Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

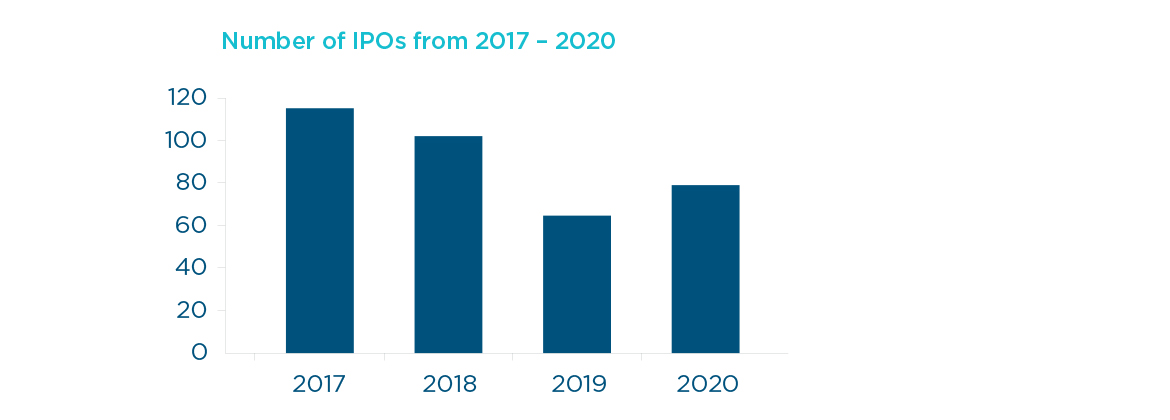

Market conditions in 2020 unfolded like an obstacle course and were significantly impacted by the onset of the Covid-19 pandemic, with a market crash in February, ongoing global trade tensions throughout the year, with bans by China on core Australian exports announced and the US presidential election in November to top it off. Unsurprisingly against this backdrop, the volume of capital raised from IPOs in 2020 was at its lowest in four years.

However, the landscape for IPOs did not turn out to be as dire as predicted at the start of the pandemic. The total market capitalisation of entities listed in 2020 exceeded the total market capitalisation of entities listed in 2019 by just over a billion dollars and there were 15 more listings in 2020 than in 2019.

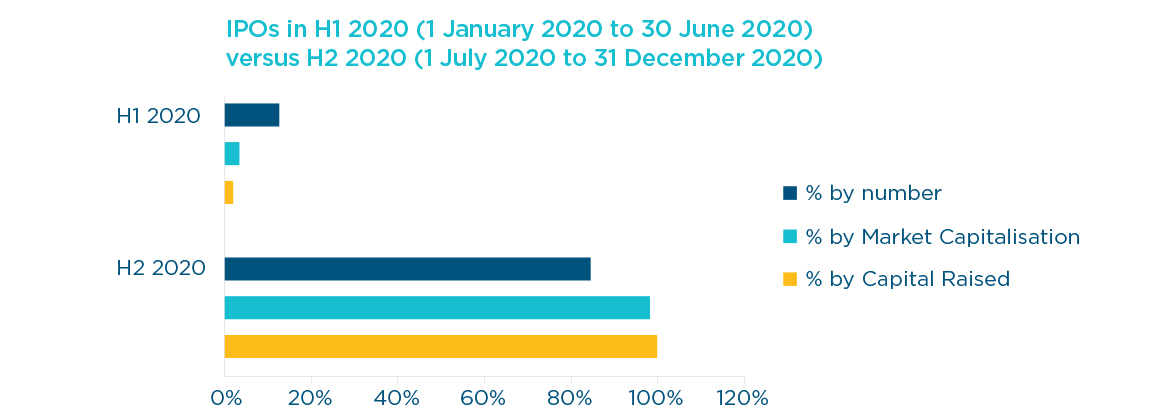

2020 was a tale of two halves, with little activity in the first half and almost all of the IPOs for 2020 launching in the second half. The second half listings for 2020 included IPOs for flagship assets like Dalrymple Bay Infrastructure, which listed with a market capitalisation of A$1.286 billion, and businesses responding to the demands of the modern world such as investigative analytics and intelligence software provider, Nuix, which listed with a market capitalisation of A$1.685 billion (on an undiluted basis). To put the volume of activity in perspective, the second half activity for 2020 was more than five times that for the first half of 2020.

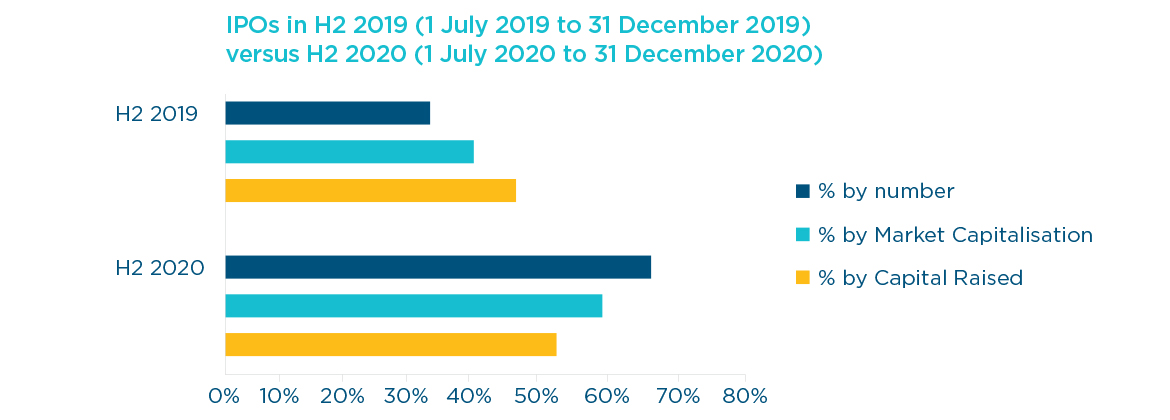

Further, IPOs by number, capital raised and market capitalisation on IPO in the second half of 2020 were all higher than in the second half of 2019.

That IPOs became such a popular path for significant exits that might otherwise have been sold via trade sale is probably not something that was on anyone’s list of predictions at the start of 2020. However, with the track record for execution of IPOs in 2020 during challenging circumstances (including new found efficiencies from back to back investor presentations by video conferencing), interest rates expected to remain low and optimism based on the enormous vaccine roll-out programs globally, this trend may continue.

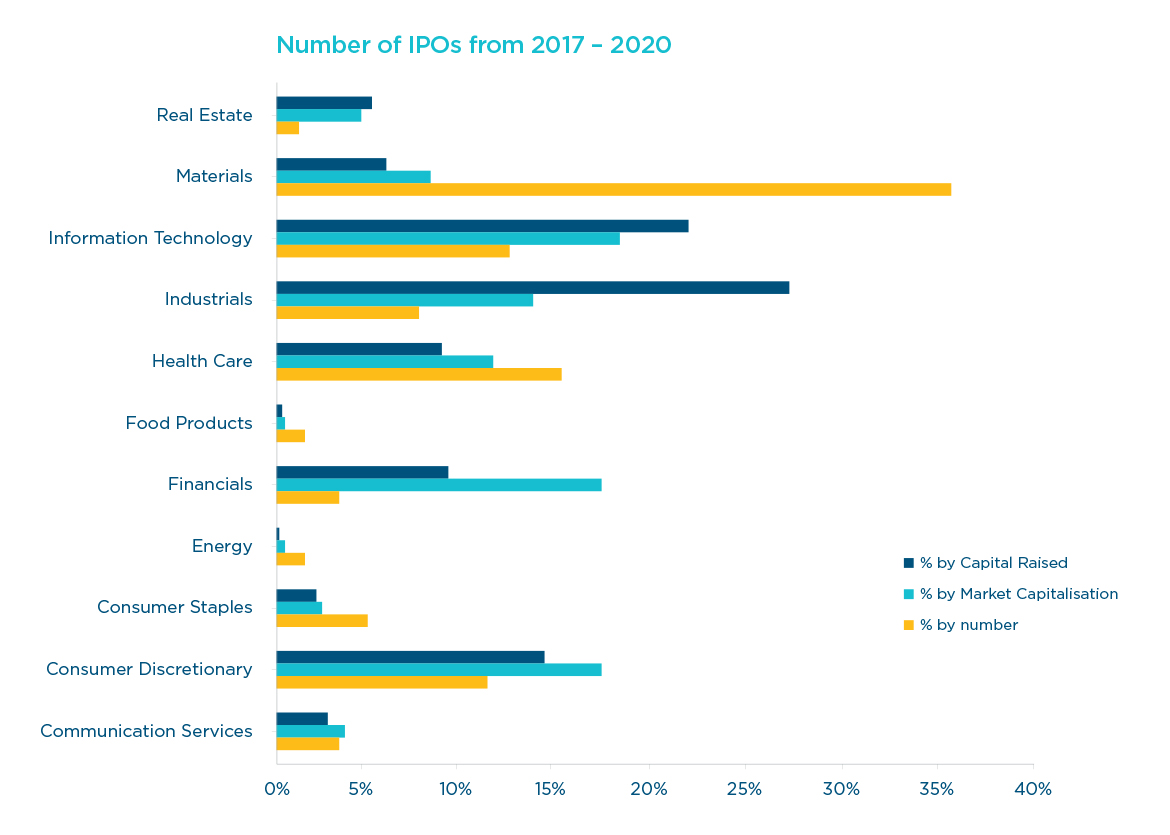

There were 30 listings in the materials sector, comprised mostly of small to mid-cap mining exploration and development entities. When matched with the 12 takeovers and schemes for ASX listed mining and exploration entities in 2020, the picture that emerges seems to be largely unaffected by the pandemic. With tightening commodities markets and the Australian coal industry finding new markets there is good reason to expect mining and exploration entities to continue to be attractive IPO candidates.

The sector with the second largest number of listings was the healthcare sector, comprised of a number of entities focused on health tech solutions which arguably reflects the accelerated growth in this sector in response to the Covid-19 pandemic. The healthcare was closely followed by the IT sector. Listings in the IT sector seemed to be generally linked by a theme of process efficiency and/or centralisation. For example, thedocyard (now named Ansarada), a SaaS provider of centralised platforms to assist with corporate transactions, listed with a market capitalisation of A$131.3 million. Herbert Smith Freehills acted on the IPO of thedocyard.

The sectors with the highest levels of capital raised were Industrials and Information Technology respectively. These results are largely reflective of the individual listings of Dalrymple Bay Infrastructure (industrials) and Nuix (information technology) and so are not representative of those sectors as a whole.

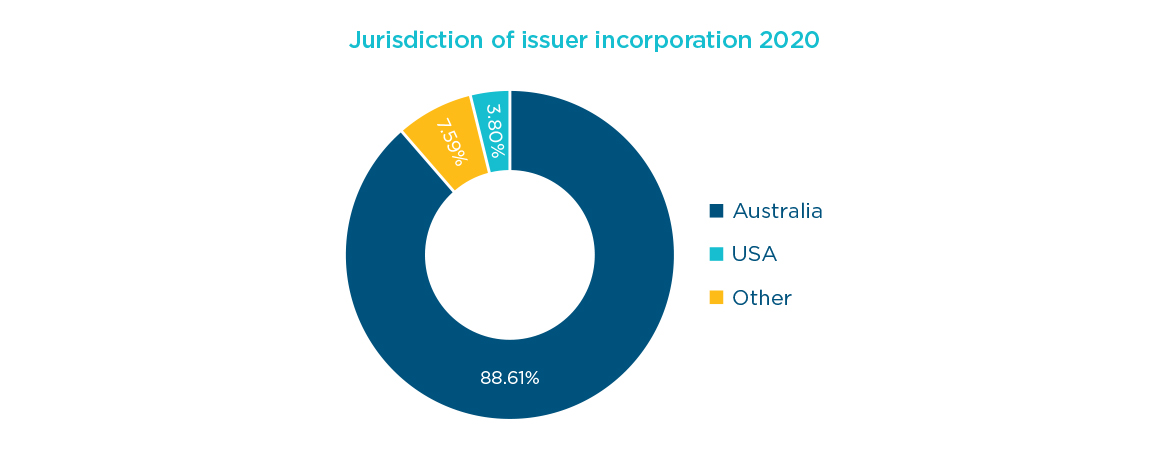

The place of incorporation of IPO issuers in 2020 was overwhelmingly Australian, which may be a reflection of the geographic challenges of 2020 resulting from the Covid-19 pandemic.

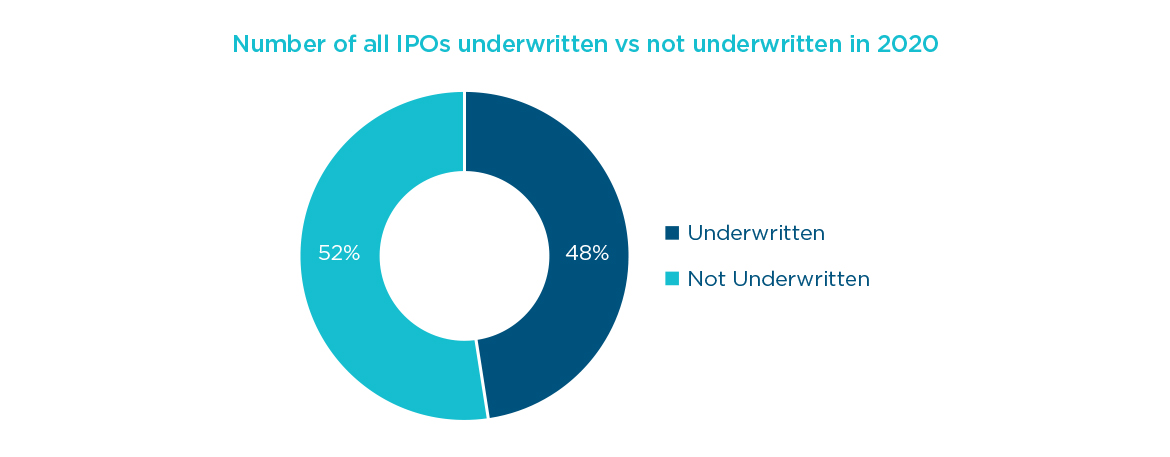

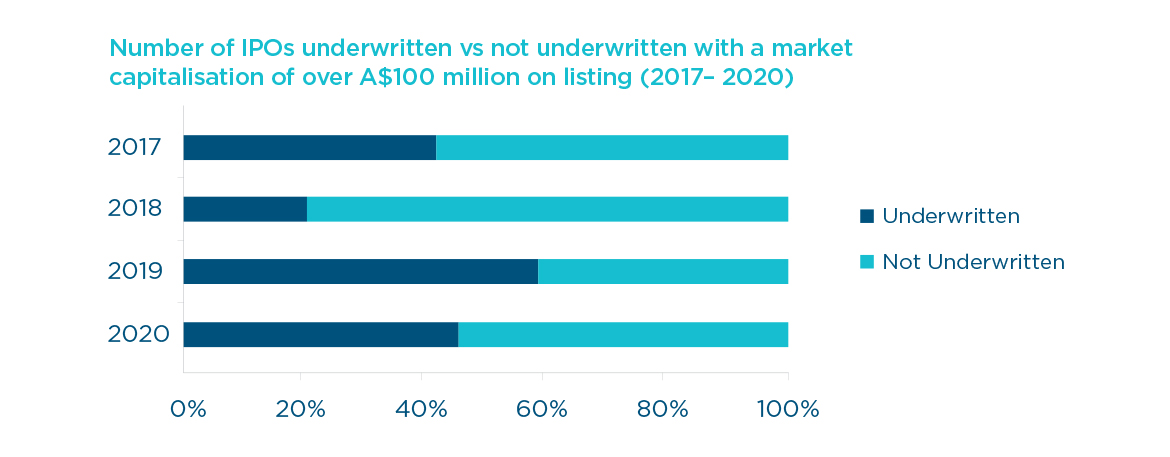

Statistics on underwriting were not markedly different from previous years which in itself is interesting given the market conditions in 2020.

Note on Methodology: All data in this ‘2020: IPOs by the numbers’ section excludes ASX Foreign Exempt Listings, AQUA and debt IPOs unless otherwise stated. Market capitalisation is based on the issue price of securities multiplied by the number of quoted securities.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs