Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

There is no question that Australia’s current payments regulatory framework is difficult to navigate, is not reflective of current products and services, is not consistent with regulatory approaches globally and is in need of reform. As set out in the Government’s Strategic Plan for Australia’s Payment System, there is a need for Australia to develop a modern, world-class and efficient payments system that is safe, trusted and accessible.

Against this aim, the shape that reform is likely to take is becoming clearer. In December 2023, Treasury released Consultation Paper 2 on its proposed approach to an updated licensing framework (Payment System Modernisation: Regulation of payment service providers).

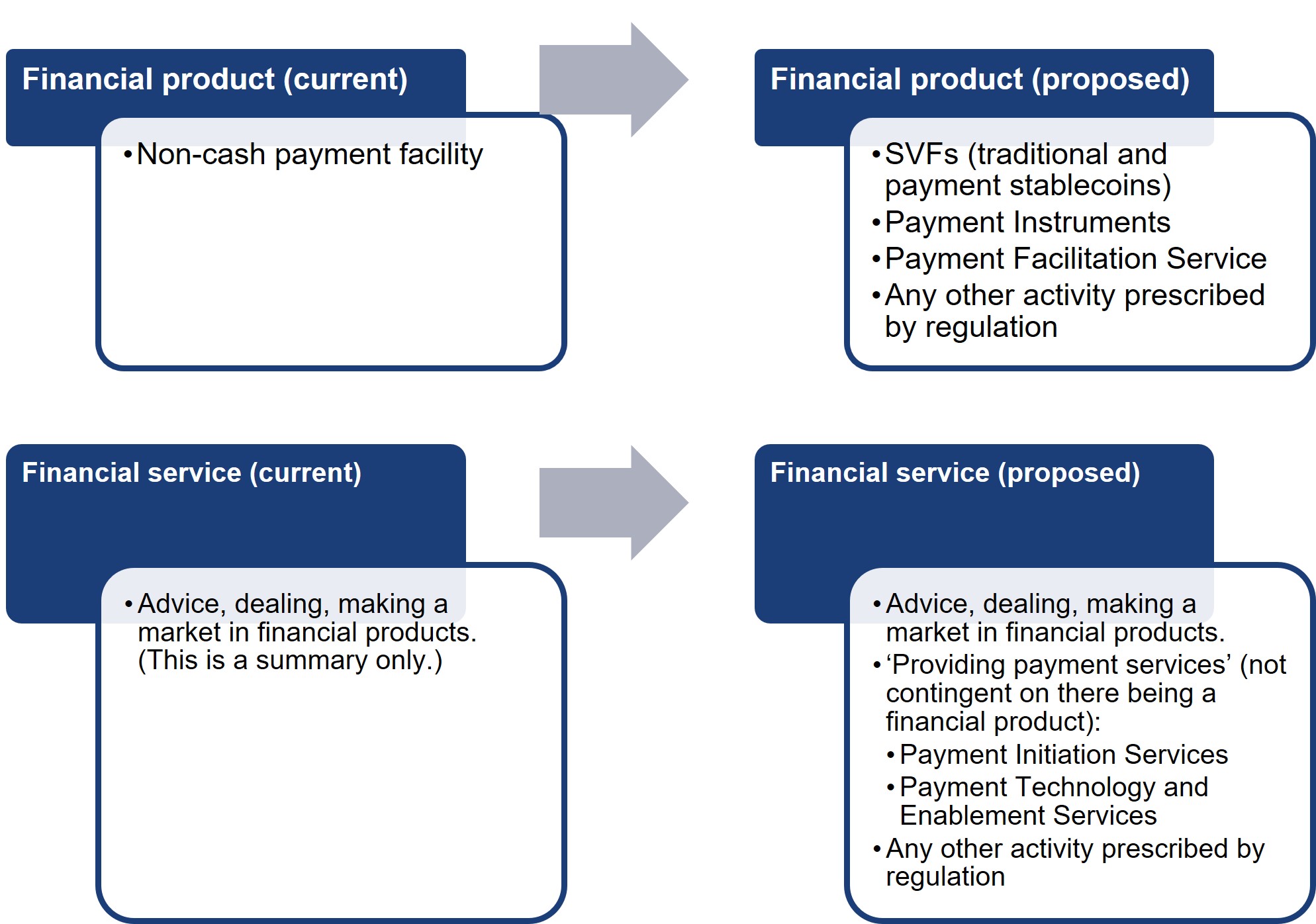

The Consultation Paper is clear – the proposed reforms will mean more products and activities will be regulated. Existing concepts of what are regulated products are proposed to be removed and new financial products and services are proposed to be regulated. In addition, existing exemptions are being revisited, with many likely to be repealed, while new exemptions are being examined for potential introduction.

While the regulatory net will be broader, it is hoped that it will create more certainty and become responsive to the risks raised in the modern economy. However, there is significant detail to carefully consider. In this article we have highlighted key features of the proposed regulatory framework and how this may apply to different business models in practice.

The Consultation Paper proposes maintaining regulatory responsibility in connection with the payments ecosystem across regulators as follows:

|

Regulator |

Proposed role |

How is it different |

|

ASIC |

ASIC would regulate the conduct of payment service providers (PSPs) performing a ‘payment function’. Either ASIC or the RBA would enforce the technical standards. |

The relevant functions that will be regulated by ASIC will be reframed and cover a broader range of products and services. ASIC will have a new role in enforcing the technical standards, if chosen as the relevant regulator. |

|

APRA |

APRA would overlay prudential regulatory oversight of “major” stored value facilities (SVFs) and any designated PSPs. APRA would also assume responsibility for facilitating access to payment systems through ‘common access requirements’ (CARs). |

APRA currently has responsibility for regulating purchased payment facilities (PPFs). The concept of PPFs would be removed. CARs is a new framework and would introduce a new licence category issued by APRA. |

|

Authorised standard-setting body (ASSB) |

An industry body authorised by the RBA will act as the ASSB and be given a mandate to set technical standards for the payments ecosystem. The ASSB would be responsible for developing and recommending mandatory technical standards applicable to payment system participants. The ASSB would be responsible for enforcing minor breaches of the standards. |

This would be a new body and function. |

|

RBA1 |

The RBA would oversee the conduct of payment system operators regarding access to non-ADIs that meet the CARs. The RBA would approve technical standards and oversee the ASSB. Either ASIC or the RBA would enforce the technical standards. |

RBA would have a new role administering the ASSB and CARs. |

The Consultation Paper proposes an expanded regulatory framework. While existing regulatory regimes are the starting point of many of the regulatory approaches, there are significant changes to the manner in which it is proposed that these would apply. We have set out below an overview of the key proposals, noting that, given that this is a Consultation Paper, the concepts remain in draft.

Regulation by ASIC – requirement to hold an AFSL

An Australian Financial Services Licence (AFSL) is required if certain products and services are provided as prescribed under Chapter 7 of the Corporations Act 2001 (Cth) (Corporations Act).

Currently, the key consideration in determining whether an AFSL is required in connection with a payments service is whether an arrangement constitutes a non-cash payment facility (NCPF). A NCPF is a “financial product” and, if a financial service is provided in connection with that financial product, an AFSL would be required unless an exemption applies.

The proposed reforms would remove the concept of NCPFs and replace them with a new “payment product” concept. It would also add a list of financial services that require an AFSL without there being any financial product involved.

Regulation by APRA – prudential oversight of Major SVFs

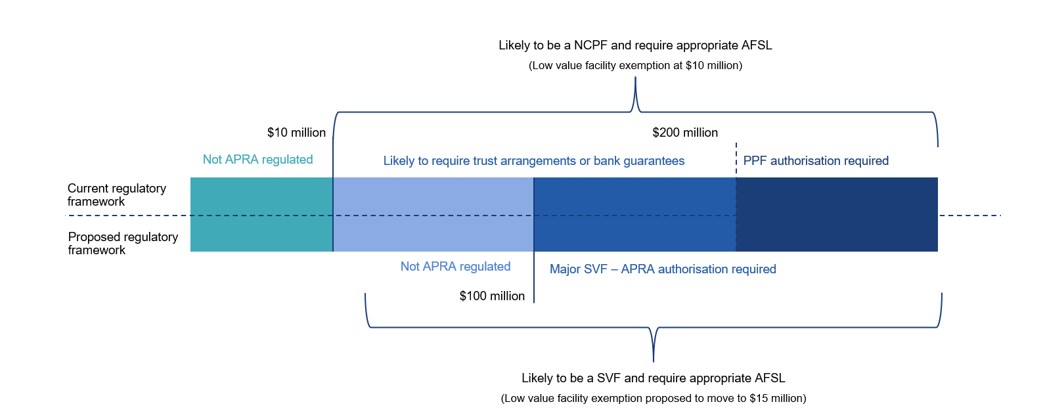

As described above, SVFs will be regulated as a financial product under the AFSL regime overseen by ASIC. However, recognising the risks to the financial system posed by large SVFs, APRA will have a role in overseeing SVFs where the value of customer funds stored reaches AUD$100 million (calculated on a whole of group basis). The proposed reforms would do away with the PPF regime and the multitude of exemptions, modifications and uncertainties associated with the PPF regime.

Regulation by APRA – CARs

APRA would also be responsible for setting and supervising the CARs. The CARs are a new regulatory concept and anticipated to operate as prudential standards. They would be a set of regulatory obligations for non-ADI PSPs seeking direct access to Australia’s payment systems to clear and settle payments. An entity that meets the CARs would be licensed and supervised by APRA. An APRA CARs licence would not automatically provide access to payment systems. The decision to grant access to a payment system would remain the responsibility of the payment system operator.

Role of new ASSB

The Consultation Paper proposes a move to mandatory technical standards for the payments industry. While there are voluntary codes that are applicable to various aspects of the payments ecosystem and standards set by the RBA, the Consultation Paper identifies that there are not technical standards that PSPs are legislatively required to adhere to. Technical standards are suggested in the Consultation Paper as being “necessary to achieve interoperability, security, reliability, accessibility, customer protection and to promote competition”.

The Consultation Paper proposes that the technical standards would apply to a broader category of PSPs than those that require an AFSL. Therefore, the application of these standards would not be merely identified by considering the entity’s licensing status. However, while compliance with the technical standards is proposed to be enforceable, it is also proposed to be a condition of holding an AFSL, for those that do hold a licence.

The ASSB would be responsible for:

Oversight by RBA – CARs and Payment Systems Operators

The RBA would be responsible for overseeing the conduct of payment system operators with regard to providing access to those systems for non-ADI PSPs that hold the CARs licence. It is proposed that the RBA would work with payment system operators to ensure that:

In the event that payment systems operators do not cooperate with the RBA in facilitating access to non-ADIs holding CARs, the Consultation Paper notes that it would be open to the RBA to use its existing powers under the Payment Systems (Regulation) Act 1998 (PSR Act) to impose an access regime on participants in a designated payment system.

While the Consultation Paper examines a range of products and services, we have selected some key business models and considered how the proposals in the Consultation Paper may affect these product and service offerings.

The following diagram is a summary of the key aspects of Australia’s current regulatory framework, as it affects SVF providers, and how this may be impacted by the proposals in the Consultation Paper2.

Note: The AFSL low value facility exemption also caps the total amount available to any one customer at $1,000. The consultation proposes to increase this cap to $1,500.

How are SVF providers currently regulated?

Currently, SVF providers must consider:

In addition, APRA currently has an overarching discretion to declare a SVF to be ‘banking business’ under the Banking Act 1959 (Cth) (Banking Act) where certain conditions are met.

How are SVF providers proposed to be regulated?

It is proposed that SVFs will be a type of “financial product” under the Corporations Act. This will require issuers of a SVF to hold an AFSL as they would be dealing in a financial product. In addition, issuers of Major SVFs will be prudentially regulated by APRA and will require an additional APRA licence.

What would be a SVF?

Treasury has proposed a ‘principles based’ approach to defining SVFs. It is proposed that the definition of SVFs would capture arrangements having the following key characteristics:

It is intended that the broad principles-based approach will cover a wide range of possible legal arrangements. Examples of SVFs given in the Consultation Paper include current PPFs, digital wallets that store value, value stored on online accounts, virtual and physical pre-paid cards. SVFs that are currently not rejected as NCPFs as they rely on the single payee exclusion, may find themselves in scope of the regulatory regime going forward as this exclusion, and other exemptions, are proposed to be repealed.

What is not intended to be regulated as a SVF?

The Consultation Paper makes it clear that the definition of SVF is not intended to capture:

What would be a Major SVF?

A Major SVF is proposed to be a SVF which:

Unlike the regulation of PPFs, it is proposed that Major SVFs would not be regulated as a type of banking business under the Banking Act amongst other requirements. The regulation of Major SVFs will mark a significant change to the current approach to PPFs with the RBA no longer having a regulatory role in connection with these products.

Proposal to require cross-border payment providers to hold an AFSL

The provision of cross-border transfer services is proposed to be a financial product. Providers of this function would require an AFSL. Such an arrangement is only in scope if the service facilitates a cross-border payment, not a domestic payment (domestic payments are intended to be regulated as Payment Facilitation Services – another new financial product).

How are cross border payment providers currently regulated?

Cross-border payment services are not currently regulated, in and of themselves, as a seperate financial product or service in addition to NCIF/AFSL considerations. The primary source of regulatory oversight for such services is currently under the Anti-Money Laundering and Terrorism-Financing Act 2006 (Cth) (AML/CTF Act). Under the AML/CTF Act, providers of designated remittance arrangements would need to comply with the registration and compliance obligations under that Act.

The Consultation Paper does not propose changes to the AML/CTF Act, although that legislation is subject to its own consultation process (read more about that here).

In considering the application of AFSL requirements, providers of cross-border payments services are currently likely to focus on:

How would the services be regulated going forward?

For the reasons described above, considering whether a remittance arrangement amounts to a NCPF would no longer be relevant. Going forward, a remittance provider is likely to need to consider whether:

The new inclusion of cross-border payments as a regulated financial service is likely to bring many businesses into scope of AFSL requirements where they have not been providing a NCPF as defined and whose business does not involve a regulated foreign exchange contract.

The proposed regulatory reforms would not only affect entities that are accepting payments and taking control of funds. The proposed reforms recognise that risks in the payment ecosystem can be raised by entities providing technology services underpinning payments.

The provision of “Payment Technology and Enablement Services” would be a financial service and require an AFSL. The Consultation Paper describes that this financial service could include:

“authentication, authorisation, routing and capture and transfer of payment credentials (whether tokenised or not) and other payment data”.

However, the Consultation Paper makes it clear that the intended regulatory perimeter is for those that directly enable a payment, not those who merely provide technology services to PSPs, to be within scope of the licensing requirement. Whether a technology service provider will be impacted by the reforms will depend on the precise nature of their role.

There are a number of other important issues discussed in the Consultation Paper and a range of other business models that we have not examined in this article. For example:

The proposed payments framework is only one part of the Government’s Strategic Plan and other regulatory priorities. Proposed regulatory changes for Digital Asset Platforms and reform to the AML/CTF Regime have also been released for separate consultation. Alongside these, this Consultation makes it clear that the Government intends to introduce major reforms that will have significant impacts for Australia’s payments regulatory framework.

Submissions in response to the Payments Systems Modernisation consultation are due by 2 February 2024. If you would like any assistance in preparing your submission, or would like to discuss any other regulatory reforms, please reach out to us.

¹ We have not examined changes to the Payment Systems (Regulation) Act 1998 (Cth) in this article however proposed reforms to this legislation would also impact the RBA’s role.

² The Consultation Paper also proposes additional obligations for Payment Stablecoin SVFs which have not been explored in this article.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs