Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

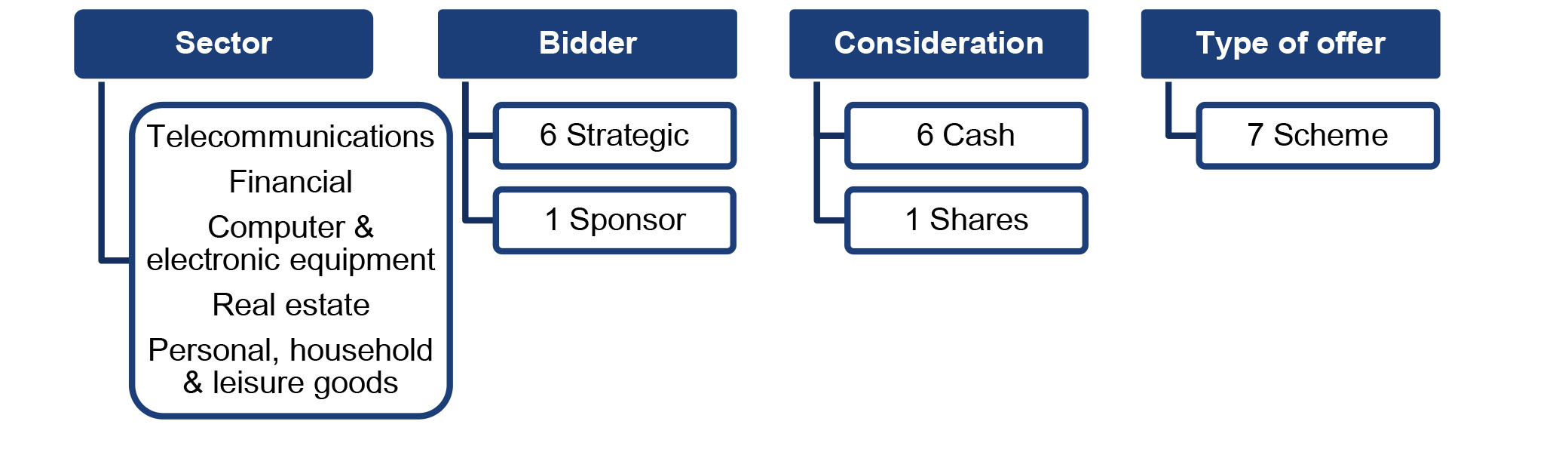

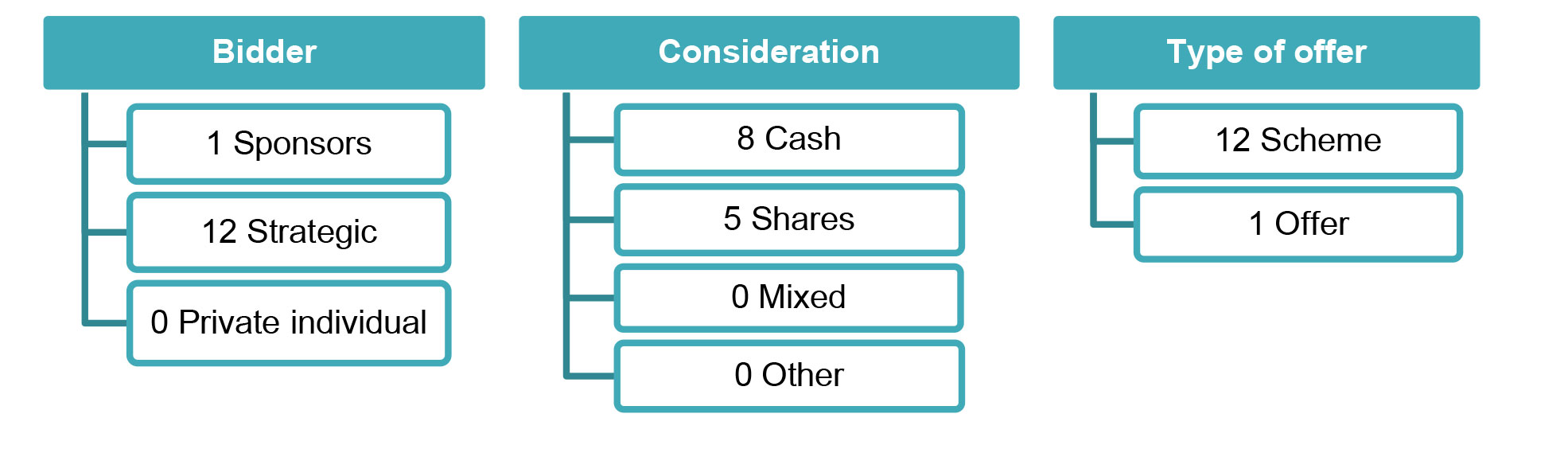

In March 2024, there were seven Rule 2.7 announcements made across the UK public M&A market and six further possible offers announced.

Global M&A Outlook 2024 – Regional and sectoral perspectives

In our global M&A report for 2024, titled “Global M&A Outlook for 2024: Ready for take-off?”, we explored that there are good reasons to believe 2024 will be a stronger year for M&A; but no-one is going to call a sudden change in conditions, or underestimate execution challenges.

We also explored

We have now published regional perspectives from our offices around the world and our sector and broader perspectives in which we look at regional and sectoral trends in M&A and the outlook for 2024.

Our podcast on activism in M&A

In the latest episode of our shareholder activism podcast series, we talk about activism in the context of M&A. We discuss how shareholders may:

We also discuss what parties can do if a transaction is challenged by a shareholder or group of shareholders.

To listen to the full conversation, and for further information on shareholder activism including the previous episodes in our activism podcast series, please visit our Shareholder Activism podcast page.

FCA secures conviction of senior staff member at a listed company

Stuart Bayes has been found guilty of two offences of insider dealing in a prosecution brought by the Financial Conduct Authority (FCA).

Mr Bayes was employed as a site manager at RPC Group Plc. Through his employment, he learned that RPC was about to announce the takeover of BPI plc (a listed company). That information was inside information. Ahead of the deal being announced to the market, Mr Bayes traded in BPI shares, resulting in a profit of £132,000. He also encouraged another individual to trade in BPI shortly before the announcement.

After the jury failed to reach a verdict in a previous trial in 2022, the FCA pursued a retrial and Mr Bayes has now been found guilty of insider dealing – a criminal offence punishable, on conviction, by a fine and / or up to 7 years’ imprisonment at the time of the offending. For offences committed on or after 1 November 2021, the maximum sentence is up to 10 years’ imprisonment. He will be sentenced on 26 April 2024. The other individual was found not guilty of insider dealing.

Public M&A deal activity this March has almost doubled compared to the same period in 2023, with seven firm offers and six possible offers announced. This continues the trend seen throughout Q1 2024 – in each month of the year so far, the number of offers announced has been higher than in the same period last year.

A notable deal announced this month was Nationwide Building Society's £2.9 billion offer for Virgin Money UK PLC. It is the highest value offer of 2024 so far and is also one of the highest offers seen since Q4 2022, beaten only by EQT Fund Management S.à r.l. and Abu Dhabi Investment Authority's £4.5 billion offer for Dechra Pharmaceuticals PLC in June 2023.

Four of the six possible offers made this month involved the announcement of strategic reviews. Six strategic reviews have been announced in 2024 so far, three of which included a formal sale process (FSP). Companies may commence a strategic review for a variety of reasons. For example, Renalytix plc commenced its strategic review and FSP after being approached by a company which was evaluating an offer for it. Equals Group plc has contacted a number of potential counterparties during its strategic review to assess whether they could put forward proposals which would deliver greater value to shareholders, and has since announced that it has received an indicative non-binding proposal regarding a possible offer from a consortium. Both Jaywing plc and Revolution Bars Group plc are taking the opportunity to explore their respective strategic options.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs