Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

When we last conducted the trust companies survey, we had experienced an explosion of changes in the private client tax space, together with a significant uptick in enforcement activity and increased reporting requirements.

Against that backdrop, it came as no real surprise that top of the tax agenda were (1) keeping up with tax changes and (2) managing historical tax issues.

In the two years that have passed since that first survey, certainly from a UK perspective, we've seen a significant decrease in the rate of legislative change; a bedding in of reporting requirements and associated systems and controls; and (impacted by the pandemic) enforcement activity ground to a halt.

It might be expected, then, that concerns about day-to-day and new business compliance would have decreased; perhaps also concerns about keeping up to date with legislative change.

Certainly, this is borne out, to an extent, in the results of the latest survey.

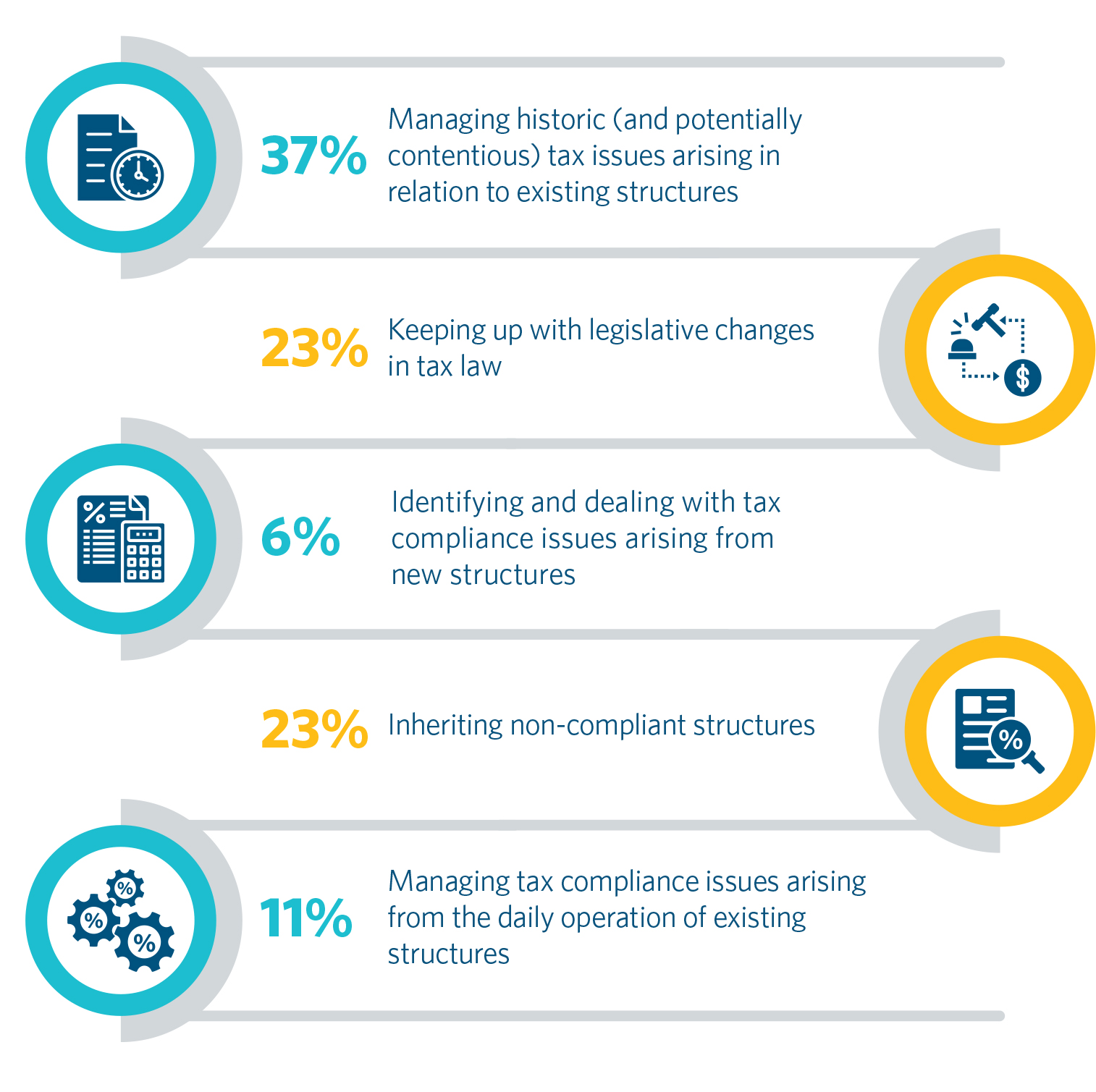

Dropping down to 6% (from 16%) is concern about new structures, and to 11% (from 15%) is concern about managing day to day compliance.

The big increase is management of historical and potentially contentious issues, leaping up to 37%.

At first blush, that might seem odd, given the sharp drop off in investigative work referred to above (at least, in relation to non-CJRS (Coronavirus Job Retention Scheme) related matters). However, there are most likely at least three factors in play.

An overarching theme remains HMRC's continued and aggressive pursuit of challenges against claims of non-dom status.

In this arena, a perennial problem has been dealing with onerous and speculative requests for documents and information. In a spate of recent cases, the UK Courts and Tribunals have grappled with a number of cases in which parties have tried in various ways to rein in expansive information requests. Although the Courts have been robust in curtailing clear fishing expeditions, it is still the case that HMRC will be given the benefit of the doubt whether they have reasonable grounds for investigation.

Looking a little further into the future, the pace and scope of relevant legislative change in the UK looks somewhat unclear. Whilst, since the last trust survey, decisions have been taken against large scale reform of the taxation of trusts, inheritance tax and capital gains tax, the Government made clear at Spring Statement 2022 that it would be looking at plans to reform reliefs and allowances ahead of 2024 in a bid "to make the tax system simpler, fairer and more efficient".

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs