Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

Herbert Smith Freehills has a large network of founders who’ve raised from a range of different investors, including domestic and global VC Funds, corporate venture and family offices — we want to harness our network to better highlight the founder voice.

Our survey data found that continued challenges in the fundraising environment have not extinguished optimism among Australian start-ups, and that founders expect to raise and achieve higher valuations, whilst recognising the new paradigm in the Australian VC ecosystem.

While times are currently challenging, most respondents expect their own companies to raise in the next 12 months and to do so at a higher valuation than the last round, probably through a priced round.

74% intend to raise in the next 12 months, with 60% agreeing that they were confident that their company’s next raise will be above its last post-money valuation.

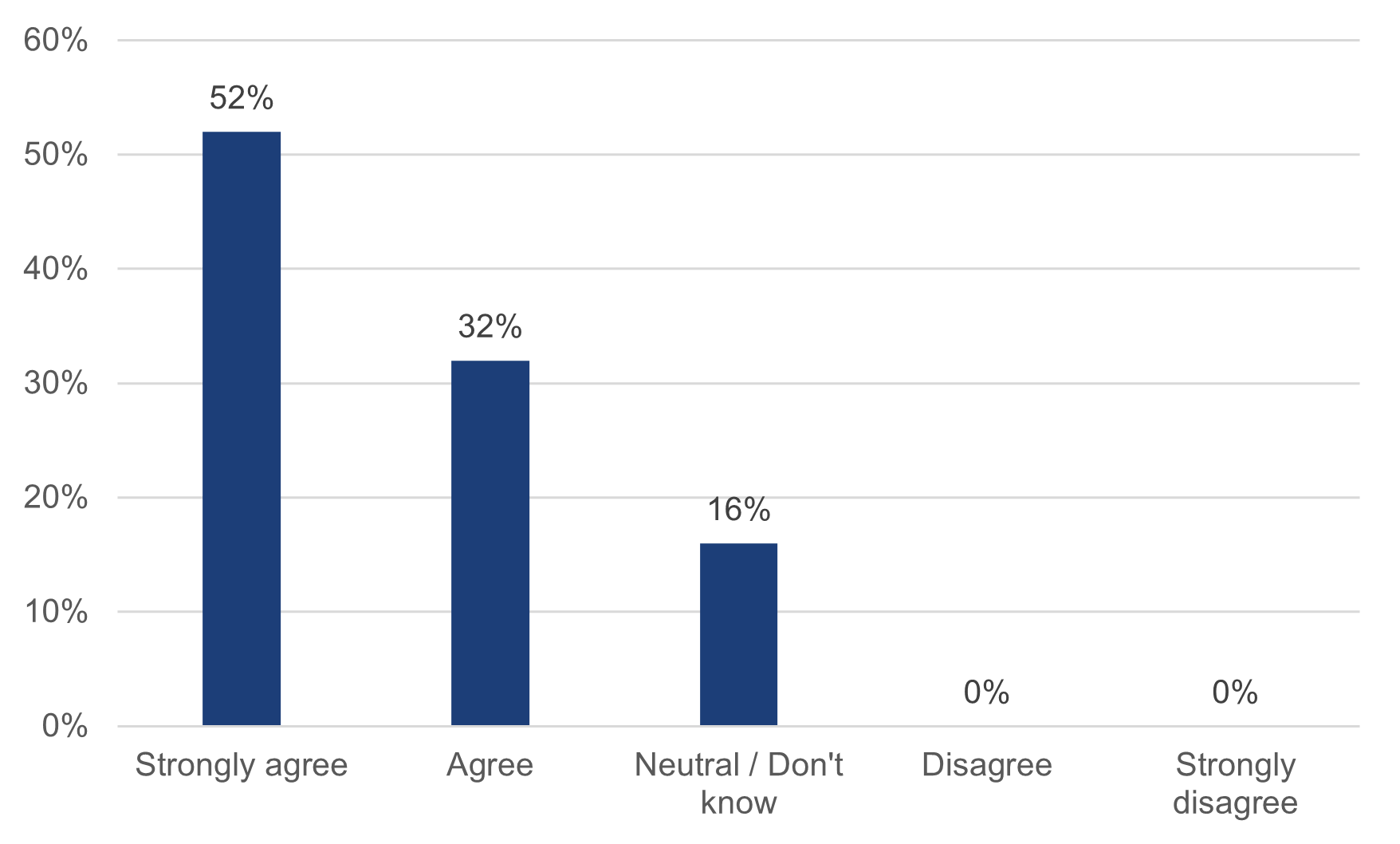

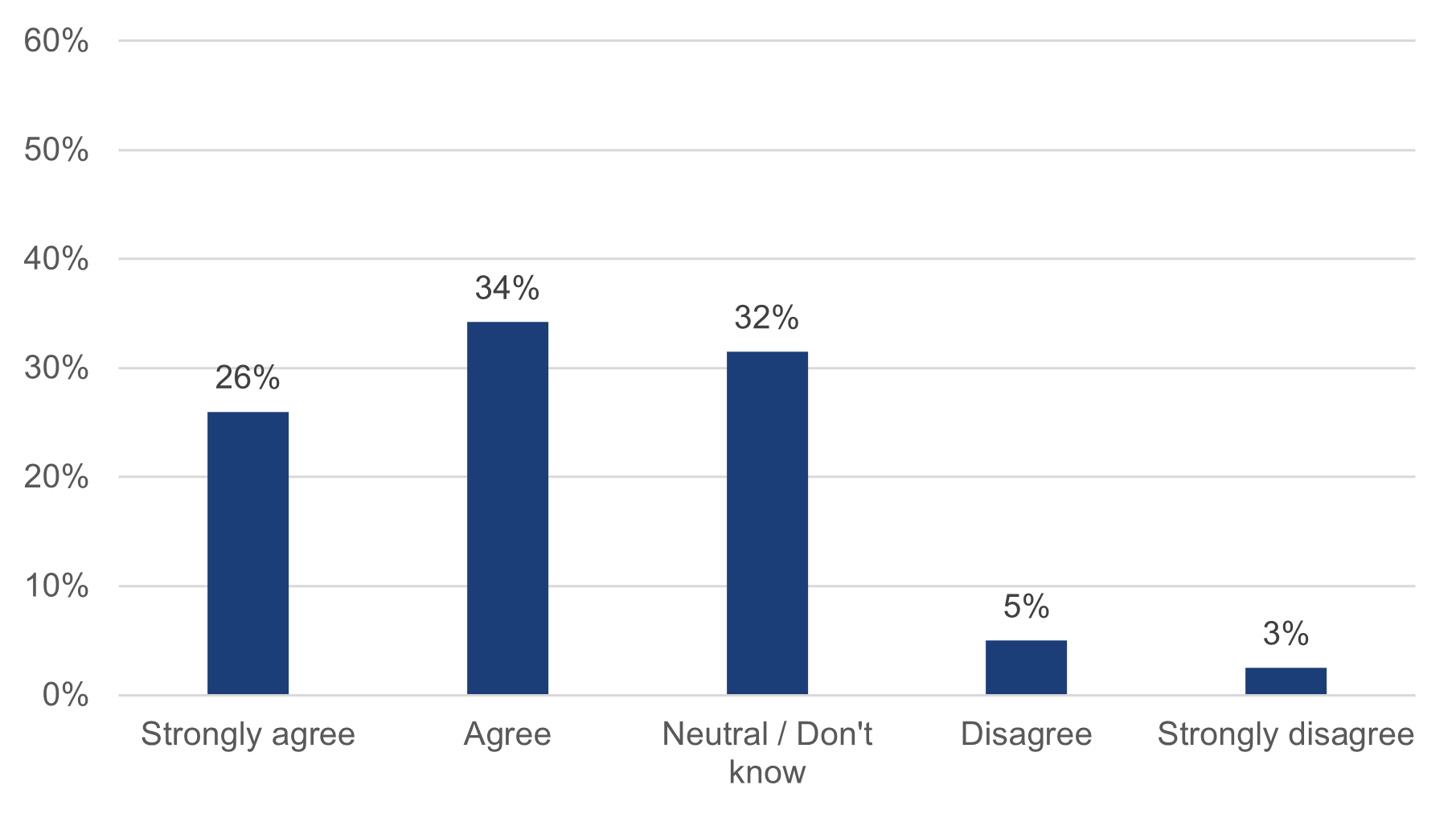

84% of respondents agreed that the current fundraising environment is impacting strategic decision making in the Australian start-up industry. This is down from 97% in 2022, indicating that founders are coming to grips with the new environment.

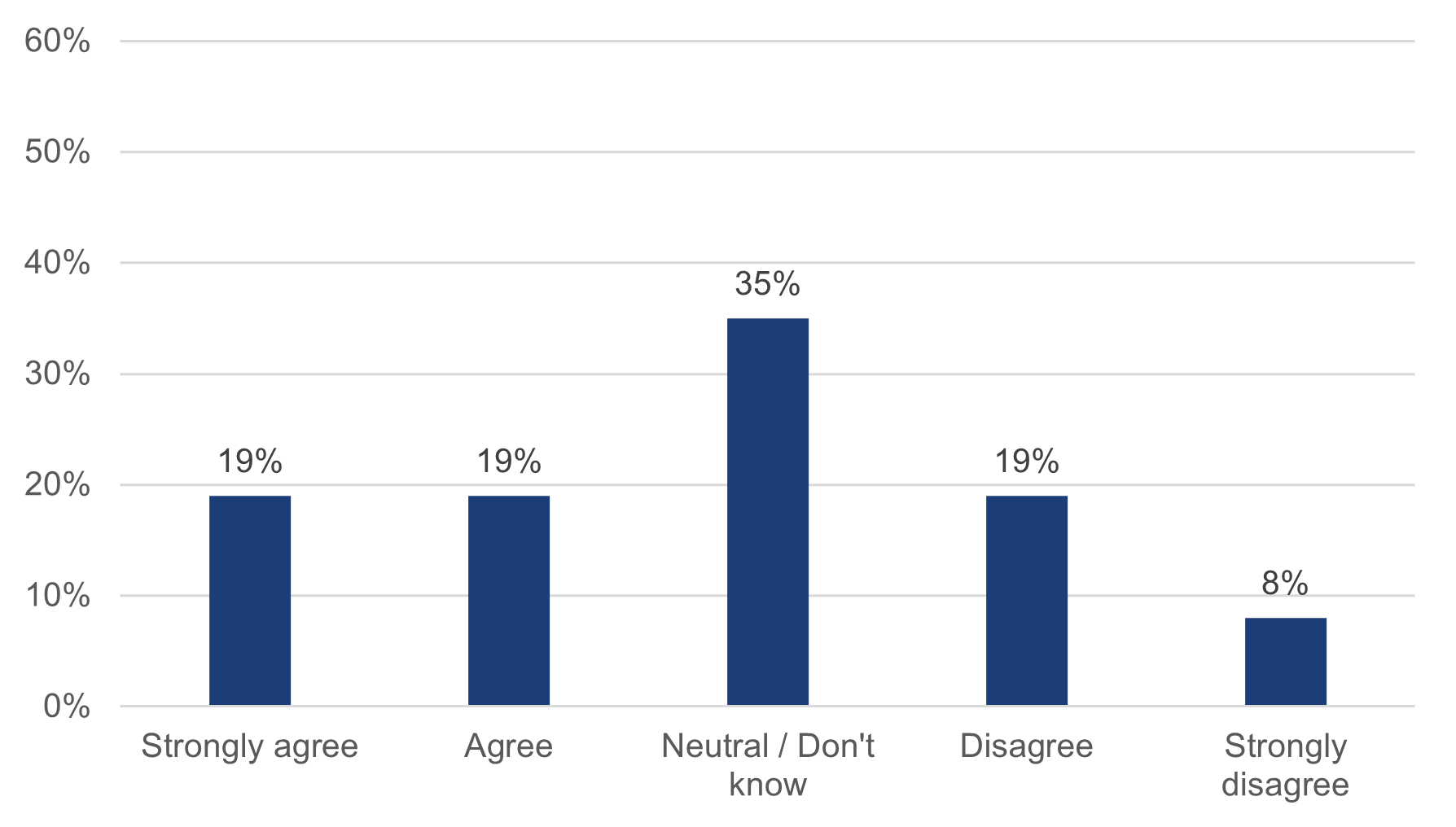

The current environment is driving strategic decision making, in particular a much stronger focus on profitability or cash burn reduction and a pivot from growth to profit — over 90 per cent of respondents agreed that Australian start-ups will need to reach profitability earlier because of current market conditions.

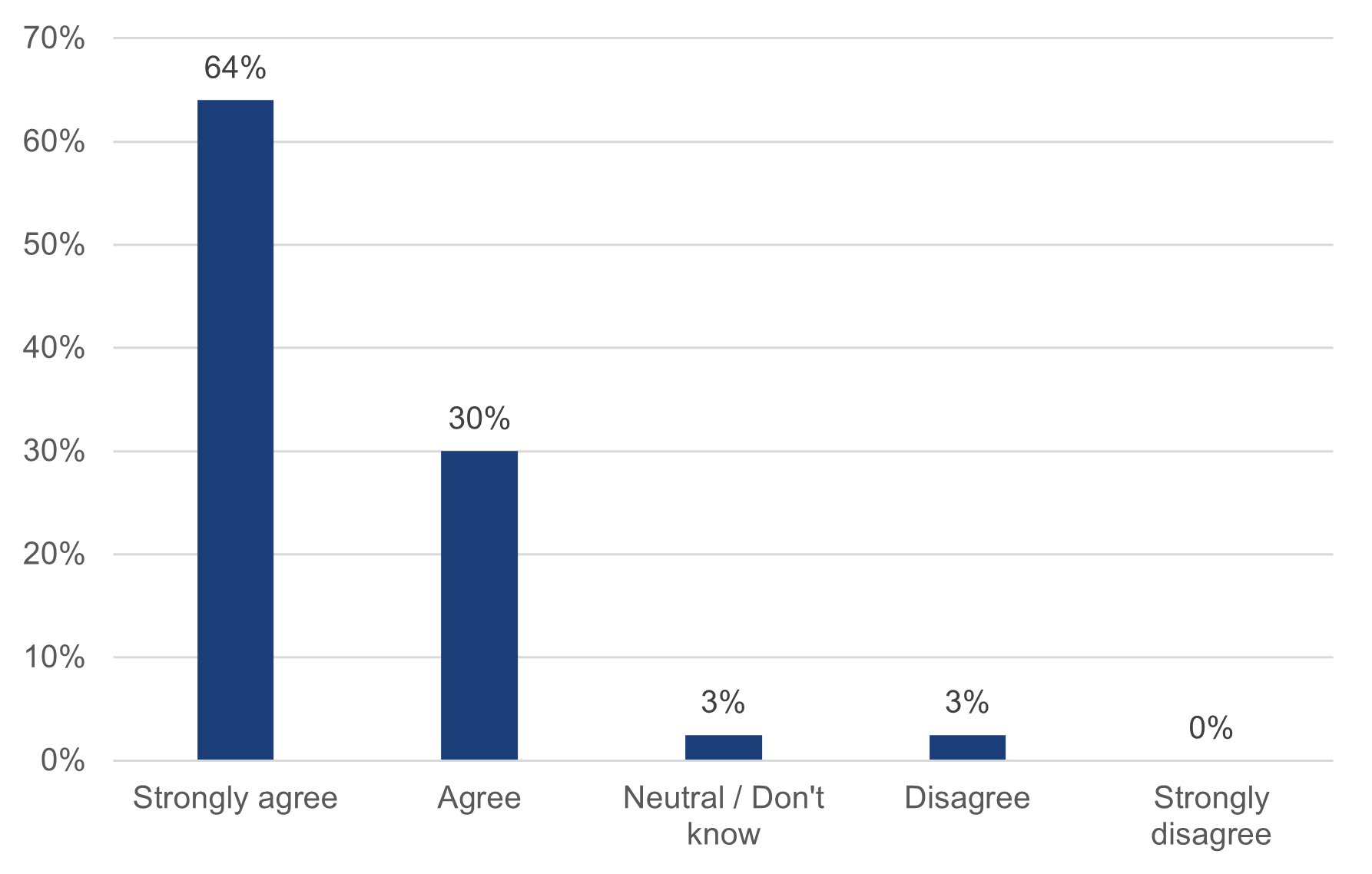

But despite a challenging economic landscape, many Australian start-ups remain positive about their prospects and future — 62% of respondents agreed that they felt optimistic.

The current fundraising environment is more challenging than the last 12 months

The current fundraising environment is impacting strategic decision making by Australian start-ups

My company intends to raise in the next 12 month

My company is confident our next raise will be above its last post-money valuation

My company will look at a bridging round before its next series or priced round

My company intends to pursue a liquidity event (eg, IPO or trade sale) in the next 12 months

Overall, I am optimistic about the long-term prospects for Australian start-up

Australian start-ups will need to reach profitability earlier because of current market conditions

We value the contribution and/or support from our major investors

Governments can do more to support Australian start-ups

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs