Australian Public M&A Report 2020

Twelfth edition

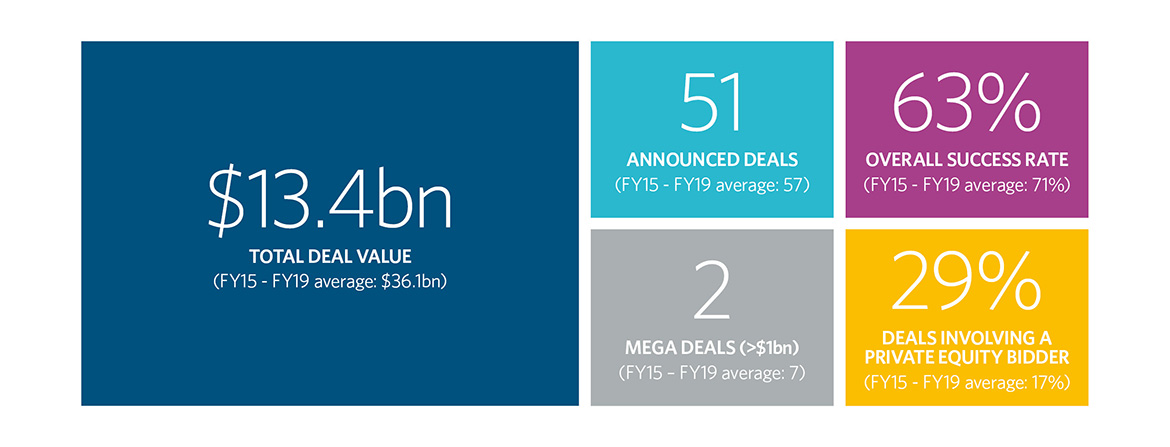

This edition examines the 51 control transactions involving Australian targets listed on the ASX that were conducted by way of takeover bid or scheme of arrangement in the 2020 financial year.

The report provides detailed insight into:

An overview of some of the key findings of this year’s report is set out below.

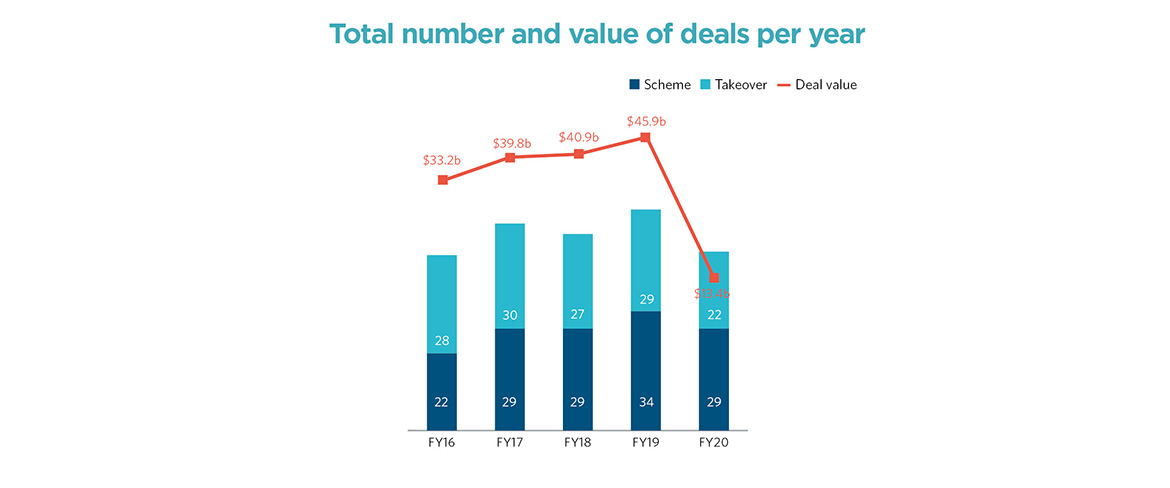

Public M&A activity was reduced in FY20. There were 51 deals announced compared to 63 in FY19, 56 in FY18 and 59 in FY17. Total deal value for FY20 was also reduced, at an aggregate $13.4bn (compared to $45.9bn in FY19, $40.9bn in FY18 and $23.4bn in FY17).

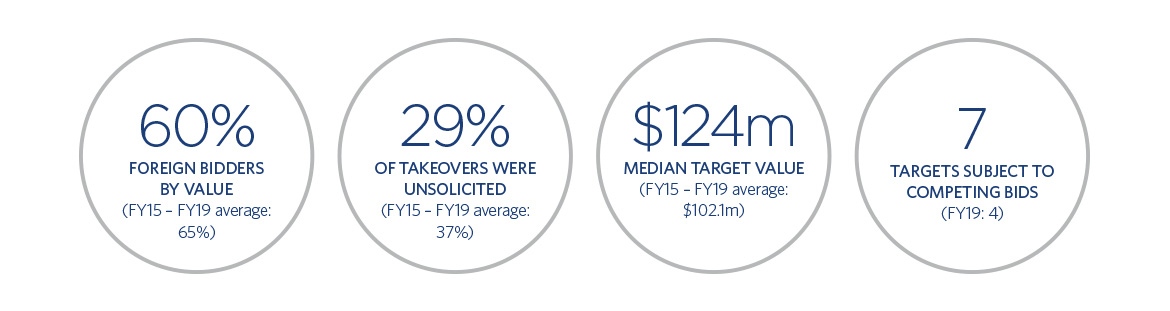

The reduced activity appears to have been largely caused by the global uncertainty and economic effects resulting from the Covid-19 pandemic. The impacts of the Covid-19 pandemic had implications across the board, including on mega deals (only 2 mega deals were announced in FY20, the lowest we have recorded in 12 years), success rates (63%, down from 74% in FY19) and deal structures (FY20 saw a higher level of schemes used as opposed to takeovers at 57%, compared with the 49% average in FY15-19).

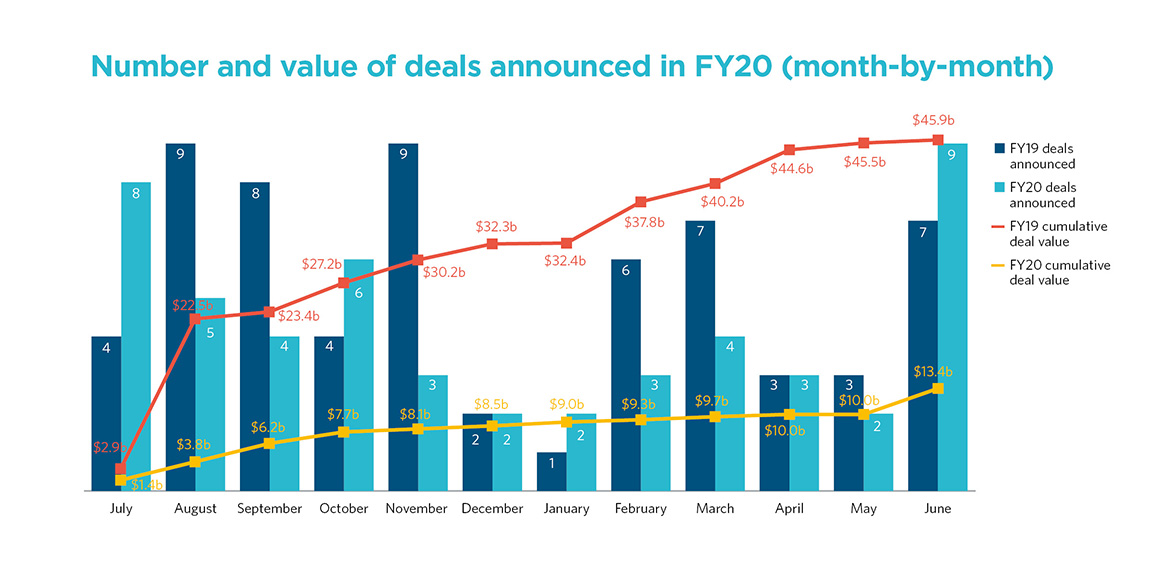

There was a strong start to FY20, with the aggregate number of deals announced from July to October similar to the levels seen in FY19. Interestingly, the lower aggregate deal value for FY20 relative to FY19 appears to have been present in the first half of FY20 (ie pre-Covid-19 pandemic). As may be expected, activity between January and May 2020 was significantly reduced as bidders retreated during the period of uncertainty caused by the Covid-19 pandemic. However, late in FY20 the green shoots of a recovery in activity started to appear, with 9 deals announced in June and a noticeable uptick in cumulative deal value relative to the corresponding month in FY19.

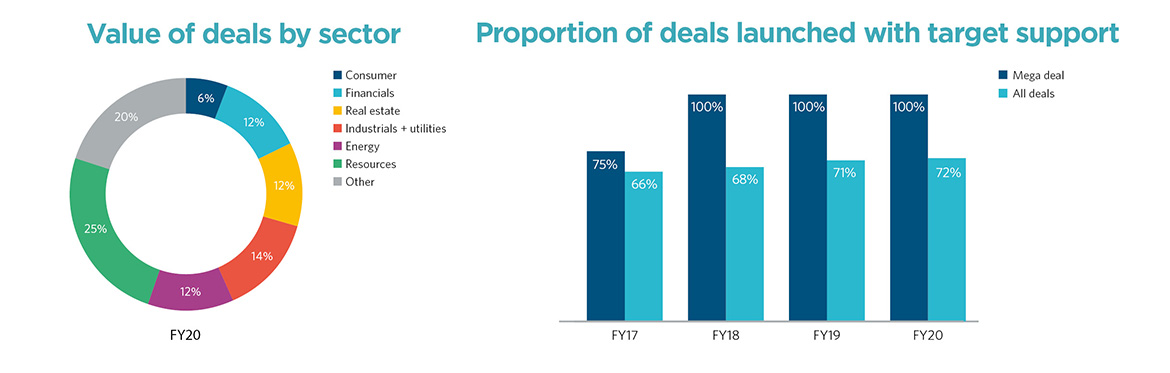

FY20 saw high value targets spread across several sectors, including Real Estate (24% of deal value), Industrials and Utilities (20% of deal value), and Energy and Resources (18% of deal value).

In particular, the Energy and Resources sector showed continued strength in FY20. Energy and Resources deals accounted for 37% of all public M&A activity, driven by the large number of Gold deals, with key targets including Cardinal Resources, Echo Resources and Spectrum Metals.

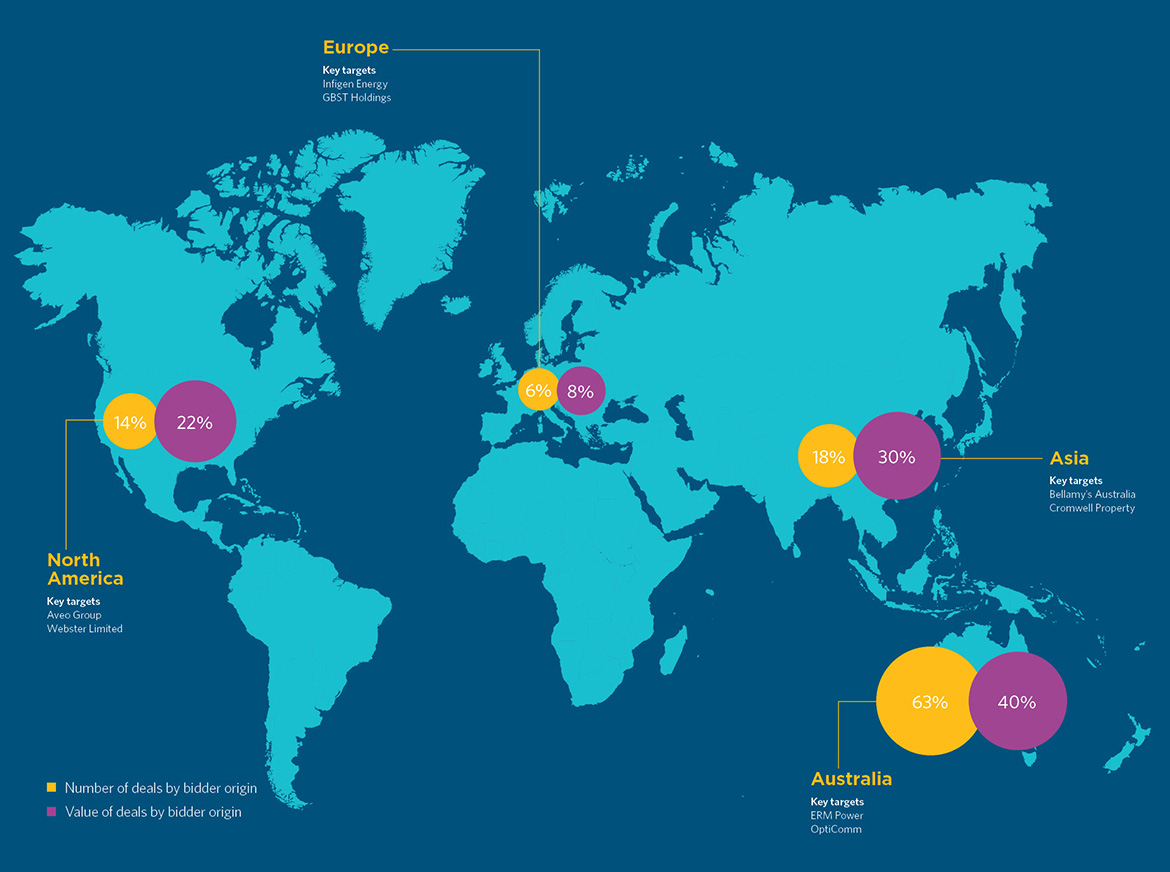

While the volume of foreign bidder activity in FY20 remained largely consistent with FY19 values (37% in FY20, 38% in FY19), FY20 saw a reduction in the value of foreign bidder activity (60% in FY20, 80% in FY19).

| TARGET | BIDDER | DEAL VALUE | SECTOR | ANNOUNCED |

|---|---|---|---|---|

| Bellamy's Australia Limited | China Mengniu Dairy Company | $1,434.1m | Consumer Staples | September 2019 |

| Aveo Group | Brookfield | $1,248.6m | Real Estate | August 2019 |

| Infigen Energy | Iberdrola Renewables Australia | $834.8m | Utilities | June 2020 |

| Infigen Energy | UAC Energy | $776.6m | Utilities | June 2020 |

| Webster Limited | Public Sector Pension Investment Board | $724.5m | Consumer Staples | October 2019 |

| Cromwell Property Group | ARA Asset Management | $667.8m | Real Estate | June 2020 |

| ERM Power Limited | Shell Energy Australia | $605.7m | Energy | August 2019 |

| OptiComm Ltd | Uniti Group | $530.8m | Telecommunications | June 2020 |

| Australian Unity Office Fund | Charter Hall Limited and Abacus Group Holdings Limited | $495.0m | Real Estate | September 2019 |

| Australian Unity Office Fund | Starwood Capital Group | $485.2m | Real Estate | January 2020 |

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs