Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

Businesses must increasingly prioritise their ESG goals. This article explores recent regulatory and policy updates in relation to sustainable finance, notable developments in sustainability-linked loans and ASIC's enforcement action against greenwashing.

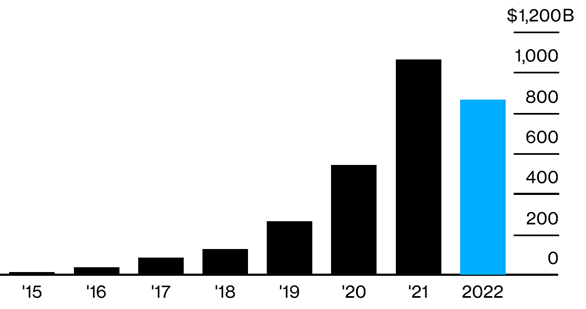

Since Adelaide Airport signed the first Australian sustainability-linked loan (SLL) in 2018, interest in SLLs has steadily risen in the Australian and broader Asia-Pacific region. Borrowers and lenders have used SLLs as a way to align financing terms with their environmental, social and governance (ESG) strategies. However, in the past year, the volume of sustainable debts issued globally, including SLLs, declined for the first time by 19% from the peak of US$1.1 trillion in 2021. Similar trends have been seen in the Asia-Pacific region.

Source: Bloomberg

Despite the decrease in the volume of SLLs in the past year, SLLs remain an attractive financial product, especially given that ESG goals continue to be a key area of focus in Australian boardrooms.

Institutional lenders are also continuing to work towards their targets to increase sustainable financing. For example, Commonwealth Bank has targeted $70b of funding towards sustainable finance by 2030 and Australia and New Zealand Banking Group with $50b by 2025.

Despite the significant activity in the sustainable finance sector in Australia, regulation has been weak. Prior to 2023, the Australian Securities and Investment Commission (ASIC) had only issued up to $140,000 in infringement notices in response to concerns about alleged greenwashing. This seems set to change, with greenwashing as one of ASIC’s enforcement priorities in 2023.

As SLLs continue to gain traction in Australia, we have seen an increasingly diverse range of SPTs. While emissions-related SPTs continue to be popular, SPT targets in the wider ESG space have also grown.

Below is a snapshot of recent significant sustainability-linked loans in Australia, which demonstrate the broader range of SPTs being adopted by borrowers.

|

Borrower |

Date reported |

Value |

Industry |

Sustainability performance targets |

|

March 2022 |

$1.8b |

Transport |

|

|

|

March 2022 |

$920m |

Electricity distribution network |

|

|

|

September 2022 |

$420m |

Manufacturing |

|

|

|

September 2022 |

Unreported |

Transport |

|

|

|

Orica |

November 2022 |

$1.3b |

Mining and infrastructure |

|

|

February 2023 |

$800m |

Agriculture |

|

In February 2023, ASIC launched its first civil penalty proceedings in the Federal Court for greenwashing against Mercer Superannuation (Australia) Limited (Mercer). Mercer had allegedly made misleading statements about the sustainable nature of some of its superannuation investment options.

ASIC alleged that Mercer allowed members to select their own ‘Sustainable Plus Investment options’, which were promoted as an investment strategy that excluded companies involved in fossil fuels, alcohol production and gambling. However, ASIC alleges that the Sustainable Plus Investment option members had investments in companies said to be excluded for the strategy – for example, ASIC found investments in 15 companies involved in alcohol and 15 companies involved in gambling.

It will be interesting to monitor the outcome of the Mercer case, which may create an important precedent and insight into how the court will evaluate when marketing in respect of sustainable financing becomes misleading or deceptive. The case demonstrates that ASIC is acting on its announcement last year that greenwashing in sustainable financing will be one of its top enforcement priorities this year.

Despite a decline in annual growth in 2022, SLLs will continue to be a significant financial product for companies looking to develop their ESG goals. The last quarter of 2022 also marked the beginning of ASIC’s increasing enforcement in the area, and it will be more important now than ever for companies engaging in the sustainable finance space to ensure compliance with disclosure requirements in Australia.

|

Herbert Smith Freehills has extensive experience in the sustainable financing and sustainability linked loan sector in Australia. We have acted on landmark SLL transactions in Australia such as:

|

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs