deal with the expected rise in complaints.

Contact us

If you have any queries about any of these developments, please speak to your usual HSF adviser or contact a member of our pension disputes team below.

More on Catalyst //